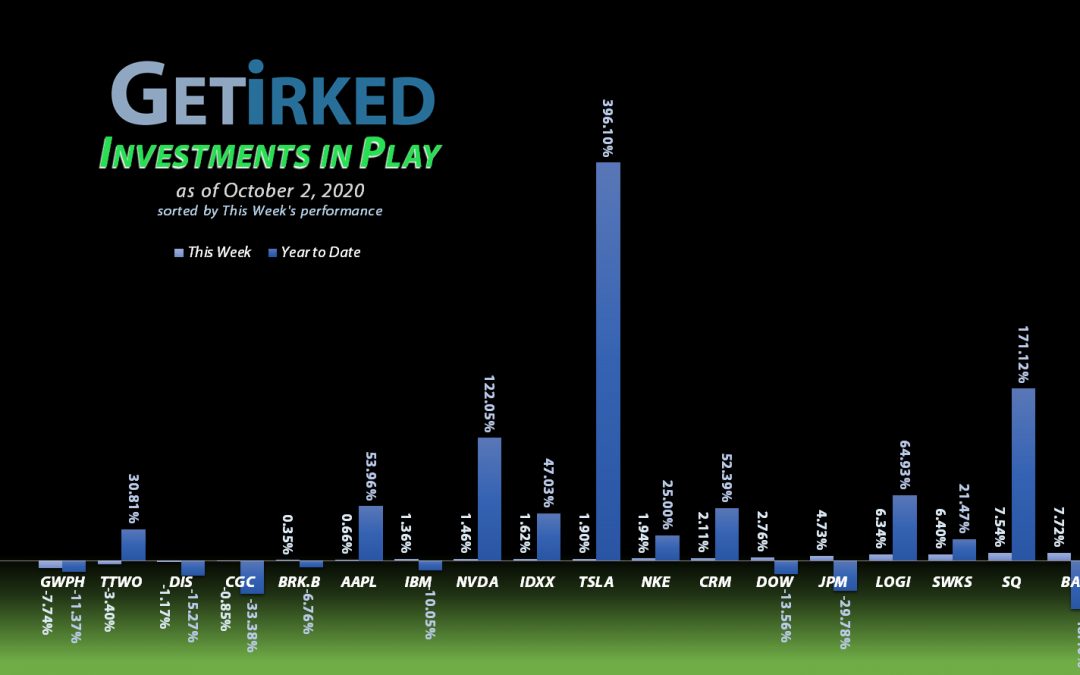

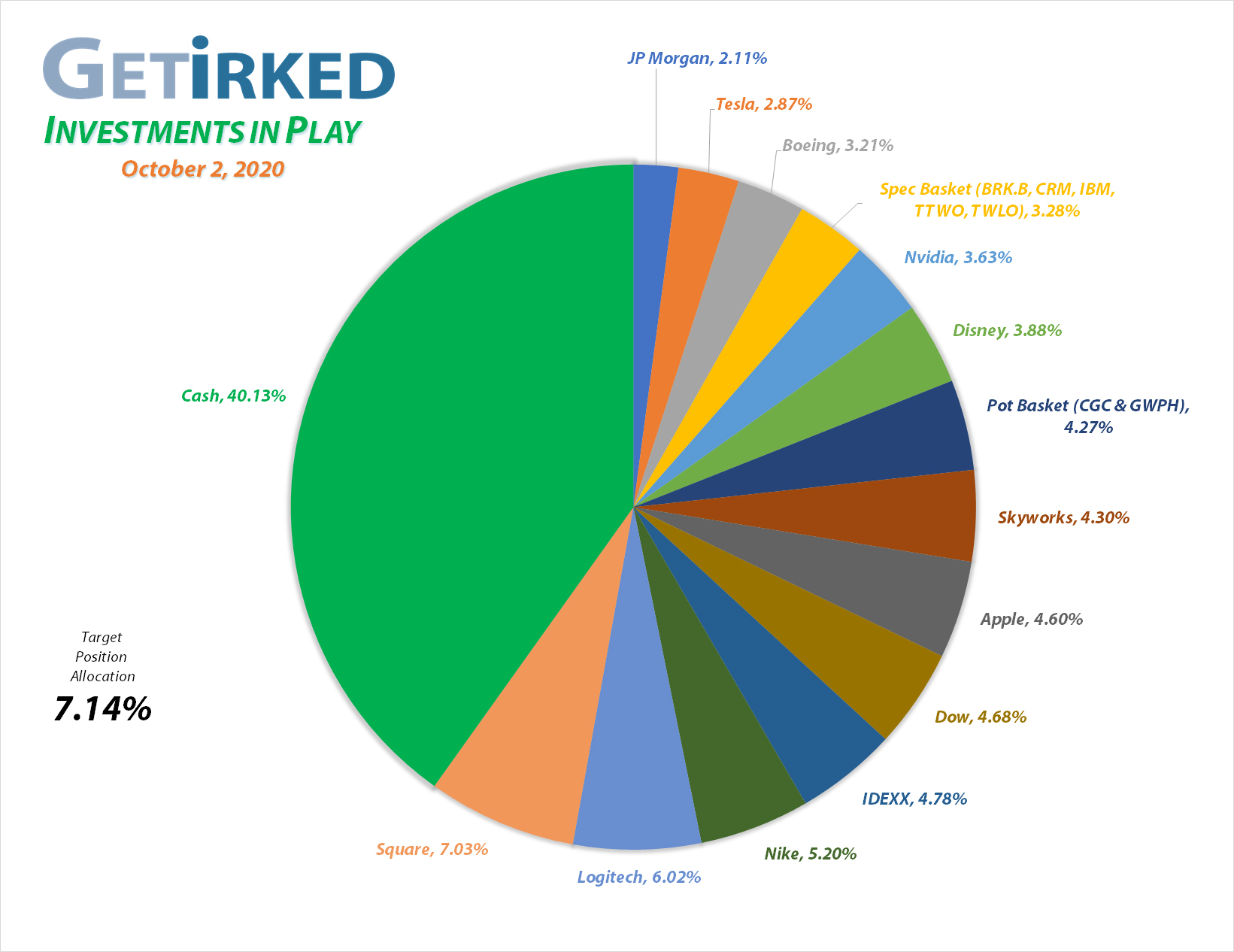

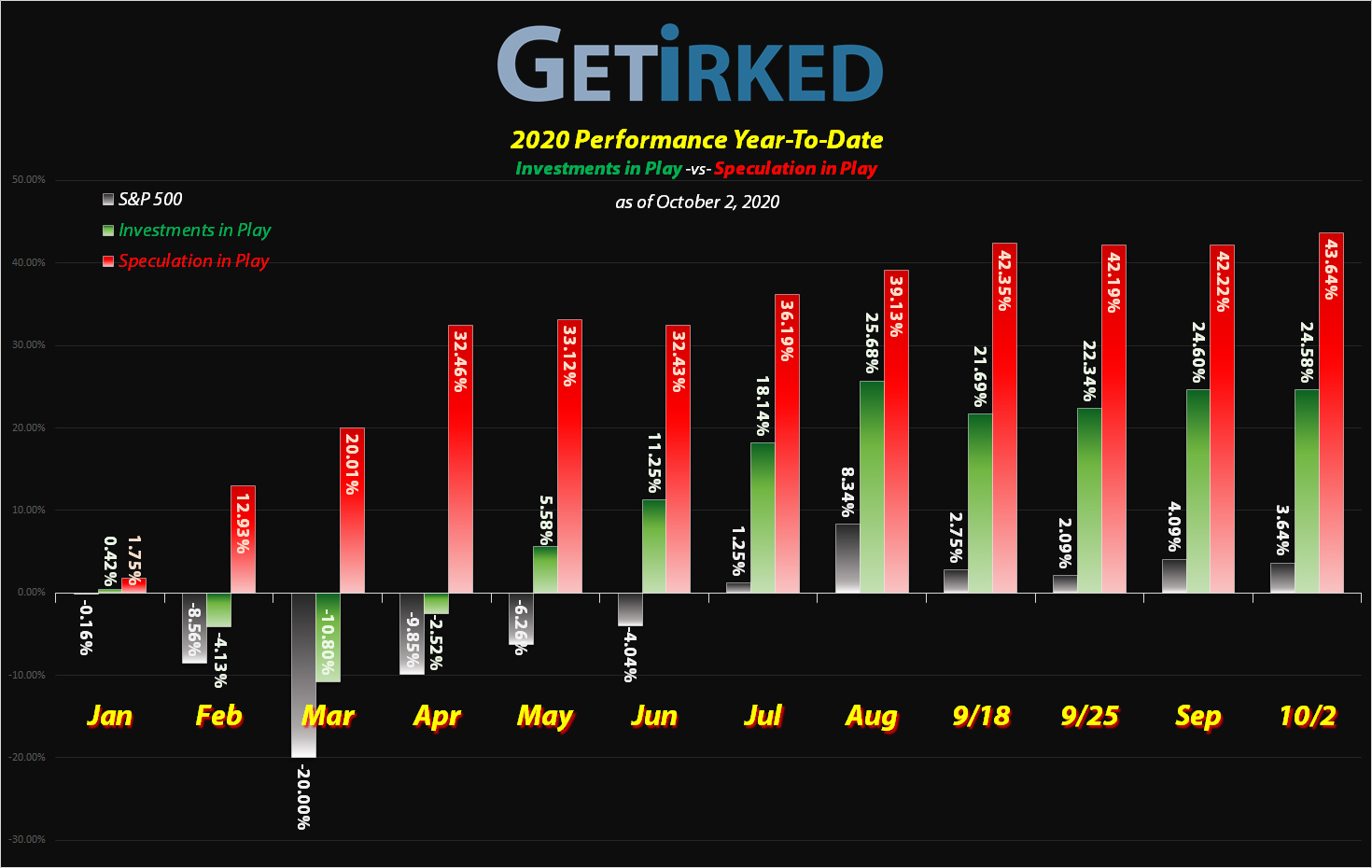

October 2, 2020

The Week’s Biggest Winner & Loser

Twilio (TWLO)

Twilio (TWLO) blew away all competitors when it announced incredibly revenue projections, leaping +18.50% in a volatile week to earn its spot as the Biggest Winner.

GW Pharma (GWPH)

Consumer cannabis continues to take it on the chin, and whenever consumer cannabis gets hit, so does the biopharma GW Pharma (GWPH), losing -7.74% this week to earn itself the Biggest Loser spot (and motivating me to create the Pot Basket – see below).

