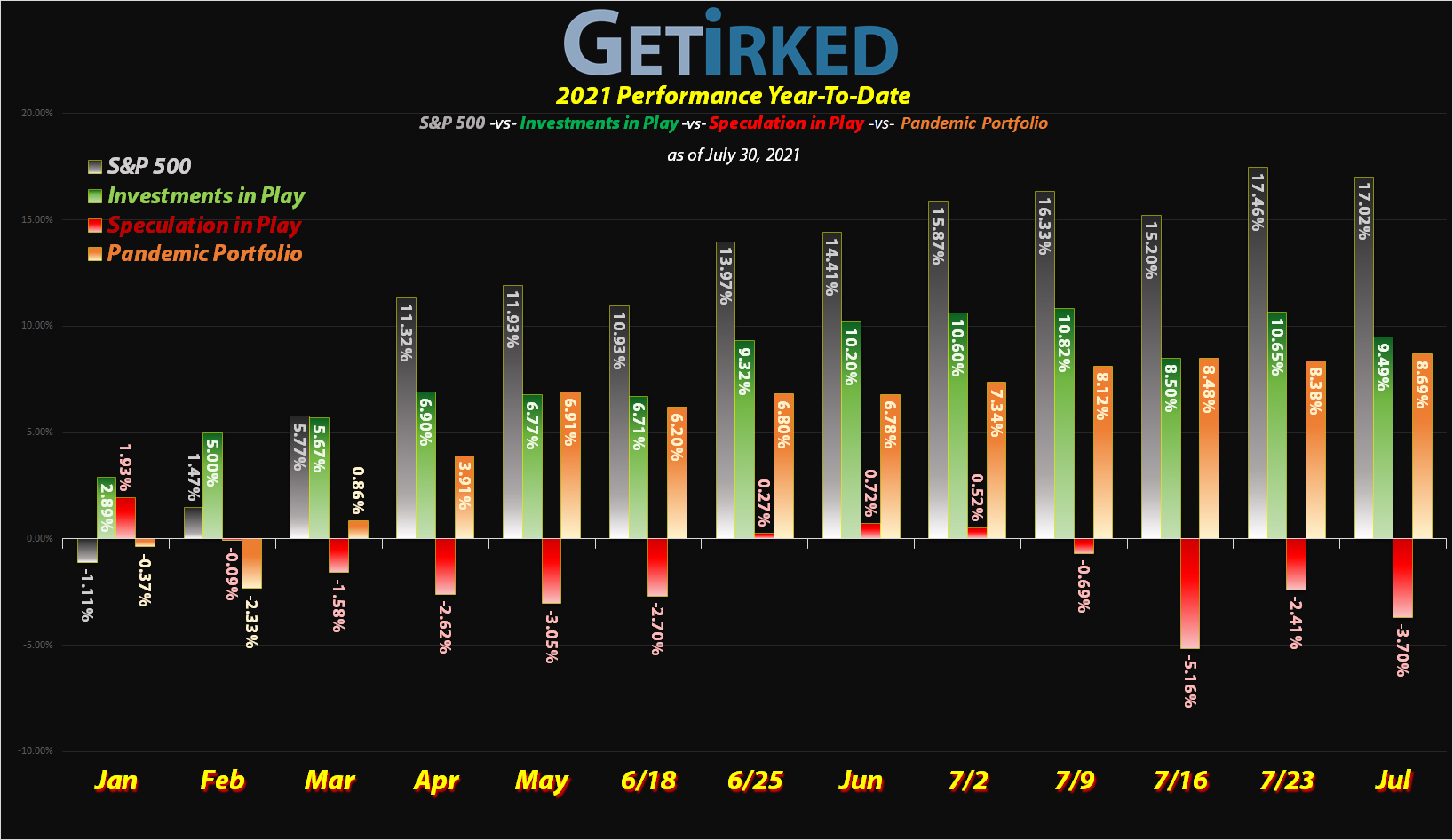

July 30, 2021

Risk Disclaimer

The positions in this portfolio are incredibly risky and extremely volatile.

