October 9, 2020

The Week’s Biggest Winner & Loser

Canopy Growth (CGC)

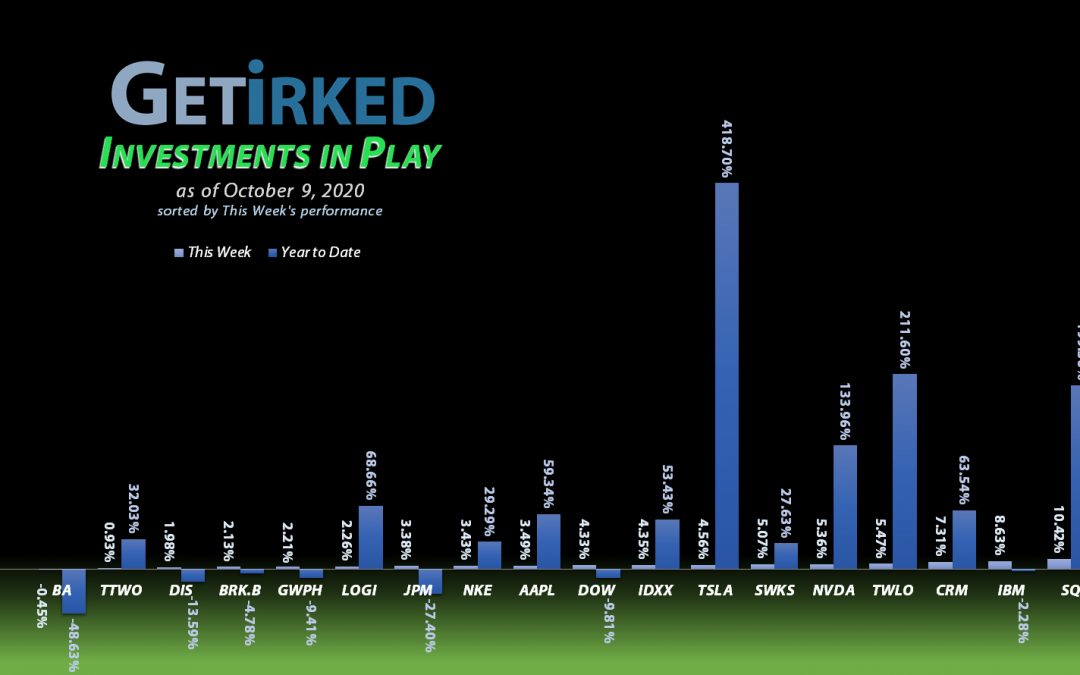

It might be the first time where something said in the Vice Presidential debates actually had real-world impact after Kamala Harris announced that ex-VP Joe Biden and herself would legalize marijuana at the Federal level. This promise lit the cannabis stocks on fire with Best-of-Breed consumer play Canopy Growth Corp (CGC) popping a whopping +28.61% this week and earning itself the Biggest Winner spot.

Boeing (BA)

How does a company drop in a week that saw almost nothing but green? Dramatically cut demand expectations for its products.

Boeing (BA) announced they forecast serious drops in demand for their airliners causing the stock to drop -0.45% as a result, down nearly -50% for the year, and earning itself Biggest Loser of the week.

