May 17, 2019

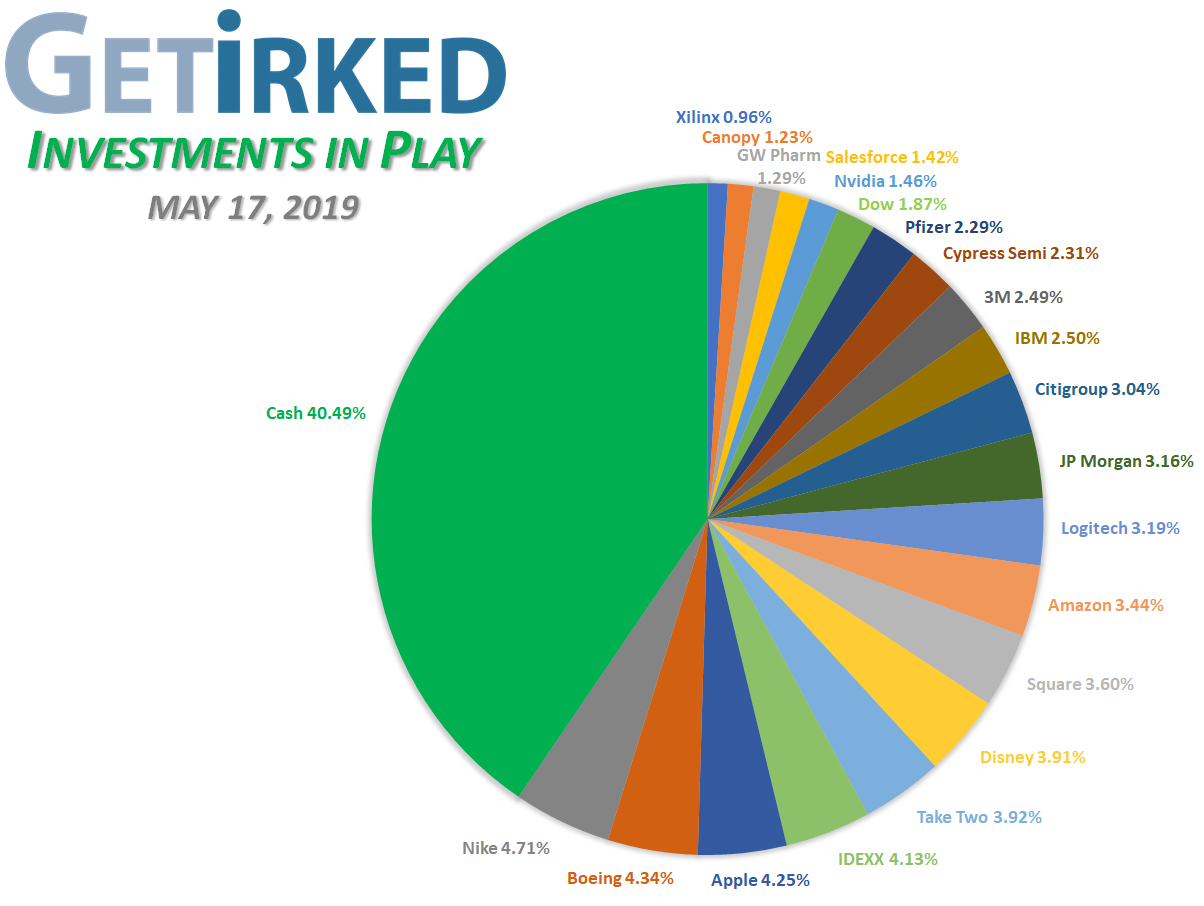

Portfolio Allocation

Positions

%

Target Position Size

%

Desired Cash On-Hand

Current Position Performance

Cypress Semi (CY)

+627.91%

Boeing (BA)*

+571.60%

Square (SQ)*

+395.37%

Nvidia (NVDA)*

+349.67%

Apple (AAPL)

