September 18, 2020

The Week’s Biggest Winner & Loser

Tesla (TSLA)

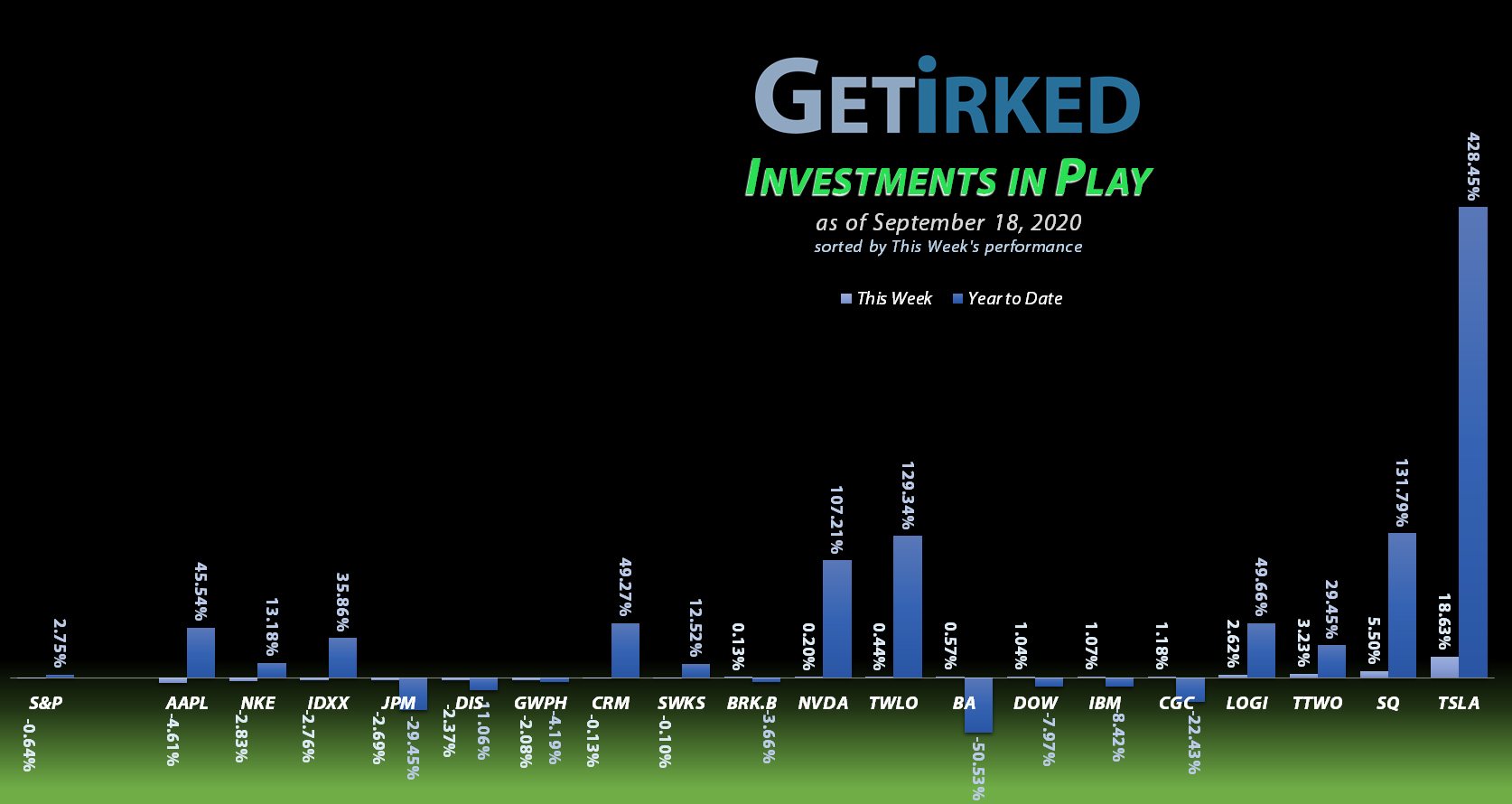

Tesla’s (TSLA) volatility never ceases to be positively electrifying, rocketing +18.63% this week (on no real news, as usual) to earn itself the spot of the week’s Biggest Winner.

Apple (AAPL)

Even though all the analysts told us that we wouldn’t be hearing about the iPhone 12 at Monday’s event, investors still were disappointed, selling the stock to the tune of -4.61% which earned the Biggest Loser spot for the week.

