Highlights from the Week

What a difference a bad preannouncement makes!

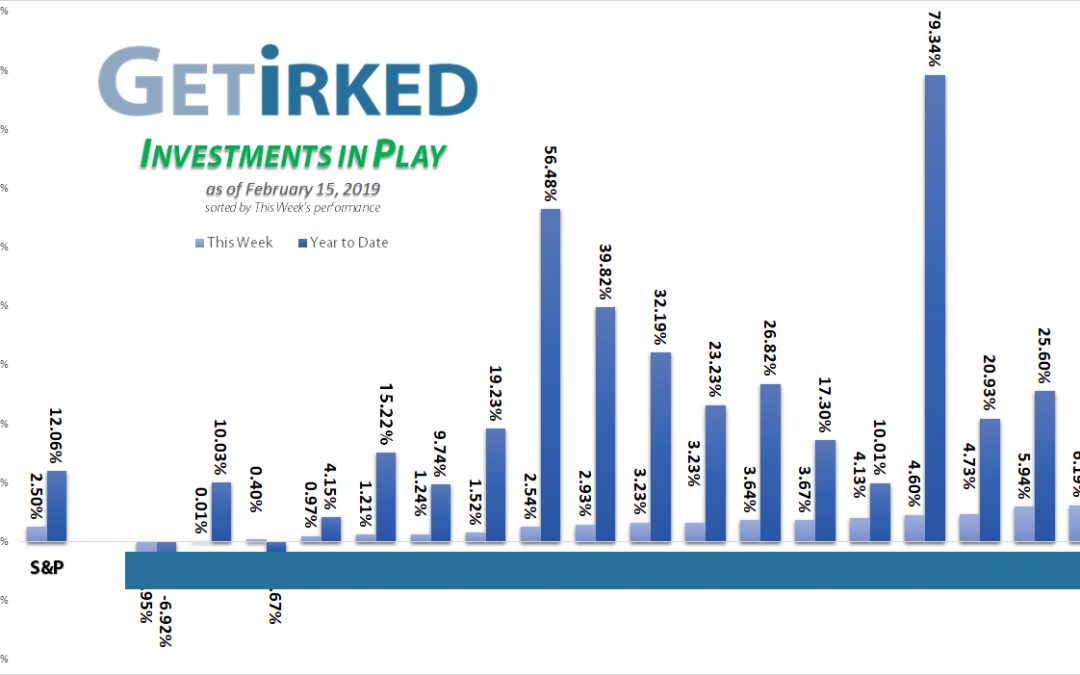

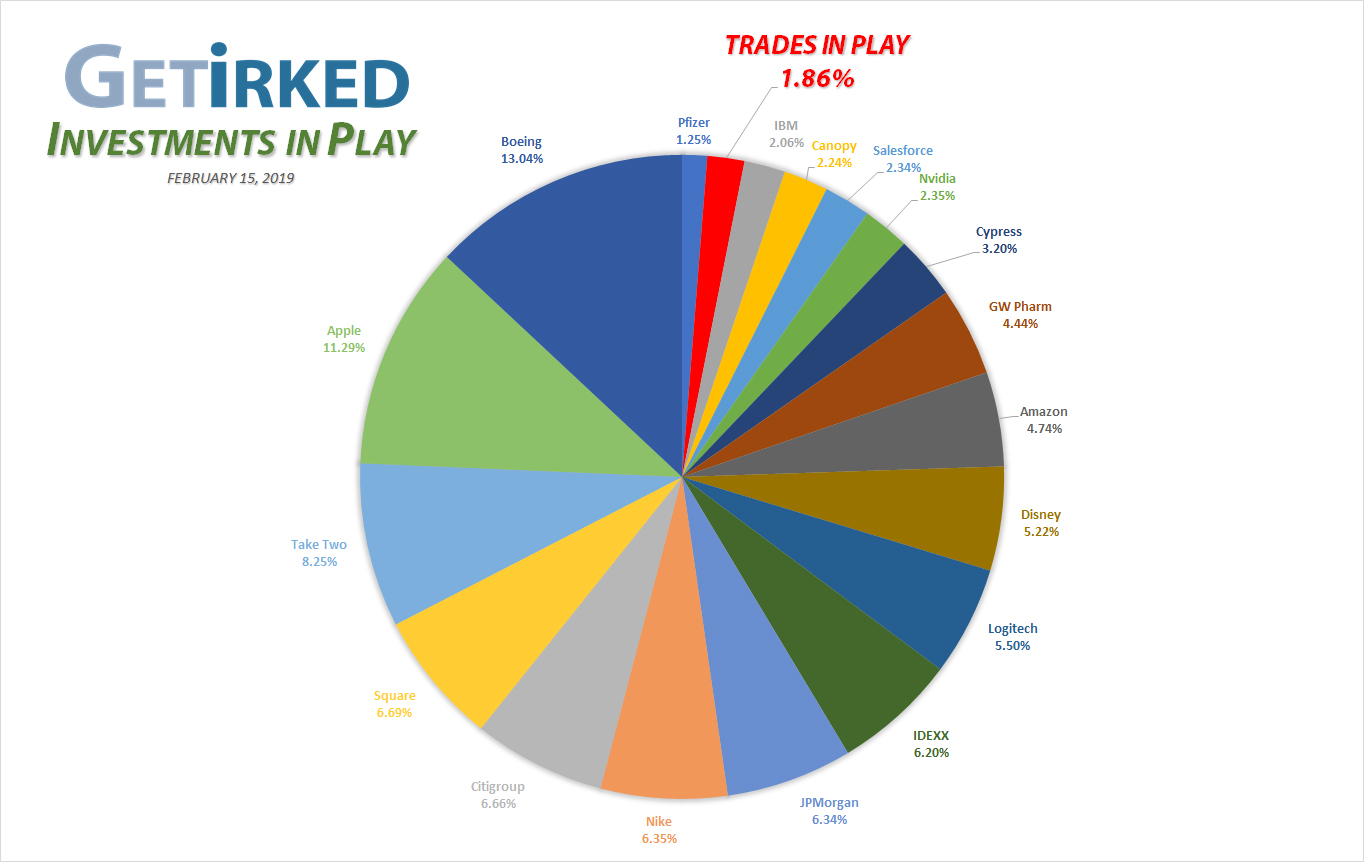

Nvidia (NVDA) is our big winner this week, up 6.19%! Despite completely decimating their quarter, NVDA makes a return to form after “beating” the terrible lowered guidance they gave just a week or two ago; an incredible rebound for the position which left us scratching our heads – didn’t analysts say this was supposed to crash to $125?

If you don’t play with friends, you will be left alone.

Take Two (TTWO) takes the loser’s place for the second week running, down 3.95% this week after reporting a slowdown in the industry last week and no massively multiplayer First Person Shooter in its wheelhouse. Electronic Arts (EA) bounced big-time after releasing Apex Legends, its new Fortnite competitor that’s bringing all the boys to the yard, and they’re, like, it’s better than Fortnite, that’s right.

No move is still a move.

The week’s slightly upward movement left us with only two moves this week, but that’s an important lesson – if you don’t know what to do, it’s better to do nothing at all. Doing nothing is a legitimate move in this game. At this point, we’ve lightened up as much as we’re going to in our portfolio unless some of our growth plays make incredible upside moves. We’ve got a significant amount of dry powder on the sidelines and will wait to see what market moves the coming days and weeks bring to us.

