November 6, 2020

The Week’s Biggest Winner & Loser

Square (SQ)

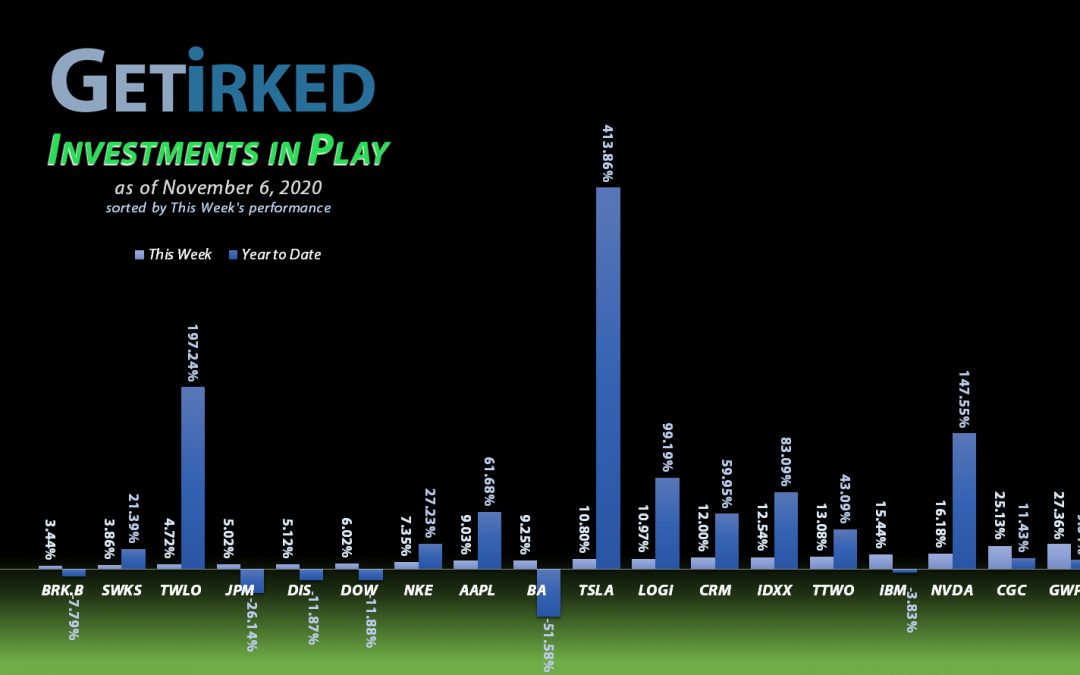

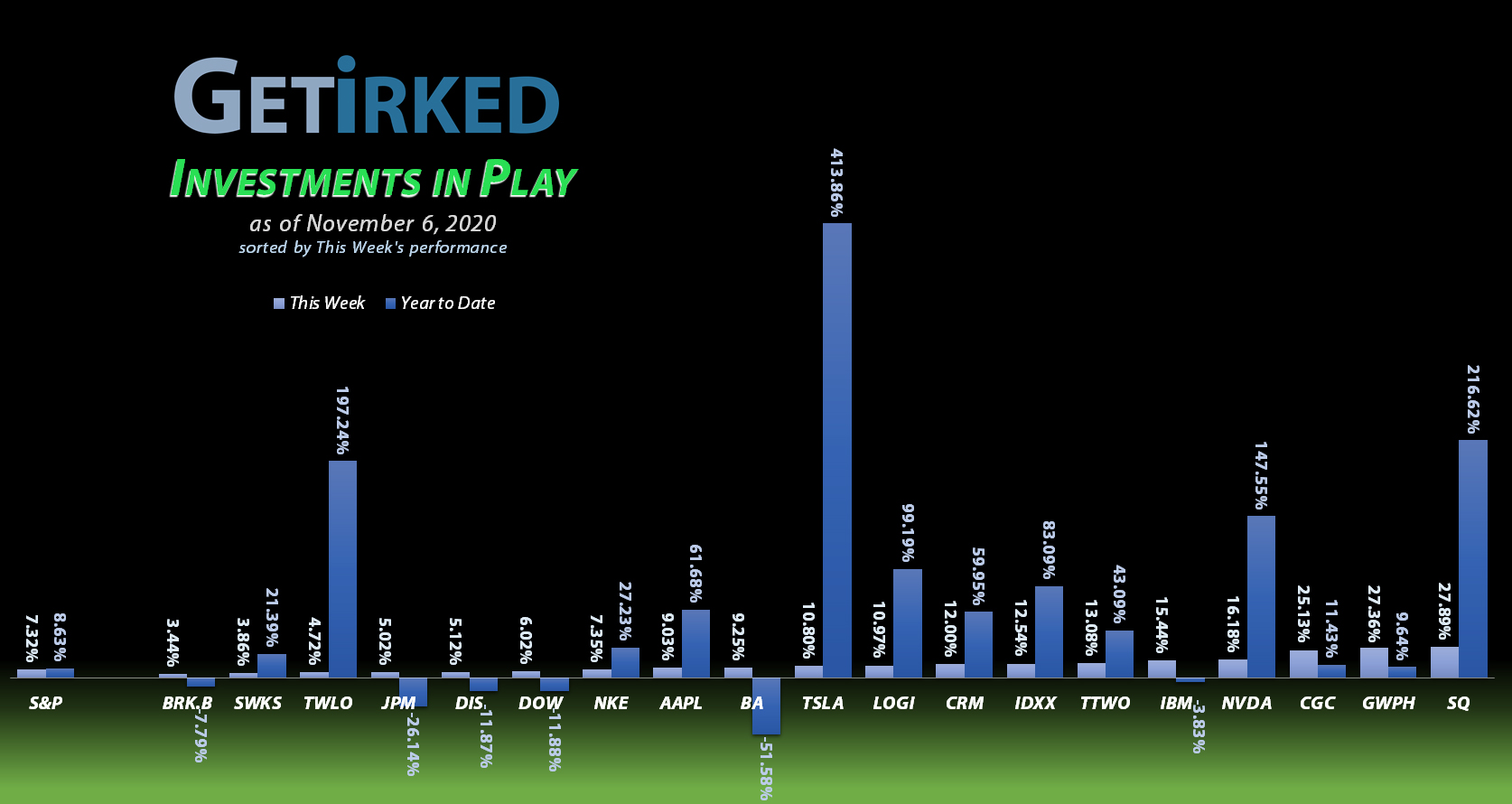

Square (SQ) does it again, reporting an absolutely blow-out earnings report with excellent forward guidance, jumping +27.89% and earning the spot of the week’s Biggest Winner.

Berkshire-Hathaway (BRK.B)

The opposite of last week, this week’s “Biggest Loser” is simply the stock that gained the least, and that “honor” goes to stodgy old Berkshire-Hathaway (BRK.B), once again underperforming the S&P 500 by gaining only +3.44%.