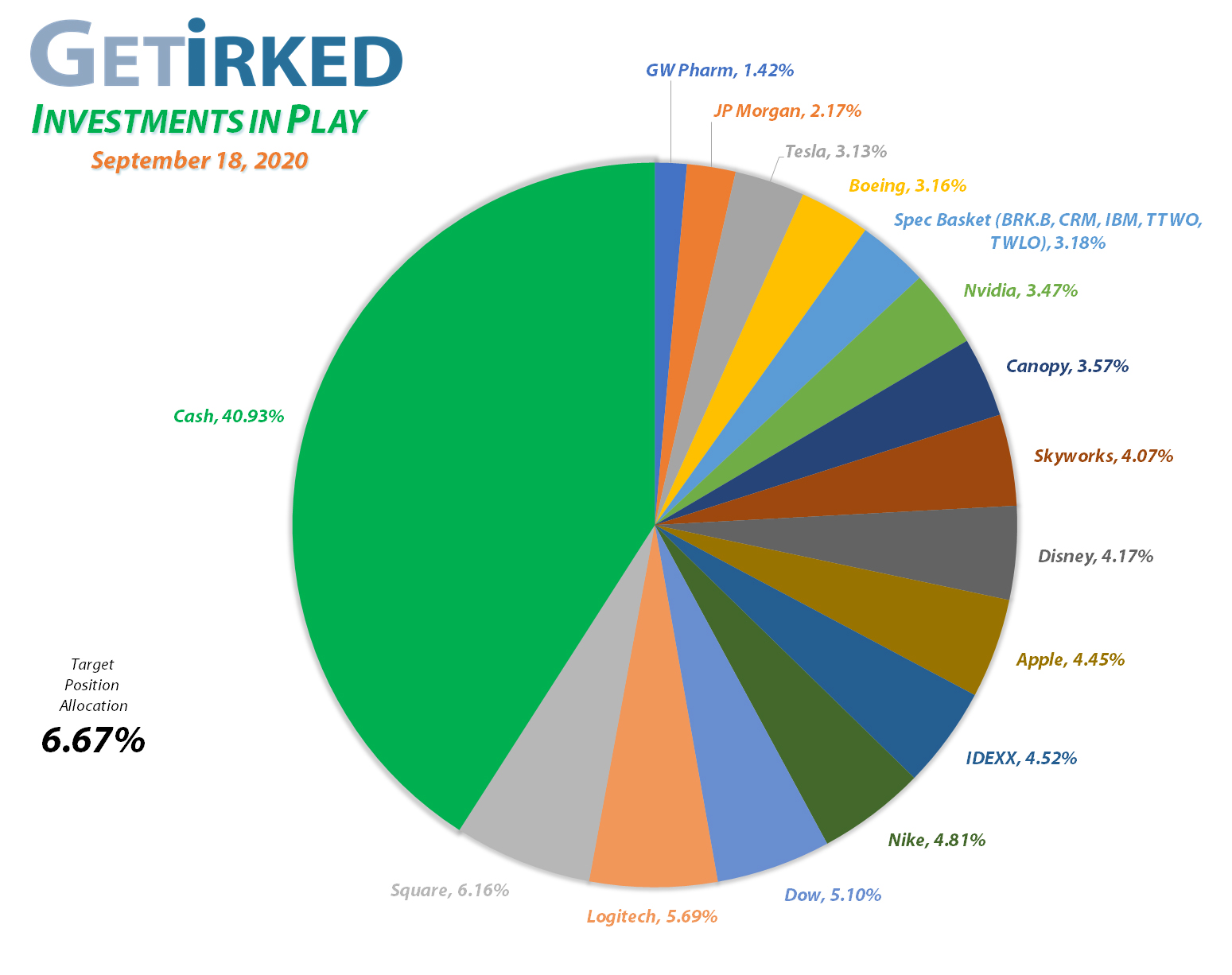

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Square (SQ)

+746.27%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$104.51)*

Disney (DIS)

+716.62%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+628.06%*

1st Buy 4/18/2013 @ $14.17

Current Per-Share: (-$62.40)*

Boeing (BA)

+616.33%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Take Two (TTWO)

+507.66%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nvidia (NVDA)

+470.14%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+444.44%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$30.00)*

IDEXX Labs (IDXX)

+354.88%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Tesla (TSLA)

+244.75%*

1st Buy 3/12/2020 @ $111.30

Current Per-Share: (-$11.86)*

Twilio (TWLO)

+228.15%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Salesforce (CRM)

+203.80%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Logitech (LOGI)

+164.87%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $26.65

IBM (IBM)

+71.42%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $71.62

Skyworks (SWKS)

+62.47%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Berkshire (BRK.B)

+53.43%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Dow (DOW)

+31.81%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $38.21

Canopy (CGC)

+11.67%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

JP Morgan (JPM)

+10.43%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.06

GW Pharm (GWPH)

+0.11%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Dividend-Reinvestment

Dow Chemical (DOW) paid out its quarterly dividend of $0.70 per share on Friday, September 11, 2020, an annual yield of 5.62% as of Friday’s $49.85 closing price, beating the pants off the nonexistent yields of money market funds.

The payout lowered my position’s per-share cost -1.52% from $38.80 to $38.21.

As always, whenever I have an eligible position, I elect to enroll it in a Dividend Reinvestment Program (DRiP) to have dividends paid out in shares of stock rather than cash so I can “set-it-and-forget-it,” having my portfolio automatically reinvest for long-term compounded gains instead of having cash sitting in an account potentially accruing nothing at all.

IBM (IBM): Dividend-Reinvestment

IBM (IBM) paid out its quarterly dividend of $1.63 per share on Friday, September 11, 2020, an annual yield of 5.37% as of Friday’s $121.46 closing price, an excellent yield comparative to anything out there available from banks or bonds.

The payout lowered my position’s per-share cost -1.31% from $72.57 to $71.62.

Just like Dow Chemical (DOW) above, my IBM position is enrolled in a DRiP to reinvest the dividends as stock.

Nike (NKE): Profit-Taking

Nike (NKE) has been an unstoppable train of a stock for weeks now, making new all-time high after new all-time high. On Monday, I decided to stop pushing my luck by taking some profits with a sell order that filled at $119.07.

The sale locked in +84.06% in gains on shares I bought for $64.69 on March 16. The sale also lowered my per-share “cost” from -$25.14 to -$30.00 meaning that each share I hold cost me nothing plus it adds $30.00 to my portfolio’s net profits.

My next buy target is $85.30 and my next sell target is $166-$167 where Nike will be nearing a full target allocation in my portfolio.

NKE closed the week at $114.66, down -3.70% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.