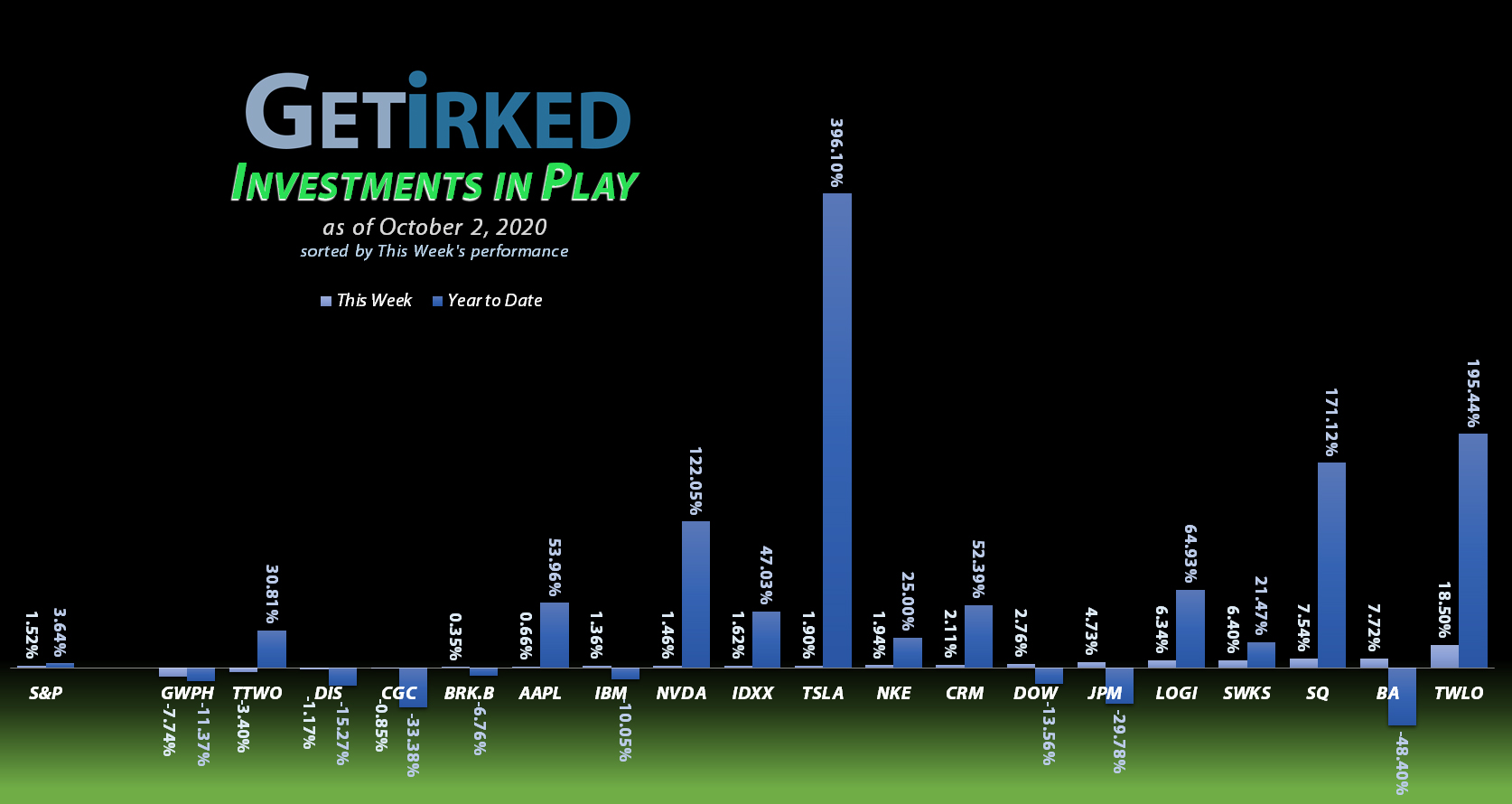

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+819.85%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$104.51)*

Disney (DIS)

+682.75%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+650.99%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Boeing (BA)

+624.34%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Take Two (TTWO)

+512.97%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nvidia (NVDA)

+498.07%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+481.25%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$30.00)*

IDEXX Labs (IDXX)

+392.18%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Twilio (TWLO)

+262.60%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Tesla (TSLA)

+230.16%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

Salesforce (CRM)

+210.15%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Logitech (LOGI)

+209.26%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $25.15

Skyworks (SWKS)

+75.39%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

IBM (IBM)

+68.36%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Berkshire (BRK.B)

+48.49%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+23.80%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $38.21

JP Morgan (JPM)

+9.91%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.06

Canopy (CGC)

-4.10%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

GW Pharm (GWPH)

-7.39%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Pot Basket: Canopy Growth (CGC) & GW Pharma (GWPH)

Given the current weakness in the consumer cannabis space combined with the volatility in the biopharma space, I’ve decided to reduce risk in my Investments in Play portfolio by combining my two cannabis positions – Canopy Growth Corporation (CGC) and GW Pharmaceuticals (GWPH) – into a single position.

The result increases the overall target allocation for every position from 6.67% to 7.14% and also reduces my overall potential exposure to the cannabis and biopharma sectors should either (or both) implode.

From here on, the Portfolio Basket will show CGC and GWPH as a single “Pot Basket” position rather than as the individual names.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) made new all-time highs on Wednesday, triggering a sell order I had in place at $78.25. The sale locked in +127.01% in gains on shares I bought for $34.47 back on March 12.

The sale also served to lower my per-share cost -5.63% from $26.65 to $25.15. While I normally wouldn’t take profits on a position until it exceeds my portfolio’s allocation target (currently 6.67%), Logitech is up nearly +63% year-to-date and my discipline dictates I take advantage of those gains.

My next sell target is $93.90 and my next buy target is $51.25 near a past point of support.

LOGI closed the week at $77.78, down -0.6% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.