Originally posted January 10, 2019. Last Updated: April 10, 2019

“Professional” advisers will often say that individual investors cannot beat the market and that you’d be better served investing in a S&P 500 tracking fund.

Don’t believe it.

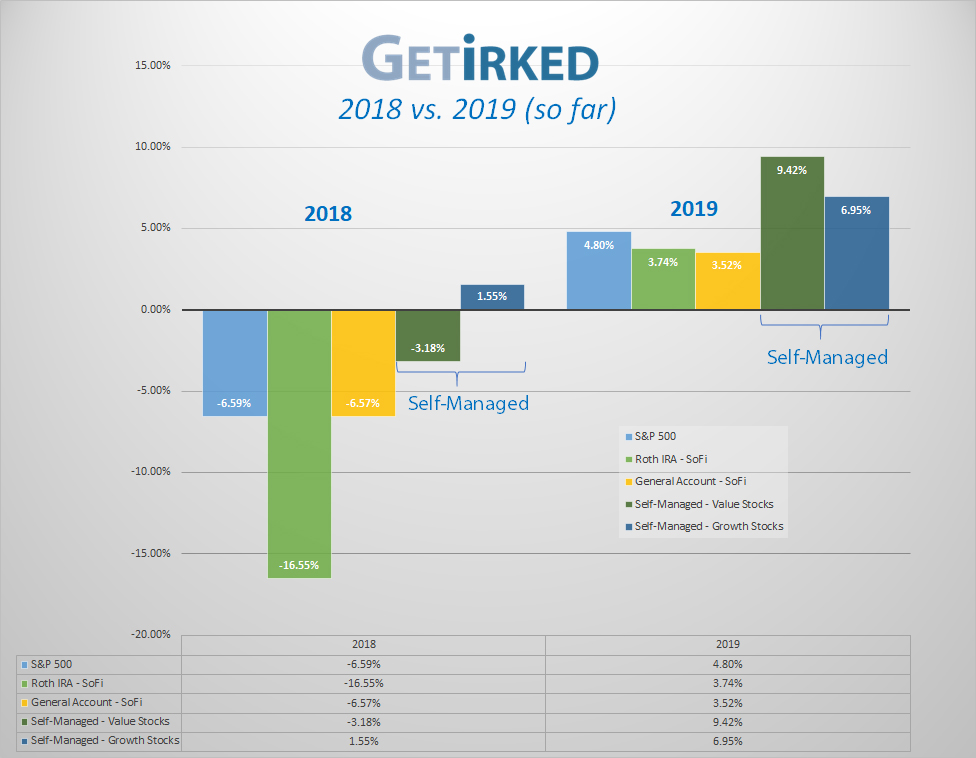

Below is a chart comparing our accounts (which include two roboadviser accounts) and the S&P for 2018 and 2019, so far:

2018

In 2018, the S&P 500 dropped 6.59%.

Get Irked manages two portfolios – one focused on more value-oriented stocks and another with growth-oriented.

Our results compared to -6.59%?

Our value-oriented portfolio dropped -3.18%, less than half the drop of the market.

Our growth-oriented portfolio GAINED 1.55%.

Our roboadviser, SoFi, lost 6.57% (less than the S&P’s loss) in our main account. The -16.55% in our Roth account with SoFi includes the epic losses suffered by the poor management of Wealthfront which we closed in November. (For more about roboadvisers, check out GetIrked’s feature – Roboadvisers versus the S&P 500 – FIGHT!)

2019

So far in 2019, the S&P is up 4.80%. Get Irked’s Roth IRA and General Account managed by SoFi are up 3.74% and 3.52%, respectively.

Our Value portfolio is up 9.42% and our Growth portfolio is up 6.95%.

The average investor CAN beat the market. It just takes time, dedication & discipline.

YOU can do it!