No one at Get Irked is a professional financial adviser (or a doctor), so consult with your own financial adviser to see if any of these positions fit your risk profile (and stomach).

Click image to bring up larger version.

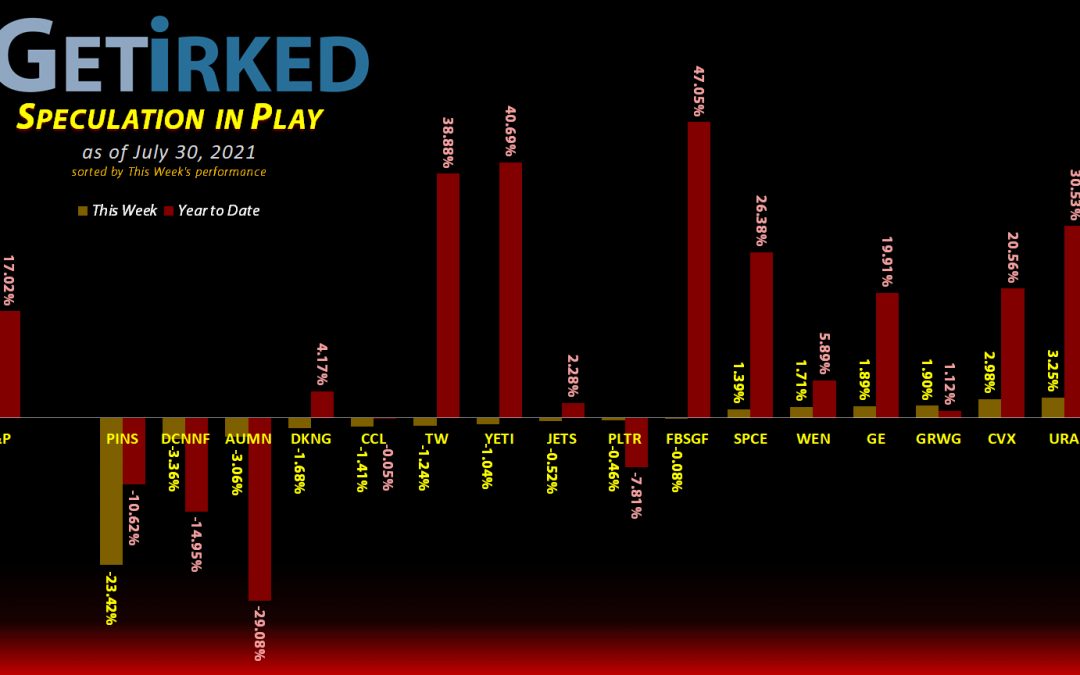

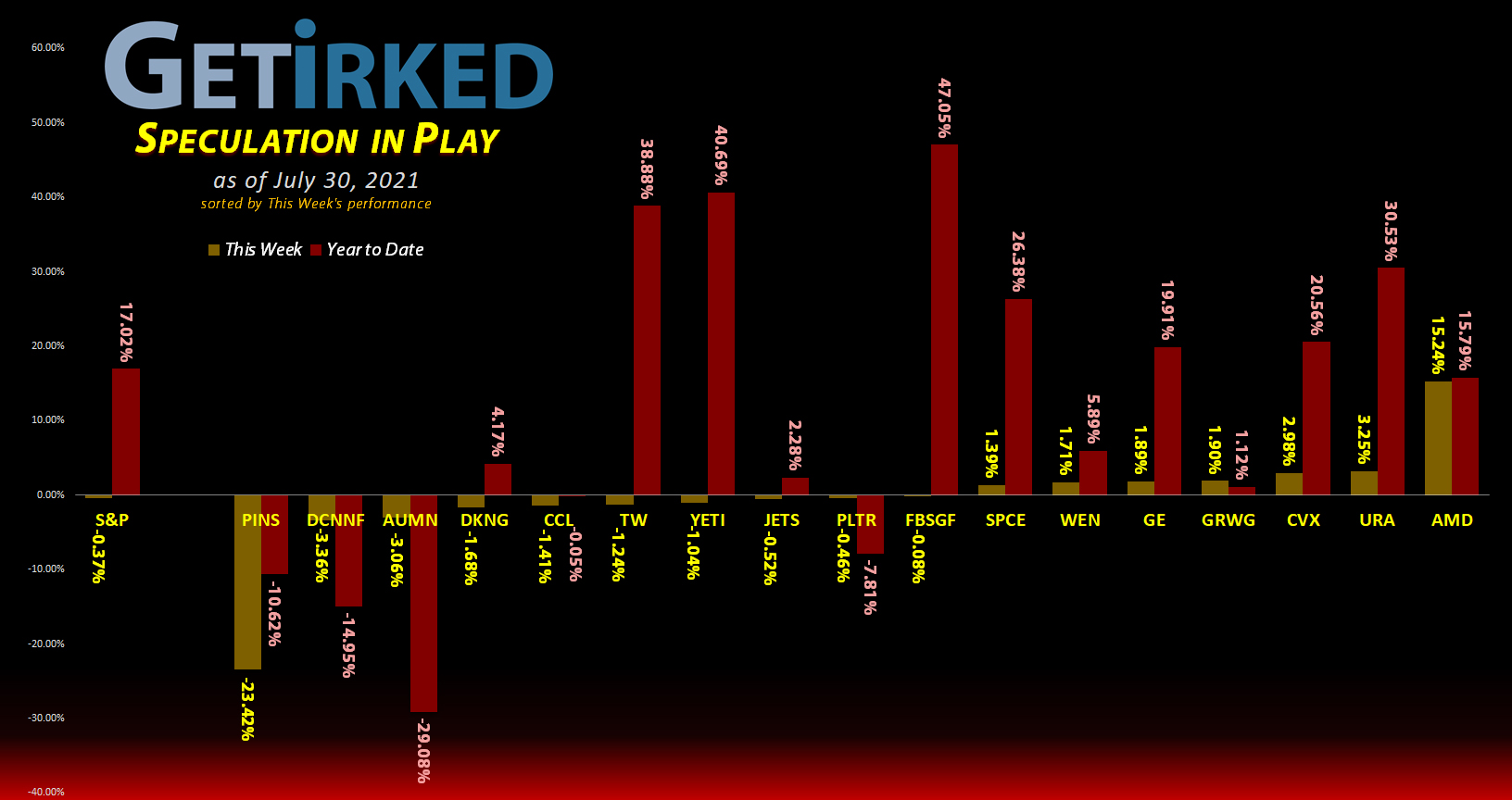

The Week’s Biggest Winner & Loser

Advanced Micro D (AMD)

Advanced Micro Devices (AMD) reported yet another blowout quarter, and, when combined with Xilinx’s (XLNX) blowout quarter (the company AMD is going to acquire), you have a recipe for new all-time highs with AMD scoring a +15.24% gain in a single week, easily locking in its Biggest Winner spot.

Pinterest (PINS)

Pinterest (PINS) reported decent earnings, however, they also announced the social network was experiencing social kryptonite – decreasing users! Their report and guidance was SO bad that the stock dropped -23.42% on Friday, the day after earnings, marking itself the shame of being this week’s Biggest Loser.

