July 22, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

GrowGeneration (GRWG)

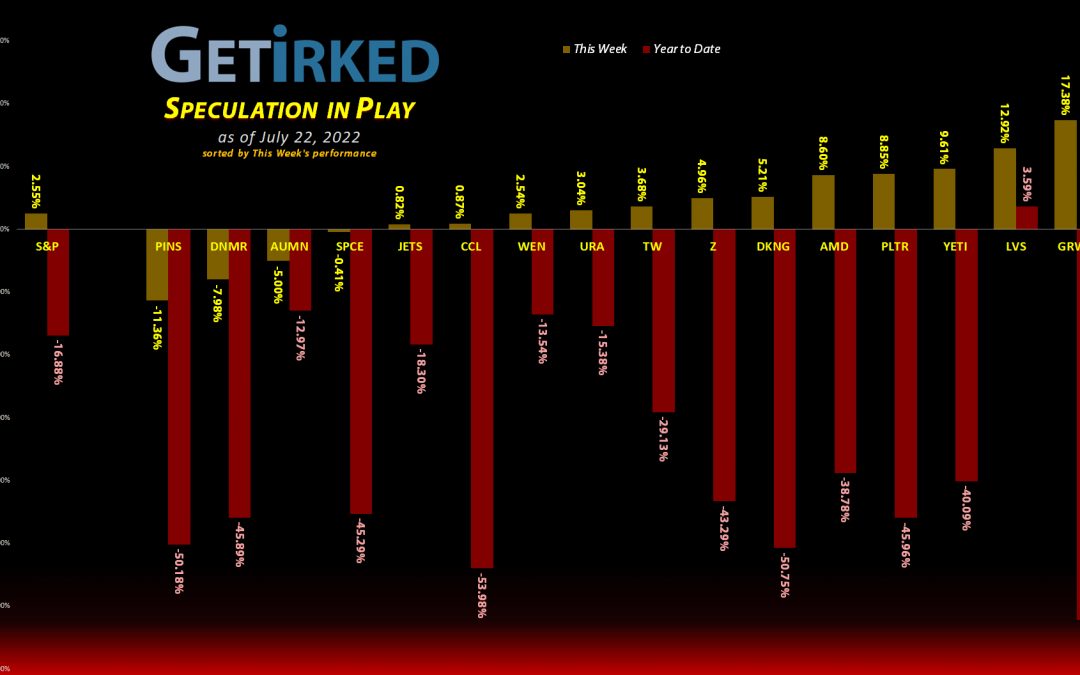

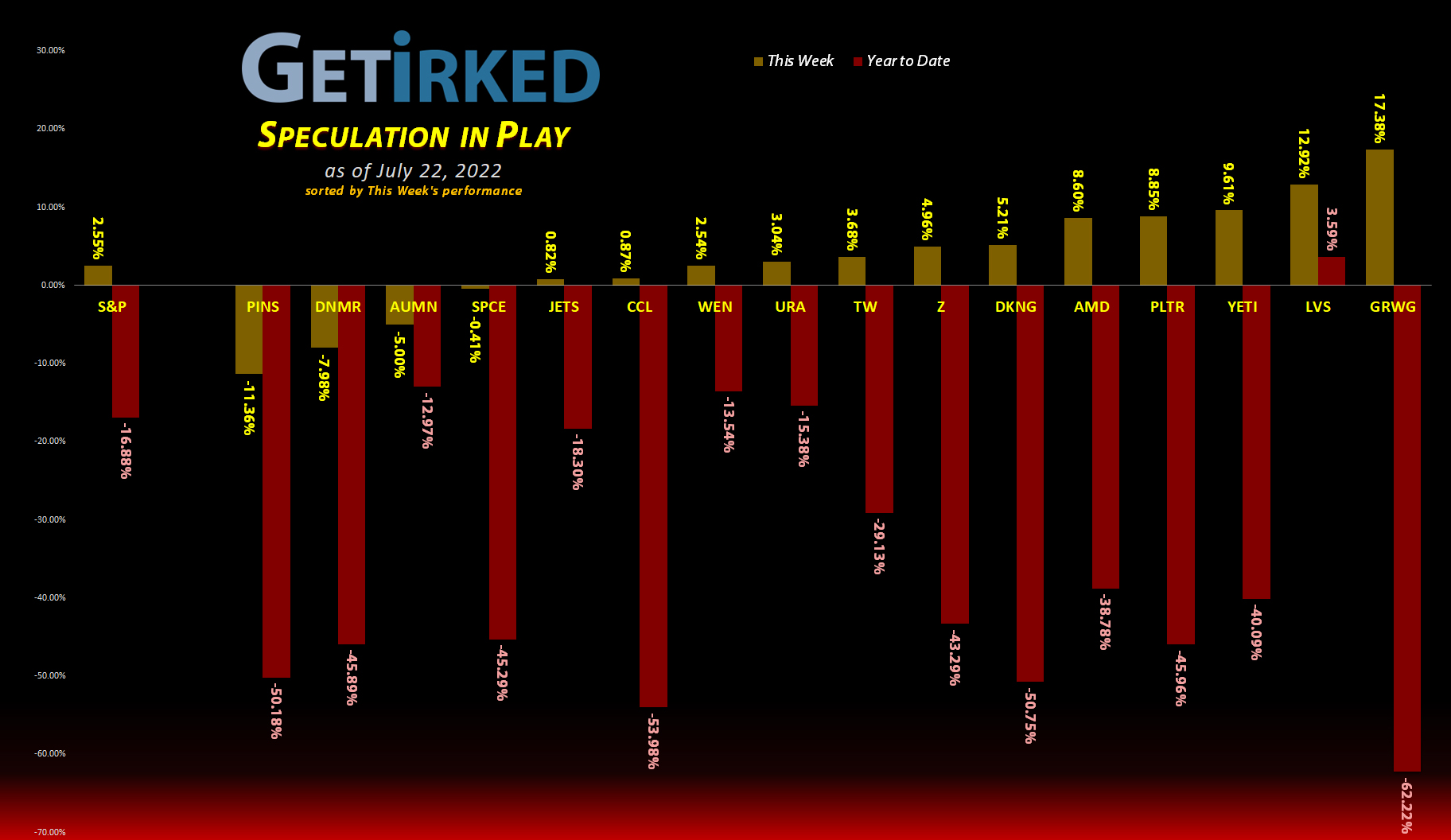

The cannabis sector has been hit so hard over the past 12-18 months that the mere mention of the Senate simply talking about new legislation for the space caused the entire sector to positively skyrocket this week. GrowGeneration (GRWG) leapt +17.38% to easily lock in the spot as the Week’s Biggest Winner.

Pinterest (PINS)

It absolutely sucks to get busted when you do something wrong, but it’s even worse when you get busted for something someone ELSE did wrong. In this case, Snap (SNAP) reported an atrocious quarter, warning of weakening ad sales and lowering its year-end guidance which DESTROYED the social media space. Pinterest (PINS), which doesn’t even report until next week, dropped -11.36% in sympathy, landing it in the spot of the Week’s Biggest Loser.

