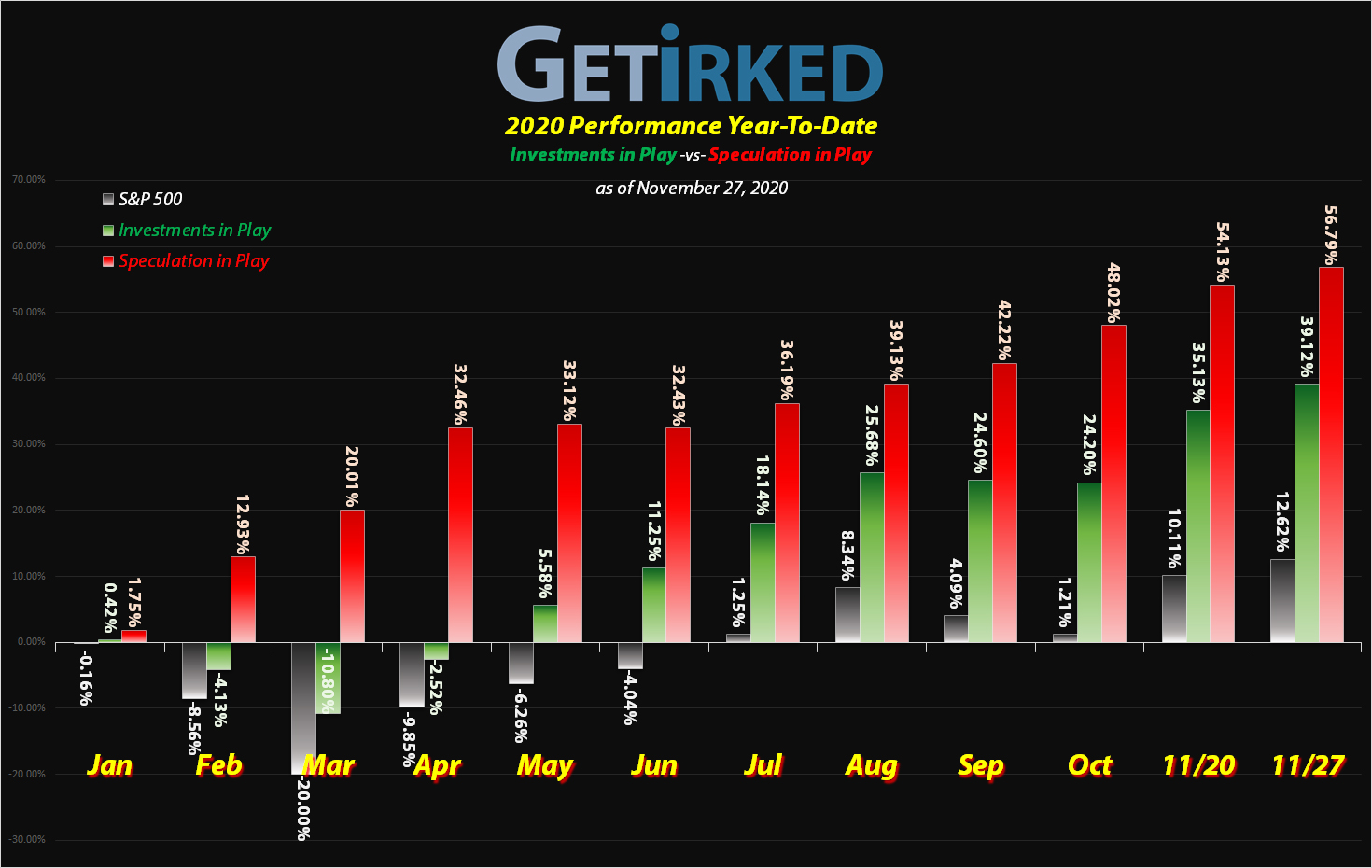

November 27, 2020

The Week’s Biggest Winner & Loser

Canopy Growth Corp (CGC)

