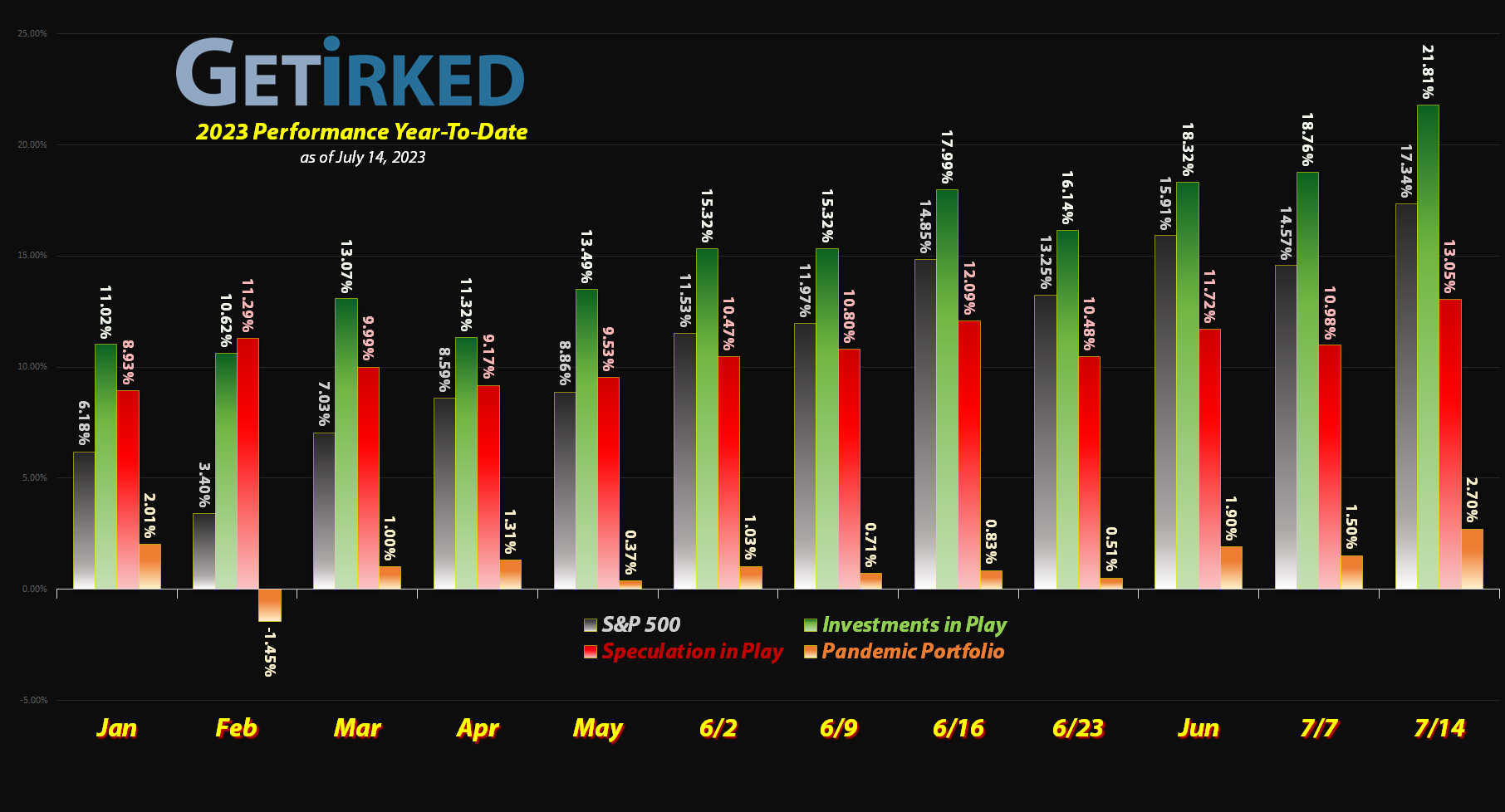

July 14, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

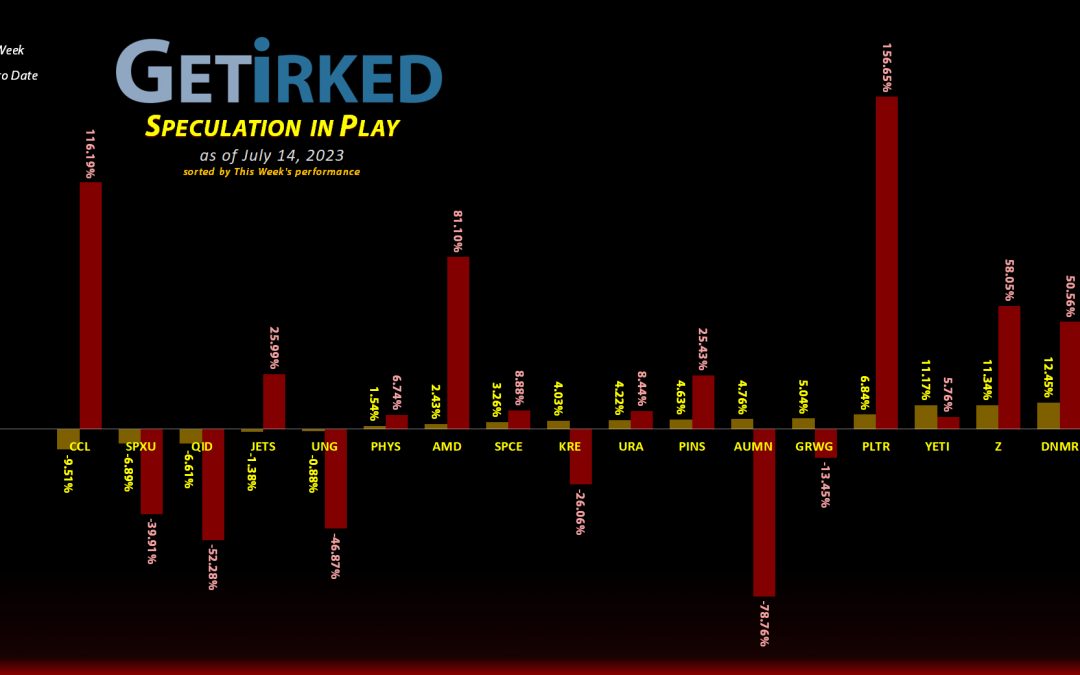

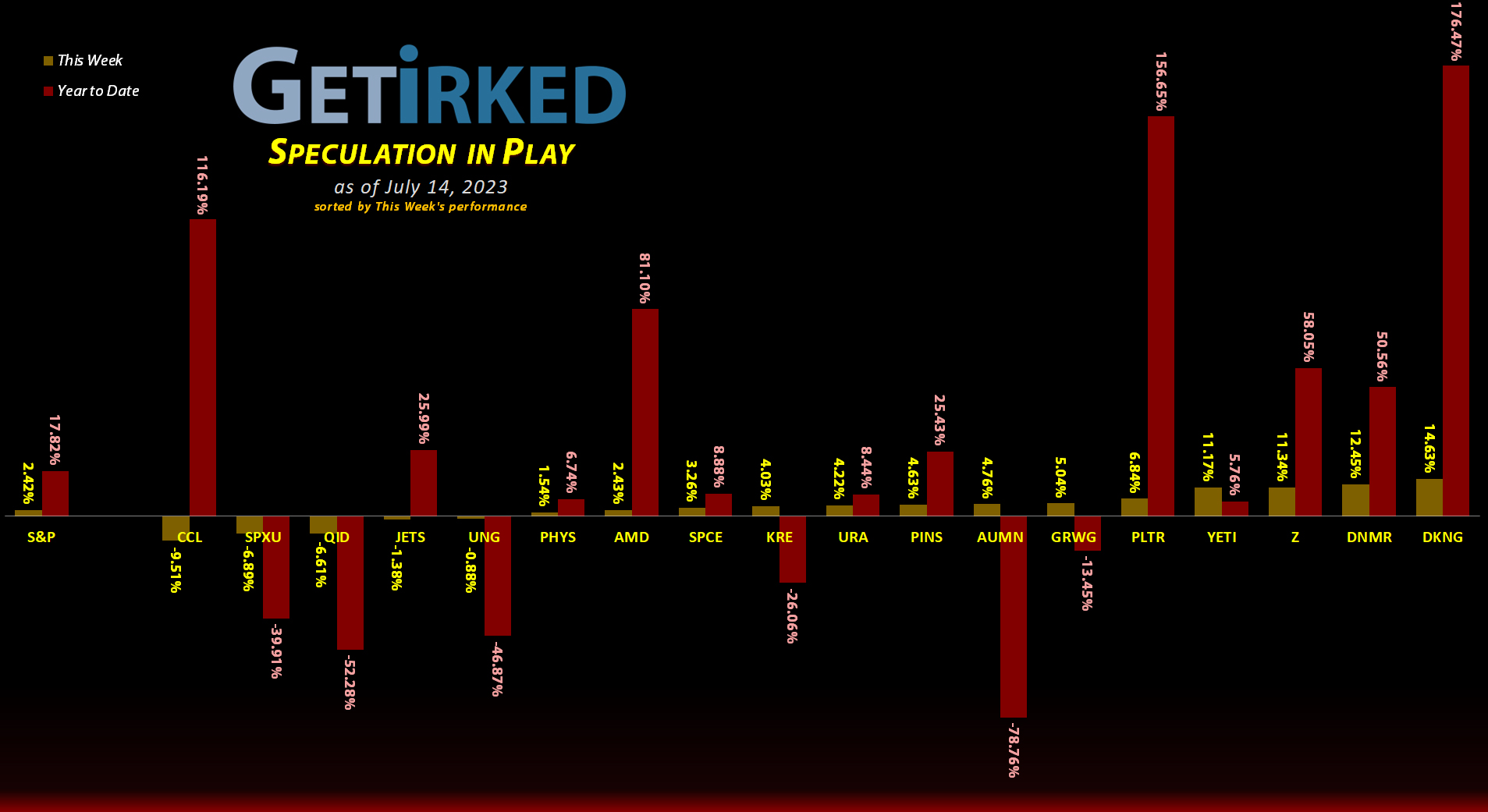

The Week’s Biggest Winner & Loser

DraftKings (DKNG)

DraftKings (DKNG) rocketed higher this week on the back of analyst reports showing that sports gambling is getting more and more popular combined with DraftKings’ getting costs under control.

As a result, DKNG popped +14.63% this week, hitting the jackpot as the Week’s Biggest Winner.

Carnival Cruise Lines (CCL)

After weeks of rallying, the travel space – Carnival Cruise Lines (CCL), in particular – got hit hard this week on the back of weakening demand and potentially challenging economic conditions facing consumers.

Carnival sunk -9.51% during a week where nearly everything headed higher, easily dropping its anchor as the Week’s Biggest Loser.

