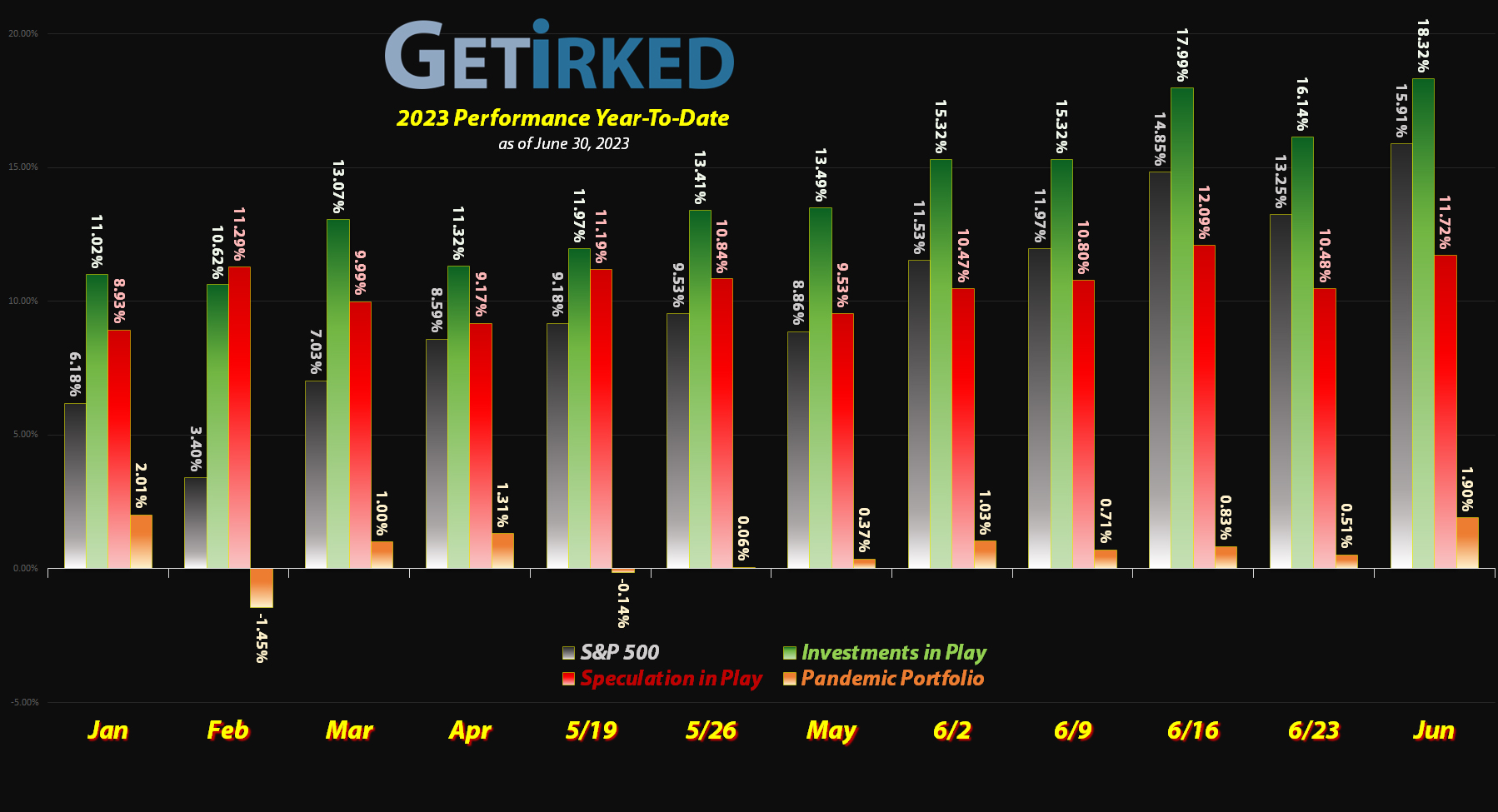

June 30, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

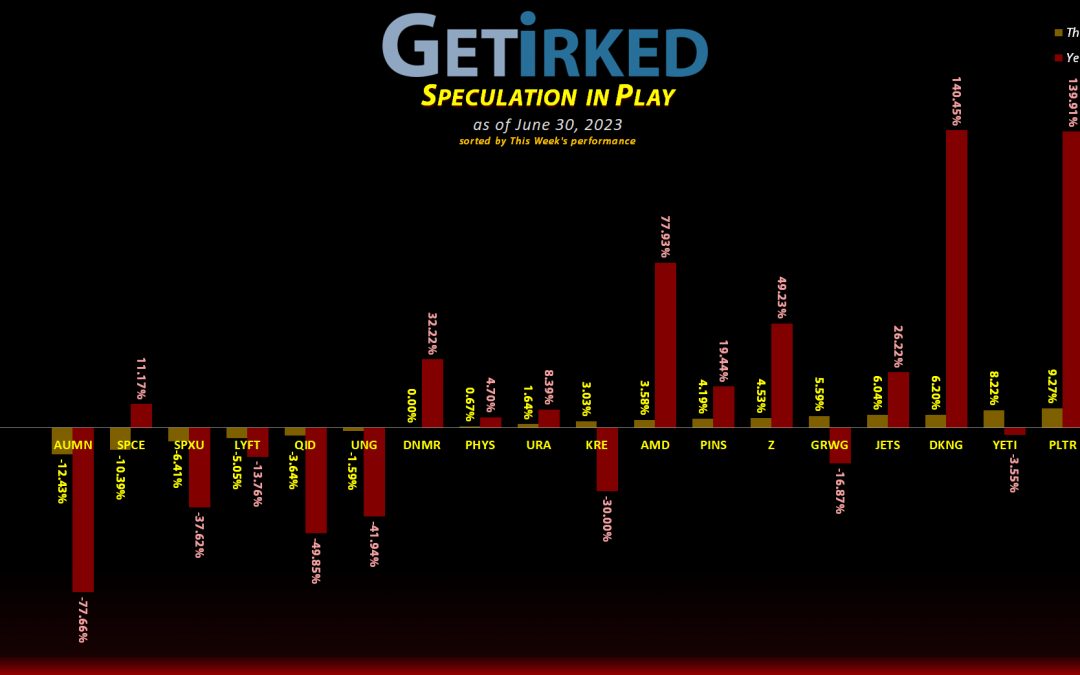

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Between epic demand for cruises and a new CEO who seems to be doing everything right, Carnival Cruise Lines (CCL) isn’t just the Week’s Biggest Winner with a +19.18%, it’s the third best performing stock in the entire market behind Nvidia (NVDA) in first place and Meta (META) in second place. WOW!

Golden Minerals (AUMN)

On the back of an equity distribution diluting the stock price further (man, this company is terrible), Golden Minerals (AUMN) dropped another-12.43% this week. In a week that was generally positive for much of the market, this locked in AUMN as the Week’s Biggest Loser for the second week in a row!

