January 27, 2023

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Danimer Scientific (DNMR)

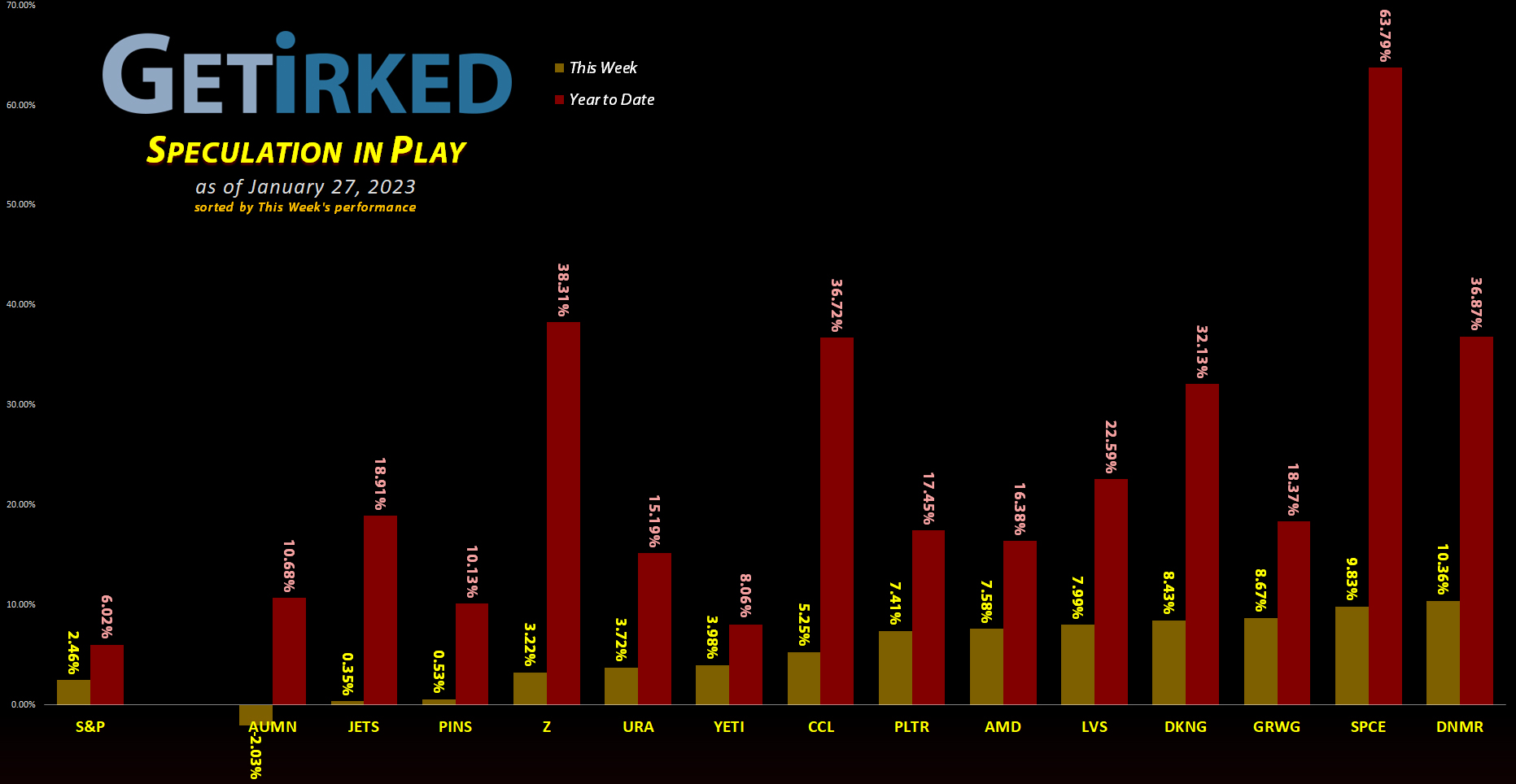

Yes, Danimer Scientific (DNMR), the absolute worst position in the portfolio (in terms of promise, at least) has, somehow, come out as the Week’s Biggest Winner for two weeks in a row.

Do not take this as a reason to buy this stock! It’s been a terrible investment, even in this portfolio where things often go… awry.

Regardless, DNMR added another +10.36% onto last week’s gains, giving it one of its first twofers.

Golden Minerals (AUMN)

The precious yellow metal rolled over a bit this week and took all of the miners with it. Where the junior miners usually get hit particularly hard, Golden Minerals (AUMN) more or less shrugged off the hit, dropping just -2.03%.

