March 3, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

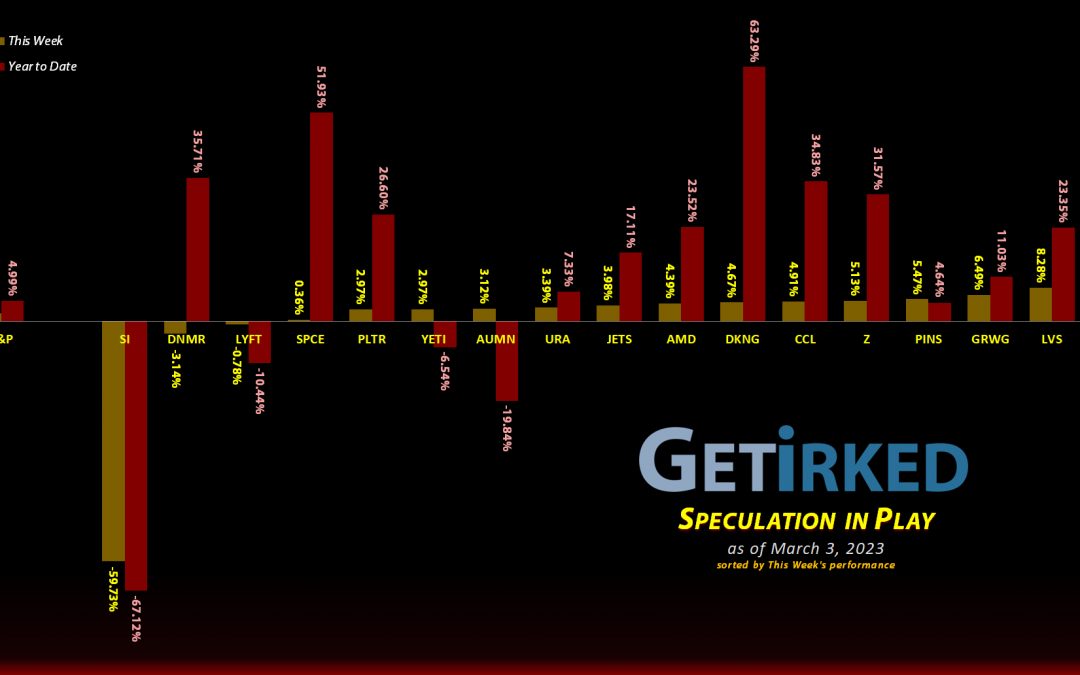

The Week’s Biggest Winner & Loser

Natural Gas (UNG)

This week’s winner was the U.S. Natural Gas Fund (UNG) which may have finally bottomed (fingers crossed) as it bounced a pretty incredible +16.37% this week to turn up the heat and become the Week’s Biggest Winner.

Silvergate Capital (SI)

One of the new positions this week, Silvergate Capital (SI) collapsed -59.73% this week alone after the crypto bank announced that it didn’t know if it would survive and would be delaying its annual 10-K report. As a result, SI most certainly swung in as the Week’s Biggest Winner (and could be very soon becoming the Year’s Biggest Loser if it loses -100%…)

