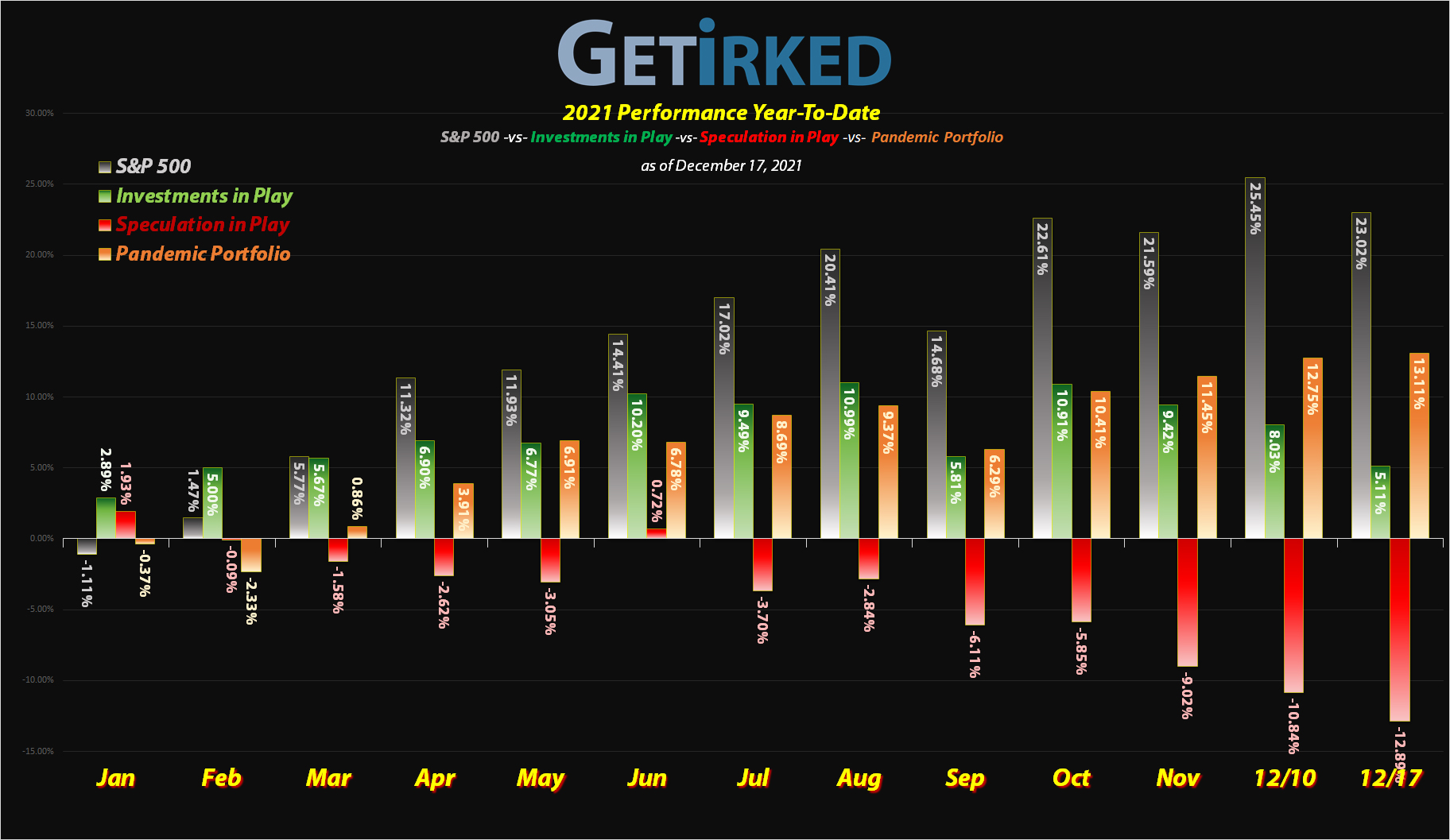

December 17, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

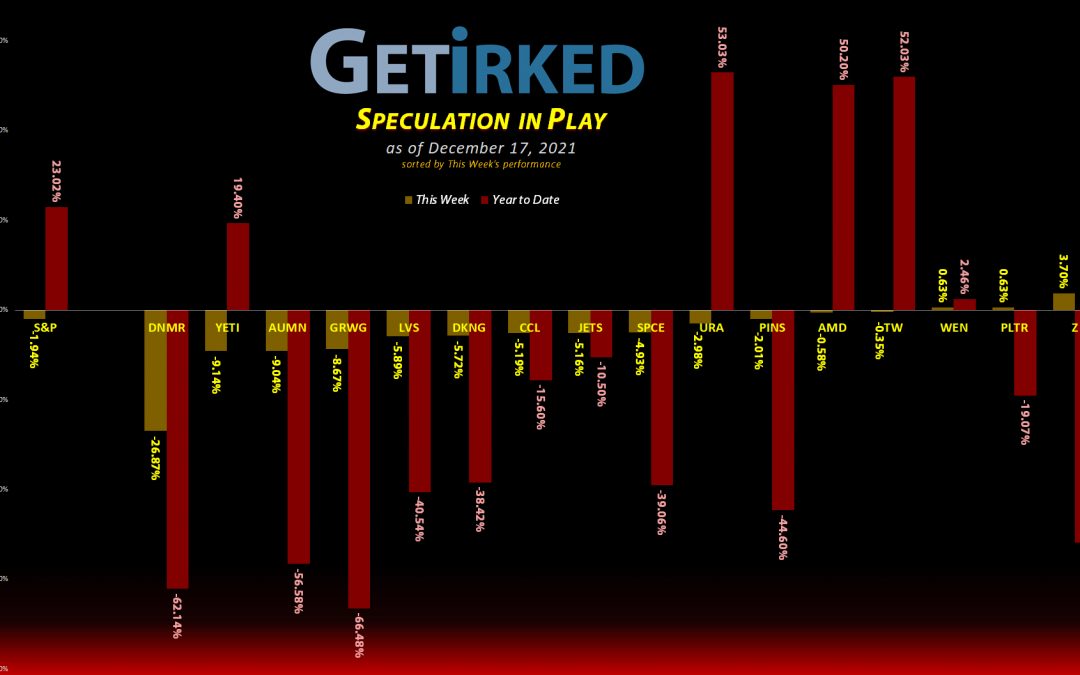

The Week’s Biggest Winner & Loser

Zillow (Z)

In a week of mostly red, Zillow (Z) continues to make its comeback, earning +3.70% and locking in its spot as the Biggest Winner of the Week.

Danimer Sci (DNMR)

Danimer Scientific (DNMR) reported they would be converting senior notes and the stock positively tanked. I get that convertible notes into equity will certainly dilute shareholder value, but a -26.67% drop in a week seems a bit overdone. Regardless, Danimer definitely earned its spot as the Week’s Biggest Loser.

