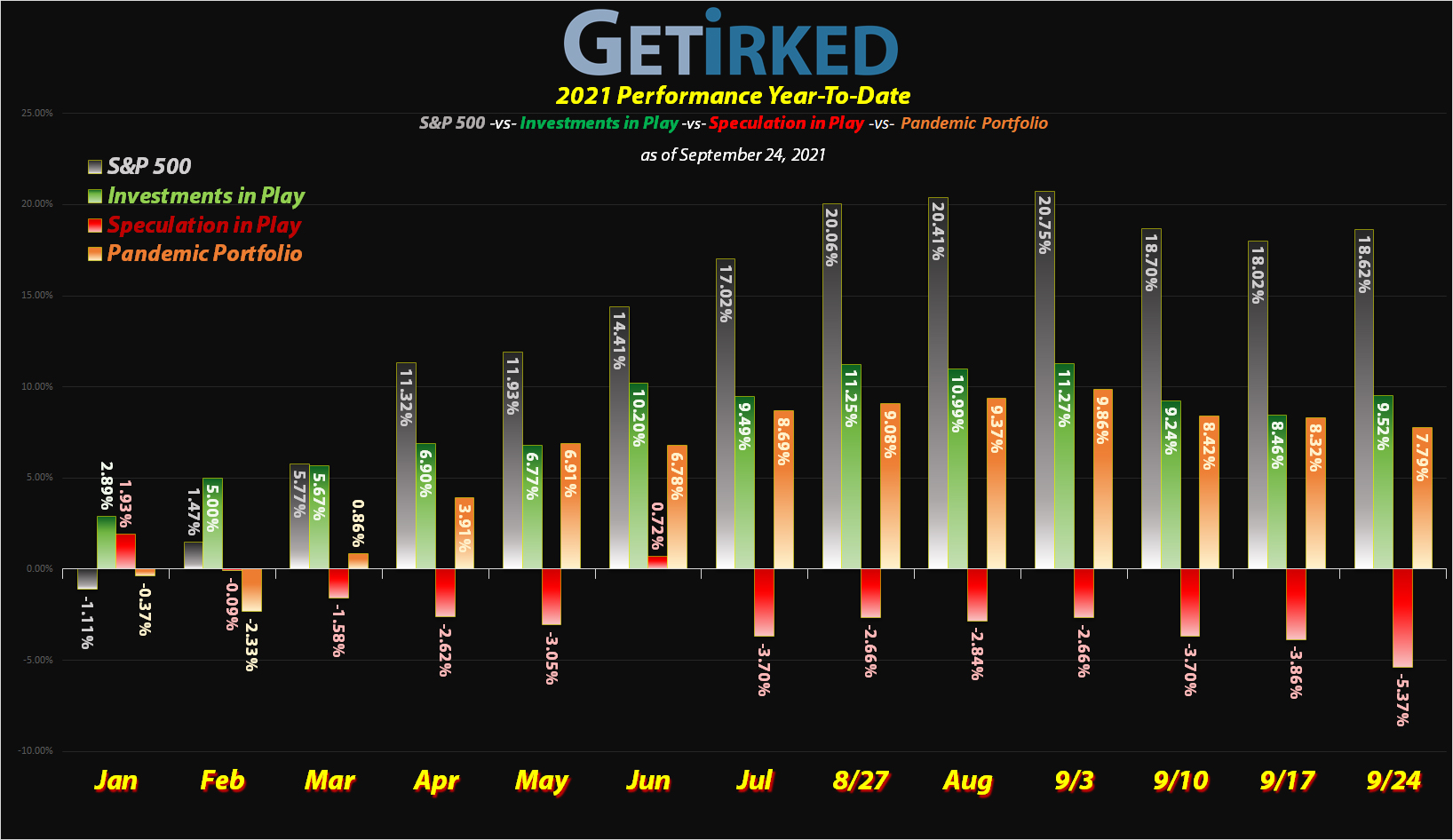

September 24, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

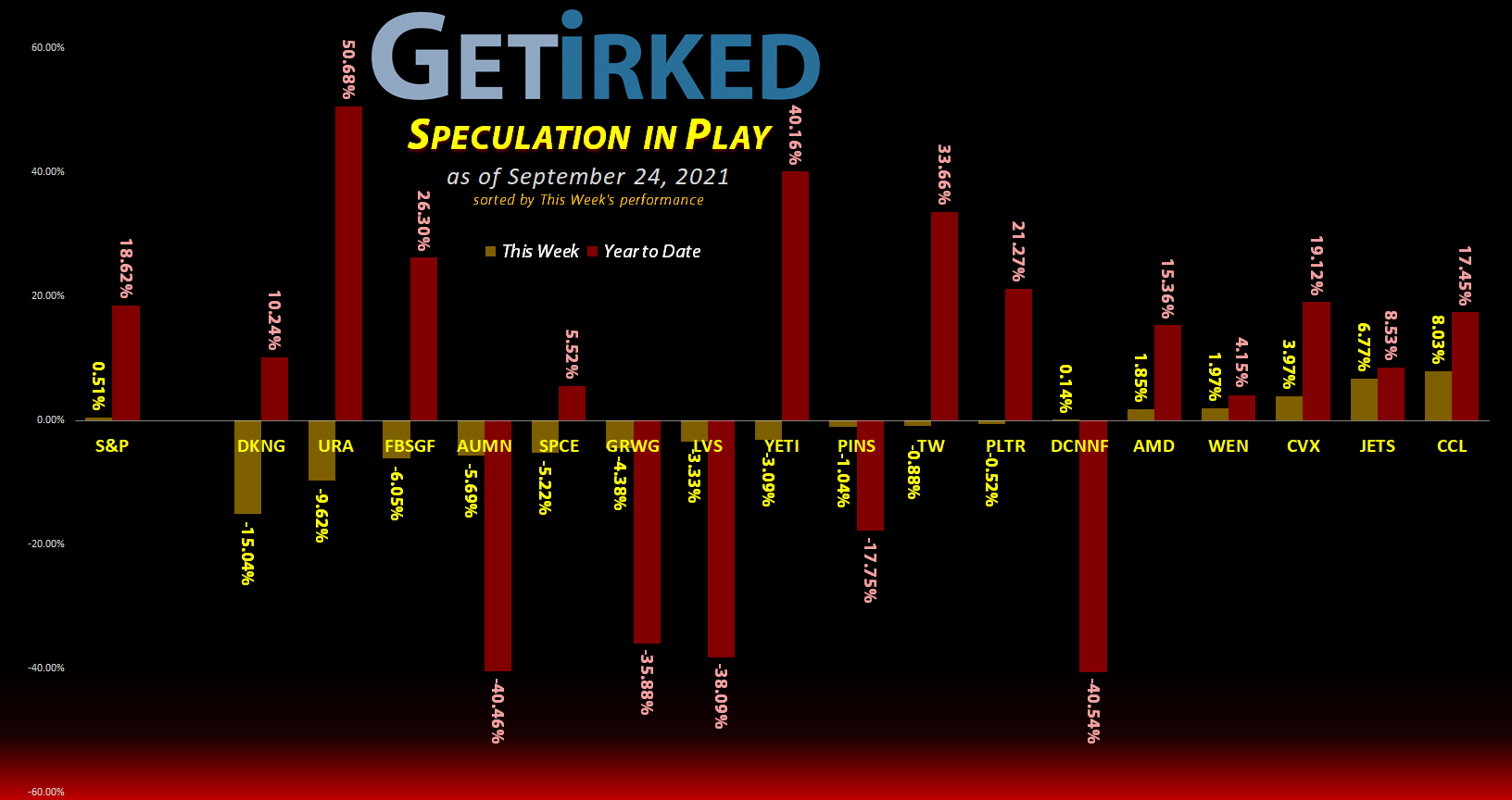

The Week’s Biggest Winner & Loser

Carnival Cruise Lines (CCL)

Carnival Cruise Lines (CCL) announced its ships are once again, well, cruising, and this caused CCL to launch +8.03% in an incredibly volatile week, landing itself the spot of the Week’s Biggest Winner.

