October 22, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

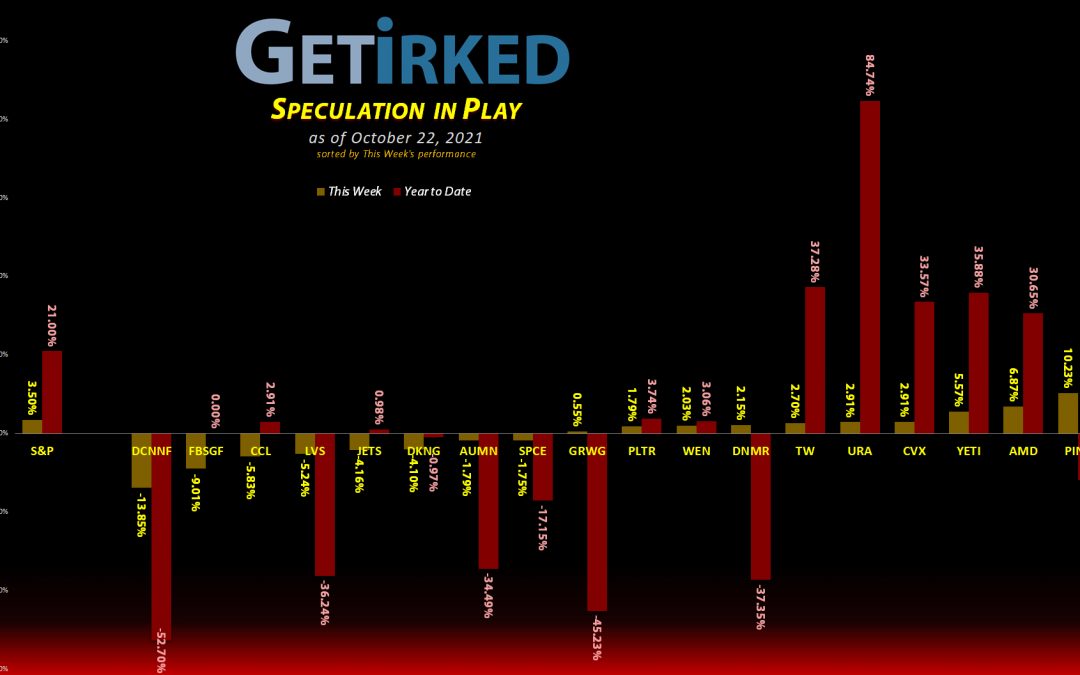

The Week’s Biggest Winner & Loser

Pinterest (PINS)

Everything changes when a suitor comes around. For Pinterest (PINS), the love interest is… payment-processing fintech company PayPal (PYPL)?!

Even the analysts who cover both these companies can’t quite figure out what PayPal wants with Pinterest, but the potential of a $70/shr buyout price caused PINS to pop +10.23%, earning itself the spot of the Week’s Biggest Winner.

Can. Palladium (DCNNF)

Despite gold and silver finally seeing a reasonable pop this week, Canadian Palladium (DCNNF) and the rest of my Super-Spec commodities plays came under fire this week with DCNNF taking the brunt of it.

DCNNF dropped to the tune of -13.85%, easily locking in the spot of the Week’s Biggest Loser.