Of course, in a week where the entire market’s rallying, that loss is enough to earn AUMN the spot of the Week’s Biggest Loser.

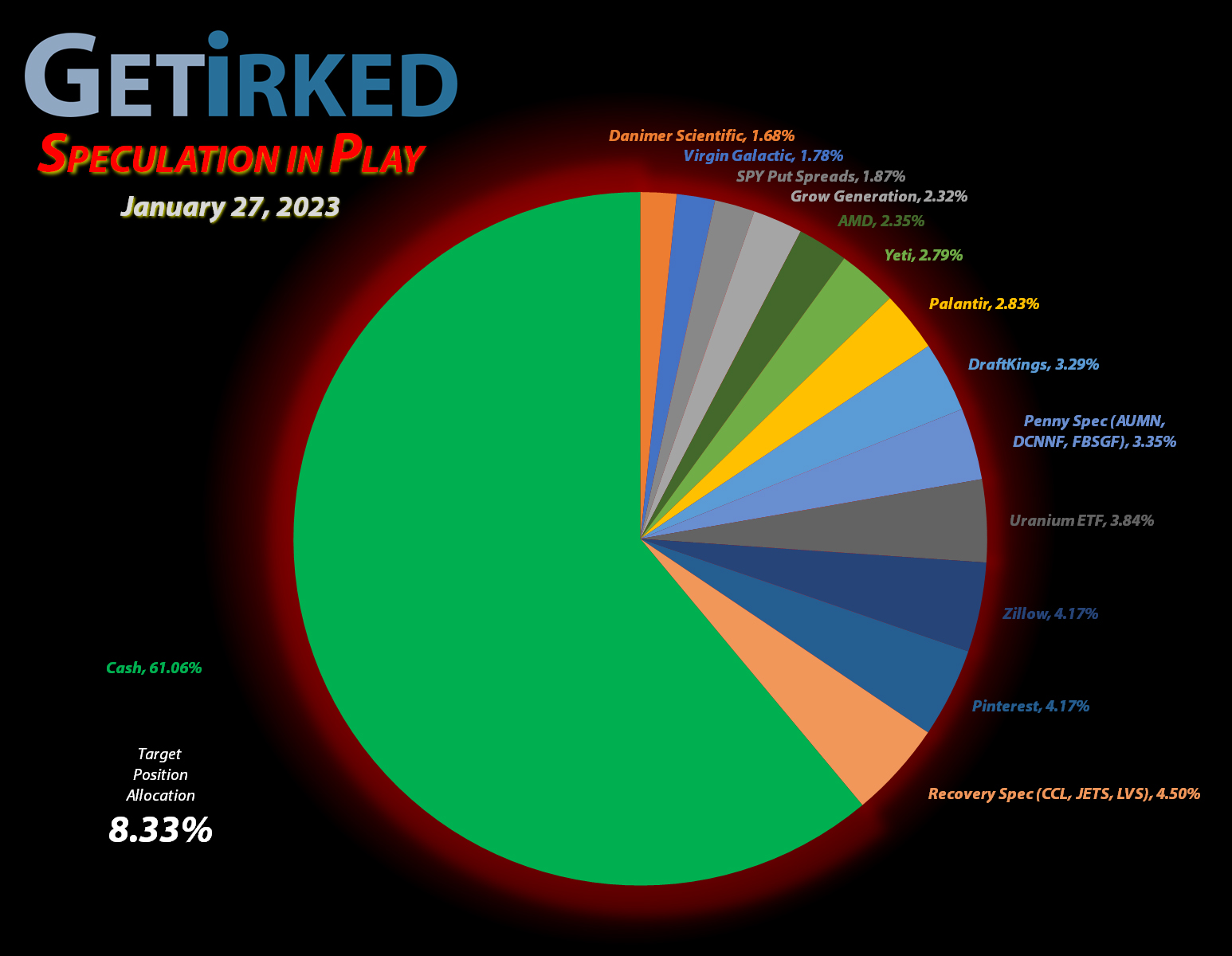

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+537.72%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($135.01)*

Yeti (YETI)

+383.14%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+371.79%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($29.14)*

Las Vegas Sands (LVS)

+171.26%*

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: -($10.44)*

Virgin Galactic (SPCE)

+167.63%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$3.60)*

Carnival Cruise (CCL)

+142.06%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.56

Airlines ETF (JETS)