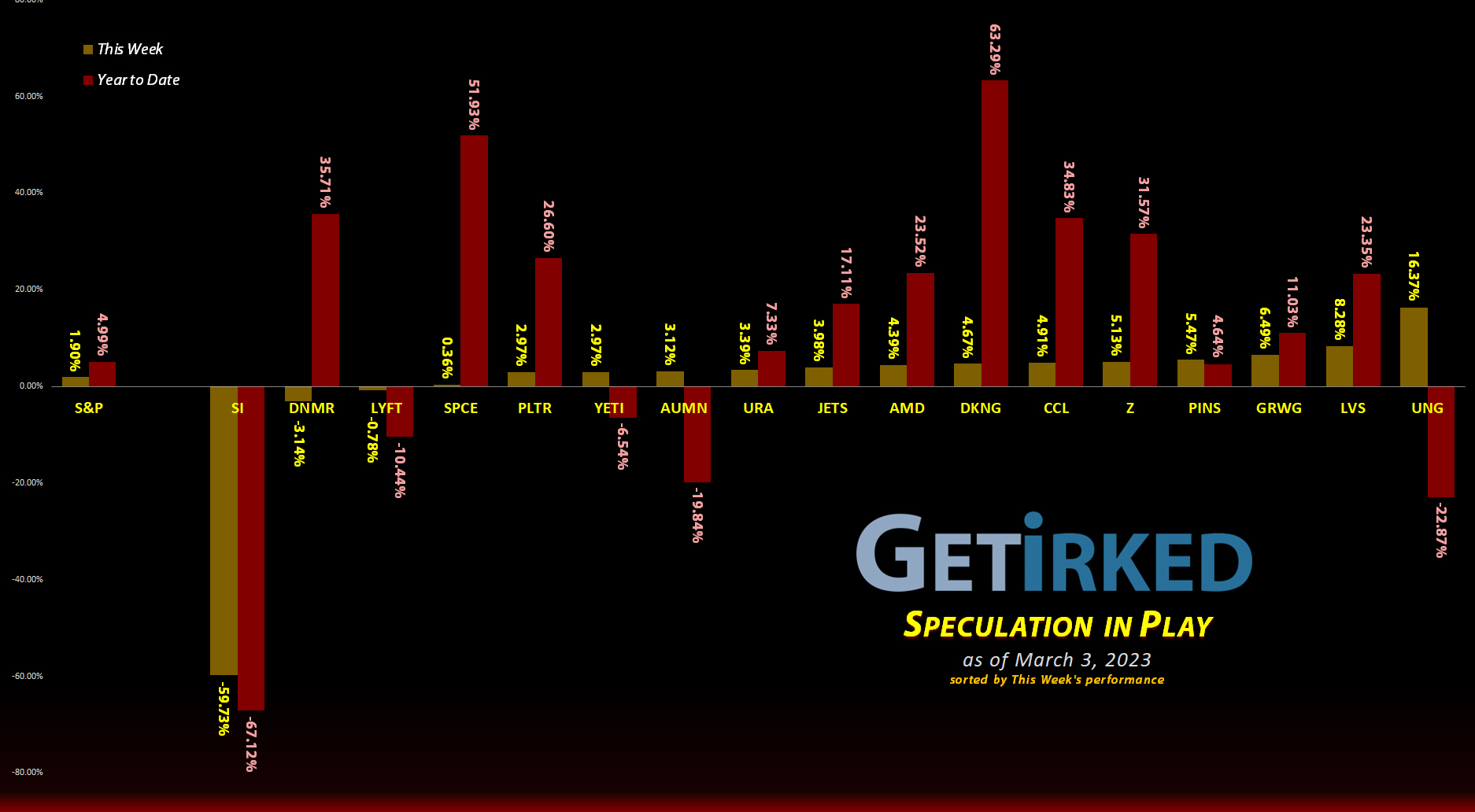

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+553.36%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: (-$135.01)*

Pinterest (PINS)

+369.53%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Yeti (YETI)

+361.24%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Las Vegas Sands (LVS)

+175.90%*

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: (-$10.44)*

Virgin Galactic (SPCE)

+163.85%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.60)*

Carnival Cruise (CCL)

+144.04%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Airlines ETF (JETS)

+82.05%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$2.68)*

Uranium ETF (URA)

+22.71%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

U.S. Natural Gas (UNG)

+14.89%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.60

Lyft (LYFT)

+3.79%

1st Buy: 3/2/2023 @ $9.75

Current Per-Share: $9.75

Zillow (Z)

-12.95%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

Silvergate Holdings (SI)

-20.48%

1st Buy: 3/2/2023 @ $7.40

Current Per-Share: $7.25

Golden Mine. (AUMN)

-27.35%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.3097

DraftKings (DKNG)

-39.27%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $31.35

Palantir (PLTR)

-47.95%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.00

Canadian Pal (DCNNF)

-51.55%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Danimer Sci (DNMR)

-71.11%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Grow Gen. (GRWG)

-71.69%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $15.65

Fabled Gold (FBSGF)

-80.95%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Lyft (LYFT): *New Position*

This week, I opened a brand new position in Lyft (LYFT) on Thursday when it finally cracked below $10.00 and triggered my buy order which filled at $9.75.