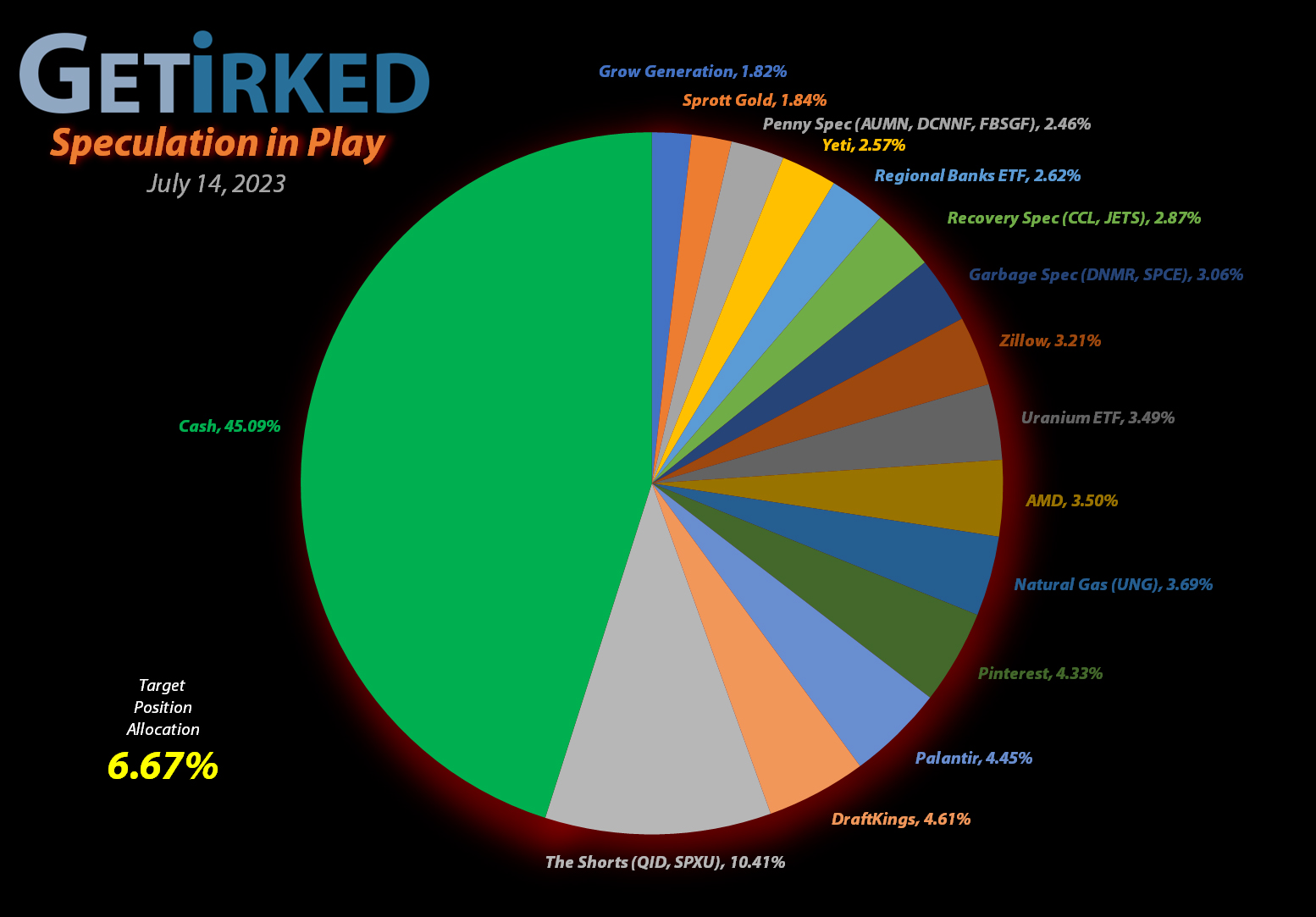

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+641.32%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+384.90%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+374.45%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+134.68%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+91.85%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$4.17)*

Carnival Cruise (CCL)

+75.80%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: (-$0.21)*

Uranium ETF (URA)

+22.94%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Zillow (Z)

+10.21%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $48.30

Sprott Gold Trust (PHYS)

+1.40%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $15.00

Regional Banks ETF (KRE)

+0.49%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $42.93

Palantir (PLTR)

-0.30%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.45

DraftKings (DKNG)

-7.57%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-17.70%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short SPY (SPXU)

-19.07`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $12.69

Short QQQ (QID)

-24.21%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $17.20

Canadian Pal (DCNNF)

-52.25%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-68.30%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Golden Mine. (AUMN)

-75.82%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Grow Gen. (GRWG)

-76.24%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-95.99%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

SPY & QQQ Shorts (SPXU/QID): Added to Position

When the CPI report came out on Wednesday with lower inflation readings than expected, limit buy orders were triggered in both of my short positions, the ProShares SPXU and QID which inverse the S&P 500 and Nasdaq-100, respectively.

My SPXU buy filled at $10.45, lowering my per-share cost -2.91% from $13.07 to $12.69. From here, my next buy target is $9.97, a price calculated using the Fibonacci Method and my next sell target is $13.21, slightly below a past point of resistance.

On Wednesday, my QID order filled at $13.04, lowering my per-share cost -1.83% from $17.52 down to $17.20. On Friday, my next QID order filled at $12.41, reducing my per-share cost an additional -3.49% from $17.20 to $16.60, a total reduction of -5.25% and giving me an average buying price of $12.62.

From here, my next QID buy price is $11.53 and my next QID sell price is $17.34.

SPXU closed the week at $10.27, down -1.72% from where I added Wednesday.

QID closed the week at $12.58, down -0.32% from my $12.62 average buy price.

Zillow (Z): Profit-Taking

I decided it was time to take profits in Zillow (Z) when it made a run at its recent high with a sell order which was filled at $52.35 on Tuesday. The sale locked in +8.97% in gains on shares I bought for $48.04 on January 26, 2022 and lowered my per-share cost -2.72% from $49.65 to $48.30.

From here, my next sell order is $96.60, right near a point of past resistance, and my next buy order is $31.20, right above a key point of support Zillow saw in December 2022.

Z closed the week at $53.23, up +1.68% from where I took profits Tuesday.