April 12, 2019

Current Position Performance

Cypress Semi (CY)

+648.12%

Boeing (BA)*

+537.92%

Square (SQ)*

+394.64%

Apple (AAPL)*

+365.06%

Nike (NKE)*

+322.63%

Disney (DIS)*

+268.13%

Nvidia (NVDA)*

+265.72%

Canopy Growth (CGC)*

+123.73%

IDEXX Labs (IDXX)

+70.18%

GW Pharma (GWPH)

+35.35%

IBM (IBM)

+35.26%

Salesforce.com (CRM)

+33.82%

Logitech (LOGI)

+25.64%

Amazon (AMZN)

+14.06%

Citigroup (C)

+5.79%

JP Morgan (JPM)

+5.37%

Pfizer (PFE)

+2.84%

Take Two Inter (TTWO)

-11.32%

* Indicates a position where the capital investment has been previously sold.

This figure represents the profit returns made on the original capital investment.

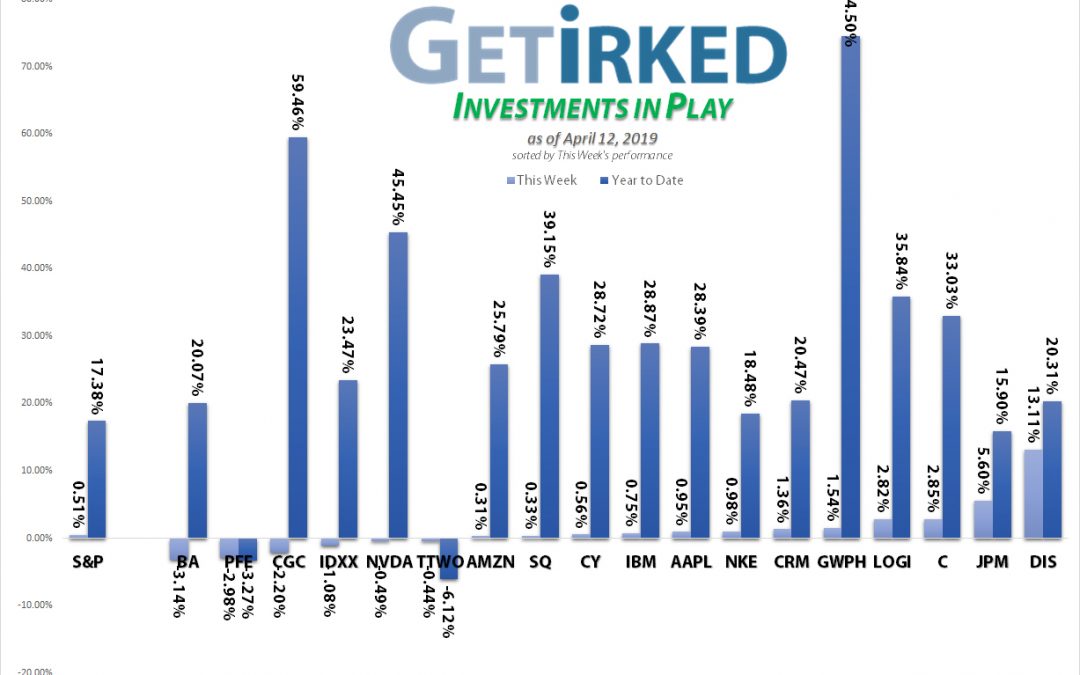

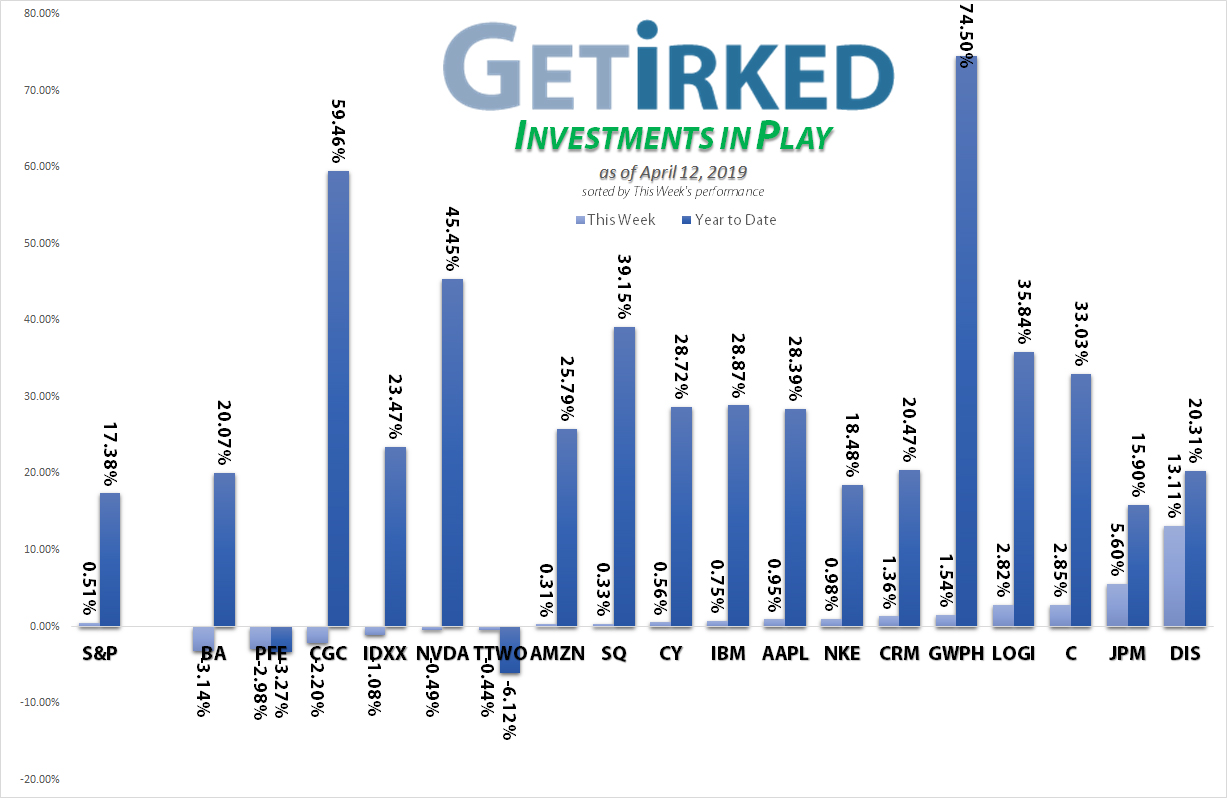

Highlights from the Week

Biggest Winner: Disney (DIS)

Disney (DIS) announced its streaming service Thursday evening (see below) making DIS the week’s biggest winner with its largest single-day move in a decade, grabbing +13.11% for the week.

Biggest Loser: Boeing (BA)

After announcing production cuts for 2019, Boeing (BA) stock dove in price and gets shamed with our Biggest Weekly Loser title with a loss of -3.14%. The news from Boeing is so bad that we sold enough of our position to take it from overweight to equal-weight in our portfolio, grabbing our gains in case Boeing drops in altitude to its December sub-$300 lows.

Other Highlights

Disney announces Streaming Service – Price Target: $164?!

Disney (DIS) announced its new Disney+ streaming service at $6.99/mo. available starting this November during their Thursday evening investors meeting and the stock rocketed 10%+ on Friday.

Why?

Even Netflix (NFLX) has shown this isn’t a war of services – this is a war of content, and no one has better content than Disney: Marvel, Pixar, Star Wars, plus they just picked up Fox’s properties which include The Simpsons and X-Men among many others. Speaking of Big Red, Netflix (NFLX) collapsed more than $15 a share (-4.3%) on the news on a day where the markets were headed higher.

Our year-end price-target for Disney (DIS) assuming no broad economy issues is $160-164, a gain of 25% from Friday’s $130.90 high, and that’s assuming analysts don’t give Disney a Netflix-like multiple.

Throw in Disney’s diversified interests including theme parks and consumer products plus a 1.57% dividend yield even at these levels, and you can see why DIS has been a Get Irked core holding for retirement accounts since February 2012 at our initial per-share price of $41.70 – more than 200% ago.