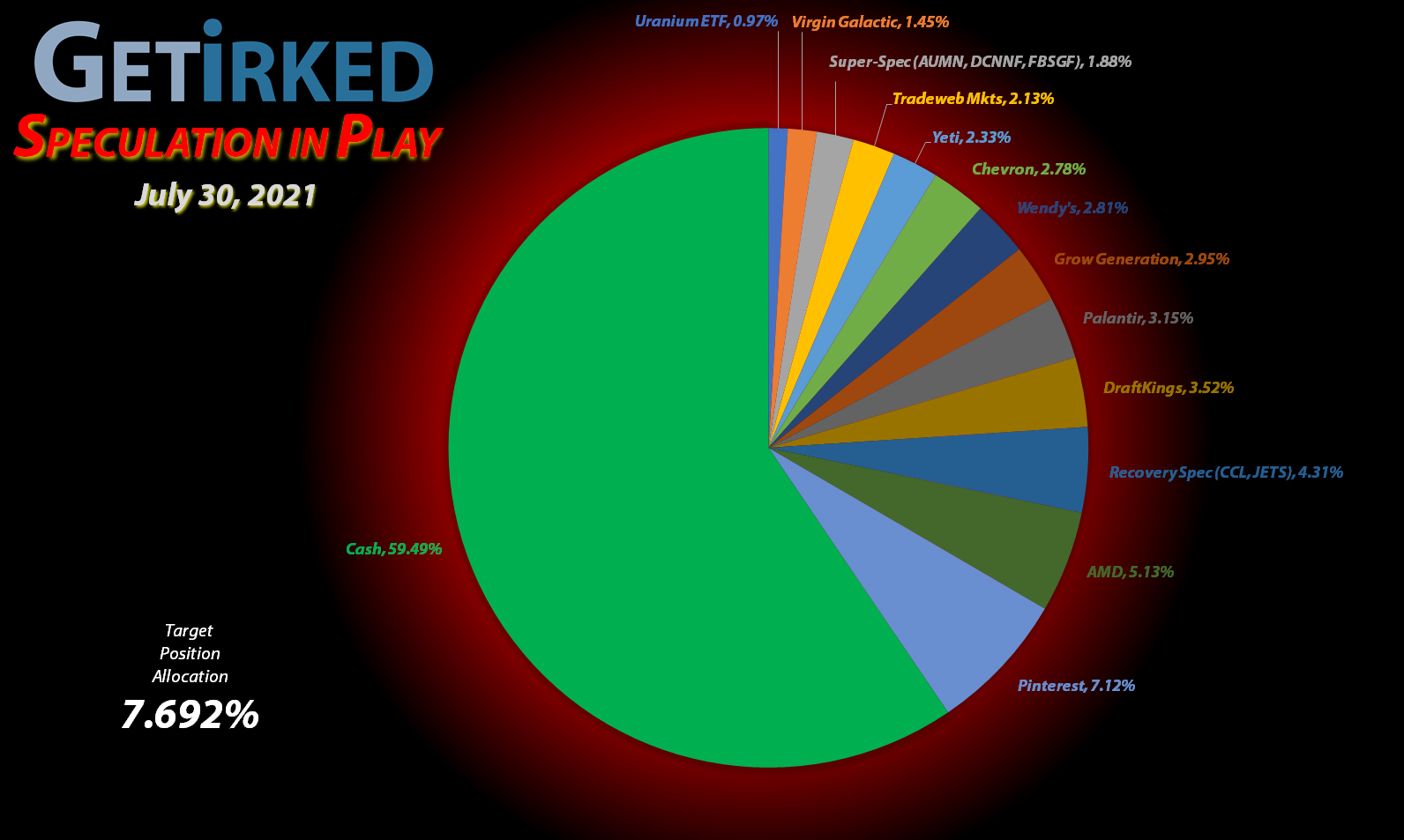

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

AMD (AMD)

+616.92%*

1st Buy: 1/10/2019 @ $19.54

Current Per-Share: -($29.02)

Pinterest (PINS)

+616.01%*

1st Buy: 5/16/2019 @ $25.72

Current Per-Share: -($33.69)*

Yeti (YETI)

+505.17%*

1st Buy: 2/26/2019 @ $23.23

Current Per-Share: (-$142.16)*

Carnival Cruise (CCL)

+403.78%

1st Buy: 3/12/2020 @ $17.25

Current Per-Share: $4.30

Virgin Galactic (SPCE)

+310.24%*

1st Buy: 10/31/2019 @ $9.87

Current Per-Share: (-$56.17)*

Airlines ETF (JETS)

+231.85%

1st Buy: 5/14/2020 @ $11.30

Current Per-Share: $9.87

Tradeweb Mkts (TW)

+184.19%*

1st Buy: 4/8/2019 @ $39.22

Current Per-Share: -($128.08)*

Chevron (CVX)

+149.64%*

1st Buy: 3/12/2020 @ $76.94

Current Per-Share: (-$0.07)*

General Electric (GE)