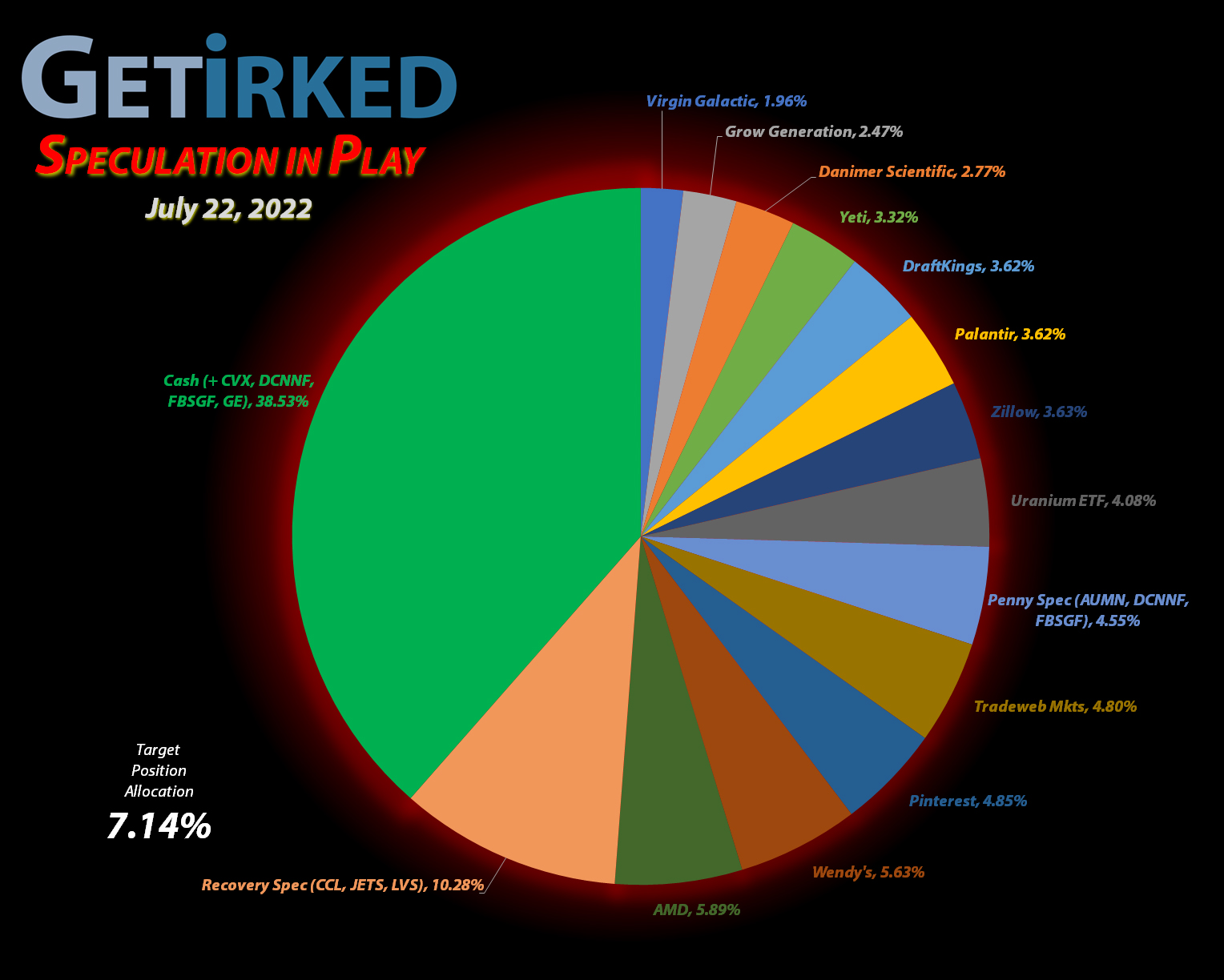

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+524.46%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+404.26%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$45.80)*

Pinterest (PINS)

+287.11%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($8.85)*

Virgin Galactic (SPCE)

+186.68%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$5.65)*

Tradeweb Mkts (TW)

+161.33%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.54)*

Airlines ETF (JETS)

+65.69%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $10.40

Carnival Cruise (CCL)

+21.34%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $7.64

Las Vegas Sands (LVS)

+21.28%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $32.15

Uranium ETF (URA)

+4.41%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $18.50

Wendy’s (WEN)

-13.47%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $23.83

Golden Mine. (AUMN)

-31.58%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4443

Zillow (Z)

-33.07%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $54.10

Palantir (PLTR)

-41.74%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $16.90

DraftKings (DKNG)

-51.51%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $27.90

Danimer Sci (DNMR)

-53.90%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $10.00

Grow Gen. (GRWG)

-70.12%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $16.50

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+220.93%*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

General Electric (GE)

+64.39%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.21)*

Canadian Pal (DCNNF)

-39.08%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Fabled Gold (FBSGF)