This Week’s Moves

JP Morgan (JPM)

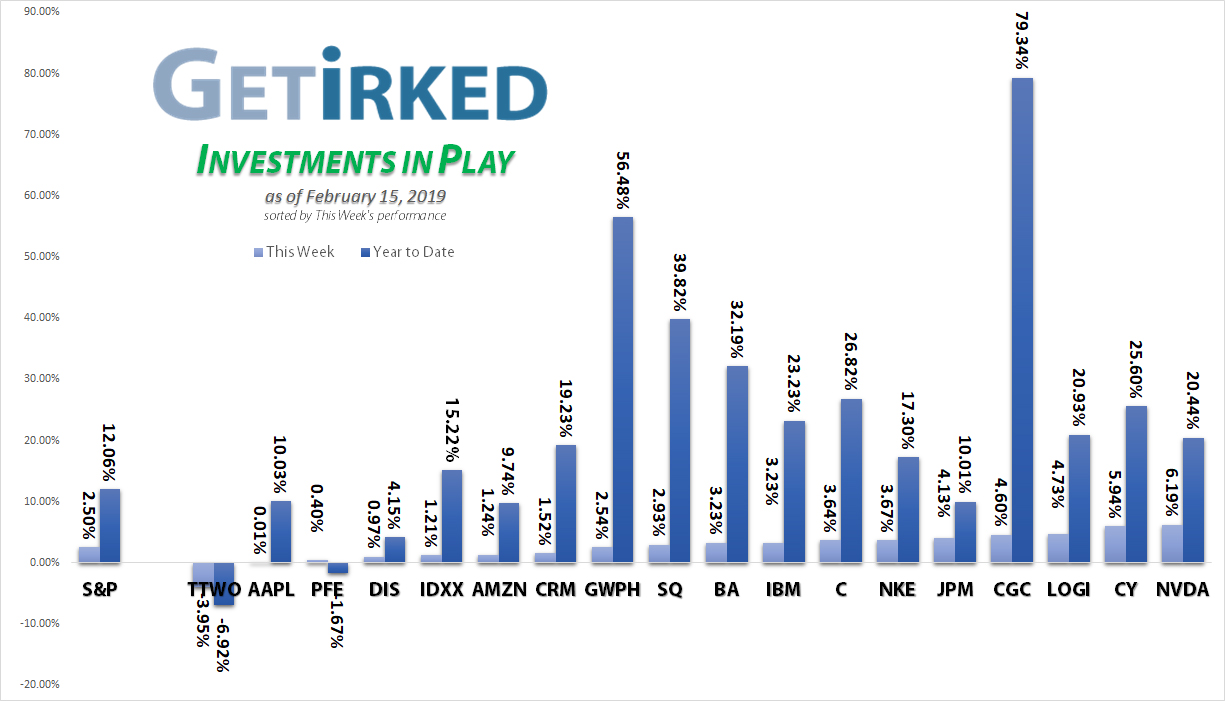

We broke a cardinal rule – we sold below our per-share cost basis. Back on Christmas Eve, we picked up some more JPM at $92.66, inches from its $91.11 all-time 2018 low. This week, we sold those shares at $101.43, slightly below our $104.57 per-share basis when it looked like JPM might be rolling over to capture a gain of 9.46% and to free up the capital to buy more JPM if it retraces. Once again, breaking a trading rule was a huge mistake. Friday’s news caused JPM to jump over our previous per-share cost (previously $104.57, now $105.52 thanks to our premature sale) where we would have been able to sell the shares without lowering our cost basis. This reinforces the trading commandment – always stick to your discipline and follow the rules. JPM closed the week at $105.55 with our position up +0.01%.

Nike (NKE)

Nike has been a huge winner for us since we first started buying it in February 2012 at $25.21 a share (it’s split a few times since we bought it). This week, NKE headed for higher highs so we put in a stop-limit sell order which triggered at $83.40 and we took some profits – bulls make money, bears make money and hogs get slaughtered. NKE closed the week at $85.38 with our position up a very respectable +320.20%.

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.