February 10, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

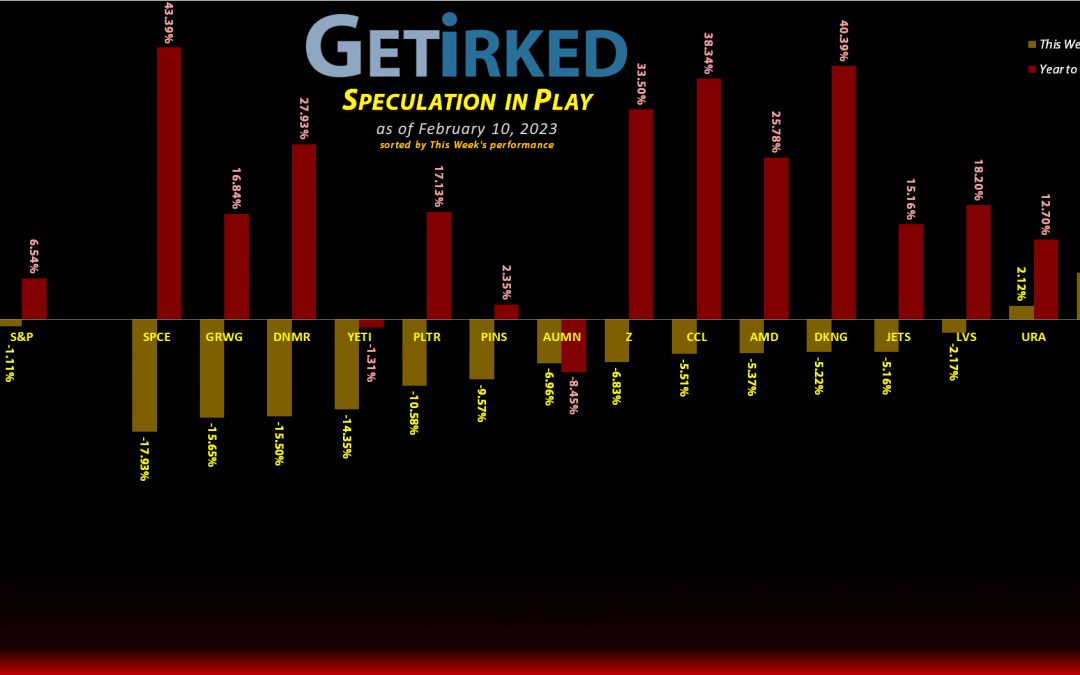

The Week’s Biggest Winner & Loser

U.S. Natural Gas (UNG)

The U.S. Natural Gas Fund (UNG) finally caught a break this week after natural gas inventories lowered faster than analysts were expecting. As a result, the fund popped +7.45%, nearly enough to hit my break-even price, and earning UNG the spot of the Week’s Biggest Winner.

Virgin Galactic (SPCE)

Virgin Galactic (SPCE) pulled back -17.93% on no news this week, but given that this is one of the most speculative names out there and the fact that it is still up more than +40% YTD, you can see why. SPCE earned the spot of the Week’s Biggest Loser, though.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+553.26%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($135.01)*

Yeti (YETI)

+366.74%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+359.15%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Las Vegas Sands (LVS)

+166.07%*

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: -($10.44)*

Virgin Galactic (SPCE)

+154.66%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.60)*

Carnival Cruise (CCL)

+145.14%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Airlines ETF (JETS)

+80.36%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$2.68)*

Uranium ETF (URA)

+28.15%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

U.S. Natural Gas (UNG)

-0.09%

1st Buy: 1/30/2023 @ $9.30

Current Per-Share: $8.80

Zillow (Z)

-13.39%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

SPY 3/3 400-398 Puts

-29.45%

Cost: $0.7442

Current Value: $0.38

Golden Mine. (AUMN)

-41.26%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4277

DraftKings (DKNG)

-46.51%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $29.90

Canadian Pal (DCNNF)

-51.38%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Palantir (PLTR)

-53.05%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.00

Grow Gen. (GRWG)

-70.73%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $15.65

Danimer Sci (DNMR)

-73.22%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Fabled Gold (FBSGD)