+334.18%

Nike (NKE)*

+319.19%

Disney (DIS)*

+273.59%

Canopy Growth (CGC)*

+125.02%

IDEXX Labs (IDXX)

+107.97%

GW Pharma (GWPH)

+57.66%

Salesforce.com (CRM)

+28.70%

Amazon (AMZN)

+15.67%

Logitech (LOGI)

+15.66%

IBM (IBM)

+12.48%

JP Morgan (JPM)

+8.87%

Citigroup (C)

+5.89%

Pfizer (PFE)

+2.90%

Take Two Inter (TTWO)

-1.52%

Dow (DOW)

-3.14%

3M (MMM)

-4.25%

Xilinx (XLNX)

-6.10%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

Highlights from the Week

Biggest Winner: Take Two Interactive (TTWO)

Take Two Interactive (TTWO) continues its winning streak for two weeks in a row, earning an additional +3.17% this week and a total gain of 6.40% for the year. What makes these gains truly phenomenal is knowing that TTWO was $84.41 less than three months ago – a total gain of +26.36% to its current $106.66 share price… on mediocre news.

Biggest Loser: Xilinx (XLNX)

New to the portfolio this week, Xilinx (XLNX) is a semiconductor manufacturer specializing in mobile phone technology. Not a new company (it’s been publicly traded since the 1990s), XLNX has recently been a market darling due to its focus on the upcoming 5G rollout.

XLNX recently reported disappointing forward guidance. Compound that with the news about Trump targeting Huawei, a major customer of XLNX, and the stock has been slammed in recent weeks, dropping -10.40% this week alone and earning our Biggest Loser spot for the week.

This Week’s Moves

3M (MMM): Adding to Position

3M continued to get slammed during the market-wide sell-off, triggering a buy order we had in place at $172.48, lowering our per-share cost from $188.97 to $176.60, a decrease of -6.39% and increasing our allocation to about 1/2 of our overall desired size.

Our next buy target for 3M is $147.29, an additional -16.6% below our per-share cost basis which would represent considerably oversold levels for the stock. We will review 3M regularly over the coming days and weeks to determine its potential price action, and will adjust our buying targets, if necessary.

3M closed the week at $169.09, down -1.97% from where we added.

Apple (AAPL): Adding to Position

As expected, the U.S.-China Trade Wars caused the stocks of companies with China-exposure like Apple (AAPL) to drop like a rock thrown off a cliff.

We added back into our Apple position from last week’s half-position sale, starting small by replacing 1/4 of what we sold when Apple dropped to $187.46 on Monday, a price cut of -9.7% from our $207.61 selling price.

We have additional buy targets in place to replace more of what we sold starting at $161.81, -13.6% lower than Monday’s $187.46 buy price and -22% lower from our $207.61 sell price of half of our position last week.

AAPL closed the week at $189.00, up +0.82% from where we added.

Boeing (BA): Adding to Position

Like Apple, Boeing (BA) felt the pain as its China exposure combined with headline risk from the 737-MAX issues sent the stock lower.

We are slowly adding to our Boeing position after substantially reducing what once was the biggest position in our portfolio by 50%+ at an average price of $369.30.

We started Monday by adding 4% of what we sold when Boeing hit $343.09, -7.1% lower than our average selling price and more than -23% lower than its $446.01 all-time high. Our next target is $317.54, -7.45% lower than Monday’s buy and -28.80% off its high.

Company-specific good news came later in the week when Boeing announced it finished the software patch to repair the 737-MAX issues which caused two fatal airline crashes.

BA closed the week at $355.02, up +3.48% from where we added.

Dow (DOW): Adding to Position

Dow (DOW) showed remarkable strength during last week’s sell-off, so when it started to weaken this week, we decided to add another 1/4 to our position at $51.32, about -3.5% off our per-share cost, lowering our per-share slightly from $53.18 to $52.45, an overall decrease of just 1.37%.

Dow’s astounding 5.4% dividend yield at these levels makes it an investment we want in our portfolio for the long-term, plus the stock doubles as a reassuring place to hold funds during times of volatility and economic uncertainty.