Portfolio Allocation

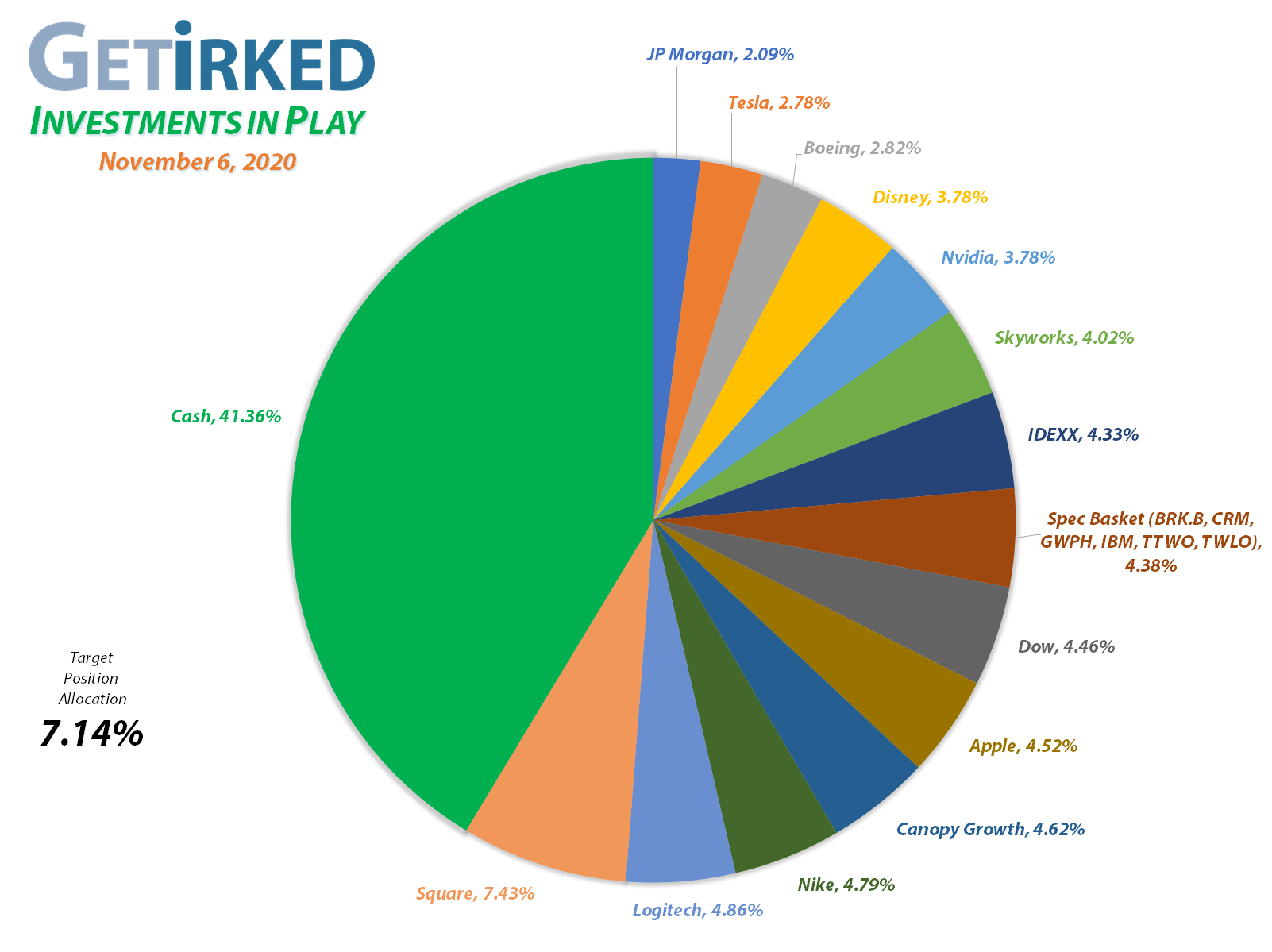

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+903.45%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Logitech (LOGI)

+788.85%*

1st Buy 11/11/2016 @ $24.20

Current Per-Share: (-$2.29)*

Disney (DIS)

+710.10%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+672.03%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Boeing (BA)

+612.40%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Nvidia (NVDA)

+545.86%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+489.23%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

IDEXX Labs (IDXX)

+425.49%*

1st Buy 7/26/2017 @ $167.29

Current Per-Share: (-$32.76)*

Twilio (TWLO)

+263.54%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Tesla (TSLA)

+238.17%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

Salesforce (CRM)

+225.54%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Take Two (TTWO)

+144.91%*

1st Buy 10/9/2018 @ $128.40

Current Per-Share: -($114.95)*

Skyworks (SWKS)

+75.28%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Canopy (CGC)

+61.31%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.57

IBM (IBM)

+59.24%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+46.85%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+26.21%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $38.21

JP Morgan (JPM)

+16.61%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $88.30

GW Pharm (GWPH)

+14.57%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Canopy Growth Corporation (CGC): Profit-Taking

When consumer cannabis play Consumer Growth Corporation (CGC) popped during the week, I decided it was time to trim a little more of the position, locking in profits with a sale that filled on Thursday at $20.89.

Thursday’s sale locked in +123.66% in gains on a few shares I bought back on March 18 for $9.34 and lowered my per-share cost a minor -0.55% from $14.65 to $14.57. My next sell target is just over $30.00. My buy target is $13.05.

CGC closed the week at $23.50, up +12.49% from where I sold Thursday.

IDEXX Labs (IDXX): Profit-Taking & Capital Removed

Despite an election with no known results, IDEXX Labs (IDXX) rocketed to a new all-time high of $482.50 on absolutely no news on Wednesday, so I used trailing-stop sell orders to remove the remainder of my investment capital out of the stock with an average selling price of $465.61.

The sales locked in +82.06% in gains on shares I bought for $255.74 back on December 16, 2019. The sale also eliminated my per-share cost, bringing it down to -$32.76 (each of the shares I hold in the position cost nothing and add $32.76 in profits to the portfolio).