+82.35%*

1st Buy: 3/6/2020 @ $9.40

Current Per-Share: -($7.80)*

Grow Gen. (GRWG)

+49.96%

1st Buy: 10/30/2020 @ $16.04

Current Per-Share: $27.12

Uranium ETF (URA)

+24.23%

1st Buy: 2/23/2021 @ $17.97

Current Per-Share: $16.11

Fabled Co. (FBSGF)

+20.37%

1st Buy: 7/19/2021 @ $0.1036

Current Per-Share: $0.1036

Golden Mine. (AUMN)

+1.39%

1st Buy: 7/29/2021 @ $0.5316

Current Per-Share: $0.5316

Can. Palladium (DCNNF)

+0.70%

1st Buy: 7/19/2021 @ $0.1000

Current Per-Share: $0.1000

DraftKings (DKNG)

-5.83%

1st Buy: 1/29/2021 @ $52.97

Current Per-Share: $51.50

Palantir (PLTR)

-11.09%

1st Buy: 2/12/2021 @ $31.50

Current Per-Share: $24.42

Wendy’s (WEN)

-12.74%

1st Buy: 6/9/2021 @ $28.50

Current Per-Share: $26.60

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Total Profit / Original Capital Investment

This Week’s Moves

Advanced Micro Devices (AMD): Profit-Taking

Advanced Micro Devices (AMD) had a very good week, popping more than 5% on Wednesday alone when I took profits with a sell order that filled at $95.02. The sale locked in +19.70% in gains on shares I bought for $79.38 back on May 3.

The sale also removed all the capital out of the position once more, lowering my per-share cost from $22.00/shr to -$14.51/shr (each of my remaining shares cost nothing, instead adding +$14.51/shr to the portfolio’s bottom line in addition to the value of the shares).

From here, my next buy target is $74.05 and I have no additional sell targets as we wait to see where AMD will go following its acquisition of Xilinx (XLNX).

AMD closed the week at $106.19, up +11.76% from where I sold Wednesday.

General Electric (GE): *Closed Position*

With its upcoming 1:8 reverse-split (each shareholder receives 1 share for every 8 held before the split) and a significant rebound from its lows, I decided it was time to take more profits in General Electric (GE) and relegate the remainder to the “non-active” part of the Speculation in Play portfolio along with other positions like Twitter (TWTR) .

My non-active positions are ones where I’ve taken my capital plus significant profits out and I’m letting the rest run, however, I have no plans to actively manage the position by purchasing more shares so I no longer track them in my Speculation in Play blog posts (positions in the non-active part of the portfolio are reported weekly as part of the “Cash” position).

I bought back into GE during the March 2020 selloff at $9.40 and added all the way down with my last purchase at $5.54 on May 13, 2020. Following GE’s reverse split, the stock price will skyrocket to $100, making it into a mediocre industrial investment rather than a speculative play since many traders were attracted to GE due to its low share price and, without that, GE is no longer interesting.

My sell order filled on Monday at $12.80, locking in +86.59% in gains on shares I bought on March 16, 2020 at $6.86 and lowering my per-share “cost” to -$7.81 (each of my remaining shares cost nothing instead adding +$7.81/shr to the portfolio’s bottom line in addition to the value of the shares).

GE closed the week at $12.95, up +1.17% from where I sold Monday.

Golden Minerals Co. (AUMN): *New Position*

I was able to add the third position to my Super-Speculative Commodities Basket, Golden Minerals Company (AUMN), when it triggered my first buy order on Thursday, filling at $0.5316. My next buy target for AUMN is $0.3916.

Just like the other two in the basket – Canadian Palladium (DCNNF) and Fabled Silver & Gold (FBSGF) – these three are some of the most speculative and wildly volatile stocks I’ve ever been involved with. Accordingly, I’m only allocating a single position to the THREE of them and don’t expect to attain a full position unless all three see extreme moves to the downside.

DISCLAIMER: Once again, these stocks are lottery tickets and I am only allocating as much money to them as I’m prepared to lose entirely as it’s probably stupid for me to buy any shares in these three companies to begin with…

AUMN closed the week at $0.539, up +1.39% from where I opened it Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.