-86.58%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Points of Interest

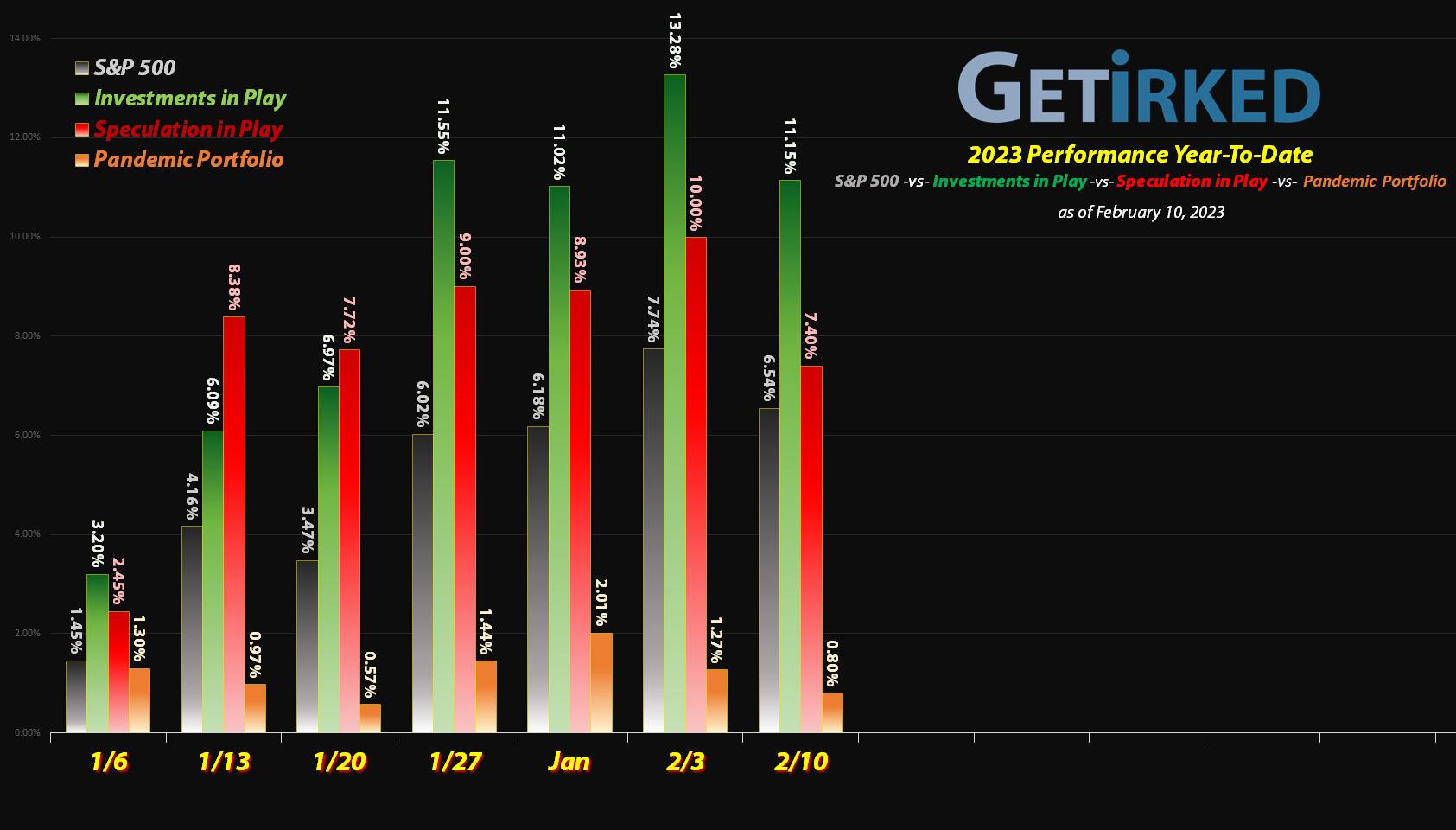

The Rotation out of Speculation into Commodities

It’s always interesting to see what I can glean about the state of the entire market simply by reviewing the microcosms of my own portfolios. For example, a market rotation seems to have started as commodities such as natural gas and even uranium (URA) caught a bid this week, rising as investors switched back to the sector.

In addition to speculative positions like Virgin Galactic (SPCE) pulling back dramatically, investors also started to flee the cannabis space following a few negative earnings from different companies. This caused any company in the space – GrowGeneration (GRWG) in the case of this portfolio – to pull back substantially, too, even though GRWG has not yet reported this season.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.