October 14, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

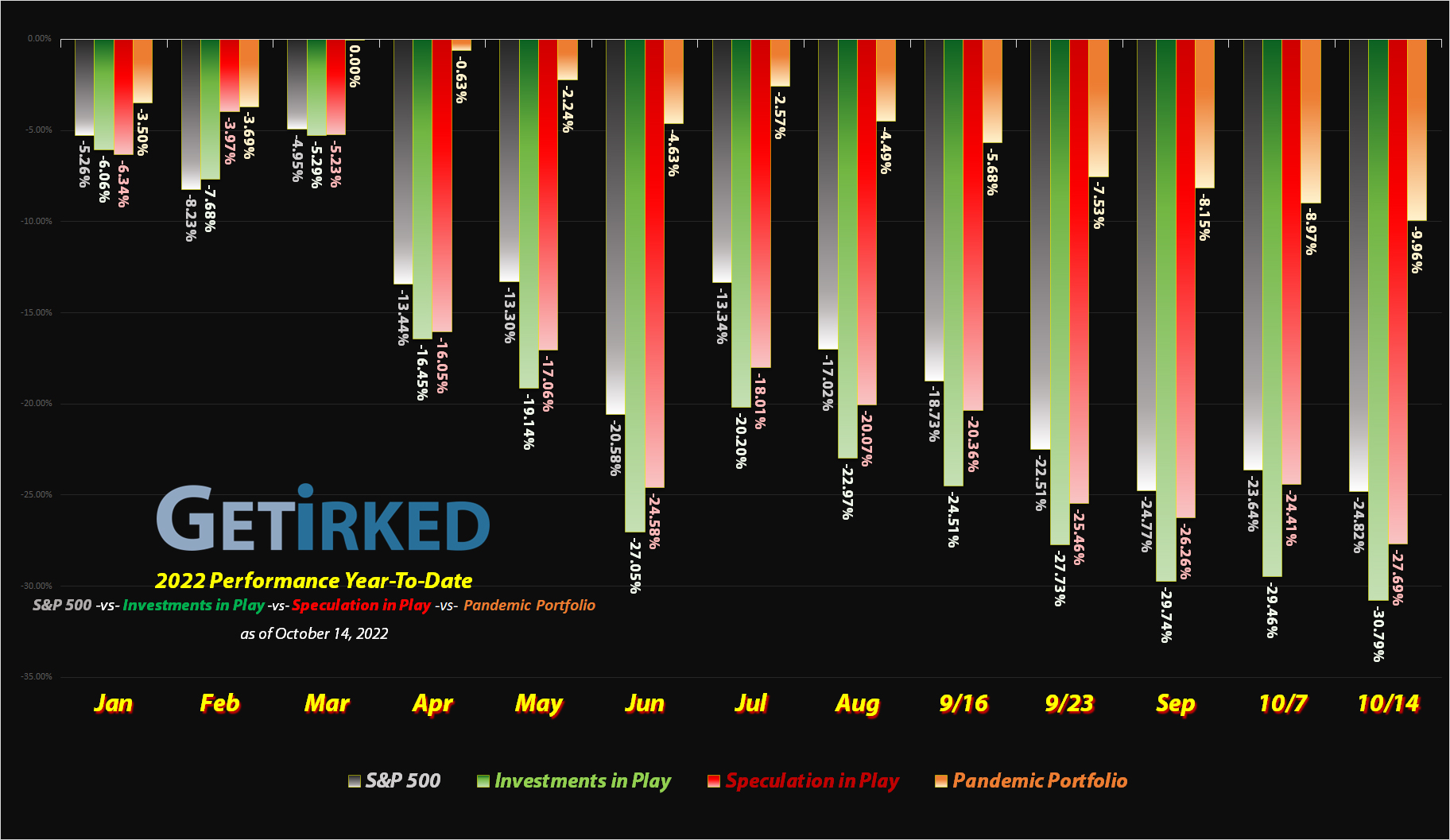

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Ever hear the line, “So bad, it’s good?” Well, that was the cruiseline sector this week, which, after weeks (if not months) of relentless beatdowns, saw a huge pop this week, despite the negative price action marketwide.

The result? Carnival Cruise Lines (CCL) walks away with the Week’s Biggest Winner after finishing the week up +5.32%.

DraftKings (DKNG)

Last week’s pop as a result of a pending deal with ESPN evaporated this week when surveys show that California’s proposition to legalize sports gambling is not likely to pass. As a result, the gambling space got slammed with Best-of-Breed DraftKings (DKNG) getting hit for an epic -24.64%, easily landing it in the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+439.25%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($30.00)

Pinterest (PINS)

+324.62%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($13.50)*

Yeti (YETI)

+319.85%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Virgin Galactic (SPCE)

+146.51%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$4.45)*

Tradeweb Mkts (TW)

+131.38%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.51)*

Airlines ETF (JETS)

+52.71%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $10.40

Las Vegas Sands (LVS)

+17.79%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $29.90

Uranium ETF (URA)

+6.11%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $17.70

Carnival Cruise (CCL)

-4.30%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $7.45

Wendy’s (WEN)

-17.82%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $23.68

Golden Mine. (AUMN)

-41.52%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4277

Zillow (Z)

-43.64%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $47.85

DraftKings (DKNG)

-55.27%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $27.90

Palantir (PLTR)

-55.42%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.90

Danimer Sci (DNMR)

-75.21%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $9.60

Grow Gen. (GRWG)

-79.70%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+247.50%*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

General Electric (GE)

+64.12%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.08)*

Canadian Pal (DCNNF)

-36.04%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Fabled Gold (FBSGF)

-55.86%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Actual Cash

35.99%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

Carnival Cruise Lines (CCL): Added to Position

Carnival Cruise Lines (CCL) hit the iceberg that was Monday’s market selloff, breaking through to new 2022 lows and triggering my buy order which filled at $6.18. The buy lowered my per-share cost -2.49% from $7.64 to $7.45.

From here, my next buy target, derived from the Great Financial Crisis in 2008-09, of all things, is down at $5.20, above a historical point of support. My next sell target is $11.30, just below CCL’s rally in August.

CCL closed the week at $7.13, up +15.37% from where I added Monday.

Danimer Scientific (DNMR): Added to Position

The unrelenting selloff in bioplastic manufacturer Danimer Scientific (DNMR) remained, well, unrelenting this week with DNMR pushing through my next buy target which filled on Wednesday at $2.40.

The buy lowered my per-share cost -4.00% from $10.00 to $9.60. From here, my next buy target is $1.70, a price calculated using Fibonacci Retracement, and my next sell target is $10.05, slightly below a past point of support and resistance.

DNMR closed the week at $2.38, down -0.83% from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.