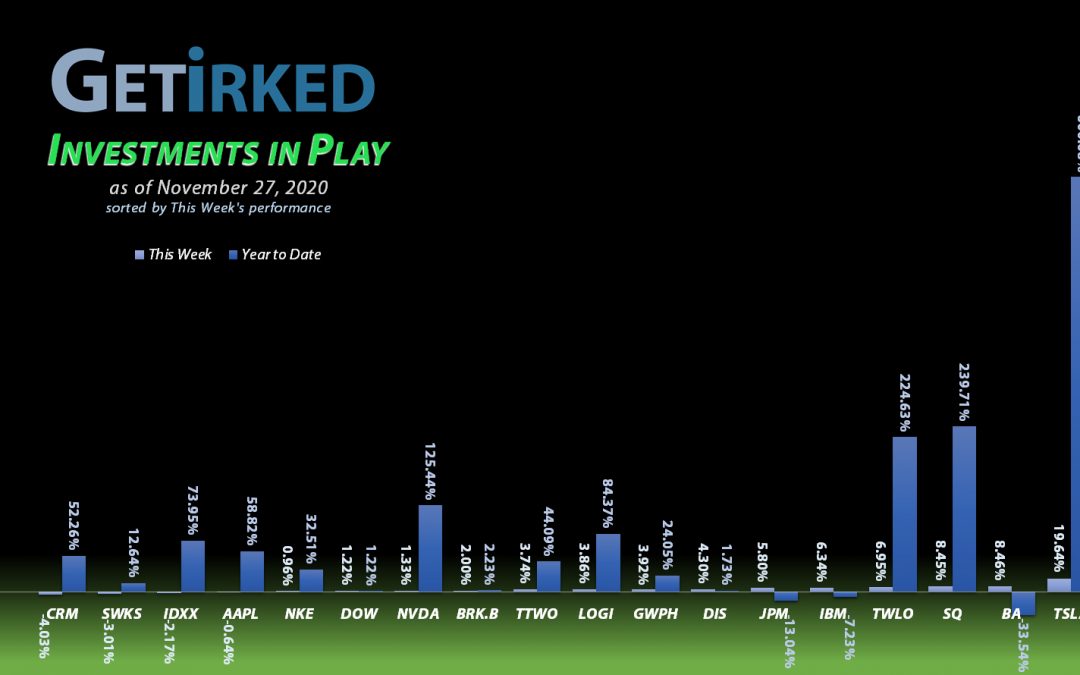

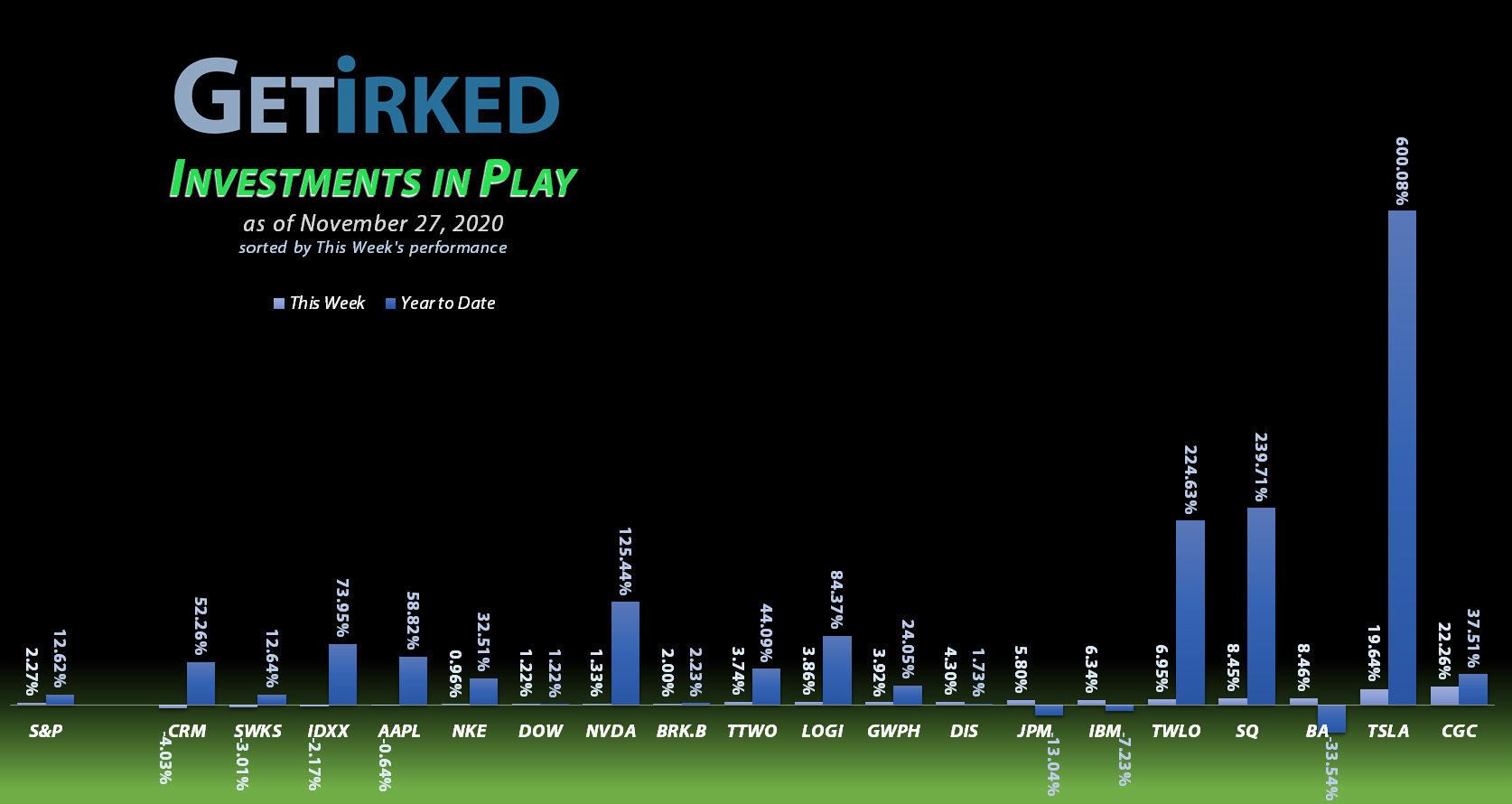

After the complete collapse of the cannabis sector in 2019, consumer cannabis got a huge hit (pun intended) when five states passed legalization laws in the November election. This week, the entire cannabis sector continued to rally with Canopy Growth Corp (CGC) – the Best-in-Breed in the space – locking in +22.26% and the spot of the Week’s Biggest Winner.

Salesforce (CRM)

Salesforce (CRM) has gotten where it is through the amazing leadership of CEO and Founder Marc Benioff. Unfortunately, Benioff is so forward-thinking that whenever a new acquisition is announced, investors typically sell off the stock, not understanding the acquisition and not having faith in Benioff (despite his outstanding past record). This week, CRM announced its plans to acquire Slack (WORK) – the enterprise collaborative program – and dropped -4.03% to lock in the Week’s Biggest Loser spot.