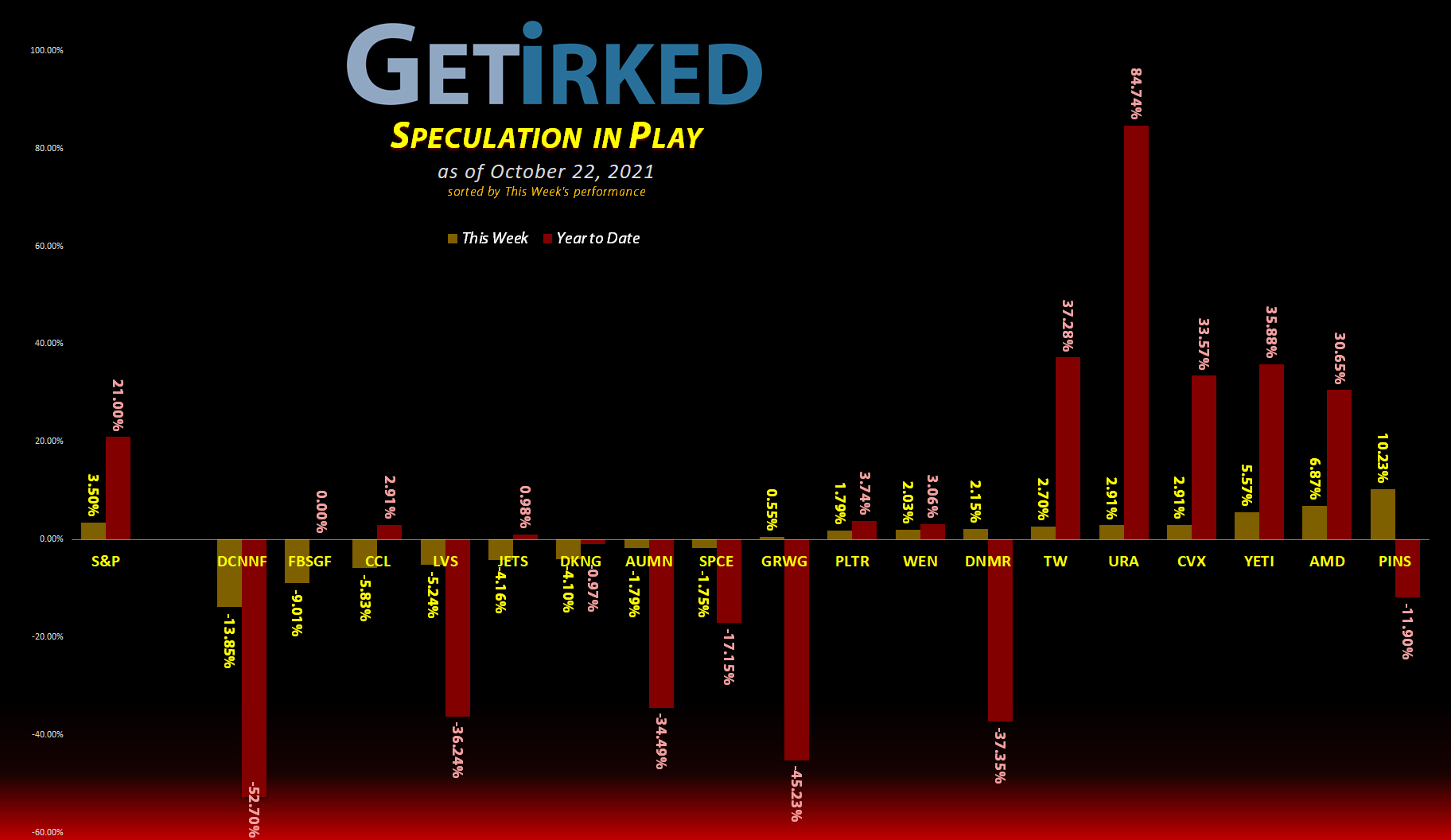

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+686.58%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Pinterest (PINS)

+610.42%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Yeti (YETI)

+498.20%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+274.18%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$31.10)*

Airlines ETF (JETS)

+228.91%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+186.10%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($23.60)*

Chevron (CVX)

+168.04%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.06)*

Carnival Cruise (CCL)

+106.00%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: -($2.09)*

Uranium ETF (URA)

+67.60%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $16.90

Las Vegas Sands (LVS)

+5.82%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.91

DraftKings (DKNG)

+1.99%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $45.21

Palantir (PLTR)

+1.53%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

Golden Mine. (AUMN)

-0.01%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4980

Danimer Sci (DNMR)

-1.80%

1st Buy: 10/20/2021 @ $15.00

Current Per-Share: $15.00

Fabled Co. (FBSGF)

-10.18%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.0945

Wendy’s (WEN)

-12.10%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $25.70

Grow Gen. (GRWG)

-24.68%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $29.25

Can. Palladium (DCNNF)

-32.06%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0825

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Canadian Palladium (DCNNF): Added to Position

Canadian Palladium Resources (DCNNF) has been slamming down for the past few weeks, and it finally triggered my buy order which filled on Wednesday at $0.0606.

