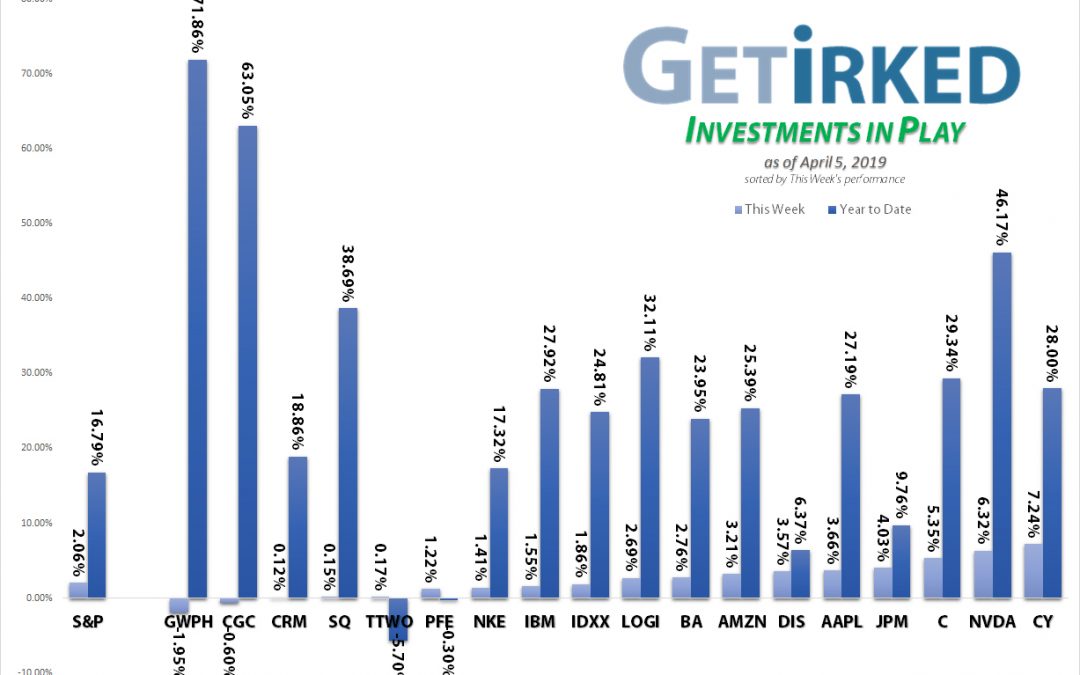

April 5, 2019

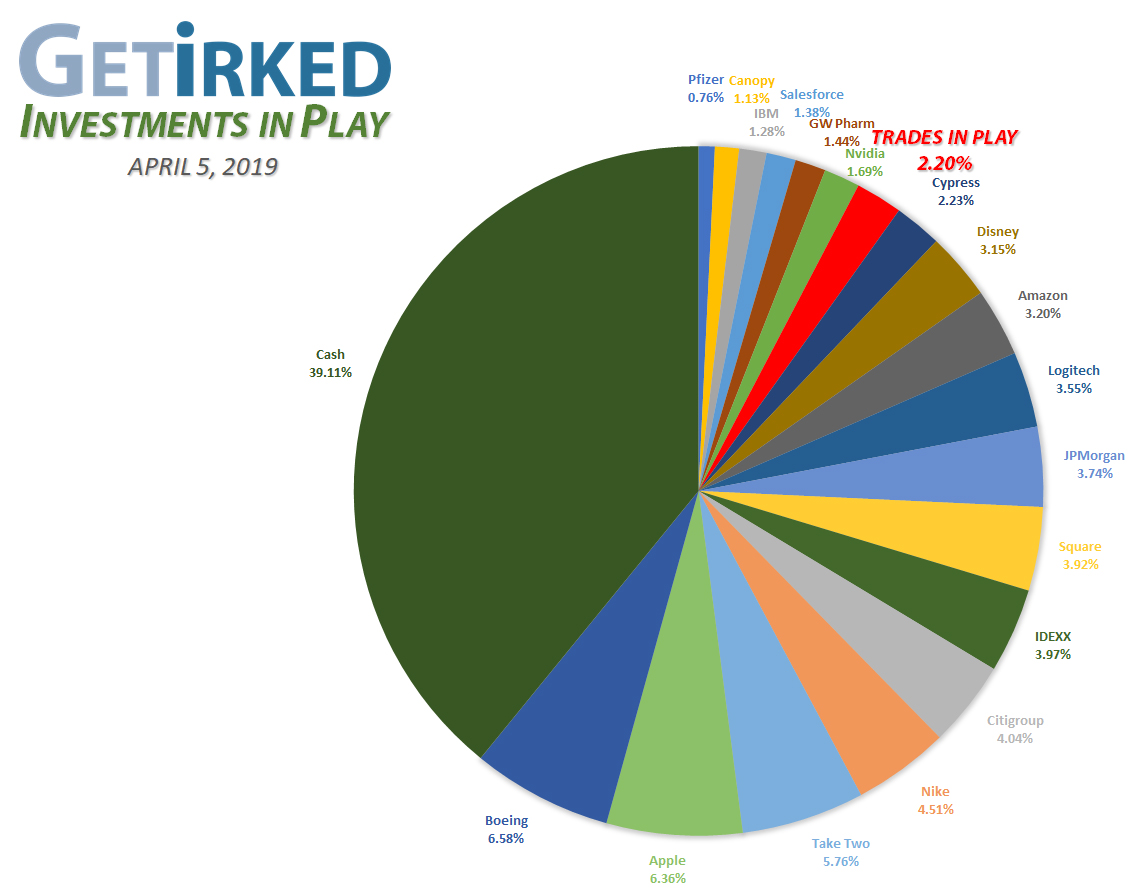

Click either chart for an enlarged version

Current Position Performance

Cypress Semi (CY)

+643.94%

Boeing (BA)

+545.61%

Square (SQ)

+394.12%

Apple (AAPL)

+335.44%

Nike (NKE)

+320.90%

Nvidia (NVDA)

+266.47%

Disney (DIS)

+251.64%

Canopy Growth (CGC)

+105.28%

IDEXX Labs (IDXX)

+72.03%

IBM (IBM)

+34.26%

GW Pharma (GWPH)

+33.30%

Salesforce.com (CRM)

+32.03%

Logitech (LOGI)

+19.89%

Amazon (AMZN)

+13.70%

Pfizer (PFE)

+5.99%

Citigroup (C)

+2.85%

JP Morgan (JPM)

-0.22%

Take Two Inter (TTWO)

-10.93%

Highlights from the Week

Biggest Winner: Cypress Semiconductor (CY)

The semiconductor sector roared back to life this week on hopes of a U.S.-China trade deal and while the media talks about AMD (AMD), Intel (INTC) and Nvidia (NVDA), Cypress Semiconductor (CY) – our favorite under-the-radar semi play – became the biggest winner in our portfolio jumping +7.24%.

Although AMD had bigger gains for the week at +13.56%, we enjoy CY’s 2.86% dividend yield for when the sector reverses direction and gives investors the good ol’ stomach flip.

Biggest Loser: GW Pharmaceuticals (GWPH)

Despite a strong overall economy, the cannabis sector is still trying to find its groove and is struggling to make any gains at all in a market where stocks seem to do no wrong.

High-flying GW Pharma (GWPH) is wrestling with the huge gains it saw after reporting an outstanding upside surprise on its earnings report, and the bears continue to push it down with the stock losing -1.95% compared to consumer cannabis plays like Canopy Growth (CGC) which only lost -0.60% this week.

This Week’s Moves

Citigroup (C)

After getting a little excited last week by adding to our Citigroup (C) position when it touched oversold levels, we decided to reduce Citigroup’s position size when it crossed over our per-share basis, selling some at $64.61 on Wednesday as banks rallied on trade news, reducing our per-share cost to $63.73, but, more importantly, reducing the size of the position in our portfolio to closer to 4.00%.

Citigroup closed the week at $65.55 with our position up +2.85%.

In Summary

The Market Climbs a Wall of Worry

Some of the most challenging times to be an investor come when the market continues to grind upward in the face of a myriad of potential negatives with only gentle positive economic data pushing the market higher. The S&P’s all-time highs are in reach which makes analysts say we’re due for a pullback and consolidation (downdraft), yet stocks work higher each day. What to do? This is when we work on our trading plan by adjusting our buy levels higher while simultaneously reducing the quantity we plan to buy. This way, we add to our positions if we only see a small pullback (2-5%) before heading higher, but still keep funds available in case we see a more dramatic pullback scenario (10-20%). Moderation is the watchword in this kind of environment where we execute strategies to capture a variety of outcomes.Want Further Clarification?

As always, if you have questions any of our positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Disclaimer: Eric "Irk" Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.