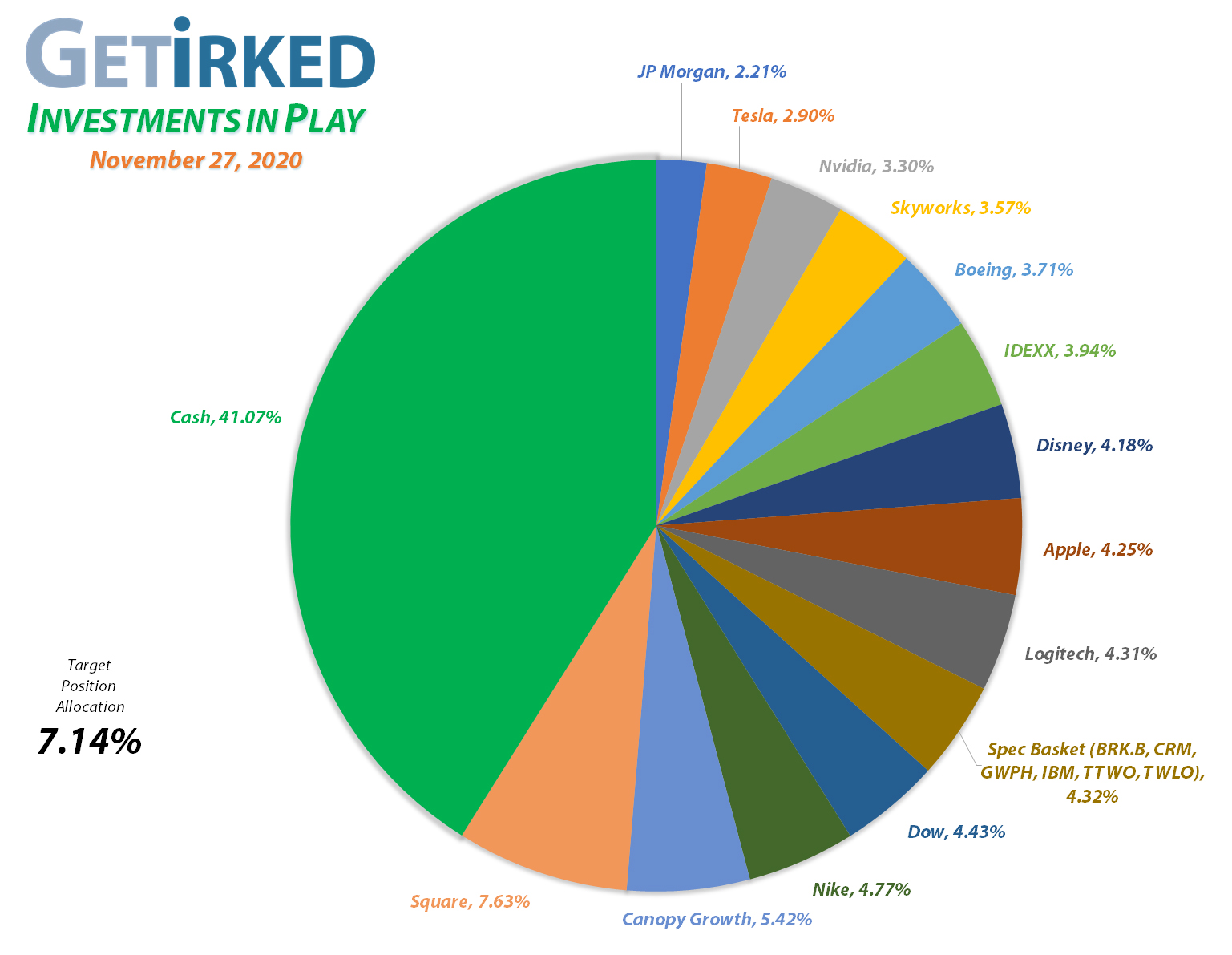

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+945.20%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Disney (DIS)

+819.69%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Logitech (LOGI)

+731.55%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Boeing (BA)

+680.29%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+664.50%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.30)*

Tesla (TSLA)

+522.05%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$140.53)*

Nike (NKE)

+505.15%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

Nvidia (NVDA)

+504.42%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

IDEXX Labs (IDXX)

+405.61%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Salesforce (CRM)

+209.87%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Twilio (TWLO)

+177.82%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Take Two (TTWO)

+145.10%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Canopy (CGC)

+102.57%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.40

IBM (IBM)

+73.64%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+62.81%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Skyworks (SWKS)

+62.65%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Dow (DOW)

+51.78%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $36.50

JP Morgan (JPM)

+40.27%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.42

GW Pharm (GWPH)

+34.07%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $96.75

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Starting Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corp (CGC): Profit-Taking

Canopy Growth Corporation (CGC) rallied with the rest of the speculative consumer plays this week, triggering a sell order I had in place which filled on Tuesday at $27.17.

The order locked in +190.90% in gains on a few of the shares I bought back on March 18 for $9.34. My next sell target for the stock is around $34.00 and my next buy target is around $14.20.

Given that this is a long-term position eyeing CGC’s all-time high near $60.00 in the coming years, my profit-taking is limited to selling very small quantities, so Tuesday’s sale reduced my per-share cost only -1.17% from $14.57 to $14.40.

CGC closed the week at $29.17, up +7.36% from where I sold Tuesday.

GW Pharmaceuticals (GWPH): Profit-Taking

Despite not having anything to do with consumer cannabis, GW Pharmaceuticals (GWPH) continues to trade with the sector, good or bad. Fortunately, this week saw consumer cannabis popping so I decided to reduce my GWPH position since it’s now part of the Speculative Basket.

On Friday, I placed a sell order which filled at $129.90. The order locked in profits of +29.90% over my then per-stock average price of $100.00. It also lowered my per-share cost -3.25% from $100.00 to $96.75.

My next sell target for the stock is near its 2020 high of $142.00 and my next buy target for the stock is near its recent low at $87.90.

GWPH closed the week at $129.71, down -0.15% from where I sold.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.