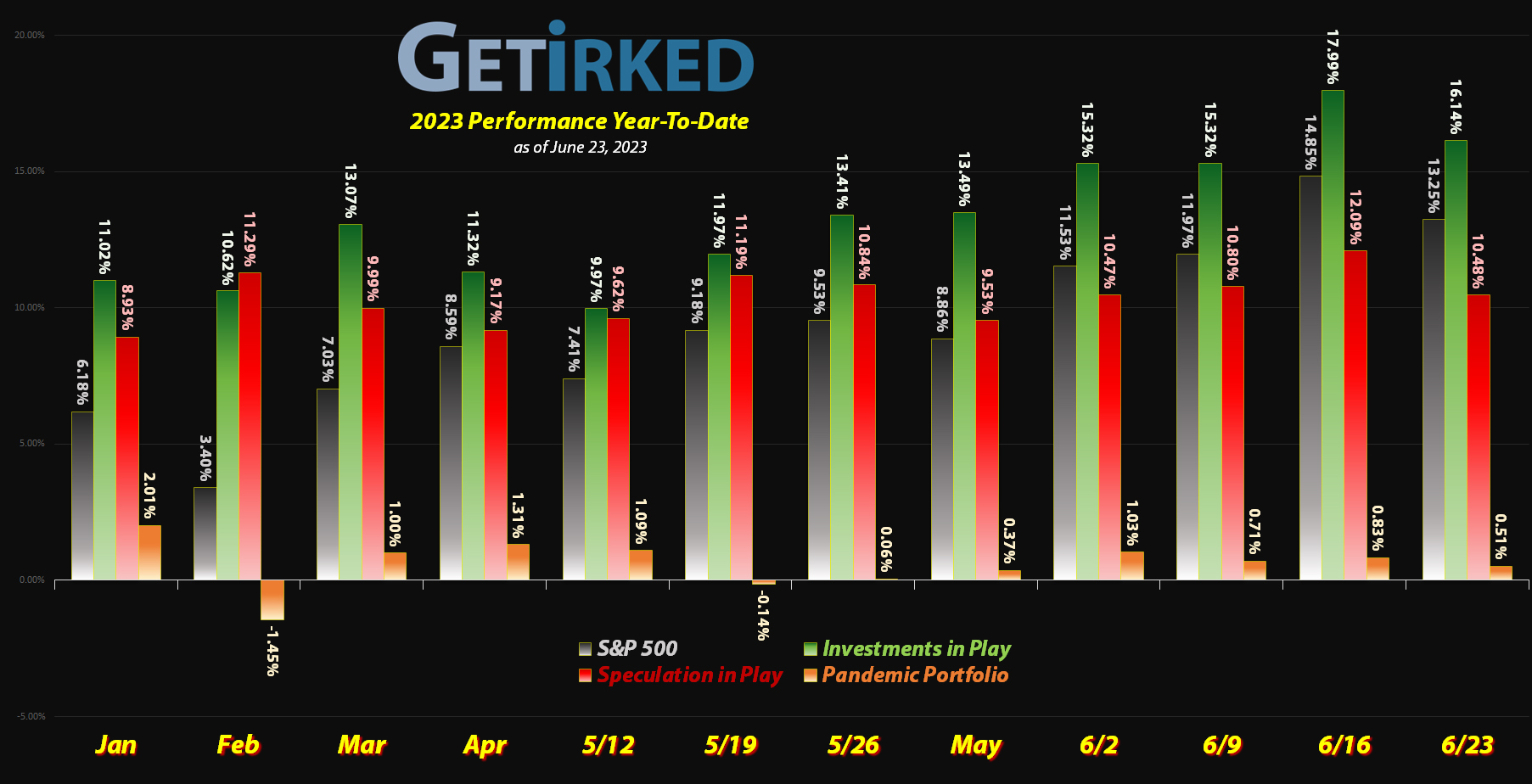

June 23, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

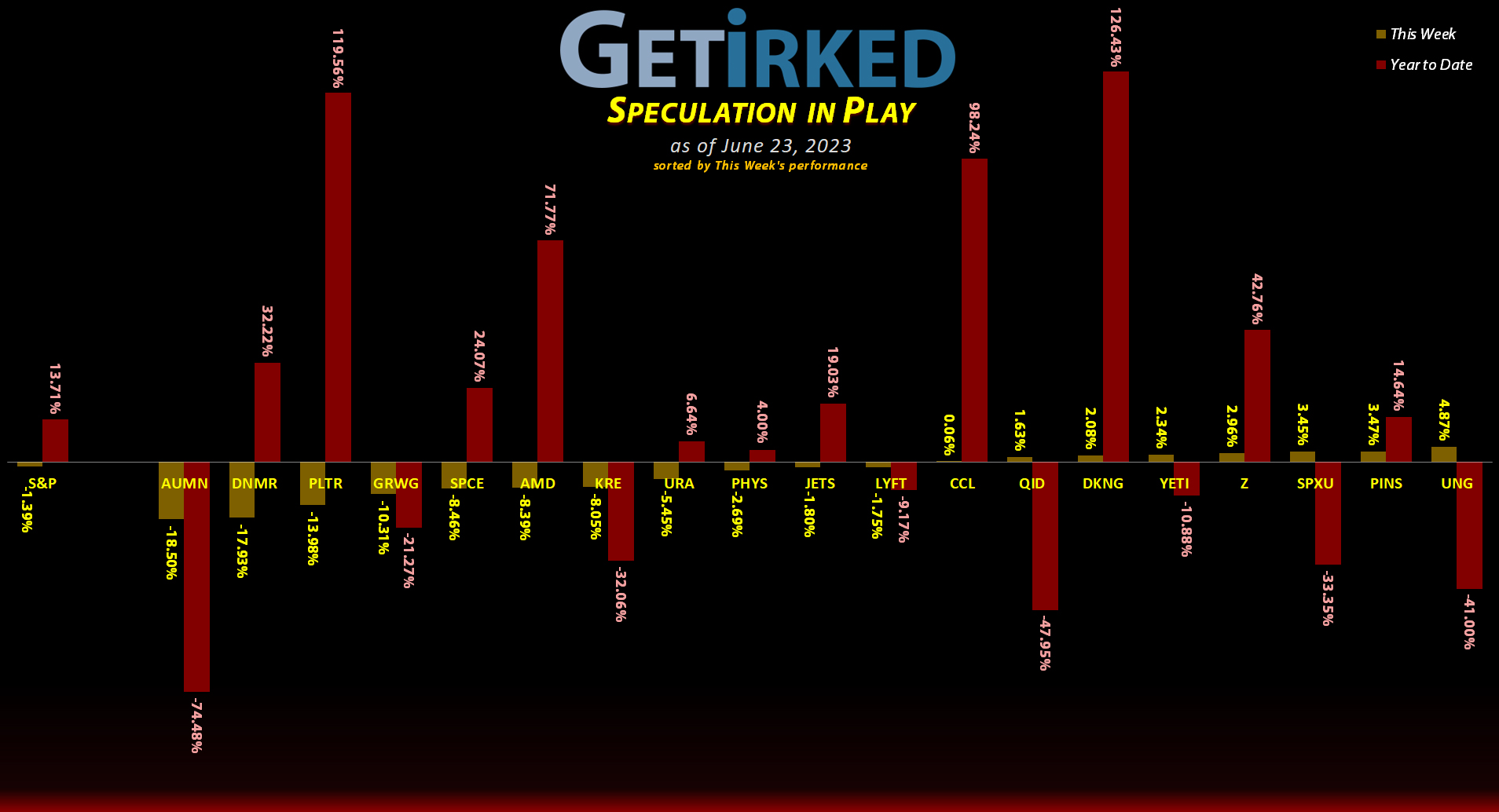

The Week’s Biggest Winner & Loser

U.S. Natural Gas (UNG)

While natural gas has been trading in the United States around $2.50, the relative price elsewhere in the world ranges from $9-13, an incredible difference.

With Liquidated Natural Gas (LNG) transfer stations coming online soon and the U.S. being able to export LNG to other countries, many experts feel UNG has finally bottomed, and this week’s +4.87% could be the green shoots the sector needs, plus it allowed UNG to flow in as the Week’s Biggest Winner.

Golden Minerals (AUMN)

It’s a good thing stocks stop going down at zero because Golden Minerals (AUMN) continues to plummet as investors jump ship, not believing AUMN will be able to meet exchange demands and prevent delisting in July.

As a result, AUMN lost yet another shocking -18.50% of its value this week, mining new lows and easily becoming the pit of coal Biggest Loser of the Week.