The buy lowered my per-share cost -7.20% from $0.0889 to $0.0825. From here, my next buy target is quite a bit lower from these levels, slightly above a past point of support, at $0.0469. My next sell target is near DCNNF’s high from earlier in 2021 with a target of $0.1427.

**WARNING** Canadian Palladium and the rest of the Super-Spec Basket are incredibly speculative. They should be viewed the same way a reasonable person might view a lottery ticket – I fully expect to lose all the money I put into any of the three and am risking a tiny amount of money, even for the Speculation in Play portfolio’s already small allocation sizes.

DCNNF closed the week at $0.056, down -7.59% from where I added Wednesday.

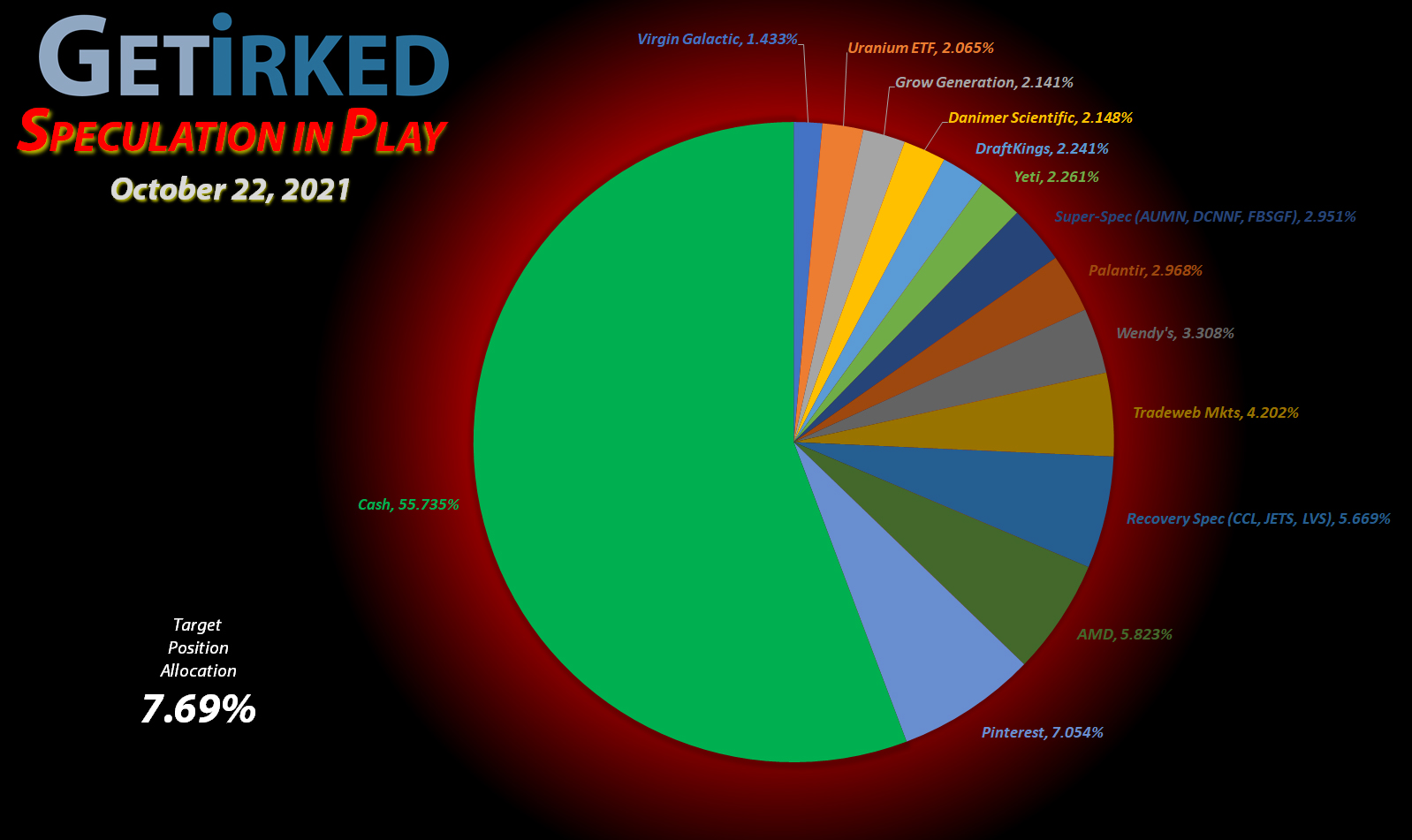

Chevron (CVX): *Removal from Coverage*

Chevron (CVX) has been quite a successful speculative investment for me with three equal buys at $76.94, $67.24, and $55.56 from March 12-18, 2020 which gave me per-share cost of $66.58. With oil prices increasing, I don’t see myself adding to CVX, and have decided to, instead, remove it from coverage and roll it into my “non-active positions” like I did with General Electric (GE) earlier this year and Twitter (TWTR) earlier than that.

My non-active positions are ones where I’ve taken my capital plus significant profits out and I’m letting the rest run, however, I have no plans to actively manage the position by purchasing more shares so I no longer track them in my Speculation in Play blog posts (positions in the non-active part of the portfolio are reported weekly as part of the “Cash” position).

For CVX’s replacement, I’m adding super-speculative Danimer Scientific (DNMR) which you can read more about below.

CVX closed the week at $112.80, giving my position a lifetime gain of +168.04%.

Danimer Scientific (DNMR): *New Position*

Danimer Scientific, LLC (DNMR) is working on developing biodegradable plastic alternatives for use in a wide variety of plastic applications – think: bottles, straws, food containers, and more under the “Nodax” brand name.

