May 3, 2019

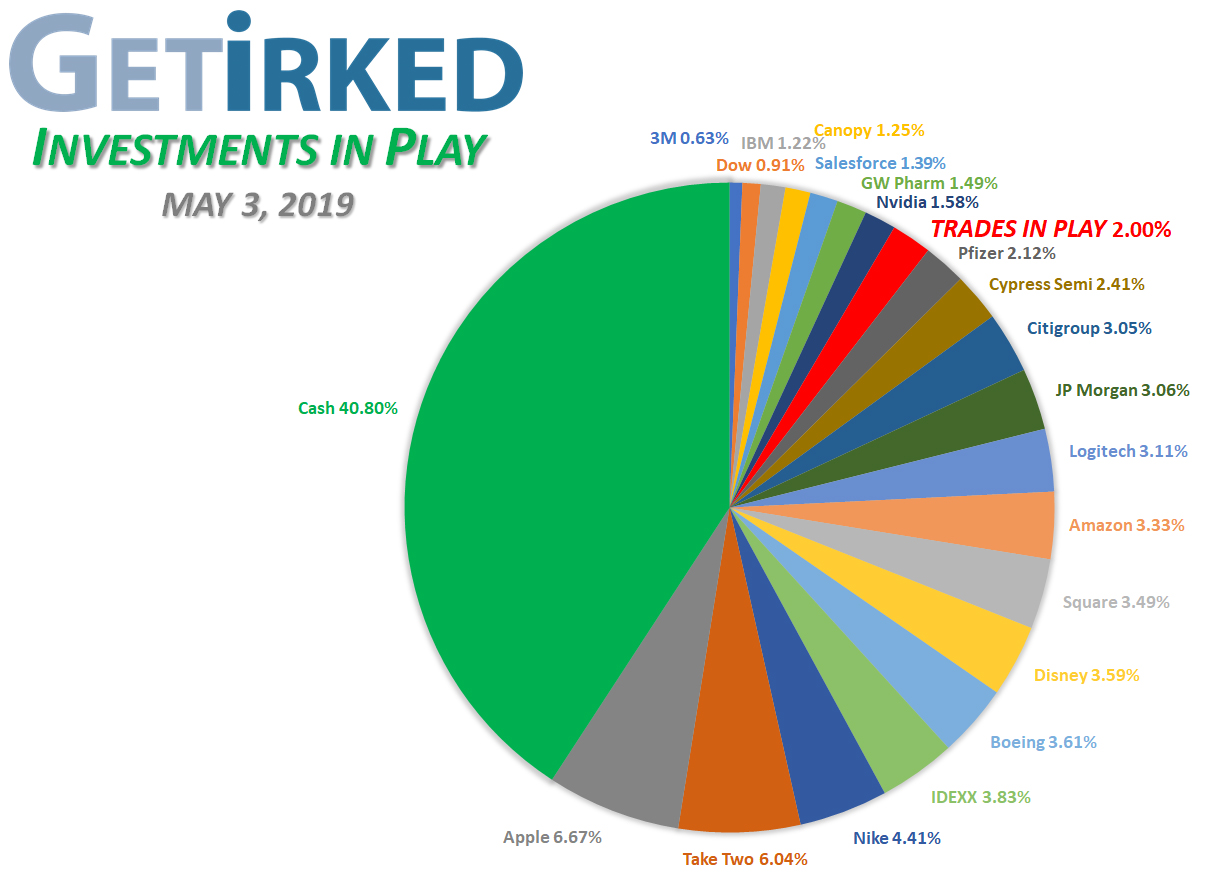

Current Position Performance

Cypress Semi (CY)

+722.47%

Boeing (BA)*

+537.10%

Apple (AAPL)

+388.70%

Square (SQ)*

+380.63%

Nike (NKE)*

+321.52%

Disney (DIS)*

+272.81%

Nvidia (NVDA)*

+260.08%

Canopy Growth (CGC)*

+127.51%

IDEXX Labs (IDXX)

+108.73%

GW Pharma (GWPH)

+41.54%

Salesforce.com (CRM)

+36.01%

IBM (IBM)

+31.42%

Logitech (LOGI)

+22.04%

Amazon (AMZN)

+21.45%

Citigroup (C)

+15.00%

JP Morgan (JPM)

+14.12%

Pfizer (PFE)

+2.70%

Dow (DOW)

+0.23%

3M (MMM)

-1.98%

Take Two Inter (TTWO)

-4.25%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

Highlights from the Week

Biggest Winner: IDEXX Laboratories (IDXX)

After reporting a great quarter, IDEXX Labs (IDXX) started gunning for its all-time highs once again, closing out the week up +7.74% with a 37.25% gain year-to-date. IDEXX is our favorite play on the “pets-as-people” space, but we did have to take some profits after its amazing run this year (see below).

