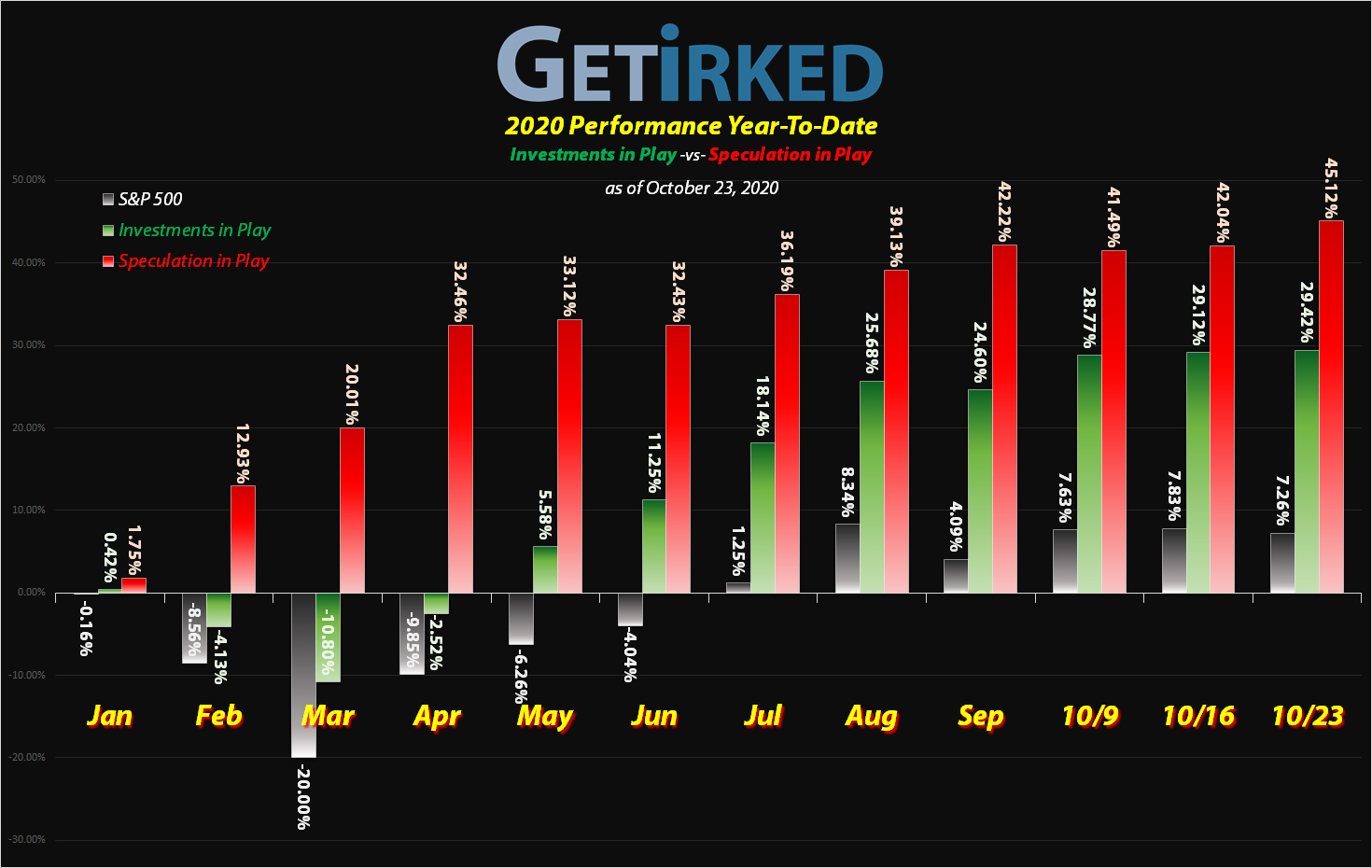

October 23, 2020

The Week’s Biggest Winner & Loser

Canopy Growth (CGC)

