May 19, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

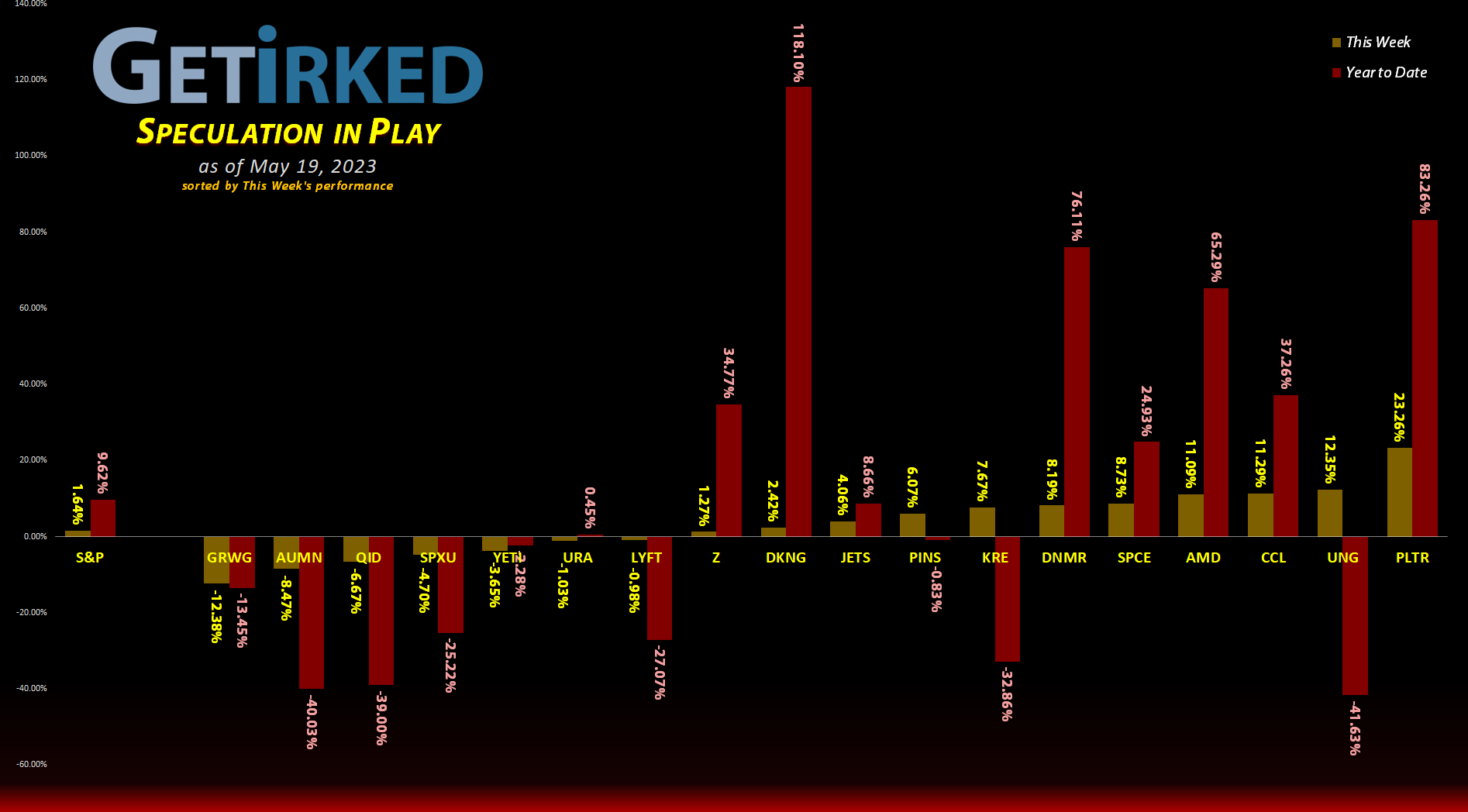

The Week’s Biggest Winner & Loser

Palantir Tech (PLTR)

The Artificial Intelligence (AI) fervor shows no signs of stopping with every AI stock rocketing even higher this week. Palantir Technologies (PLTR) made a new 52-week high this week, flying +23.26% and landing in as this week’s Biggest Winner.

