November 13, 2020

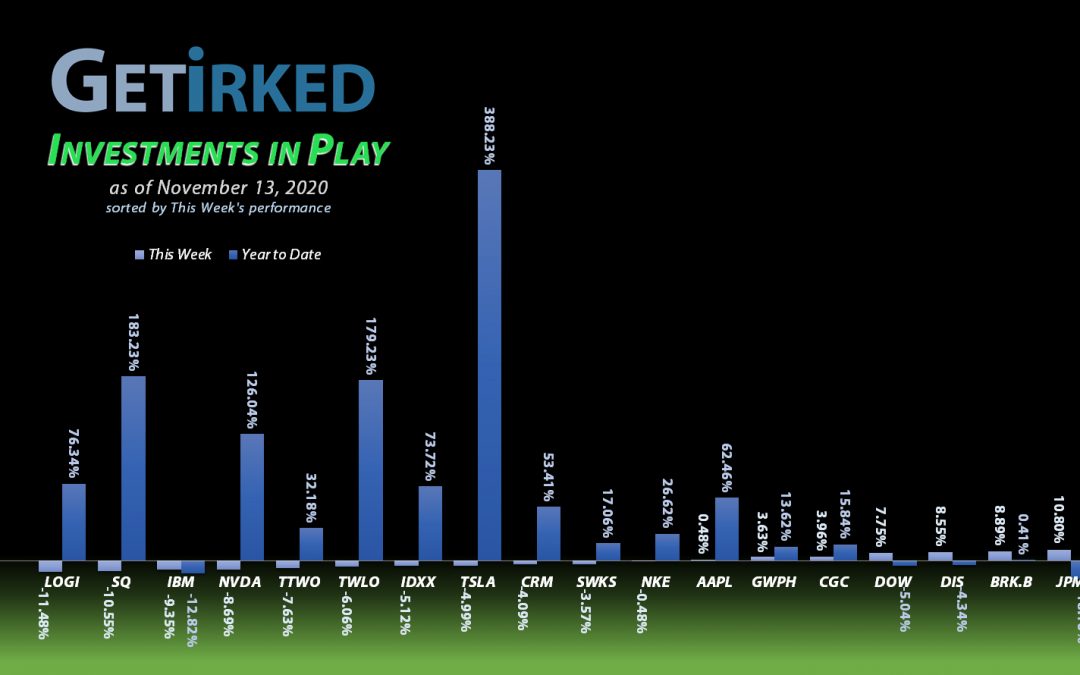

The Week’s Biggest Winner & Loser

Boeing (BA)

When no one wants to fly because of a pandemic, what could possibly flip that around? A vaccine!

Boeing (BA) rocketed +18.62% to lock in the Biggest Winner spot following Pfizer (PFE) announcing its vaccine has a 90%+ effectiveness rate on Monday.

Logitech (LOGI)

Investors bailed on all of the stay-at-home plays, positively destroying gaming and e-sports favorite, Logitech (LOGI), for a -11.48% weekly loss which earned this portfolio darling a spot as the Biggest Loser.