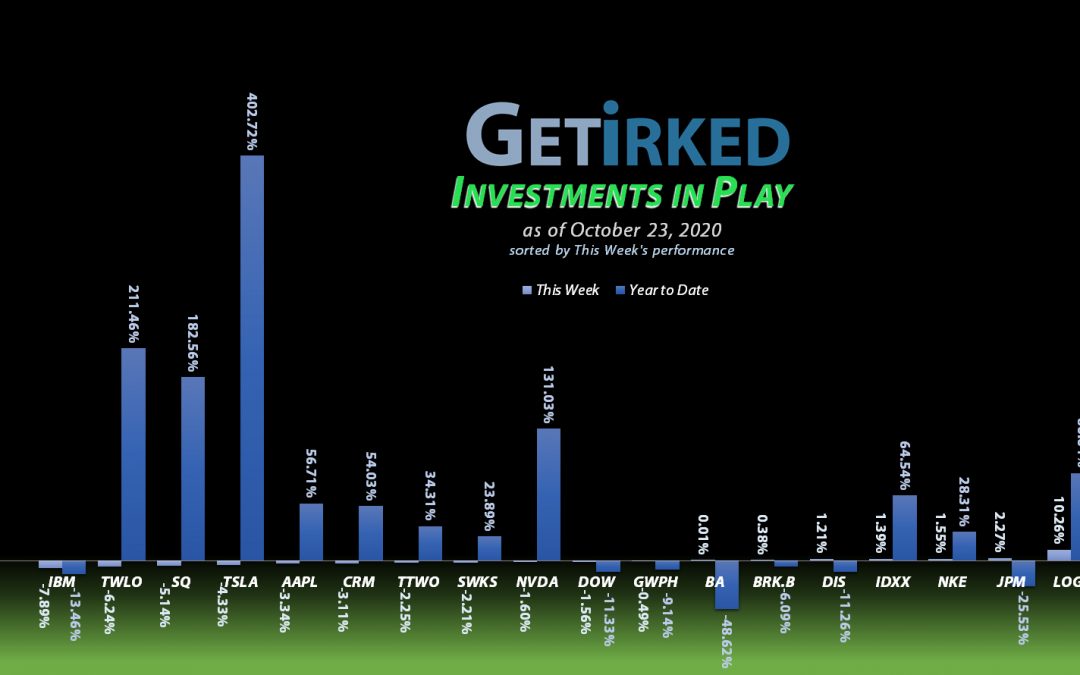

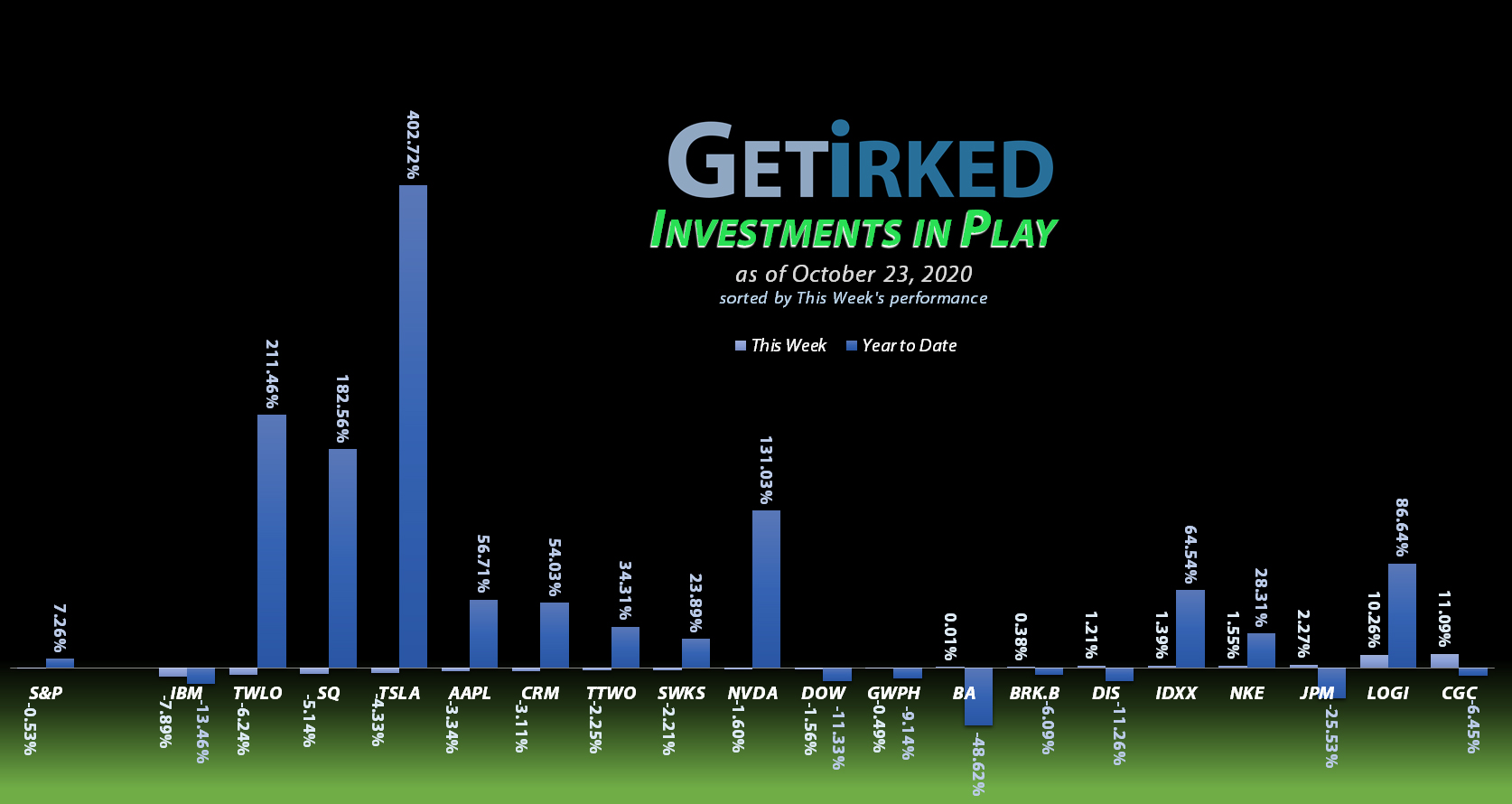

As Biden gains in the polls, the marijuana stocks continued getting higher with Canopy Growth (CGC) locking in a +11.09% spot to become this week’s Biggest Winner.

IBM (IBM)

Not even a promise of a subsidiary spinoff next year could save IBM (IBM) from its abysmal earnings report. How does a growth tech company miss on earnings? Answer – it doesn’t. IBM sold off -7.89% and earned a spot as the Biggest Loser this week.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+841.84%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Disney (DIS)

+715.06%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+658.49%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Boeing (BA)

+623.51%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Take Two (TTWO)

+526.68%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nvidia (NVDA)

+514.90%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+492.47%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$35.55)*

IDEXX Labs (IDXX)

+450.92%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Twilio (TWLO)

+270.95%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Tesla (TSLA)

+233.15%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

Salesforce (CRM)

+213.49%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Logitech (LOGI)

+268.28%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $23.90

Skyworks (SWKS)

+78.89%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

IBM (IBM)

+61.98%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+49.56%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+34.68%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

Dow (DOW)

+26.99%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $38.21

JP Morgan (JPM)

+16.56%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.06

GW Pharm (GWPH)