Where did I hear about this company? Believe it or not, from a Stansberry Research webinar where they were shilling a high-priced stock analysis newsletter. Seems like the perfect fit to replace oil company Chevron (CVX) in my Speculation in Play portfolio, doesn’t it?

On Wednesday, I placed a buy order to open the position at $15.00. From here, my next buy target is $13.60 and I already have a sell target of $21.25, near DNMR’s recent high back a few months ago in August.

The stock proceeded to pop significantly as a result of the end of the webinar. While potentially a “pump-and-dump” where shareholders force a news event in an effort to pump up the price of the stock where they then take profits on the unwitting new shareholders, I decided to take the chance since this is a speculative portfolio and my allocation sizes here are incredibly small.

DNMR closed the week at $14.73, down -1.80% from where I opened Wednesday.

Virgin Galactic (SPCE): Added to Position

Following last week’s news that Virgin Galactic (SPCE) would be delaying civilian flights for nearly a year to ensure safety and efficacy, the stock continued to sell off this week, triggering a buy order that filled on Monday at $19.04.

The buy locks in a -65.84% discount on shares I sold on June 25 for $55.74 and raises my per-share cost +$25.07 from -$56.17 to -$31.10. From here, my next buy target is $14.30, slightly above a past point of support. My next sell target is $57.20, slightly below its last high in late June.

Also, I am being very careful with my quantities so even if SPCE drops below its $6.90 all-time low, I will never put capital back into this position – only using profits to add to my position from here on. There are few things I hate more than during a win into a loss by buying up my per-share cost only to have the equity sell off below my new per-share cost and my original per-share cost (I’m looking at you Grow Generation (GRWG)!).

SPCE closed the week at $19.66, up +3.26% from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.