Grow Generation (GRWG)

As if cannabis expected anything more, Congress has once again fumbled the SAFE Banking Act by treating it like a Christmas tree, hanging so many provisions and unrelated items on to the bill that there’s virtually no chance of it passing this go-round. As a result the entire cannabis sector got hit once more meaning Grow Generation (GRWG) dropped -12.38% and snuck in as this week’s Biggest Loser.

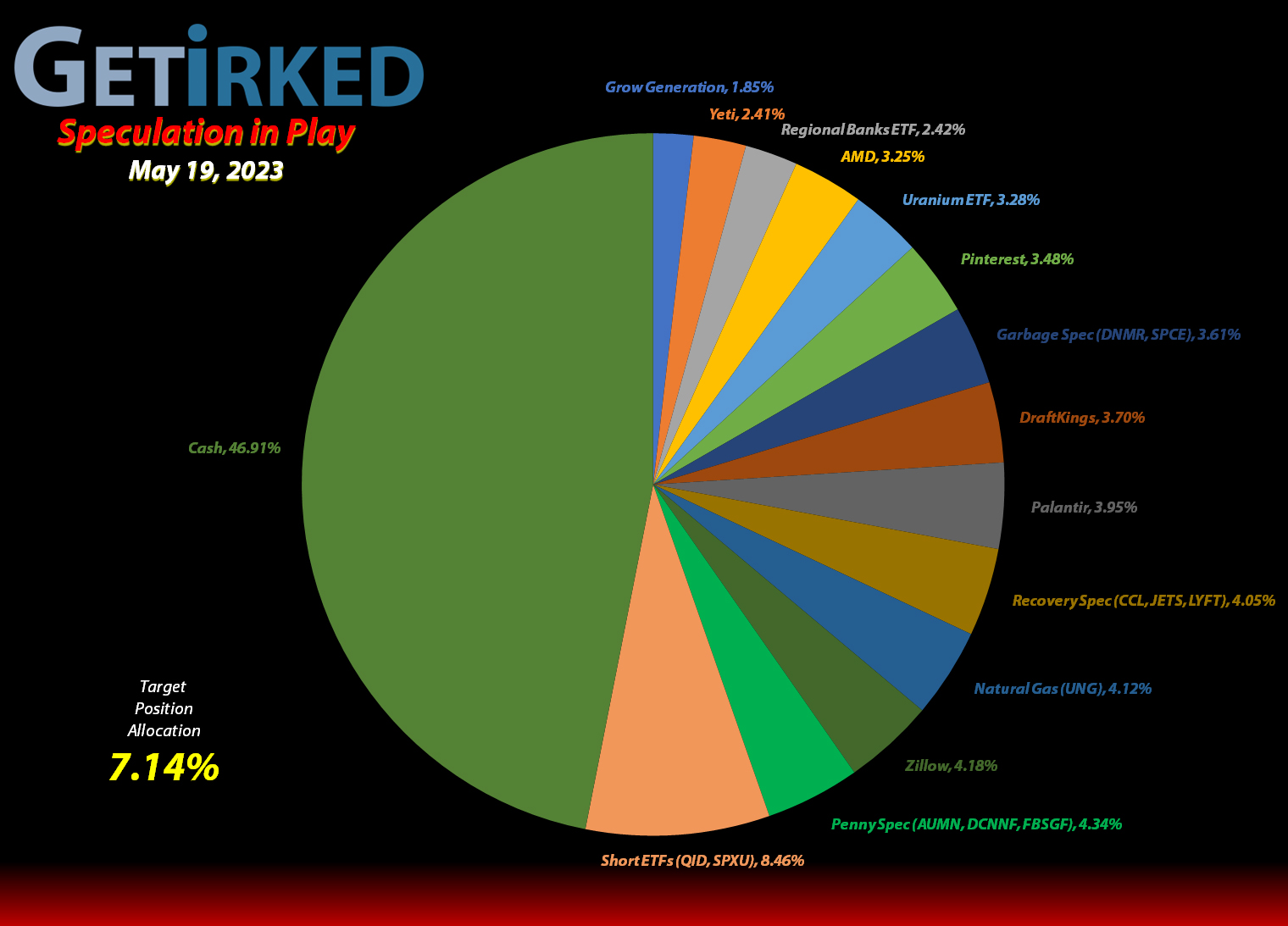

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+615.46%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Airlines ETF (JETS)

+367.03%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: 3.95

Yeti (YETI)

+360.73%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+344.91%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Virgin Galactic (SPCE)

+145.67%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.00)*

Carnival Cruise (CCL)

+140.31%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Uranium ETF (URA)

+13.88%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Short SPY (SPXU)

-5.72`%

1st Buy: 3/9/2023 @ $14.75

Current Per-Share: $13.55

Zillow (Z)

-8.58%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Regional Banks ETF (KRE)

-9.61%

1st Buy: 3/13/2023 @ $44.17

Current Per-Share: $43.33

U.S. Natural Gas (UNG)

-9.64%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.25

Lyft (LYFT)

-11.37%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $9.15

Short QQQ (QID)

-13.32%

1st Buy: 3/7/2023 @ $20.20

Current Per-Share: $18.55

DraftKings (DKNG)

-27.08%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $33.06

Palantir (PLTR)

-29.24%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.55

Golden Mine. (AUMN)

-37.48%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.2800

Canadian Pal (DCNNF)

-46.46%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-62.92%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-76.24%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $14.90

Fabled Gold (FBSGF)

-94.67%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

DraftKings (DKNG): Profit-Taking

As much as I say over and over again that you should “only sell on GREEN days,” I broke my rule when it became apparent that DraftKings (DKNG) was rolling over on Tuesday with a stop-loss limit sell order which filled at $22.84.

