June 9, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

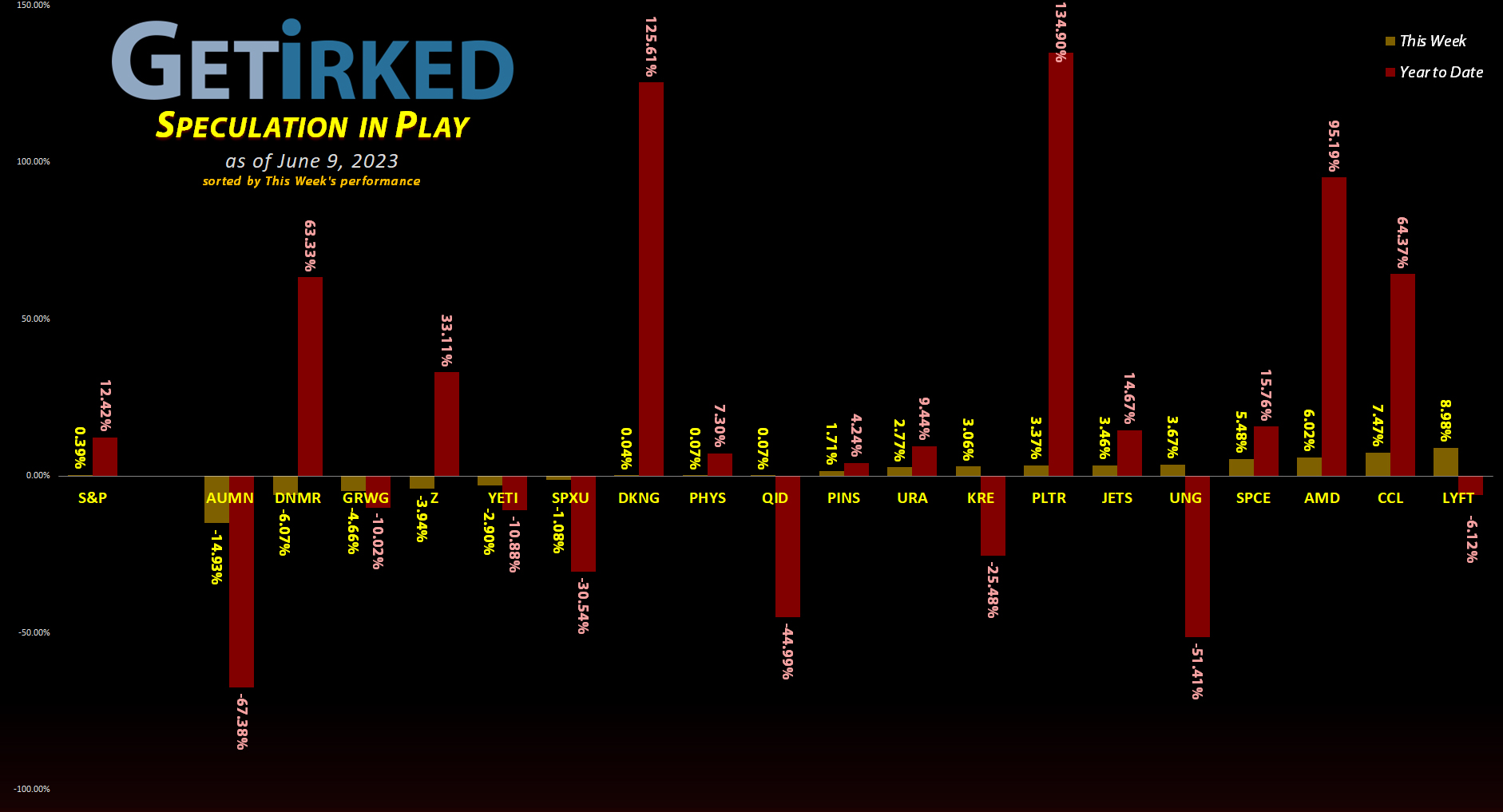

The Week’s Biggest Winner & Loser

Lyft (LYFT)

O.K. I’ve been doing Get Irked for nearly 5 years now so I’ve seen some really weird coincidences, but this week both Speculation in Play and Investments in Play have the exact same Winners & Losers they had last week.