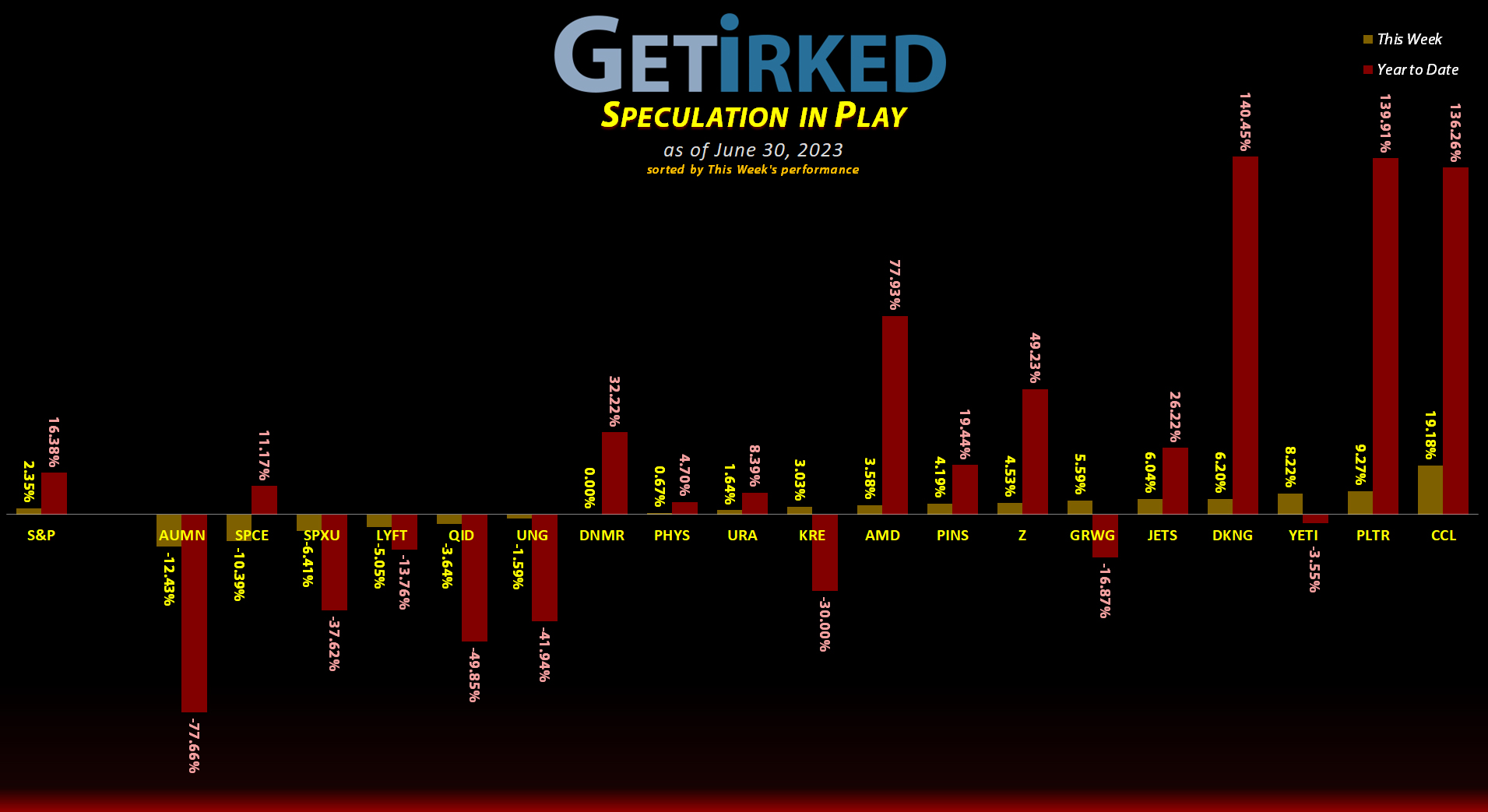

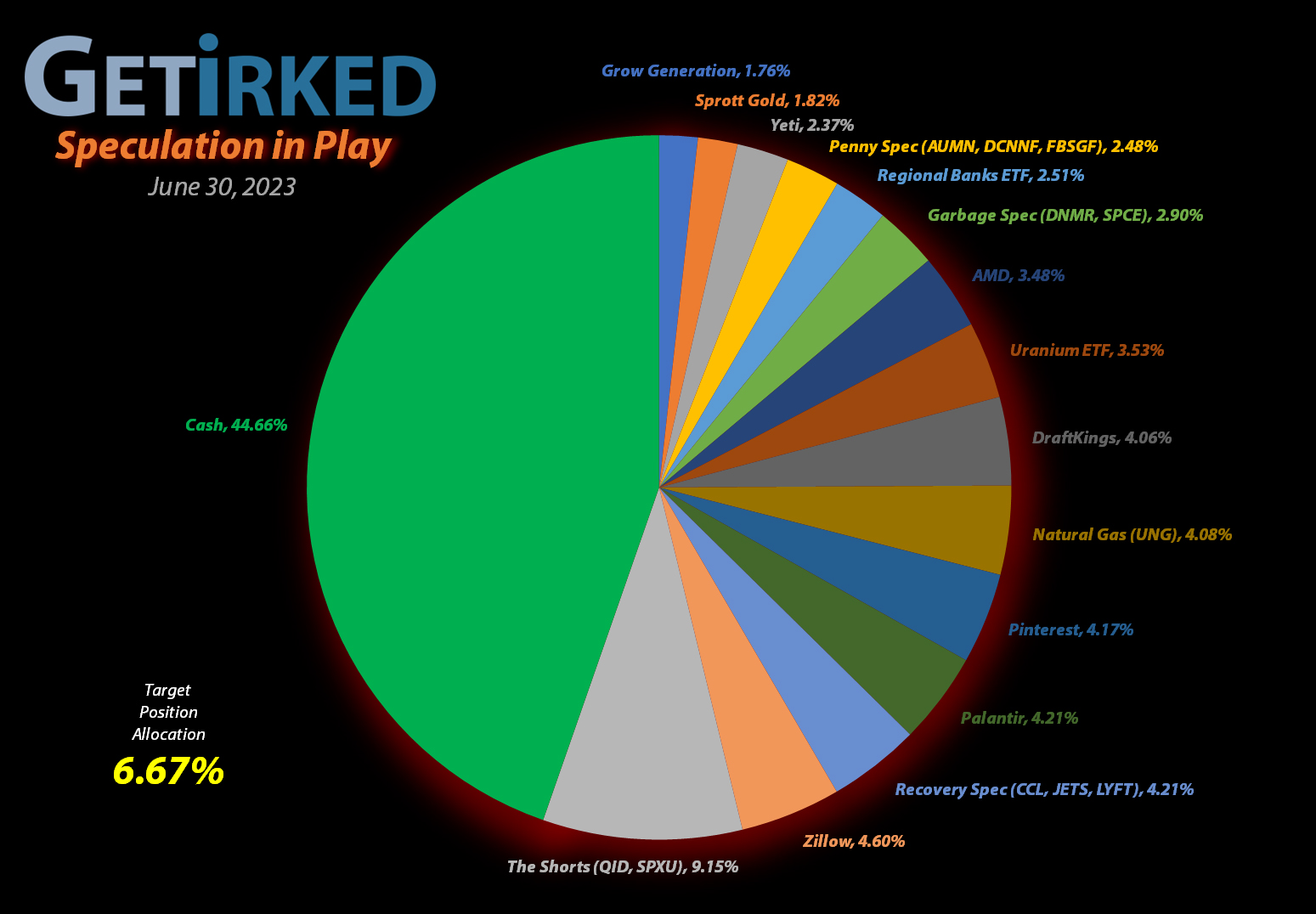

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+636.14%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+375.78%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+358.17%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Carnival Cruise (CCL)

+313.62%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Virgin Galactic (SPCE)

+136.26%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+92.09%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$4.17)*

Uranium ETF (URA)

+22.88%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Lyft (LYFT)

+19.13%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $8.05

Zillow (Z)

+1.23%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Sprott Gold Trust (PHYS)

-0.53%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $15.00

Regional Banks ETF (KRE)

-4.87%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $42.93

Palantir (PLTR)

-6.81%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.45

U.S. Natural Gas (UNG)

-10.06%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Short SPY (SPXU)

-18.40`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $13.07

DraftKings (DKNG)

-19.61%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Short QQQ (QID)

-24.53%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $17.52

Canadian Pal (DCNNF)

-56.23%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-72.16%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Golden Mine. (AUMN)