The sale locked in +36.36% in gains on shares I bought for $16.75 back on March 11, 2022, and it raised my per-share cost +5.13% from $31.35 to $33.06. However, the sale served the more important priority of freeing up capital to use should DraftKings pull back substantially which I think is a distinct possibility given its epic run since December.

From here, my next sell target is much higher at $42.06, around a key point of resistance above my new cost basis. My new buy target is $13.24, slightly above a key level of support DKNG’s has hit repeatedly in the past.

DKNG closed the week at $24.10, up +5.52% from where I took profits.

ProShares UltraShort QQQ (QID): Added to Position

When the NASDAQ rallied on Wednesday, my short position, the ProShares UltraShort QQQ ETF (QID), dropped through my next buy target which filled at $16.76 and lowered my per-share cost -1.07% from $18.75 to $18.55.

I continue adding to my short positions for two reasons: (1) the markets are becoming so exuberant that they feel frothy to me, and (2), these positions are infinitesimally small relative to both the Speculation in Play portfolio but also to my entire portfolio. Cumulatively, QID and SPXU (my short on the S&P 500) represent 0.265% of my entire investment universe.

In other words, I’m only risking money I’m willing to lose entirely.

From here, my next buy target is $15.80, around a past point of support, and my next sell target is $19.00, the next point of resistance above my cost basis.

QID closed the week at $16.08, down -4.06% from where I added Wednesday.

ProShares Short SPY (SPXU): Added to Position

On Thursday, the S&P 500 continued to rally and triggered my next buy in my SPY short position, the ProShares UltraPro Short S&P 500 ETF (SPXU), at $12.85.

The buy locked in a -9.19% discount replacing shares I sold for $14.15 back on May 4 and lowered my per-share cost -1.45% from $13.75 to $13.55. From here, my next buy is $12.50, right above the next point of support, and my next sell target is $13.95, slightly below SPXU’s recent high.

SPXU closed the week at $12.78, down -0.62% from where I added Thursday.