I know. I can’t explain it either.

Lyft (LYFT) kept getting lifted on the back of last week’s momentum. As I expected, it top-ticked around $11.00, right where it peaked before its earnings report.

LYFT closed out the week up +8.98%, a pretty remarkable move when the S&P 500 only rose +0.39%, and won the spot of the Week’s Biggest Winner for the second week running.

Golden Minerals (AUMN)

Even after its 1-for-25 reverse split finished before the open on Friday, Golden Minerals (AUMN) just kept getting squashed, dropping -14.16% on Friday alone.

AUMN dropped yet another -14.93% this week, easily snagging the spot of the Week’s Biggest Loser twice in a row, and the downside selling momentum seems to have no signs of stopping (particularly since it now has 25X further to go to hit zero than it did last week!).

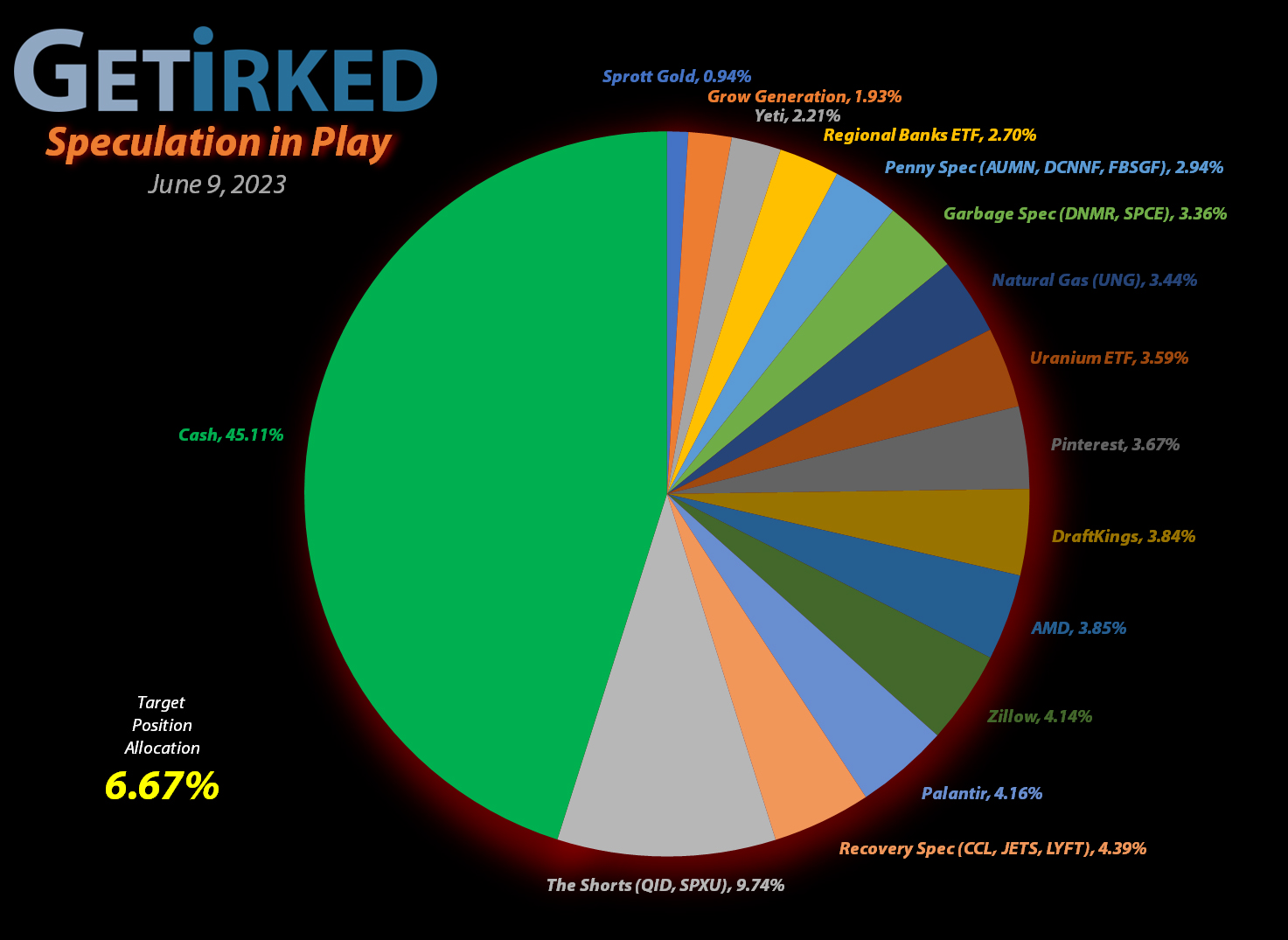

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+664.38%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Airlines ETF (JETS)

+392.87%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: 3.95

Pinterest (PINS)

+352.63%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+346.07%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Carnival Cruise (CCL)

+187.75%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Virgin Galactic (SPCE)

+139.43%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Uranium ETF (URA)

+24.07%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Lyft (LYFT)

+19.31%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $8.75

Regional Banks ETF (KRE)

+0.34%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $43.33

Sprott Gold Trust (PHYS)

+0.30%

1st Buy: 6/5/2023 @ $15.25

Current Per-Share: $15.25

Palantir (PLTR)

-8.75%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.45

Zillow (Z)

-9.71%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Short SPY (SPXU)

-10.08`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $13.20

Short QQQ (QID)

-19.41%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $18.00

DraftKings (DKNG)

-24.57%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-24.73%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-58.85%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Golden Mine. (AUMN)

-62.87%

1st Buy: 7/29/2021 @ $13.29

Current Per-Share: $6.37

Danimer Sci (DNMR)

-65.61%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-75.30%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-97.17%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Lyft (LYFT): Profit-Taking