-74.57%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Grow Gen. (GRWG)

-77.18%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-94.56%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Regional Banks ETF (KRE): Dividend Payout

The Regional Banks ETF (KRE) paid out its quarterly dividend on Monday. Whereas in my Investments in Play and Pandemic Portfolios, I do reinvest dividends, when I’m holding positions as long-term trades in my Speculation in Play portfolio, I just to accept the dividends as a cash payout.

Regardless, the dividends serve the same purpose – to reduce my per-share cost. In the case of KRE, the dividend lowered my per-share cost -0.92% from $43.33 down to $42.93. From here, my next buy target is $34.55, slightly above KRE’s March lows and my next sell target is $56.23, just below a past point of resistance.

Short QQQ & S&P 500 ETFs (QID/SPXU): Dividend Payout

As strange as it is to think a leveraged inverse ETF would even pay out a dividend, both the QID and SPXU paid out their quarterly dividends on Wednesday. Just like the KRE, I choose to receive these dividends as cash payouts rather than additional shares as I’m not certain how long I’ll be holding on to the positions.

The SPXU dividend lowered my per-share cost -0.98% from $13.20 to $13.07. My next buy target is now $10.29 and my next sell target is now $13.76.

The QID dividend lowered my per-share cost -0.74% from $17.65 to $17.52 My next buy target is $12.61 and my next sell target is $17.73.