June 2, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

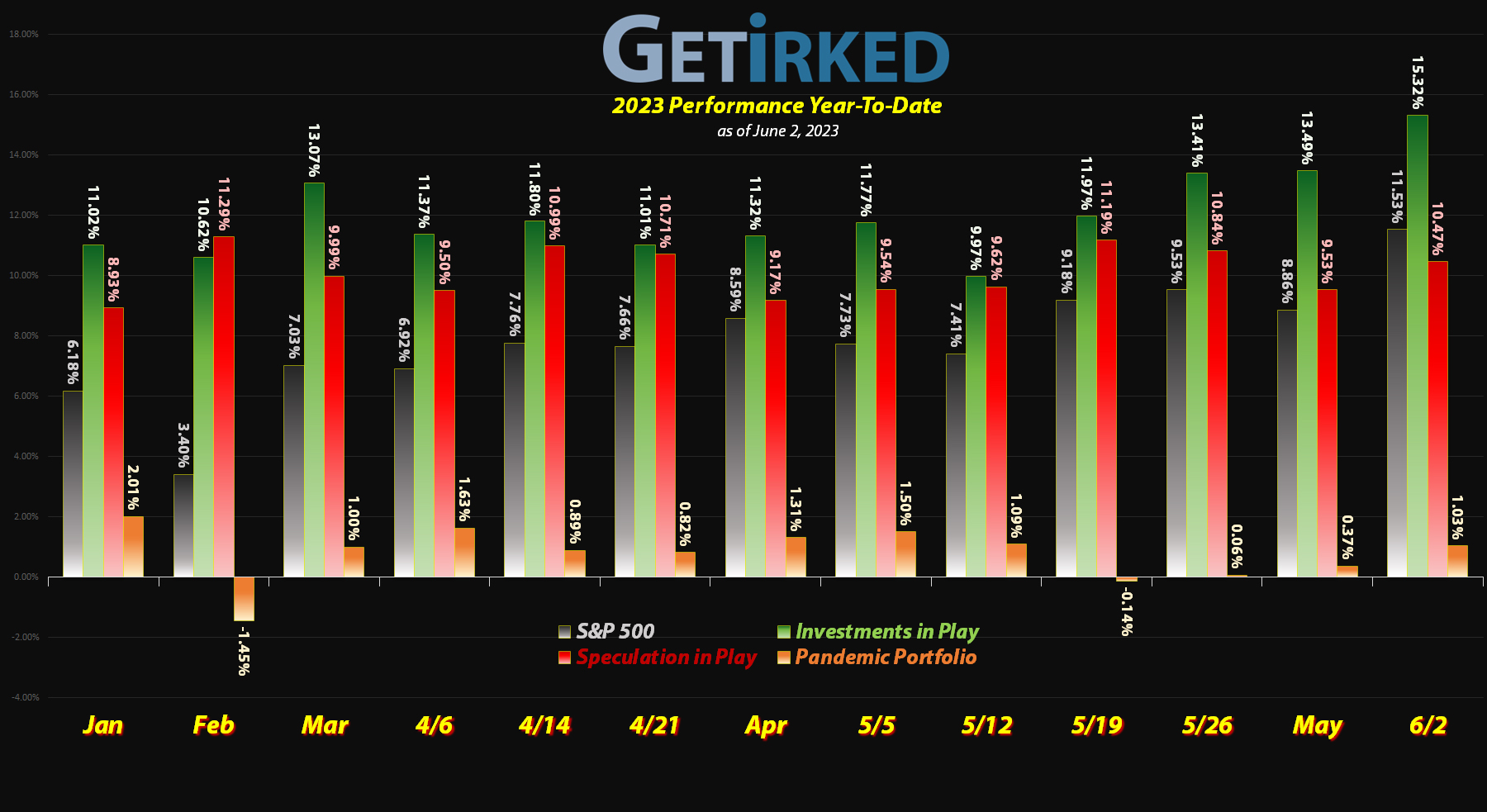

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Lyft (LYFT)

Lyft (LYFT) got a lift this week (had to.. sorry) from analyst coverage touting the ride-sharing stock as a buy. As a result, LYFT popped +14.32% this week, parking in the spot of the Week’s Biggest Winner.