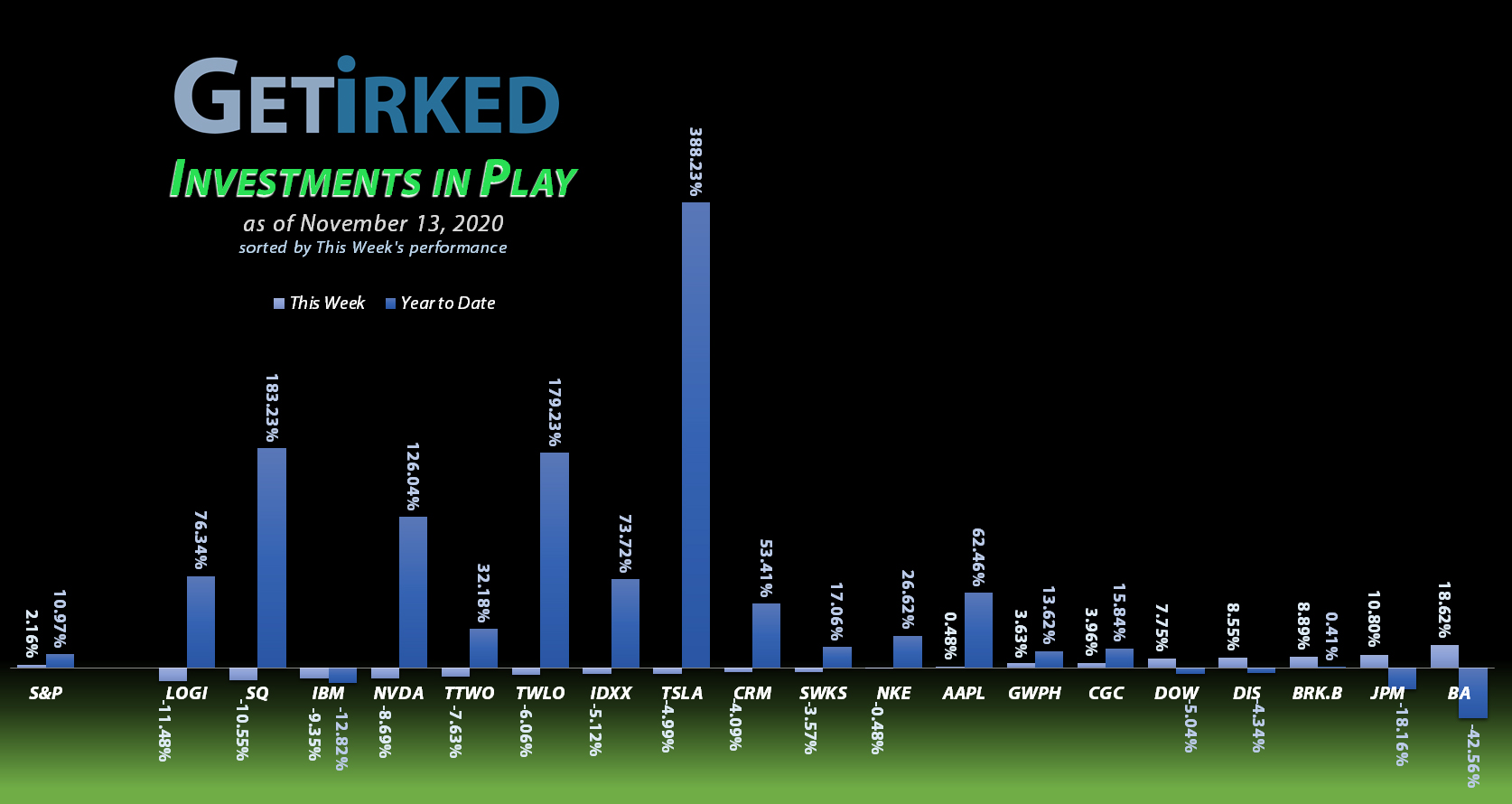

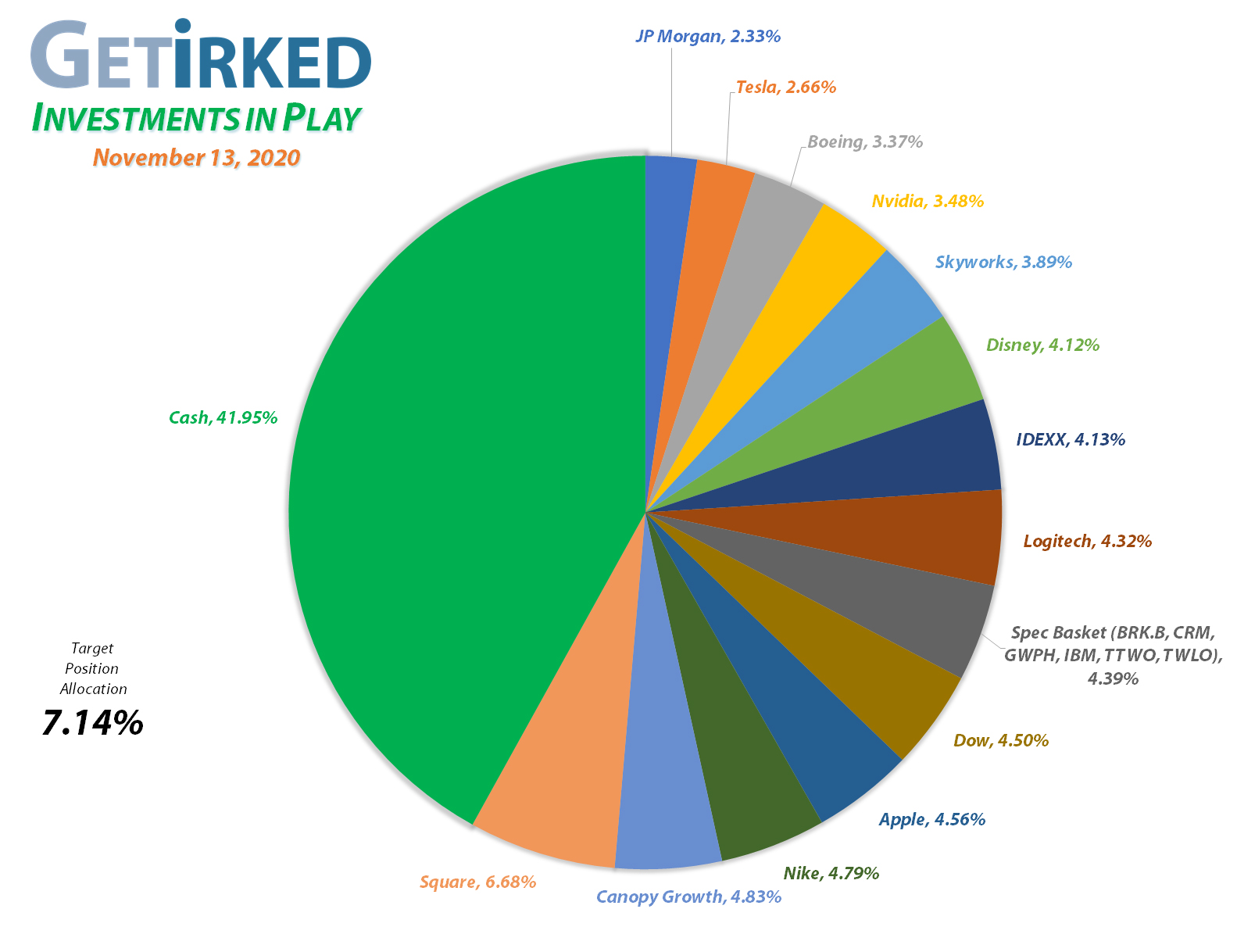

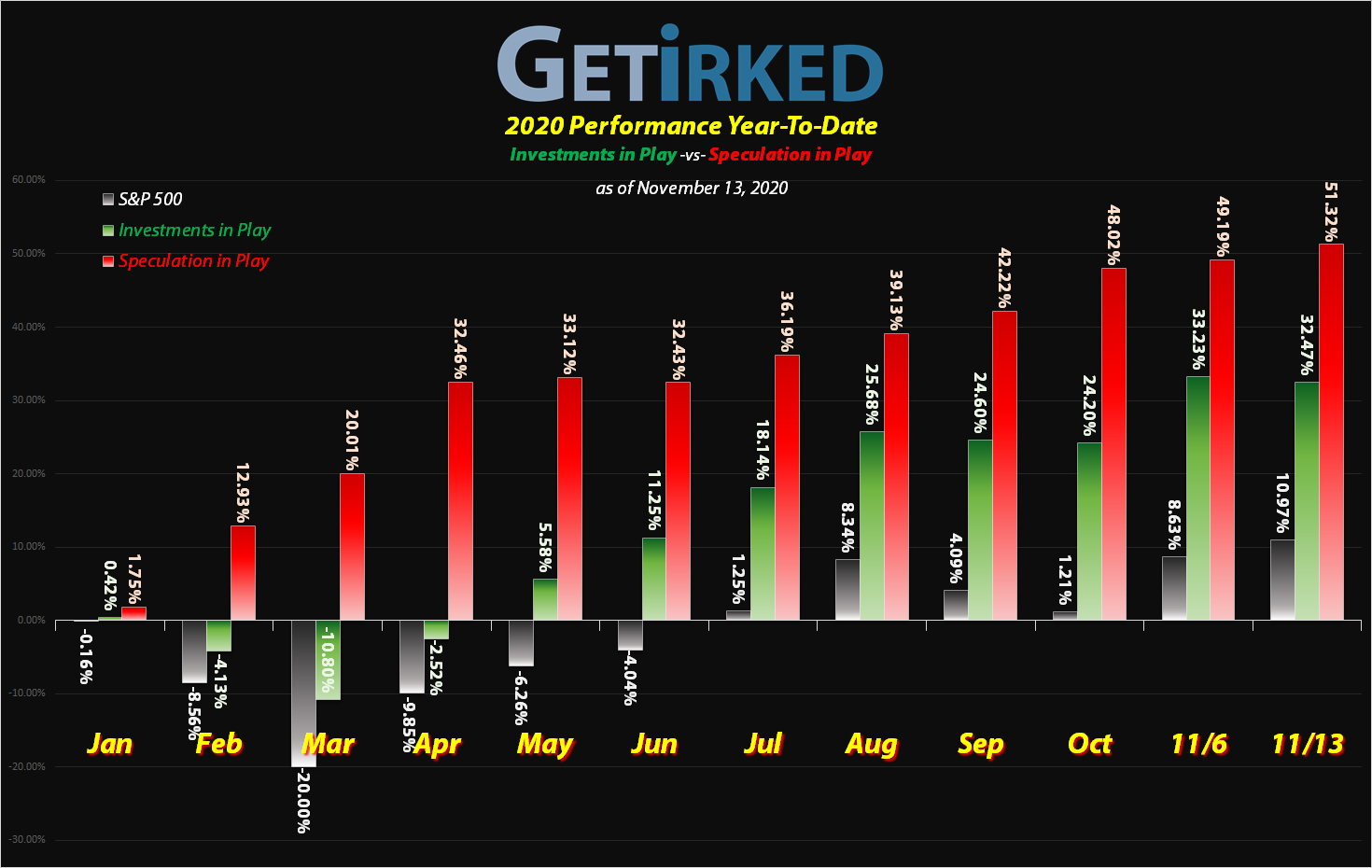

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Apple (AAPL)

+774.15%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Disney (DIS)

+770.83%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Logitech (LOGI)

+700.48%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Square (SQ)

+684.20%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Nvidia (NVDA)

+605.55%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Boeing (BA)

+454.58%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Nike (NKE)

+419.34%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

Tesla (TSLA)

+326.61%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

IDEXX Labs (IDXX)

+244.23%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Salesforce (CRM)

+212.23%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Take Two (TTWO)

+142.85%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Twilio (TWLO)

+138.59%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Skyworks (SWKS)

+69.02%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Canopy (CGC)

+67.70%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.57

IBM (IBM)

+63.16%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+59.91%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+40.14%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $37.08

JP Morgan (JPM)

+29.20%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $88.30

GW Pharm (GWPH)

+18.72%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Profit-Taking

It was time to take some profits in Dow Chemical (DOW) on Monday when it skyrocketed along with the rest of the market thanks to COVID vaccine news and election of President-Elect Joe Biden. I used trailing stop orders to take profits on some shares which filled with an average selling price of $53.27.

The sales locked in +57.51% in gains on some of the shares I bought back on March 9-10 for an average price of $33.82. The sale lowered my per-share cost by -2.96% from $38.21 to $37.08. My next sell target for the stock is $56.15 and my next buy target is $32.95.

DOW closed the week at $51.97, down -2.44% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.