-51.63%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Actual Cash

30.40%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

Finding the bright side of bear markets…

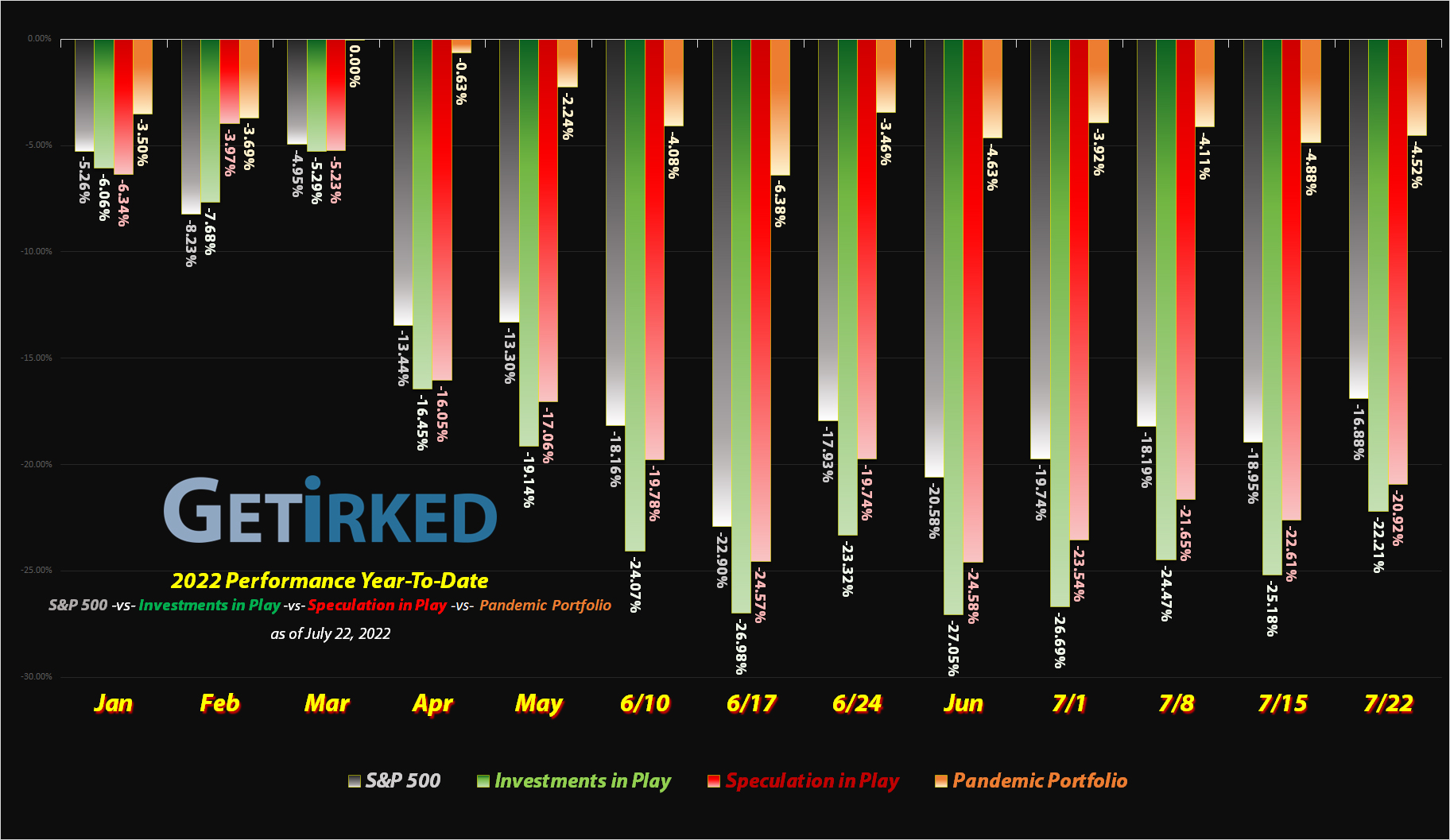

This makes week #5 of absolutely no moves in the Speculation in Play portfolio, and, as I mentioned last week, that’s the name of the investing game. However, the longer no action drags on, the more likely many investors are to make a mistake by either adding to positions at levels which are too high or taking profits at levels which are too low.

For me, I console myself by looking at absolute success, in this case in the form of how much of the cash position I’ve put to work over the year. While I still have nearly a 30% cash position even at these levels, I have put 28.06% of the cash to work that I had in the Speculation in Play portfolio at the beginning of 2022.

To me, looking at solid statistics helps to… distract me (?)… from making potential mistakes. Patience and discipline remain the key traits every investor needs to have in any market, but specifically rangebound bear markets like the one we’re all suffering through currently.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.