December 23, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

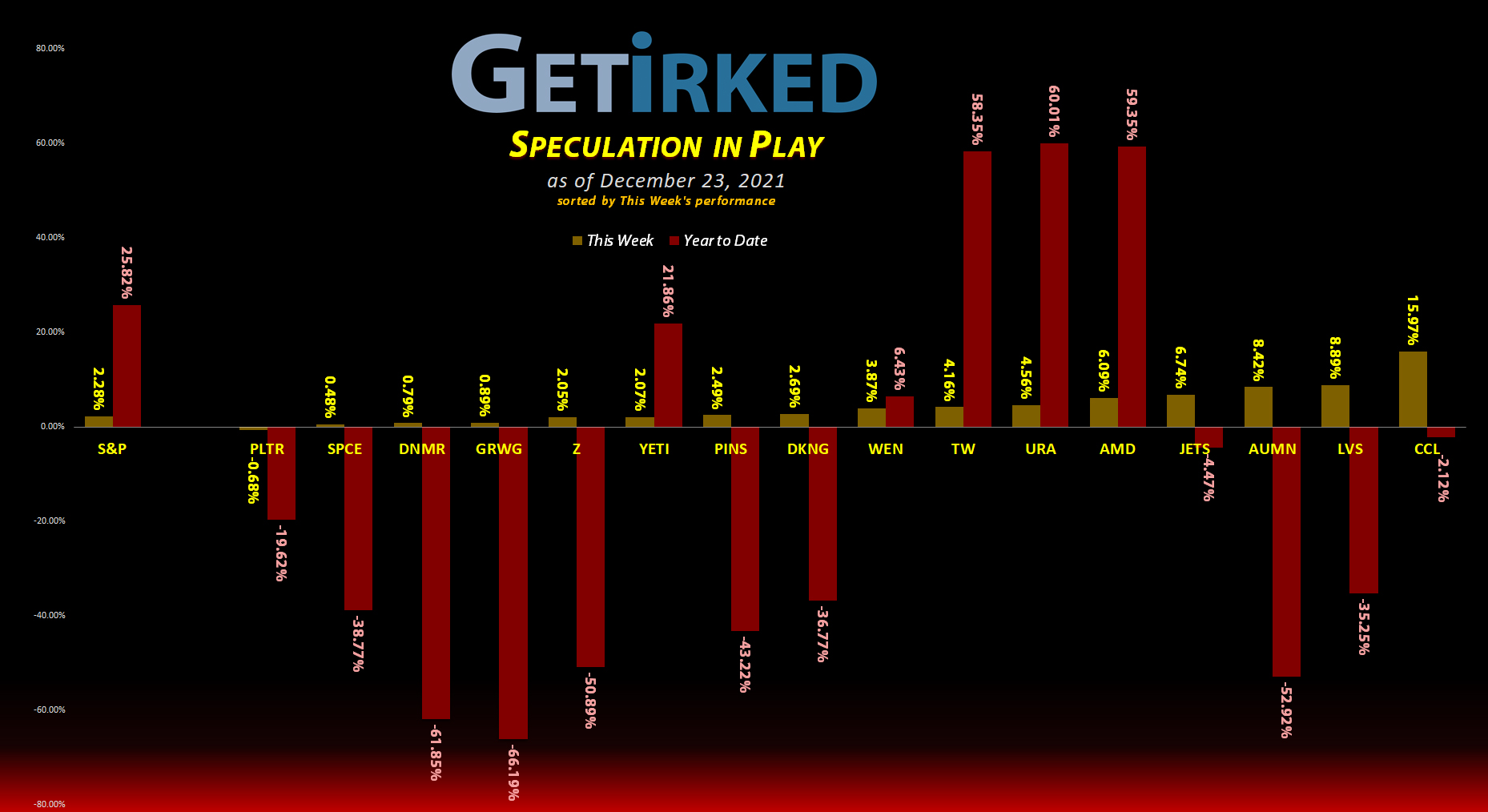

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Now that COVID-19 omicron seems to be less lethal than prior variants, people are rushing to plan vacations and get back to normal as quickly as possible. The entire travel sector, particularly the oversold cruise lines like Carnival Cruise Lines (CCL), saw the biggest benefit. CCL popped +15.97% this week, earning itself the spot of the Week’s Biggest Winner.

Palantir Tech (PLTR)

Following a number of analyst downgrades highlighting potential challenges, black-box tech company Palantir Technology (PLTR) can’t catch a break. Despite a week that saw every other position in this portfolio make at least some gains, PLTR lost -0.68%, landing itself the spot of the Week’s Biggest Loser.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+820.65%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+478.20%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Pinterest (PINS)

+463.63%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($20.65)*

Virgin Galactic (SPCE)

+245.80%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$19.60)*

Carnival Cruise (CCL)

+219.28%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $6.64

Tradeweb Mkts (TW)

+208.74%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.59)*

Airlines ETF (JETS)

+179.70%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.90

Uranium ETF (URA)

+20.60%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $20.34

Zillow (Z)

+11.64%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $57.13

Las Vegas Sands (LVS)

+7.49%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.90

Wendy’s (WEN)

-6.18%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $24.87

Golden Mine. (AUMN)

-19.47%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4444

Palantir (PLTR)

-21.33%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

DraftKings (DKNG)

-27.35%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $40.54

Danimer Sci (DNMR)

-33.69%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $13.55

Grow Gen. (GRWG)

-43.73%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $24.15

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Every Little Bit Helps: Dividend Reinvesting

Even in a speculative portfolio, dividend reinvesting can help take the edge off of waiting patiently for an investment to make its next move. Over the past few weeks, the Speculation in Play portfolio received dividends from a number of its positions: Chevron (CVX) (this position is reflected in the Cash position as it is no longer actively traded), Tradeweb Markets (TW), and Wendy’s (WEN).

Even though these dividends may be small, reinvesting them in the position increases the position size, decreases the per-share cost, and compounds the dividend payout the next time since dividends will be paid next time on the dividend amounts earned this time.

For me, I find dividends to provide solace in down markets where, despite bearish trends, positions can still provide some return, no matter how small. Additionally, when I’m being particularly conservative and unwilling to put money to work, by reinvesting dividends instead of taking the cash payout, I feel like I’m still putting money to work but not needing to make the conscious decision to do so.

While I don’t ever select an investment solely for its dividend, having a dividend-returning stock can definitely ease bearish pains in both short- and long-term portfolio investing.

Have a Happy Holidays, everyone!

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.