From here, I have no additional sell targets for the moment and my next buy target is near a past point of support at $365.90.

IDXX closed the week at $478.10, up +2.61% from my average selling price.

JP Morgan Chase (JPM): Dividend Reinvestment

JP Morgan Chase (JPM) paid out its quarterly dividend of $0.90 per share ($3.60 annually) on Tuesday, yielding 3.46% at its $104.08 close. Whenever possible, I have dividends reinvested as shares of stock rather than accepting the cash, so Tuesday’s payout lowered my per-share cost by -0.85% from $89.06 to $88.30.

My next buy target for JPM is near its last pullback at $92.25 with my next sell target near the stock’s all time high around $141.00.

Logitech (LOGI): Profit-Taking & Capital Removed

When the markets rocketed throughout election week, I decided not to push my luck with Logitech (LOGI), the Best-in-Breed play on e-sports, video gaming, the stay-at-home economy, and so much more. However, this is a stock that’s up nearly triple from its March low of $31.37!

So, on Thursday, I sold enough shares to remove my original investment capital when the stock started to make another try for $100, filling my order at $93.74.

The sale locked in more than a double (+260.32%) on shares I bought for $36.01 back on October 23, 2018 and took my per-share cost to -$2.29 (each of the shares I hold in the position cost nothing and add $2.29 in profits to the portfolio).

Obviously, I still believe in the long-term prospects of this outstanding company as it remains one of my largest positions, so I’ll let the rest run until the position outgrows the portfolio target allocation. My next buy target is $68.60 and my next sell target is around $145.00.

LOGI closed the week at $93.94, up +0.21% from where I sold Thursday.

Take Two Interactive (TTWO): Profit-Taking

Take Two Interactive (TTWO) made another try for its all-time high on Friday, triggering a sell order I had in place which filled at $177.39.

The order took +36.31% in profits on shares I bought on June 3 for $130.14 and took all investment capital I had in the position out, reducing my per-share cost to $114.95 (each of the shares I hold in the position cost nothing and add $114.95 in profits to the portfolio).

I have no additional sell targets for the position and my next buy target $154.90, above a key point of support from TTWO’s low during the last selloff.

TTWO closed the week at $175.19, down -1.24% from where I sold Friday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.