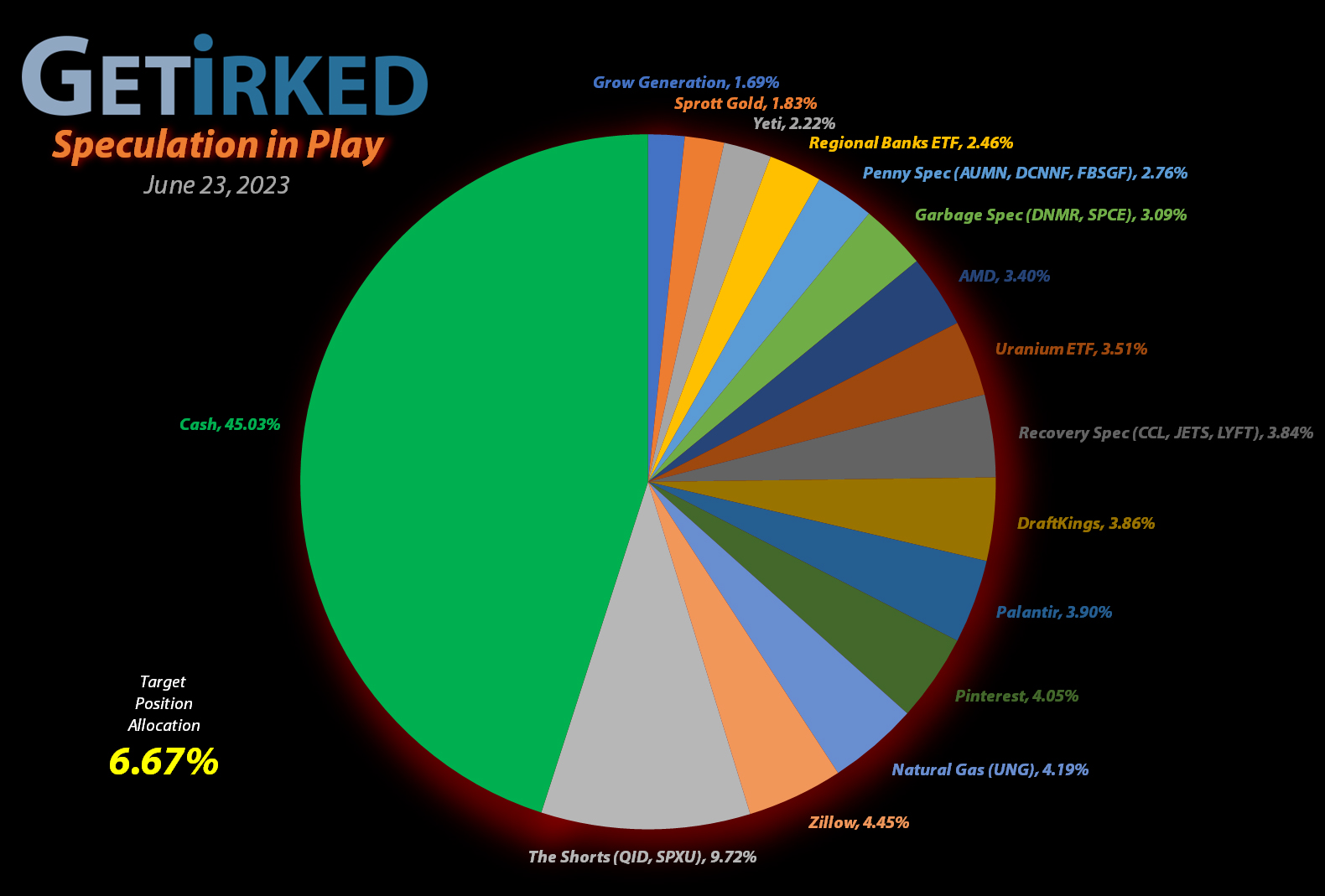

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+626.17%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+368.46%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+346.11%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Carnival Cruise (CCL)

+247.06%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Virgin Galactic (SPCE)

+145.37%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Airlines ETF (JETS)

+87.70%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$4.17)*

Lyft (LYFT)

+25.47%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $8.05

Uranium ETF (URA)

+20.90%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Sprott Gold Trust (PHYS)

-1.23%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $15.00

Zillow (Z)

-3.18%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

U.S. Natural Gas (UNG)

-8.48%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Regional Banks ETF (KRE)

-8.64%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $43.33

Short SPY (SPXU)

-13.86`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $13.20

Palantir (PLTR)

-14.71%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.45

Short QQQ (QID)

-22.27%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $17.65

DraftKings (DKNG)

-24.27%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Canadian Pal (DCNNF)

-51.52%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Golden Mine. (AUMN)

-70.80%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Danimer Sci (DNMR)

-72.16%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-78.39%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-96.71%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Lyft (LYFT): Profit-Taking

The combination of the market’s weak open on Tuesday with Lyft’s (LYFT) disappointing analysts’ meeting last week made me use stop-limit sell orders to lock in gains and reduce my position when the market opened Tuesday morning.

My stop-limit filled at $10.15, locking in just +4.10% in gains on shares I purchased for $9.75 when I opened the position on March 2. More importantly, the sale reduced my per-share cost -8.00% from $8.75 to $8.05 and also reduced my position allocation as a form of risk management.

From here, my next buy target is $7.90, slightly above Lyft’s all-time low, and my next sell target is $16.10, slightly below a point of resistance that Lyft has seen many times in the past.

LYFT closed the week at $10.10, down -0.49% from where I took profits Tuesday.

Sprott Physical Gold Trust (PHYS): Added to Position

The precious yellow metal came under selling pressure this week on the back of Fed Chair Jerome Powell’s hawkish comments about the Fed’s ongoing fight against inflation while at Congress. As a result, the Sprott Physical Gold Trust (PHYS) sold off as well, triggering my next buy order which filled at $14.75 during Thursday’s trading.

The buy lowered my per-share cost -1.64% from $15.25 to $15.00. From here, my next buy target is $13.95, above a past point of support, and my next sell target is $16.05, slightly under PHYS’ high from 2023.

PHYS closed the week at $14.82, up +0.47% from where I added Thursday.