August 12, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

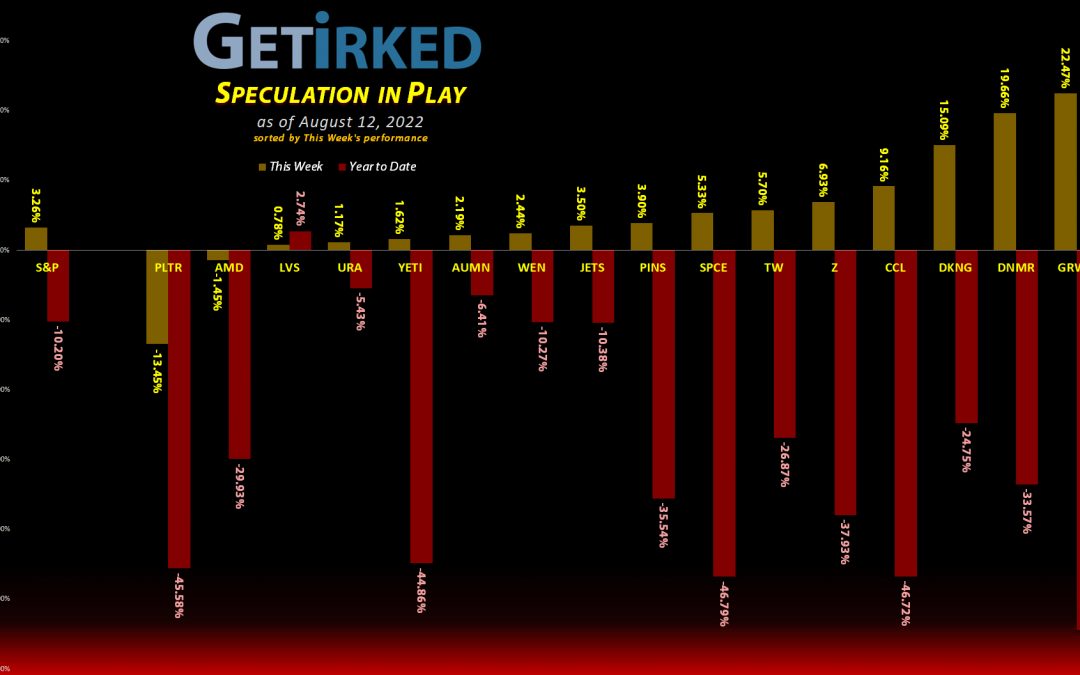

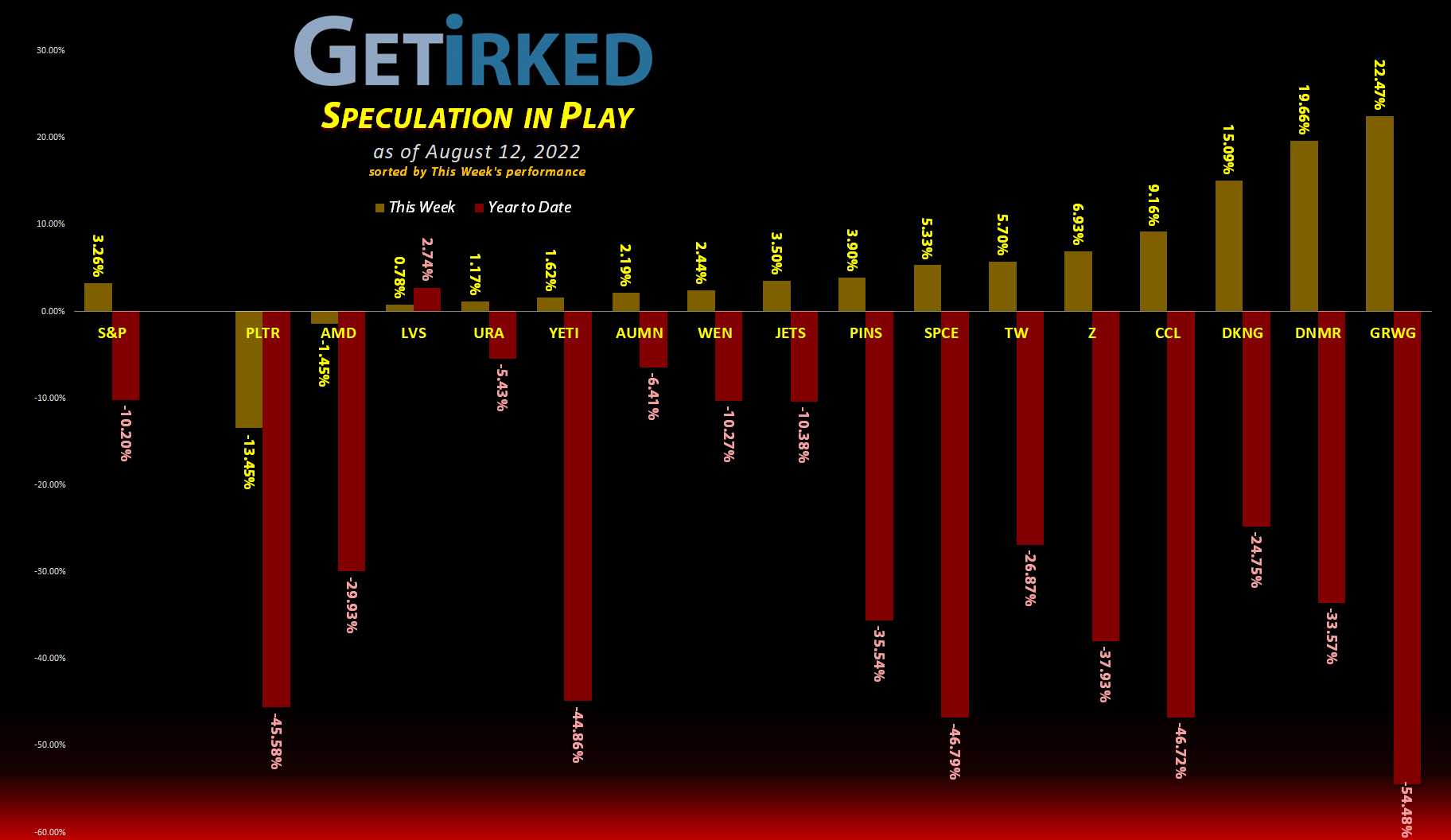

The Week’s Biggest Winner & Loser

GrowGeneration (GRWG)

The potential of Congress passing legislation permitting the cannabis industry to actually get bank accounts and credit cards caused the entire sector to pop this week. GrowGeneration (GRWG), a legitimate company which already has access to banking services since it only sells the supplies to grow cannabis, not the plant itself, still saw a massive +22.47% jump this week, easily earning itself the spot of the Week’s Biggest Winner.

Palantir Tech (PLTR)

In a week where pretty much every company went up, regardless of their earnings, you have to imagine exactly how bad Palantir Technologies’ (PLTR) quarter was, disappointing both on earnings and also on future guidance.

In a sea of green, Palantir dropped an astounding -13.45% as it disappointed across the board with no hope of recovery in sight, earning it the spot of the Week’s Stinkiest Loser.