-5.06%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

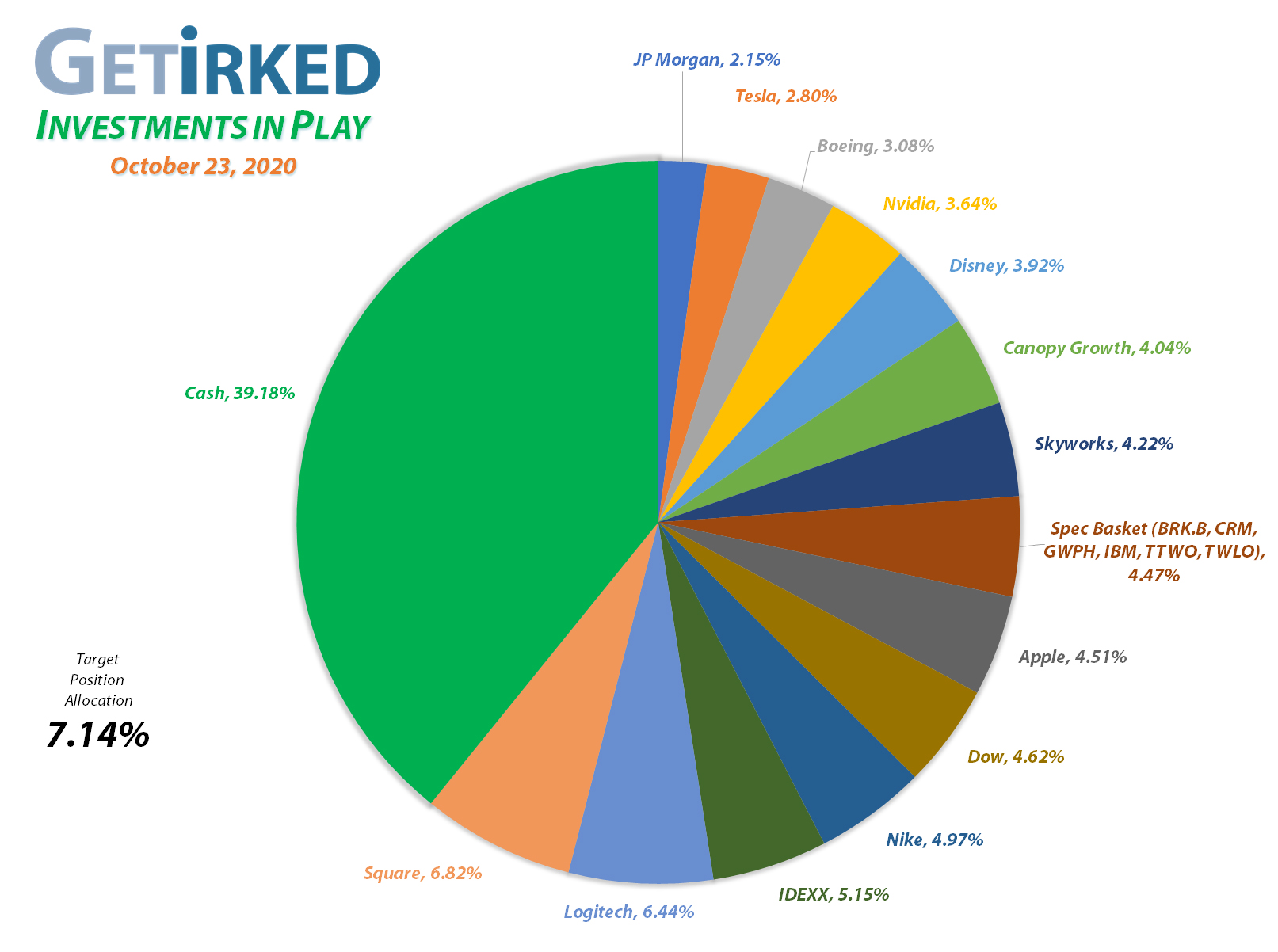

Long-Term Speculative Basket: Ch… ch… changes!

The consumer cannabis sector has seen a true bull rally as the potential for a “Blue Sweep” of Democrats into the Senate and potentially the White House becomes more realistic.

As a result, I revisited my allocation strategy of having Canopy Growth Corporation (CGC) and GW Pharmaceuticals (GWPH) as a dedicated Pot Basket. I’ve long-held that GWPH doesn’t belong in the consumer cannabis space as the company produces prescription drugs, and after watching it completely ignore the positive cannabis news, I’ve decided not to treat it that way in my portfolio, either.

Instead, I am letting Canopy Growth have an entire allocation on its own while rolling GW Pharma into the Speculative Basket, now a six-member boy band with fellow performance artists Berkshire-Hathaway (BRK.B), IBM (IBM), Salesforce (CRM), Take Two Interactive (TTWO) and Twilio (TWLO). One allocation is now split among the six stocks to limit any speculative risk stemming from their potential volatility going forward.

By giving Canopy Growth its own allocation, I’m leaving the portfolio open to capitalizing on the potential introduction of cannabis on a national level in the United States as the Federal Government considers legalizing the sale of consumer cannabis to offset the extreme budget shortfalls states will see as a result of the pandemic.

This Week’s Moves

Logitech (LOGI): Profit-Taking

Logitech (LOGI) screamed nearly 20% to a new all-time high of $95.56 after reporting an absolutely earth-shattering earnings report on Tuesday combined with an analyst upgrade from JP Morgan seeing even more growth in the future for this stay-at-home/video gaming/e-sports play. The stock flew through a sky-high sale order I had which filled at $93.90.

The sell locked in nearly a triple (+272.41%) on some of the shares I bought back on March 12 for $34.47 and lowered my per-share cost -4.97% from $25.15 down to below my initial buy in 2016 ($24.20), now $23.90.

Logitech’s epic jump on Tuesday makes it the second-largest position in the portfolio with my next sell target at $102.20, which will maintain its size near the 7.14% target allocation for the portfolio. My next buy target is $57.20, slightly below Logitech’s 200-day Simple Moving Average (SMA).

LOGI closed the week at $88.02, down -6.26% from where I sold Tuesday.

Nike (NKE): Profit-Taking

Nike (NKE) broke its all-time high on Wednesday, triggering a sell order I had in place which filled at $131.18. The sale locked in +69.26% in gains on some shares I bought for $77.50 back on March 12.

From here, my next sell target is near $194 (or dependent on where Nike consolidates next) and my next buy target is $105.35, a past point of support.

NKE closed the week at $129.99, down -0.91% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.