+82.70%*

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: (-$2.68)*

Uranium ETF (URA)

+31.01%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.66

Zillow (Z)

-10.27%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $49.65

SPY 3/3 400-398 Puts

-19.38%

Cost: $0.7442

Current Value: $0.6000

Golden Mine. (AUMN)

-28.98%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4277

Canadian Pal (DCNNF)

-49.35%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

DraftKings (DKNG)

-49.69%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $29.90

Palantir (PLTR)

-52.83%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.00

Grow Gen. (GRWG)

-70.35%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $15.65

Danimer Sci (DNMR)

-71.35%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $8.55

Fabled Gold (FBSGD)

-83.80%

1st Buy: 7/23/2021 @ $0.5180

Current Per-Share: $0.4135

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Advanced Micro Devices (AMD): Profit-Taking

The semiconductors flabbergasting rally continued this week with Advanced Micro Devices (AMD) crossing through my next sell target which filled on Monday at $75.01.

While the sale only locked in +3.46% in gains on shares I bought for $72.50 on September 22, 2022, the sale served the more important point of capitalizing on a nearly +40% run off AMD’s lows. It also lowered my per-share “cost” -$105.01 from -$30.00 to -$135.01. (a negative per-share cost indicates all capital has been removed in addition to $135.01 per share added to the portfolio’s bottom line in addition to each share’s current value).

I remain bearish on the first half of 2023, and the macroeconomic environment does not dictate anything positive for AMD or the rest of the semiconductor sector.

I’ll hang on to what I have before taking more profits, but it was definitely time to free up capital to buy at lower levels if we see them. My next buy target is $56.51, a bit above AMD’s 202 low at $54.57. Since I’ve dramatically reduced my position size, I’ll hold off doing any more profit-taking until/if AMD reaches its all-times in the $160s.

AMD closed the week at $75.40, up +0.52% from where I took profits Monday.

Palantir Technologies (PLTR): Added to Position

Weird moves happen in the markets all the time, but Palantir Technologies (PLTR) saw a particularly strange move at the open on Tuesday, when the stock suddenly dipped more than -20% to $5.84 on no news and then rebounded +50% to hit a high at $8.76, all within the first 15-30 minutes of trading.

Therein lies why I use limit orders. My next buy was at $6.20, nearly 16% lower than Monday’s close, but I was filled at $6.13 since PLTR opened so low. The buy lowered my per-share cost -5.27% from $16.89 to $16.00. From here, my next buy target is $5.18 and my next sell target is $17.03.

PLTR closed the week at $7.55, up +23.16% from where I added Tuesday.

SPY 3/3 Put Spread 400-398: *Opened Position*

I know, I know. I’m buying bearish put spreads on the S&P 500 again… but hear me out!

First, it’s been nearly a year since my last bearish option trade expired worthless in April 2022 (if only I had a longer expiration than two weeks because May positively bombed and those puts would have paid out).

I feel like I’ve learned a lot of lessons that I will apply to this trade:

Volatility is near record lows. The VIX is an index that measures volatility. When stocks sell off, the VIX skyrockets. A VIX of 30+ indicates a market that is extremely scared and approaching oversold conditions. A VIX under 20, where it is when I opened this position on Monday, indicates complacency and makes options cost less.

Bearish news is likely. For some reason, the markets have been rallying nonstop into earnings season. I think this will be ill-advised as I’m betting a lot of companies will report negative earnings. Therefore, I want to place a bearish bet on the markets.

More time. Whereas in past trades I would often give myself a few weeks, this time, I bought the put spread expiring in March, giving me nearly 6 weeks for the market to pull back.

Less Risk = Lower Cost. Rather than bet on a huge move in SPY, I’m betting it will sell off to $398.00, a -1.09% drop from where it was when I bought the spreads, within the next 6 weeks. Seems feasible.

So, here’s how it plays out. I bought the 3/3 SPY 400 put options and sold the 3/3 SPY 398 options to offset the cost on Monday, before most the companies had reported earnings.

Each spread cost me $0.7442 (options are sold in contracts of 100, so each spread cost a total of $74.42 after fees). The maximum payout is $2.00 ($200), the difference between the strike price of the options I bought ($400) and the strike price of the options I sold ($398).

This provides the play a potential payout of 2.66 to 1, more than doubling my money if the entire profit is captured as I could make $200 (before fees) for each spread I bought costing me $74.42.

Original Cost: $74.42 per spread

Current Value: $60.00 per spread

Current Profit/Loss: -19.38%

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.