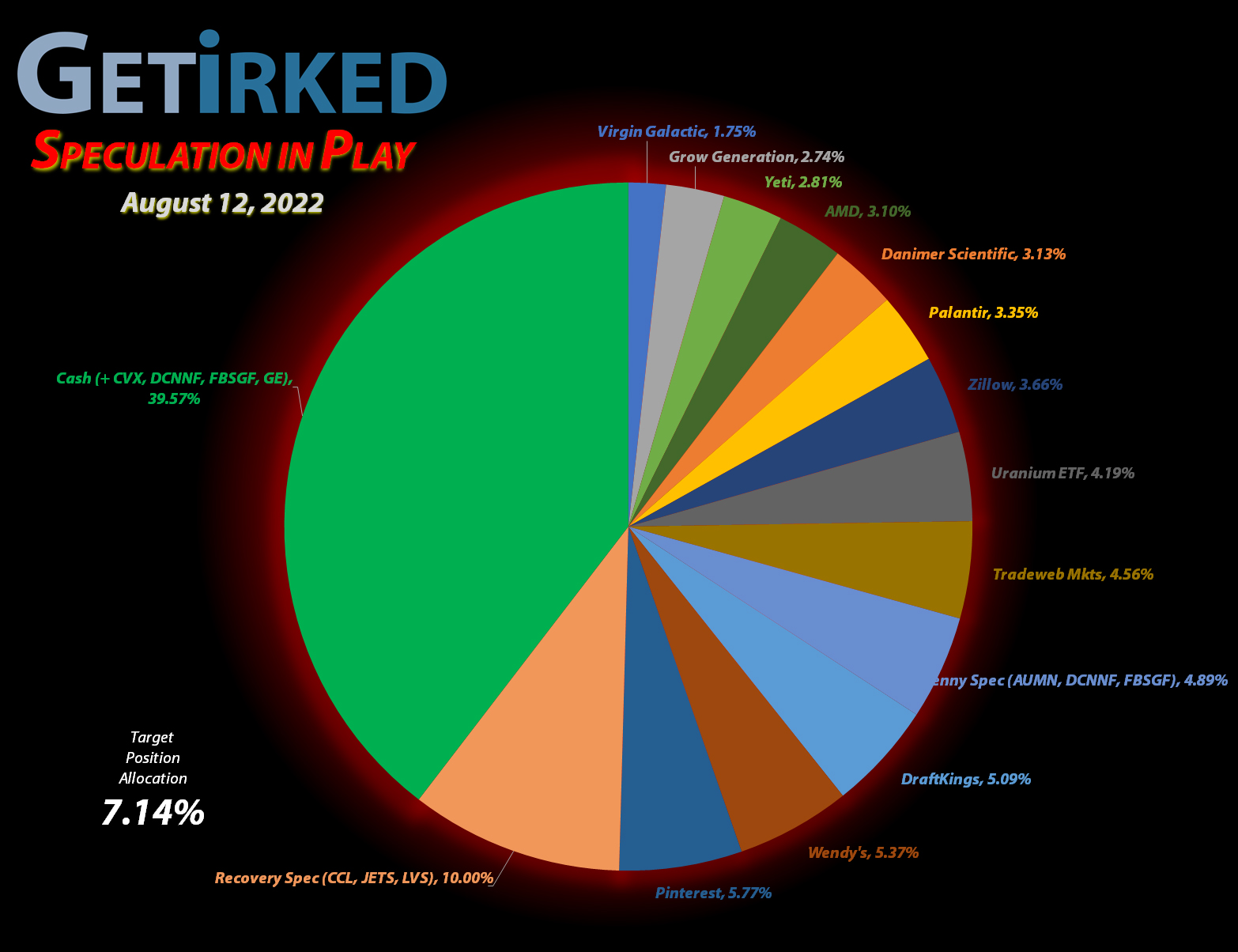

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+596.29%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($132.50)

Yeti (YETI)

+387.50%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+343.63%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($8.85)*

Virgin Galactic (SPCE)

+183.94%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$5.65)*

Tradeweb Mkts (TW)

+165.19%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.54)*

Airlines ETF (JETS)

+81.75%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $10.40

Carnival Cruise (CCL)

+40.47%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $7.64

Las Vegas Sands (LVS)

+20.28%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $32.15

Uranium ETF (URA)

+16.68%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $18.50

Wendy’s (WEN)

-10.20%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $23.83

DraftKings (DKNG)

-25.91%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $27.90

Golden Mine. (AUMN)

-26.43%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4443

Zillow (Z)

-26.75%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $54.10

Palantir (PLTR)

-41.33%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.90

Danimer Sci (DNMR)

-43.40%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $10.00

Grow Gen. (GRWG)

-64.00%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+244.91%*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

General Electric (GE)

+70.19%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.21)*

Canadian Pal (DCNNF)

-27.65%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Fabled Gold (FBSGF)