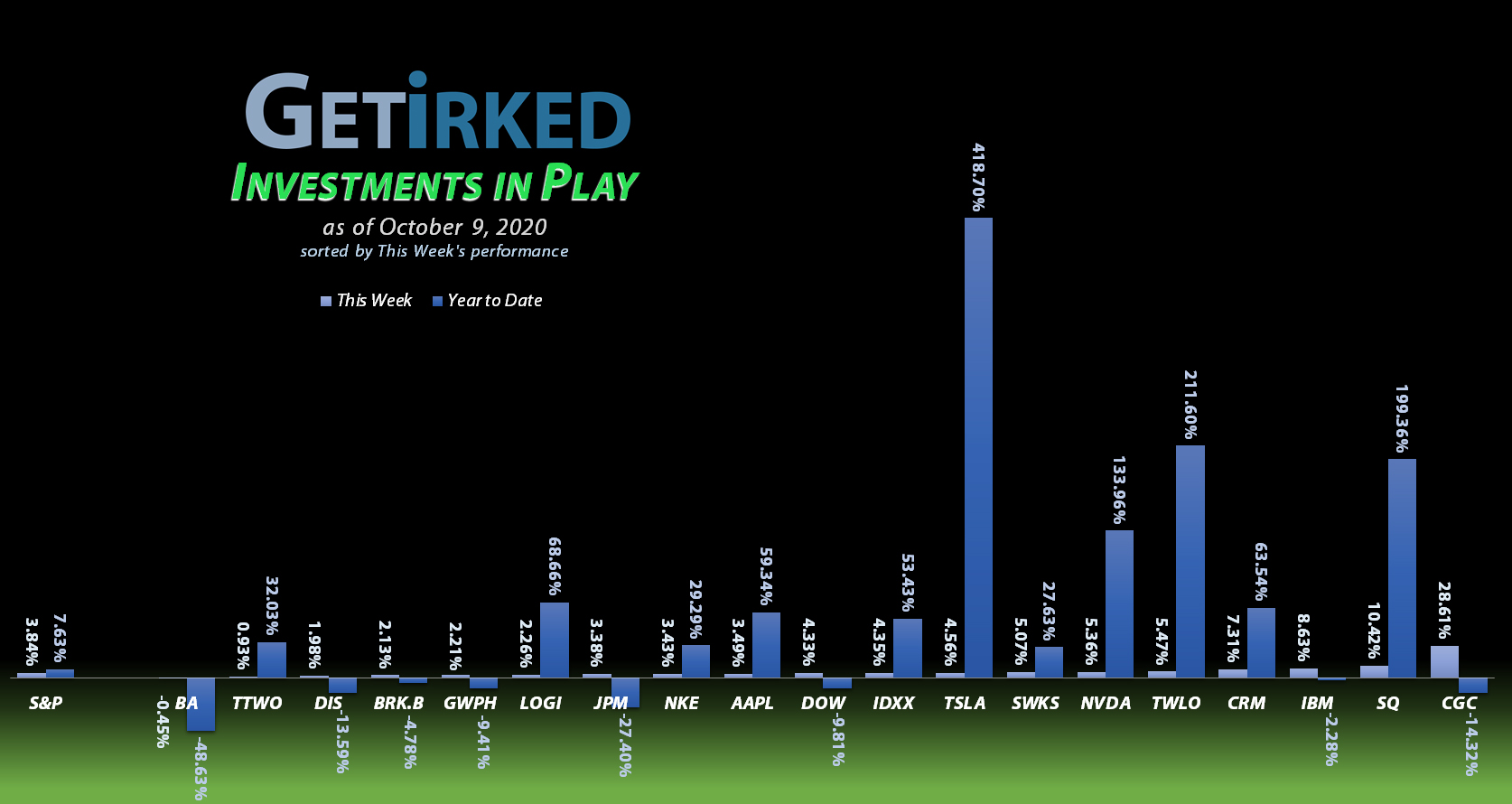

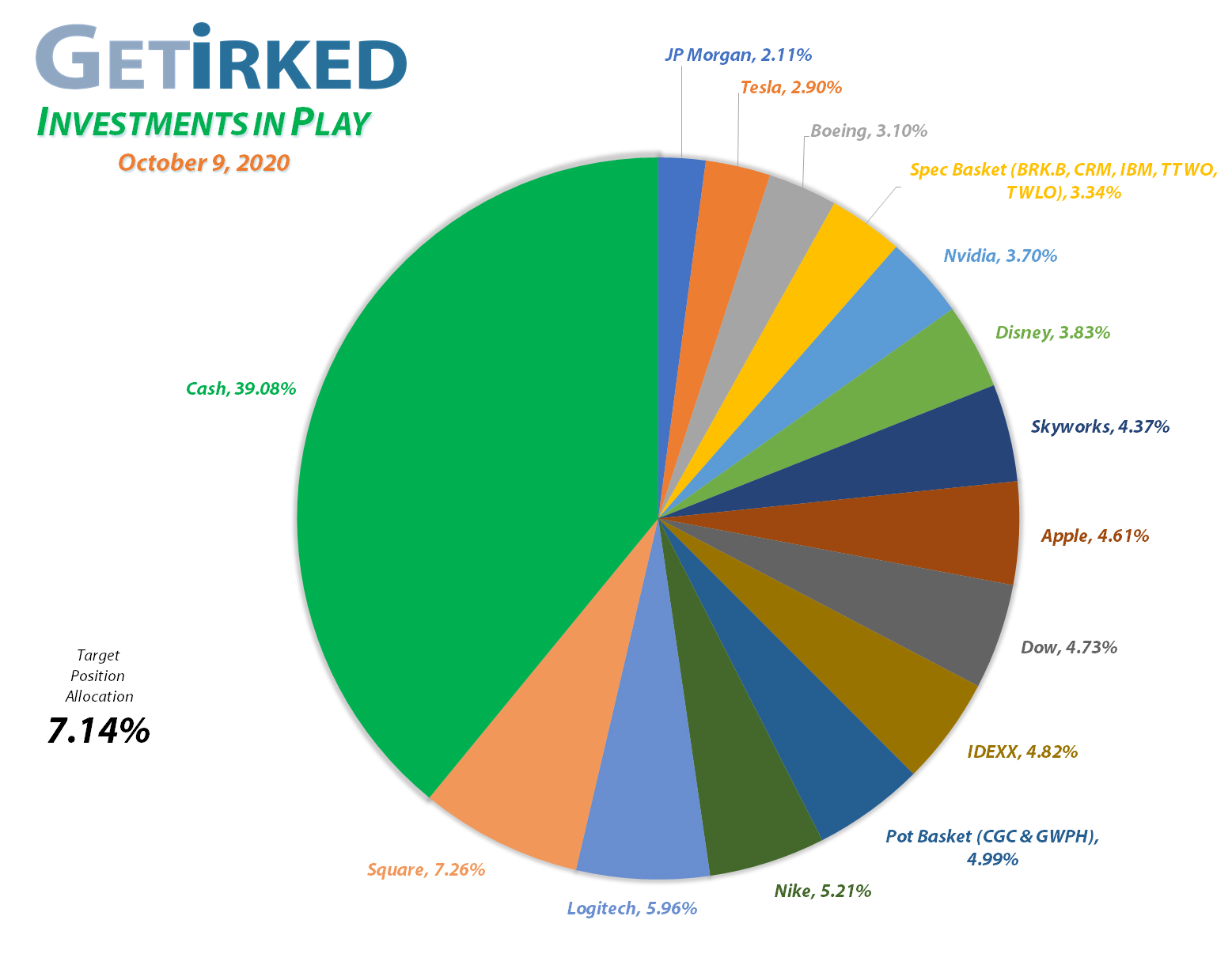

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+872.22%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$114.40)*

Disney (DIS)

+696.28%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+665.65%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Boeing (BA)

+623.48%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Nvidia (NVDA)

+520.39%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Take Two (TTWO)

+517.75%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nike (NKE)

+495.40%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$29.94)*

IDEXX Labs (IDXX)

+413.72%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Twilio (TWLO)

+271.02%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Tesla (TSLA)

+240.36%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

Salesforce (CRM)

+232.84%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Logitech (LOGI)

+216.26%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $25.15

Skyworks (SWKS)

+84.29%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

IBM (IBM)

+78.44%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+51.65%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+29.17%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $38.21

Canopy (CGC)

+23.34%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

JP Morgan (JPM)

+13.63%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.06

GW Pharm (GWPH)

-5.34%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Square (SQ): Profit-Taking