Draft Kings (DKNG)

Draft Kings (DKNG) announced a multi-billion (yes, with a “B”) dollar deal in stock and cash to buy European betting site Entain. Despite the obviously accretive potential for such a deal, many Draft King (DKNG) investors were hoping for short-term gains before being diluted to such an extent. DKNG lost a whopping -15.04% on the news, locking in the Biggest Loser spot.

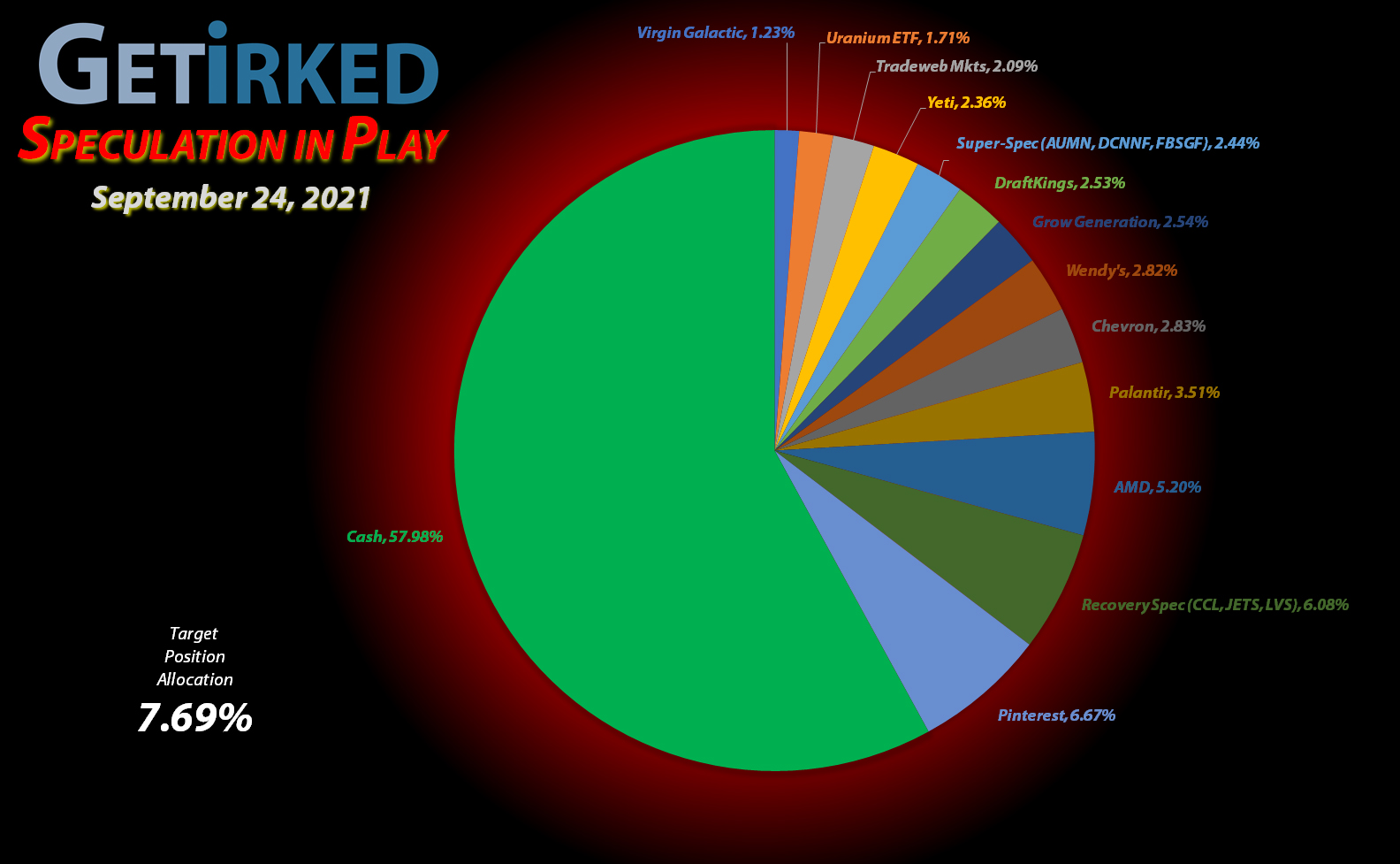

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+614.92%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Pinterest (PINS)

+584.74%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Yeti (YETI)

+504.41%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Virgin Galactic (SPCE)

+292.44%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$56.17)*

Airlines ETF (JETS)

+246.03%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+181.46%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($127.97)*

Chevron (CVX)

+149.88%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.06)*

Carnival Cruise (CCL)

+119.70%*

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: -($2.09)*

Uranium ETF (URA)

+36.70%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $16.90

Palantir (PLTR)

+18.69%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.07

DraftKings (DKNG)

+13.54%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $45.21

Fabled Co. (FBSGF)

+3.38%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.1036

Las Vegas Sands (LVS)

+2.76%

1st Buy: 8/12/2021 @ $40.50

Current Per-Share: $35.91

Golden Mine. (AUMN)

-9.13%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.4980

Grow Gen. (GRWG)

-11.83%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $29.25

Wendy’s (WEN)

-13.71%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $26.46

Can. Palladium (DCNNF)

-20.80%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.0889

SPY 436-433 Puts

-75.33%

Cost: 9/21/2021 @ $0.973

Current Value: $0.24

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

SPY 9/30 436-433 Put Spread: Options Position