-39.54%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Actual Cash

31.15%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

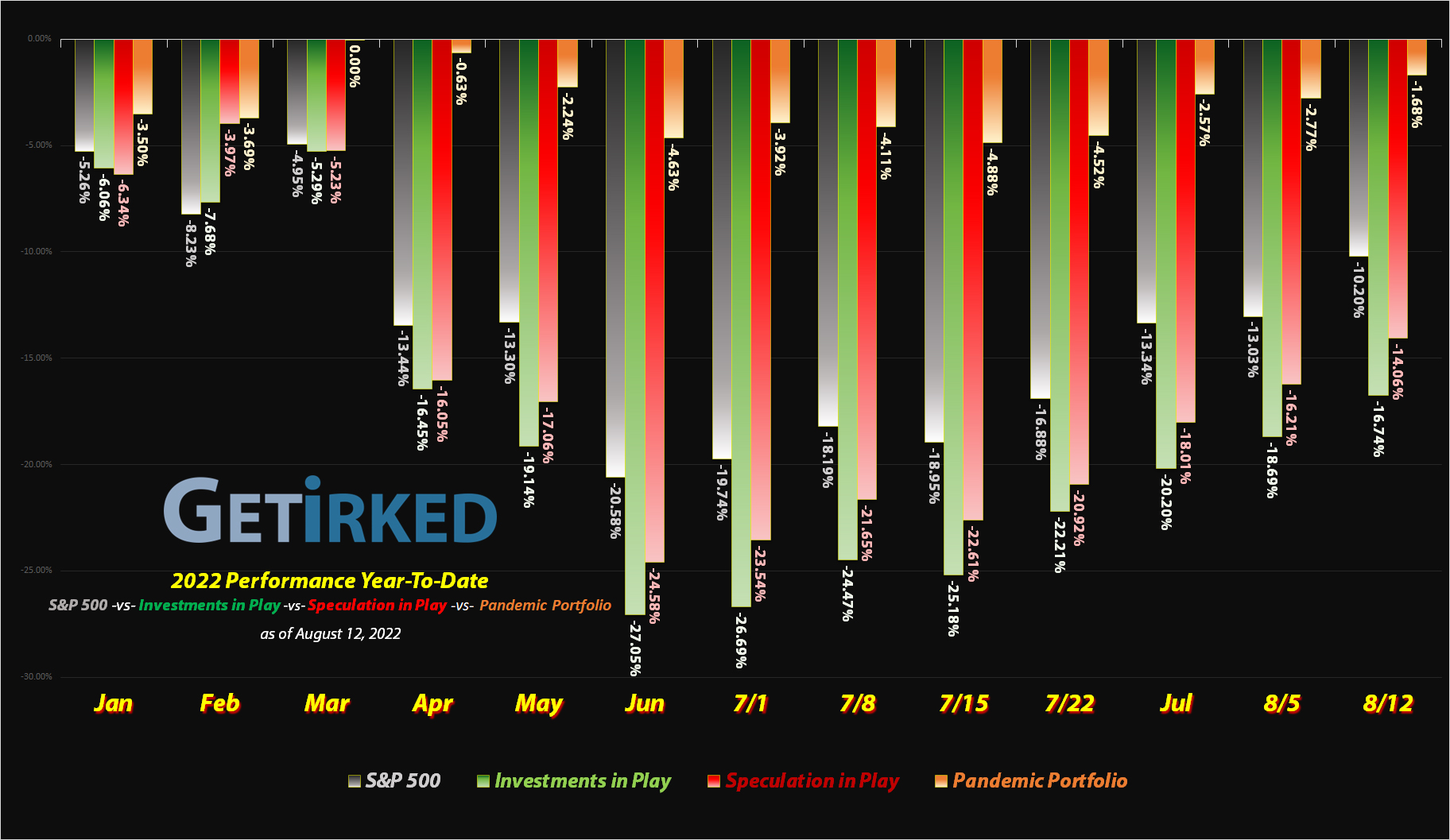

Buying Season, Selling Season, and Do-Nothing Season

The market continued its rally which started at the end of July all week this week, finishing Friday on a (seemingly) never-ending bull run.

And, once again, I’ve made no moves in the Speculation in Play portfolio…

For me, there are two different “seasons” int he markets – Buying Season and Selling Season. As always, I only buy on red days and I only sell on green days, however, for everything in between, I do nothing. We’re in Do-Nothing Season right now.

Over in the Investments in Play and Pandemic Portfolios, profit-taking is happening all over the place, but here in the speculative portfolio, while my positions have risen admirably off their 2022 lows, none of them have reached profit-taking targets, yet. Of course, that also means none of them have reached lows where I can add to them, either.

As always, patience is the watchword for any long-term investment. One of my key disciplines is “when you don’t know what to do, do nothing; and remember that doing nothing is always a legitimate strategy.”

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.