Golden Minerals (AUMN)

At first glance, the uninitiated might think that gold was selling off based on the atrocious performance of my super-speculative junior goldminer penny stock, Golden Minerals (AUMN), and, while gold didn’t have a great week, the precious yellow metal was not responsible for this selloff.

On Tuesday, AUMN shareholders approved a 1:25 reverse split. Next Friday (6/2), AUMN’s closing stock price will be multiplied by 25X and existing shareholders will receive one share for every 25 shares they own.

On face value, that shouldn’t have meant anything to AUMN’s share price, however the stock had become a trading vehicle for speculative traders who enjoy playing with sub-$1 stocks. Next Friday, AUMN will be priced at $2.78/shr (based on this week’s closing price).

As a result, the rats fled the ship, desperate to get out before their trading vehicle turned back into a pumpkin, resulting in an epic -34.92% selloff in AUMN and easily slotting it into the spot of the Week’s Biggest Loser during a week that saw mostly winners.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+646.13%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Airlines ETF (JETS)

+376.40%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: 3.95

Yeti (YETI)

+350.60%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+349.97%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Carnival Cruise (CCL)

+167.55%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Virgin Galactic (SPCE)

+135.27%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Uranium ETF (URA)

+20.73%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Lyft (LYFT)

+4.70%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $9.15

Regional Banks ETF (KRE)

-2.57%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $43.33

Zillow (Z)

-6.00%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Short SPY (SPXU)

-9.09`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $13.20

Palantir (PLTR)

-12.30%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.55

Short QQQ (QID)

-19.57%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $18.00

DraftKings (DKNG)

-24.60%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

U.S. Natural Gas (UNG)

-27.39%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Canadian Pal (DCNNF)

-52.25%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Golden Mine. (AUMN)

-57.44%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.2611

Danimer Sci (DNMR)

-63.39%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-74.09%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-97.34%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Golden Minerals (AUMN): Added to Position

When Golden Minerals (AUMN) approved a 1-for-25 reverse split this week, my super-speculative penny-stock gold-miner, continued its breakdown on Tuesday, crashing through its prior low where my next small buy order filled at $0.1619. On Wednesday, AUMN’s freefall continued and triggered my next (and final, for the moment) buy at $0.1337, giving me an average buying price of $0.1361.

The combined buys lowered my per-share cost -6.75% from $0.28 to $0.2611. From here, I have no buy or sell targets targets as it’s a matter of waiting to see how the price action will develop once the reverse split takes effect next Friday, June 9, when the share price will increase 25X.

AUMN closed the week at $0.1111, down -18.37% from my average buy price.

Short QQQ (QID): Added to Position

When the Nasdaq gapped open on Tuesday thanks to news that a debt ceiling agreement had been reached between President Biden and Speaker McCarthy, my next buy order in the ProShares Inverse QQQ ETF (QID) was triggered at $14.60.

The buy lowered my per-share cost -1.64% from $18.30 to $18.00. From here, my next buy order is much lower at $13.55, a price calculated using the Fibonacci Method, and my next sell order is $18.70, below a past point of resistance.

QID closed the week at $14.47, down -0.89% from where I added Tuesday.

Short SPY (SPXU): Added to Position x 2

When the S&P 500 rallied on Thursday following the House of Representatives passing the debt ceiling bill, my inverse play, SPXU, triggered the next buy order which filled at $12.55. On Friday, the intense rally sparked by the passage of the debt ceiling bill by the Senate triggered my next buy target at $11.95, leaving me with an average buying price of $12.15.

The buys lowered my per-share cost -2.58% from $13.55 to $13.20, and, from here, my next buy target is $11.10, a price calculated using the Fibonacci Method. My next sell target is $13.75, just below a past point of resistance.

SPXU closed the week at $12.00, down -1.23% from my $12.15 buy price.