Why Lyft and not its far-superior competitor, Uber (UBER)?

Simple. Lyft is the better speculative play. Once again, this portfolio is designed for more speculative trades and investments which is precisely why I’ve limited the entire portfolio’s size to less than one allocation of the much, much larger Investments in Play portfolio.

After reporting an absolutely dismal quarter, Lyft is now down more than -47% from this year’s highs set back at the beginning of February, and cracked through to create a new all-time low on Thursday.

Lyft is definitely struggling in comparison to Uber, however given that there are only these two real plays in the ride-sharing space, I think there’s potential for Lyft. Lyft could either turn it around and become a better company or Lyft could be potentially purchased by Uber or another interested party.

As a result, I believe Lyft has interesting prospects. That being said, I’m building this position very slowly, and I’ve already planned the entire investment in advance including how much I’m willing to lose entirely should LYFT go to zero.

With a starting cost basis at $9.75, my next buy target is $7.34, a price calculated using Fibonacci Method, and my next sell target is $17.92, just under its 2022 highs.

LYFT closed the week at $10.12, up +3.79% from where I opened on Thursday.

Silvergate Capital (SI): *New Position*

Those of you not in the crypto world might hear the name “Silvergate Capital (SI)” and think it may have something to do with finance… and you’d be right. SI initially started its life as a relatively dull regional bank. In the early 2010’s, Silvergate pivoted and began to cater exclusively to cryptocurrency companies.

When Facebook (now Meta (META)), got it rid of its own cryptocurrency project, initially called “Libra,” Silvergate was actually the company to snap it up. So, Silvergate’s got significant interests in cryptocurrency, right?

Well, yes. And it gets worse. Turns out Silvergate lent a significant amount of money to FTX, the defunct crypto brokerage run by fraudster Sam Bankman-Fried, and so that smacked the company hard.

How hard did Silvergate get hit?

Well, this week the bank announced it would have to delay its annual report to give the accountants more time to audit the financials and proceeded to announce that the bank is unsure if it will survive.

Since its all-time high in November 2021, Silvergate Capital has crashed more than –97% to its new all-time low set on Thursday, when I snatched it up with an opening buy which filled at $7.40. SI continued to sell off throughout Thursday, triggering my next small buy order at $6.80 which lowered my per-share cost -2.03% from $7.40 down to $7.25.

From here, my next buy target is $4.50, a price calculated using the Fibonacci Method, and my next sell target is $22.00 just under Silvergate’s highs from just a few weeks ago (yes, Silvergate has crashed nearly -75% since the beginning of February alone).

Just like the rest of the positions in this portfolio, SI should not be considered anything more than a speculative bet (I’m using such a small allocation, I wouldn’t even call this one an “investment”). I have planned my entire play out in advance and I know exactly how much money I’m willing to lose completely as crypto companies are notoriously volatile and unstable, and this one is at the top of the heap for dangerous positions.

SI closed the week at $5.77, down -25.65% from my $7.25 average buy price.

U.S. Natural Gas (UNG): Profit-Taking

The United States Natural Gas Fund (UNG) has seen a significant run off its lows made in late February, triggering my first sell order on Friday at $9.83. The sale locked in a +22.26% gain on some shares I bought at an average price of $8.04 throughout February.

The sale also lowered my per-share cost -1.71% from $8.75 to $8.60 (hey, I said it was a small sale). From here, my next sell target is $14.12, below a past point of resistance, and my next buy target is $7.01, slightly below UNG’s all-time low, but a point I believe it might hit if it pulled back that far.

UNG closed the week at $9.88, up +0.51% from where I took profits Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.