Gameplan: We expect Disney to pull back from today’s levels as this kind of move for a stock that’s been stuck in a $100-120 range for more than four years is unheard of. Consult your adviser about pricing and definitely wait to see how the price action shakes out for the next week, at least.

The Banks Remembered how to turn a Profit

JP Morgan (JPM) announced record earnings on Friday kicking off the earnings season with a bang and causing the entire financial sector to see a lift with JPM gaining +5.60% for the week and Citigroup (C) – which doesn’t report until Monday – to see a +2.85% gain.

This Week’s Moves

Boeing (BA): Profit-Taking

Following Boeing’s (BA) announcement that they would be reducing production of the 737-MAX combined with concerns that there is “no easy fix” for the navigation issues which led to the deaths of more than 350 people in two airplane crashes, we substantially reduced our BA position when price action fell below $370, selling 42% of our holdings at $368.29 to lock in gains as the potential for Boeing to retest its $292.47 low from December looms ever-nearer.

Boeing has been an extreme long-term winner having earned more than 500% of our original investment when we bought in at $75.28 a share in 2012. BA remains part of our portfolio, however we were far too overweight in the company and reduced our position to be appropriately diversified to the rest of our holdings.

Boeing closed the week at $379.64 with our position up +537.92%.

Logitech (LOGI): Profit-Taking

Logitech remains our favorite way to play the video games and e-sports sector, making hardware and gaming products for all platforms including PC and Mac while also having significant product lines across all of enterprise. Logitech sports nearly a 2% dividend yield even at these levels.

However, our trading discipline required us to take some profits when we had a 20% gain in LOGI at $40.28 when price action started rolling over. We won’t be taking profits again in Logitech as it’s a long-term core holding, and we have buy orders in place starting at our per-share cost of $33.06 and at lower levels from there in case LOGI tests its December lows during a market sell-off.

Logitech closed the week much higher at $41.54 with our position up +25.64%.

In Summary

The Grind is Excruciating…

The indexes continue to work their way higher and although many analysts keep calling for a pullback, they’ve been doing so for the past 10%+ of gains. Accordingly, we continue to adjust our gameplan with buy orders in place to take advantage of pullbacks of 2.5%, 5%, 10%, 15% and 20%.

Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.