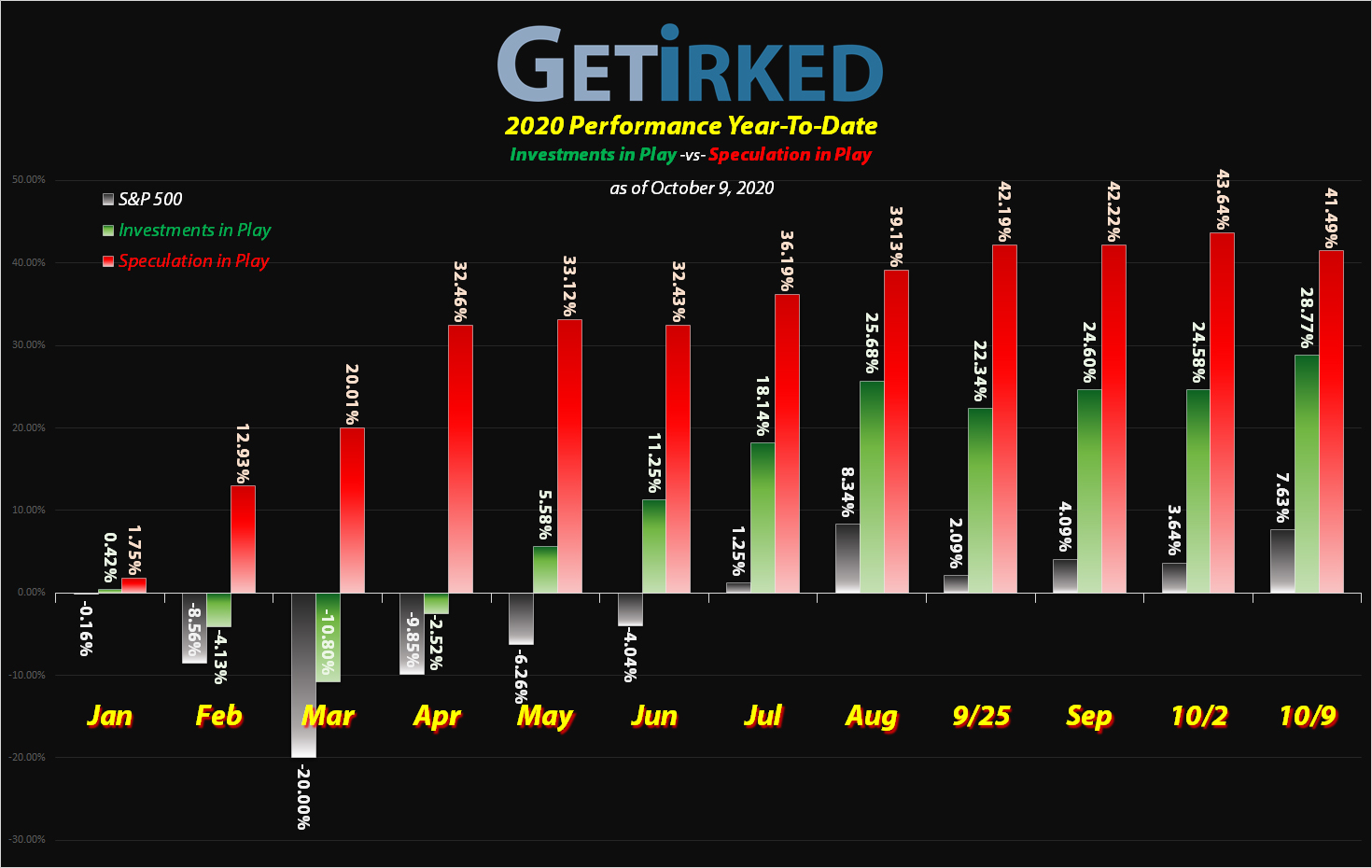

Square (SQ) took off once again this week, making new all-time highs and exceeding the target allocation for the portfolio even though I just increased it to 7.14% last week.

Thanks to the amazing success of this stock, a sale order I had in place filled on Wednesday at $182.50 locked in +1,544.14% in profits on some of the original position I bought for $11.10 way back on August 5, 2016. Square’s current performance makes it the all-time winner in my Investments in Play, valued at +15% more in profits (both taken and left in the position) over the lifetime of the portfolio than my second place lifetime profit driver, Boeing (BA). Yes, Boeing is still my second place profit driver even down nearly -50% Year-to-Date (that’s how huge BA was to the lifetime success of this portfolio).

In fact, I have taken so many profits out of Square that if it went bankrupt tomorrow, I’d still have quadrupled (4X) my original investment in this position assuming I didn’t put additional capital to work on the way down. Conversely, this is where Boeing takes the lead as I’ve taken more profits out of the position than are left in the position when compared to Square: if Boeing went bankrupt tomorrow, I’d still have quintupled (5X) my original investment!

My BA and SQ positions serve as ongoing reminders of the vital importance of Selling in Stages – take profits when you can in order to protect against the potential of incredibly negative news catalysts.

I do believe in the long-term potential of Square (SQ) which is why I still allocate a full position to it in my portfolio. However, the short-term could be challenging as small businesses (Square’s bread-and-butter customers) may go bankrupt without significant stimulus and damage Square’s revenue potential.

My next sell price for SQ is $211.69 and my next buy target is $125.70.

SQ closed the week at $187.28, up +2.62% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.