Lyft (LYFT) continued its rally following last week’s analyst coverage, triggering my next sell order on Tuesday which filled at $10.35. The sale locked in +25.45% in gains on shares I bought less than a month ago for $8.25 on May 12. The sale lowered my per-share cost -4.37% from $9.15 to $8.75.

From here, I will replace the shares I sold at $7.95, slightly above LYFT’s all-time low, and I will take more profits at $16.35, just under a point of resistance LYFT tested over the last 6-12 months.

LYFT closed the week at $10.44, up +0.87% from where I took profits Tuesday.

Palantir Technologies (PLTR): Profit-Taking

Palantir Technologies (PLTR) continued rocketing higher this week, eventually triggering my next sell order which filled at $17.00 on Wednesday. Finally above my cost basis, the sale lowered my per-share cost -0.60% from $16.55 to $16.45, a full -47.78% reduction from where I initially opened the position at $31.50 back on February 12, 2021.

While a relatively small price reduction, the sale also locked in a substantial +136.77% in gains on shares I bought on May 9 and 12 of 2022 for an average price of $7.18.

From here, my next sell target is $19.65, below a past point of resistance, and my next buy target is $7.45 above a past point of support.

PLTR closed the week at $15.01, down -11.71% from my Wednesday sale.

Sprott Gold Trust (PHYS): *New Position*

The week kicked off with me opening an all-new position in the Sprott Physical Gold Trust (PHYS). Sprott is a metals company based in Canada that has developed a reputation for creating investments based on physical investments in assets like oil, uranium, and gold. Unlike gold ETFs like GLD and IAU, Sprott backs up each of its ETFs with actual, physical, 100% ownership of the underlying asset, in this case gold, making it a more authentic 1:1 investment on the underlying unlike ETFs that may be manipulated and not backed up entirely.

I made my first buy on Monday at $15.25 when the precious metal pulled back slightly from its Friday selloff. From here, my next buy target is $14.80, which might sound aggressive, but, as always, I opened the position with a very small allocation so I’m willing to get bigger a little quicker.

At this point, I have no sell targets until and unless PHYS breaks out to new all-time highs beyond its current ATH at $16.10.

PHYS closed the week at $15.30, up +0.30% from where I opened it.