February 25, 2022

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

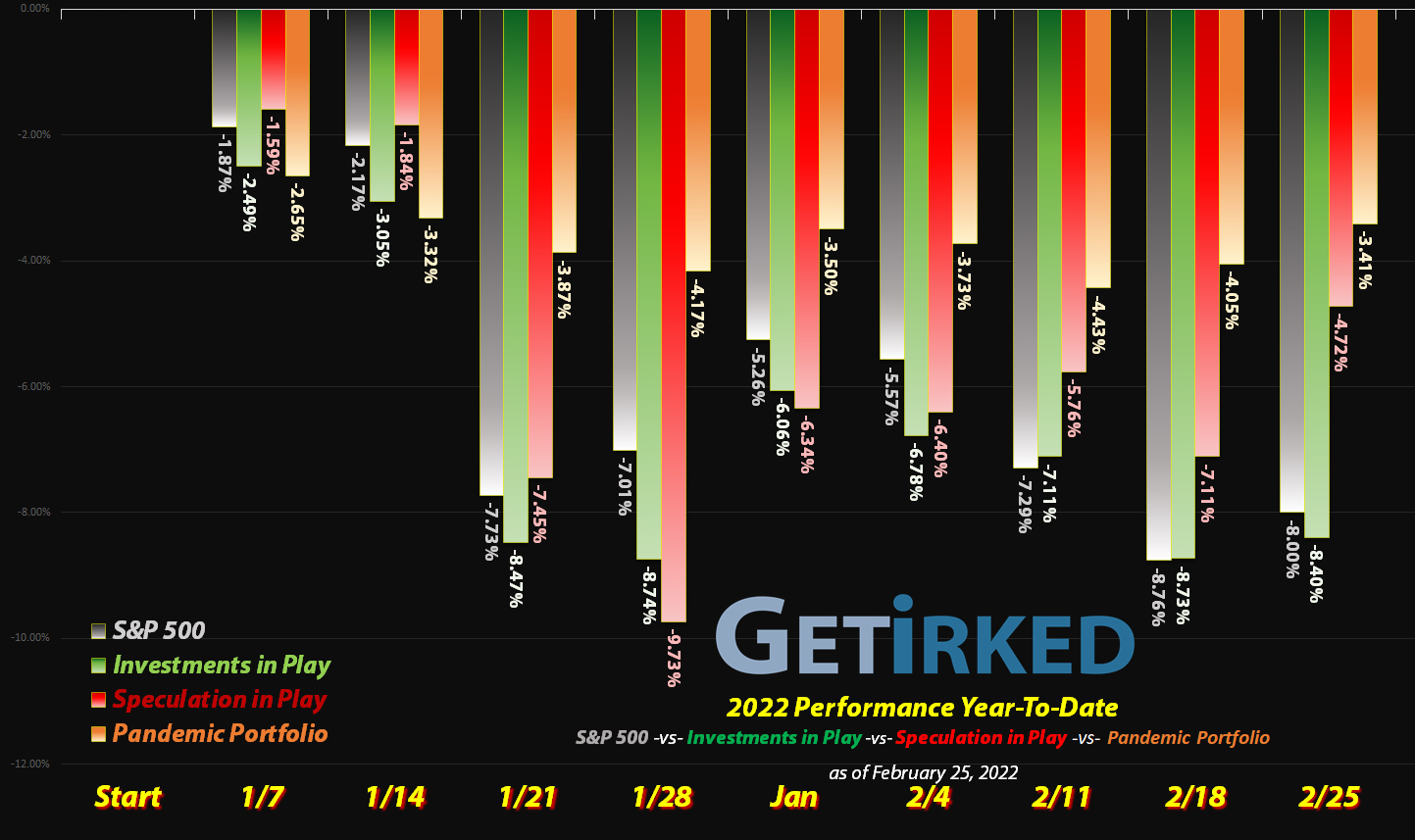

Click image to bring up larger version.

The Week’s Biggest Winner & Loser

Draft Kings (DKNG)

Draft Kings’ (DKNG) seemingly endless dive into the depths of the unknown was halted this week when casino and online sports betting operator Caesars Entertainment (CZR) reported outstanding revenues for online betting. The result? DKNG popped a whopping +28.40% to hit the jackpot of the Week’s Biggest Winner.

Las Vegas Sands (LVS)

While online sports betting is the new hotness, in-casino gambling in Macau in China is the new… coldness? Regardless, casino operators with COVID-lockdown China exposure got beat up this week with LVS dropping -5.52% to earn the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Carnival Cruise (CCL)

+744.00%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $2.50

AMD (AMD)

+692.92*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+430.76%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Pinterest (PINS)

+367.00%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($13.05)*

Airlines ETF (JETS)

+244.19%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.00

Virgin Galactic (SPCE)

+209.15%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$7.42)*

Tradeweb Mkts (TW)

+181.28%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.59)*

Las Vegas Sands (LVS)

+41.33%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $31.50

Uranium ETF (URA)

+14.87%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $19.77

Golden Mine. (AUMN)

+6.90%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4443

Zillow (Z)

+6.82%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $54.10

Wendy’s (WEN)

-8.63%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $24.87

DraftKings (DKNG)

-39.26%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $36.55

Palantir (PLTR)

-43.22%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $20.20

Grow Gen. (GRWG)

-56.52%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $19.25

Danimer Sci (DNMR)

-65.29%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $11.35

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

Cash Position Performance

The below positions are no longer actively covered each week and are instead reflected in the portfolio’s “Cash” position. Many readers mentioned wanting to still see these positions’ ongoing performance so these positions will be updated weekly in the table below.

Chevron (CVX)

+211.52*

1st Buy: 3/6/2020 @ $76.94

Current Per-Share: -($0.06)*

Twitter (TWTR)

+89.36%*

1st Buy: 10/30/2019 @ $29.79

Current Per-Share: -($45.02)*

General Electric (GE)

+78.16%*

1st Buy: 12/12/2018 @ $54.80

Current Per-Share: -($63.21)*

Fabled Gold (FBSGF)

+11.62%

1st Buy: 7/23/2021 @ $0.1036

Current Per-Share: $0.0827

Canadian Pal (DCNNF)

-11.58%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0691

Actual Cash

33.89%

This is the actual amount of cash when

accounting for the positions in this table.

This Week’s Moves

Virgin Galactic (SPCE): Added to Position

Virgin Galactic (SPCE) and the rest of the super-speculative SPAC stocks got hit particularly hard during Thursday’s selloff, dropping down and triggering a buy order I had in place which filled at $7.50.

The order locked in an astounding -86.54% discount on shares I sold for $55.74 back on June 25, 2021, and raised my per-share “cost” +2.48 from -$9.90 to -$7.42 (a negative per-share price indicates that all capital has been taken out of the position and that each share instead adds $7.42 to the portfolio’s bottom line in addition to the value of each share).

From here, my next buy target is $6.70 and my next sell target is $44.10.

SPCE closed the week at $9.18, up +22.40% from where I added Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.