We have buy targets to add substantially to our position if it attempts to breach its recent IPO price of $48.00 with our next buy planned for $48.80.

Dow closed the week weaker at $50.80, down -1.78% than our $51.72 buy.

IBM (IBM): Adding to Position

We got ahead of ourselves during the market’s bounce from its December 24 lows, selling half of our IBM (IBM) position following its January earnings report at $131.73. We’ve been waiting for a buying opportunity ever since and that opportunity arrived this week.

We added back to our IBM position when it sold off at $131.62, raising our per-share cost basis to $119.41 but increasing our position size.

We believe IBM has long-term growth potential with its recent acquisition of Linux producer Red Hat (RHAT). Combine that with a dividend-yield of 4.9% at these prices, and this is a position we want more of in our long-term portfolios.

That being said, we have another buy target at $114.80 should the selloff get out of hand.

IBM closed the week at $134.32, up +2.05% from Monday’s buy.

Take Two Interactive (TTWO): Position Reduction

Last week, we substantially reduced our overweight position size in Take Two Interactive (TTWO), fearing negative trade wars news and a bad quarterly report. This week, Take Two gave a mediocre-to-disappointing earnings report… and WENT UP!

Many analysts say that a stock’s price going up on bad news is a good sign that it’s bottomed, however that didn’t stop us from reducing our still slightly-overweight TTWO position allocation when it broke through our new per-share cost of $108.31 on Wednesday.

We’re much more comfortable with our new position size slightly under our portfolio’s target allocation of 4.29%: TTWO is now less than 4% of the portfolio. We’ll see where TTWO goes from here with a buy target at $85.97.

Definitely take care with this one, TTWO has some serious range capability, demonstrated with a low of $84.41 (-22.07% lower than here) less than three months ago!

TTWO closed the week at $106.66, down -1.52% from where we reduced our position.

Xilinx (XLNX): *New Position*

Xilinx (XLNX) is a semiconductor company with a huge division dedicated to the roll-out of 5G, the new mobile phone platform that will dramatically transform the speed of mobile phones. Unlike 2G-3G-4G which offered only incremental improvements to mobile phone speeds, 5G promises a transformation of significant change, potentially offering speeds as fast or faster than current home connections.

We’ve been eyeing this sector for a good buying opportunity, and Xilinx (XLNX) has been our #1 pick on our watch list, representing an incredible growth play considered the Best of Breed in the space. Over the past weeks, Xilinx has dropped -21.21% from its $141.60 April all-time high to $111.57 during Monday’s market-wide selloff where we opened a position with a 1/4 allocation buy order.

In addition to being the Best of Breed to play the 5G mobile rollout, XLNX also sports nearly a 1.5% dividend at these levels, making it similar to Cypress Semiconductor (CY), another favorite of Get Irked’s for the semiconductor sector where offering dividends is very rare (CY’s is currently 2.853%).

*Sector-Specific Negative News Warning*

On Thursday, Xilinx warned that they would be experiencing slower sales and earnings growth following President Trump’s attack on Huawei, banning any American company from doing business with them.

Xilinx provides semiconductors to Huawei’s mobile phone division, so the news caused XLNX to drop more than 6% during trading Thursday. The sell-off continued on Friday.

Unlike Monday’s market-wide selloff when we first opened our XLNX position, this news is sector-specific and demands that we adjust our strategy accordingly, particularly given the potential for further downward pressure should more market-moving bad news get released.

We lowered our next 1/4-position buy price target to a key level of support at $97.06, a reduction of -13% from our initial buy. We also have additional buy targets at much lower levels: $85.89, $75.82 and $69.12.

While we don’t anticipate XLNX will actually fall to $69.12, a drop in excess of 50% from its $141.60 all-time high, investors need to be prepared for any potential outcome and we still believe XLNX’s long-term growth potential would justify adding more even at those substantially-lower levels.

XLNX closed the week at $104.76 with our position down -6.10%.

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.