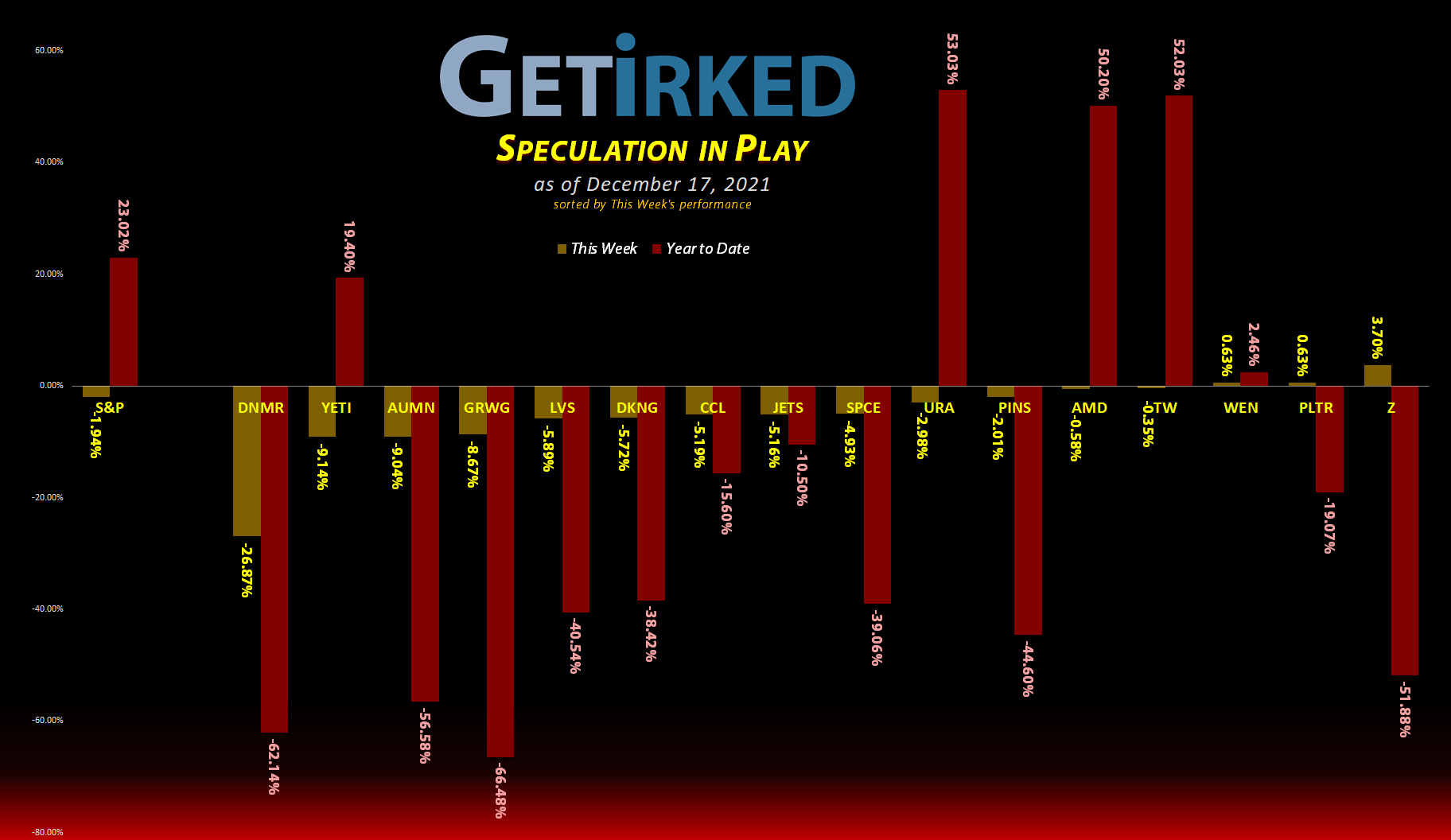

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

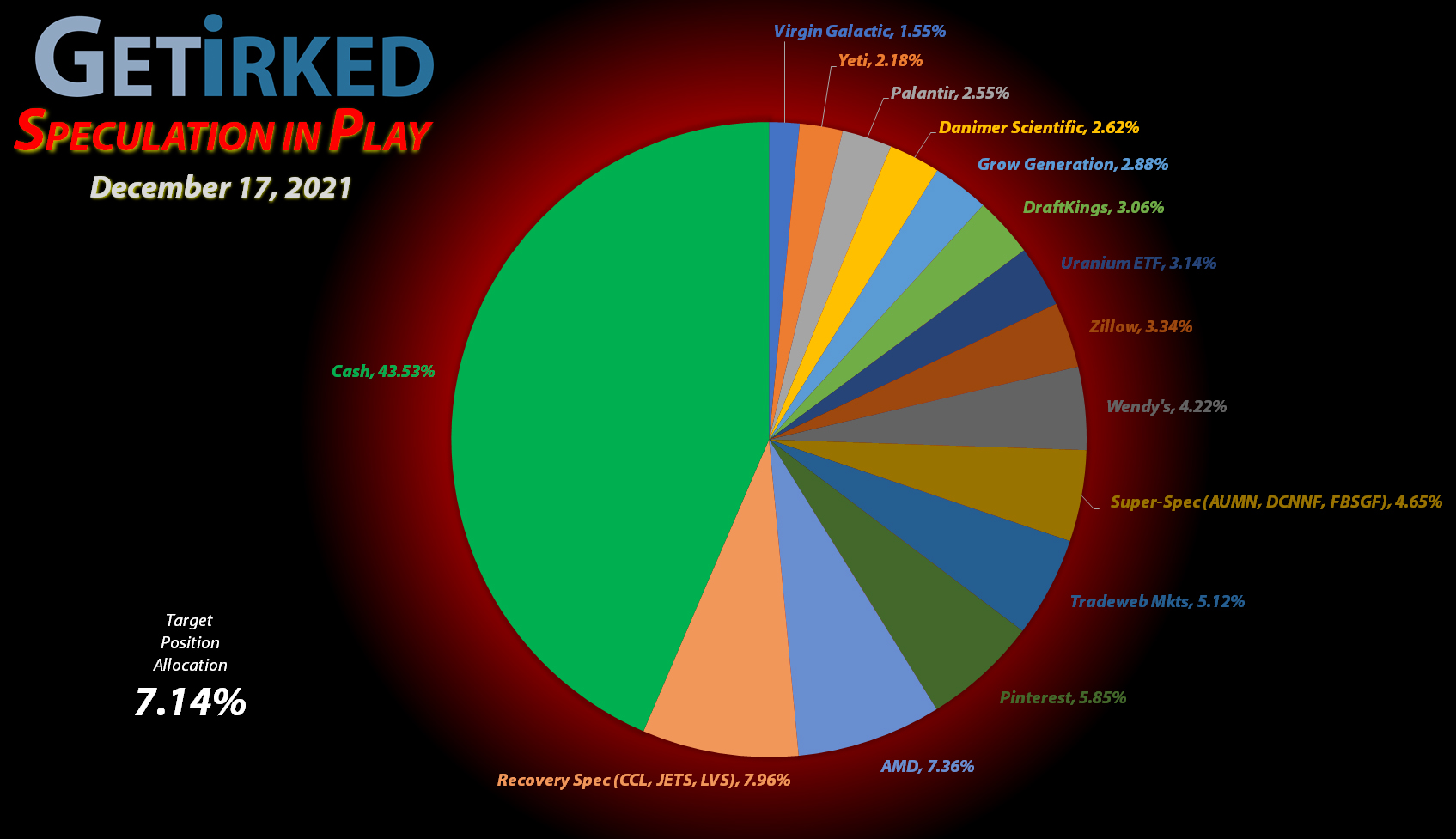

AMD (AMD)

+778.23%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Yeti (YETI)

+474.29%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Pinterest (PINS)

+456.37%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($20.65)*

Virgin Galactic (SPCE)

+245.30%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$19.60)*

Tradeweb Mkts (TW)

+201.78%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.60)*

Carnival Cruise (CCL)

+175.30%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $6.64

Airlines ETF (JETS)

+168.35%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $11.90

Uranium ETF (URA)

+15.34%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $20.34

Zillow (Z)

+9.33%

1st Buy: 11/18/2021 @ $57.13

Current Per-Share: $57.13

Las Vegas Sands (LVS)

-1.28%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.90

Wendy’s (WEN)

-10.16%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $25.00

Palantir (PLTR)

-20.79%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

Golden Mine. (AUMN)

-25.73%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4444

DraftKings (DKNG)

-29.28%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $40.54

Danimer Sci (DNMR)

-34.28%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $13.55

Grow Gen. (GRWG)

-44.18%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $24.15

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Danimer Scientific (DNMR): Added to Position

Danimer Scientific (DNMR) collapsed nearly -20% on Thursday following an announcement that it was considering a convertible senior notes offering.

Typically, while a conversion of bonds to stock equity does dilute the value of shares, this sort of event doesn’t have such a dramatic effect which led me to believe there must be some other news event as Thursday was an up-day in the markets, generally.

A standing buy order of mine filled at $9.00 on Thursday, lowering my per-share cost -3.21% from $14.00 to $13.55, however, I’m holding off on additional buys for at least the Three-Day Rule until more information becomes available about what caused such a precipitous selloff. My next sell target is around $20.00, under the high of DNMR’s last bull rally.

DNMR closed the week at $8.90, down -1.11% from where I added Thursday.

Uranium ETF (URA): Added to Position

Uranium got hit hard this week when the markets were anticipating the Federal Reserve’s meeting on Wednesday with the Uranium ETF (URA) triggering a buy order I had in place which filled on Tuesday at $22.72.

The order raised my per-share cost +2.99% from $19.75 to $20.34. From here, my next buy target is $17.70, above a past point of support, and my next sell target is $31.15, just below the high of URA’s last bull rally.

URA closed the week at $23.46, up +3.26% from where I added Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.