I know, I know – I’ve had such bad luck with options put spreads in 2021 that I banned myself from using them altogether back at the beginning of June, but when the S&P 500 bounced on Tuesday, I decided to buy some short-dated put spreads to cover a potential test of the lows between now and the end of September.

On Tuesday, I bought the 9/30 436-433 put spreads on the SPY (the index that tracks the S&P 500) for $0.973 after fees (each spread cost $97.30 as each contract contains 100 options).

By selling the 433 puts, I’m capping my profits to $3.00 (the difference between the 436 puts I bought and the 433 puts I sold). However, that gives me a 3:1 return if SPY test the low of its recent move which was below $428, offering a decent probability that this trade could pan out between now and expiration on September 30.

For this trade, I’m risking 2.33% of the portfolio for a maximum return of 7.19%, a risk-reward that I naturally wouldn’t take on in my Investments in Play portfolio, but there’s a reason why I called this one Speculation in Play.

Of course, who would have expected the Evergrande situation to basically become a non-started and the Fed to release cryptic minutes which pretty much everyone took as positive?!

Me. I should have expected it. Man, I’m a glutton for punishment with options!

The puts closed the week at $0.24, leaving me down -75.33% on the trade.

Golden Minerals (AUMN): Added to Position

Highly-speculative, lottery-ticket, penny-stock play on the commodities sector, Golden Minerals (AUMN), got hit again on Monday, triggering my second buy order which filled at $0.4547.

The order lowered my per-share cost -6.32% from $0.5316 to $0.4980. My next buy target is $0.3936 and my next sell target is $1.00.

WARNING: Once again, note that this is one of my super-speculative basket and is in no way a smart or reasonable investment or speculation – this is entirely an experiment on my part and no one should put any money in these stocks that they expect to see.

AUMN closed the week at $0.4501, down -$0.0046 from where I added Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.