Biggest Loser: Square (SQ)

Square’s (SQ) feeling the pain from its competitors, according to its earnings report this week. Investors weren’t happy with the gloomy forecast and sold SQ down -4.23% to earn it the spot as our biggest loser for the week.

This Week’s Moves

3M (MMM): *New Position*

This week, we added the 3M Company (MMM) to our long-term portfolio, our first new long-term holding since we added Pfizer (PFE) in January 2019. 3M is a mega-conglomerate and an American institution, producing innovations from a variety of sectors including its four major groups: Safety & Industrial, Transportation & Electronics, Health Care, and Consumer.

Last week, 3M reported a bad quarter. Wait. Let’s reword that – it wasn’t a bad quarter, it was a disastrous quarter, with 3M missing on every metric possible. 3M’s report knocked the stock down 15% from $219.75 to lows around $185.

Although the company has significant work to do to improve, this horrendous drop offers a buying opportunity to pick up an historic outperformer sporting a dividend yield in excess of 3%+ as a long-term investment.

We started very small, picking up less than 15% of our overall desired position size with our first purchase at $188.97 on Wednesday when the stock appeared to stabilize.

Since 3M may have significantly farther to fall, we’re holding off adding more to our position until we see lower levels and/or consolidation. We are targeting $166 for our next buy order where we plan to add a substantial amount. That price point is nearly 15% lower than our first buy and almost 25% lower than 3M’s April high of $219.75.

We’re being very careful with this one as it’s difficult to determine the magnitude of the downside even though we are confident in 3M’s ability to eventually turn itself around. Once again, we’re entering this as a long-term position and our time horizon is 20 years or longer from this point.

For future reference, we have added 3M to our Stock Shopping List.

3M closed the week at $185.22 with our position down -1.98%.

Apple (AAPL): Downside Protection using Put Options

Given Apple’s nearly 50% gain since its January 2 negative pre-announcement for its 2018-Q4 earnings, we decided to use options to protect our profits this week going into Tuesday’s earnings announcement.

We don’t usually talk about options on Get Irked, particularly because options trading is incredibly volatile and the fact options have an expiration date results in significant decay of value over time eventually going to zero if held to their expiration date.

However, from time-to-time, options can be valuable to protect existing long-term positions that we’d prefer not to sell.

To describe the two kinds of options in brief:

- Call Options give the buyer the right to buy a stock at a certain price.

- Put Options give the buyer the right to sell a stock at a certain price.

Prior to our option purchase, we researched Apple’s historical moves following earnings and found that Apple can drop as much as -15% following a particularly bad earnings report. Given its $205 share price at the time, a 15% drop meant levels as low as $174.25. We wanted to protect our position for a worst-case scenario disappointment.

We bought the Apple 190 May 3 Put for $0.58 on Monday with Apple’s stock trading around the $205 mark. Contracts are sold in quantities of 100 shares, so the price is multiplied by 100 making each contract $58.00 ($0.58 x 100 = $58 per contract).

The Apple 190 May 3 Put gave us the right to sell 100 shares of Apple at $190 per contract no matter how low the stock price dropped below $190, however, we needed to exercise this right by Friday, May 3, the contract’s expiration date. Historically, when Apple drops significantly following earnings, it drops the most within 1-2 days of reporting so 3 trading days was sufficient coverage to exercise the options.

Option contracts always expire at the market close of a Friday (traditionally, the third Friday of a month), and, in this case, our expiration date was the Friday of the same week.

A shorter expiration date means a cheaper price for the option, however since options lose value as they approach their expiration date, time was definitely not on our side as we only had four trading days to use our puts (including Tuesday before earnings).

With Apple stock at $205 when we bought the puts on Monday, that means Apple would need to drop more than -7.5% ($205 to under $190) for the options to be worth using. However, options increase in value depending on a stock’s movement, so profits were still very much possible if the stock dropped from $205 before expiration.

It’s important to note that options buyers rarely actually use the options they buy, instead selling the options and keeping the profits if the stock moves in the direction that causes the options to raise in value.

If the underlying stock’s price goes up, call options increase in value while the stock’s price going down makes puts increase in value.

We weren’t planning to make a significant profit on our “insurance,” we just wanted to sidestep any pullback in Apple’s stock as a result of a serious negative earnings report without selling any of our stock position.

On Tuesday morning, Apple’s stock started to pull back significantly before their earnings report after the same day’s market close, and this sudden movement caused our put contracts to more than double in value.

“Bulls make money, Bears make money and Hogs get slaughtered.”

When we have a gain of 100% in any investment, our trading discipline dictates we sell some to take profits, especially when that gain is made in less than 24 hours.

In order to capitalize on this move, we sold half of our contracts at $1.27 x 100 shares = $127 per contract with a $58 purchase price – a gain of 118.97% on the contracts we sold.

Selling half our options position effectively provided us with free insurance against a possible downside move by paying for the options we kept, but the sale also covered our options bet as the profits we took ensured we wouldn’t lose any of the capital we spent to initially buy the options in case Apple reported a good earnings quarter.

And report a good quarter Apple did. In fact, Apple reported a blowout quarter on Tuesday with earnings of $2.46 per share vs. $2.36 expected, an improved outlook, great news on services, and all this caused the stock to rocket 6%+ the next trading day.

Apple’s stock price pop caused our remaining options contracts to expire worthless on Friday (when options aren’t “in-the-money” – i.e. profitable – they simply expire).

Important Note: If you hold options into expiration and your position is profitable, make sure you know your brokerage’s rules. Some brokerages will automatically execute profitable options positions, meaning call options will result in your account automatically buying 100 shares per contract held of the underlying stock and put options will result in your account automatically selling 100 shares per contract sometimes even short-selling if your account doesn’t have enough shares to sell to match the contracts held.

Pay close attention to expiration dates and make sure you know what your broker will do.

Thanks to our options trading, we ended up making 9.48% in profits on our put options by selling half of them during Tuesday’s volatility and still earned the entire 5%+ gain from Apple’s report!

When options work, they really, really work!

Conversely, had we held on to our entire options position instead of selling half on Tuesday before earnings, we would have lost the entire cost of the options trade which would have eaten into the gains we earned from Apple’s positive report.

When it comes to options trading, timing is everything.

Apple closed the week at $211.75 with our position up +388.70%.

Citigroup (C): Profit-Taking

Our history with the financial sector has never been a good one. In the past, we’ve bought banks at their highs and sold at their lows. The notorious volatility of this space over the years has taught us to take profits when we have them, so when Citigroup (C) dropped through $70 support on Wednesday, we took some profits at $69.92, reducing our per-share cost 3.58% from $63.73 to $61.45 per share.

We have no intention of closing out this long-term position, but given that our Citigroup was already near our full allocation target for our portfolio and the overcooked nature of the current market, taking profits was the prudent move.

We have a buy order in place to replace this sale (and add even more) at the key support price of $52.68 should we see another dramatic pullback in the coming months.

In the meantime, Citigroup closed the week at $70.67 with our position up +15.00%.

Dow (DOW): *New Position*

Not only did we add 3M (MMM) this week after their terrible earnings report, we also decided to pick among the rubble and start a position in Dow (DOW), the fabled chemical company (think “Dow Jones Industrials Average”) which just came public on March 20, 2019.

If you haven’t been paying attention to Dow (and we can’t blame you, really), Dow and DuPont merged several years ago to create the aptly-named DowDupont company. Over the past year or two, DowDupont had been wanting to split itself up, and that split finally took place in March.

The new Dow (DOW) is a dedicated play on the industrial chemical market, and it reported a disappointing but not dismal quarter this week. We believe traders and analysts overreacted as the stock plummeted nearly -10% on Thursday from its daily high to its low.

Yielding a dividend in excess of 5% at these levels, we think Dow is an excellent long-term investment, however we’re still being cautious, opening our position with 1/4 of our desired allocation at $53.18 on Friday with buy targets at lower levels of $45-$46 for our next buy. From that point, we will re-evaluate once pricing settles more.

Dow closed the week at $53.30 with our position up +0.23%.

IDEXX Labs (IDXX): Profit-Taking

IDEXX Labs (IDXX), the veterinary testing and supply company and our long-term play on the “pets-as-people” thesis, has been galloping (pun intended) back up to its all-time highs. IDXX has gained a whopping +41.30% since its January 3, 2019 pullback!

When IDXX crossed over $248 on Friday, our discipline required us to take some profits, selling 10% of our holdings at $248.03. The sale lowered the per-share cost of our position to $120.00 a share.

IDXX closed the week at $250.47 with our position now up +108.73%.

JP Morgan Chase (JPM): Profit-Taking

As we referenced above with Citigroup (C), we have been taking a protective approach to our bank investments to guard ourselves against past transgressions from this sector (we have bad luck with banks). We took the same approach as we did in Citigroup by taking some profits in JP Morgan (JPM) following reports that the Fed would not be considering an interest rate cut.

Our JPM position mirrored our Citigroup (C) position with a near-complete allocation, so when the markets started to sell off on Wednesday, we took some profits at $115.15 in JPM, reducing our per-share cost 2.92% from $104.82 to $101.75.

Just like Citigroup, we are eyeing buying targets below our new cost basis to add back to the position should we see a pullback in the markets.

JPM closed the week at $116.12 with our position up +14.12%.

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.