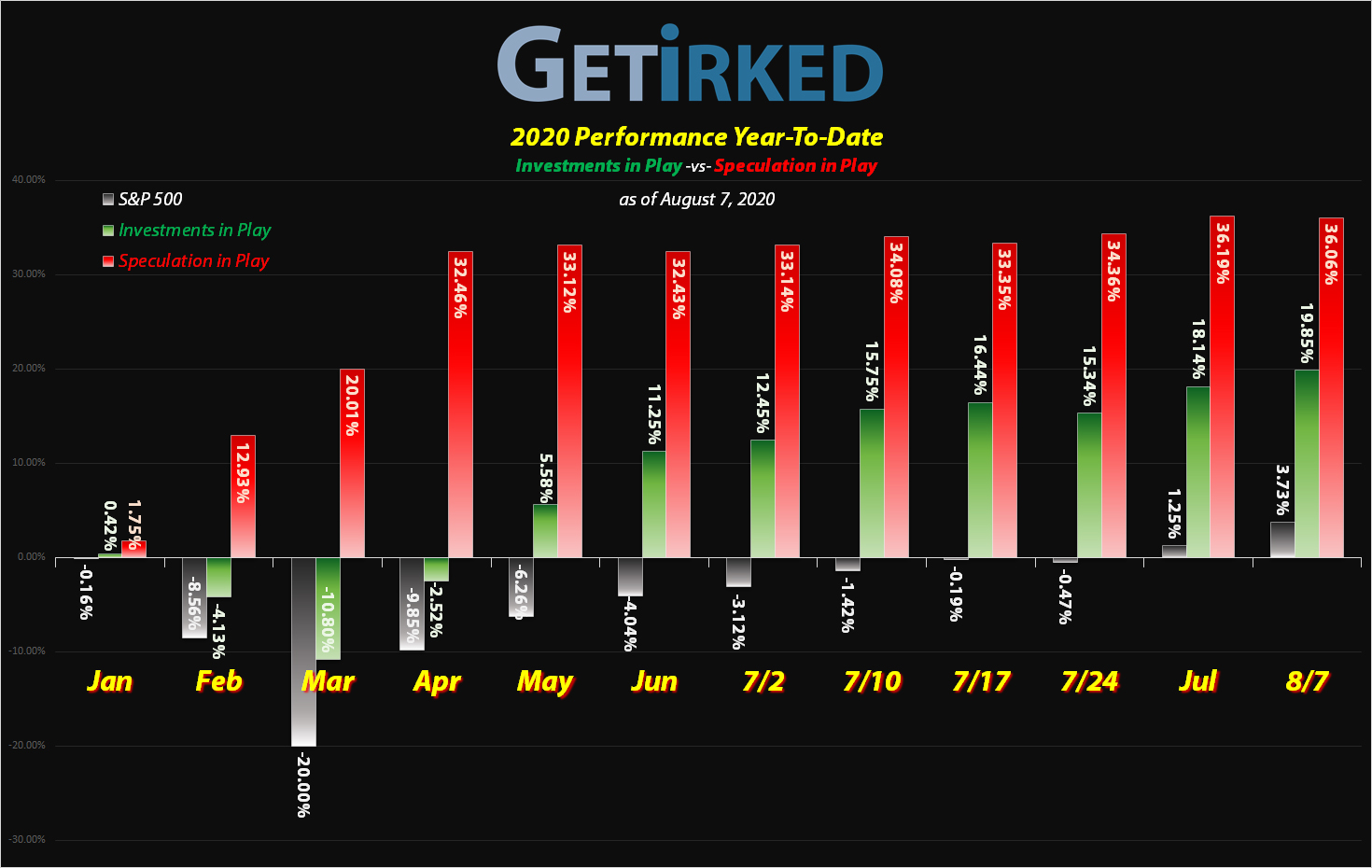

August 7, 2020

The Week’s Biggest Winner & Loser

Square (SQ)

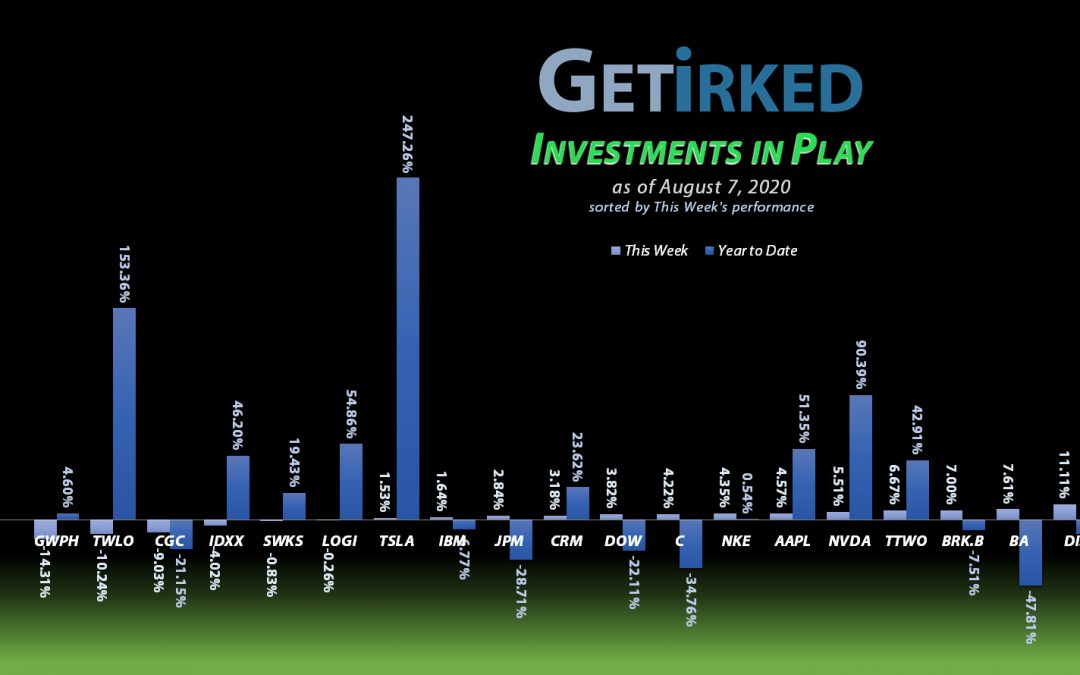

Square (SQ) released a blowout quarterly earnings report this week, surprising analysts who already had sky-high estimates and dominating the markets with a +13.38% gain to earn itself the spot of the week’s Biggest Winner.

GW Pharma (GWPH)

GW Pharmaceuticals (GWPH) has developed a reputation of either blowing out its earnings report and seeing its stock skyrocket or meeting expectations and dropping like a rock. This week, the latter won out, causing GWPH to lose -14.31% of its value and earning itself the Biggest Loser title.

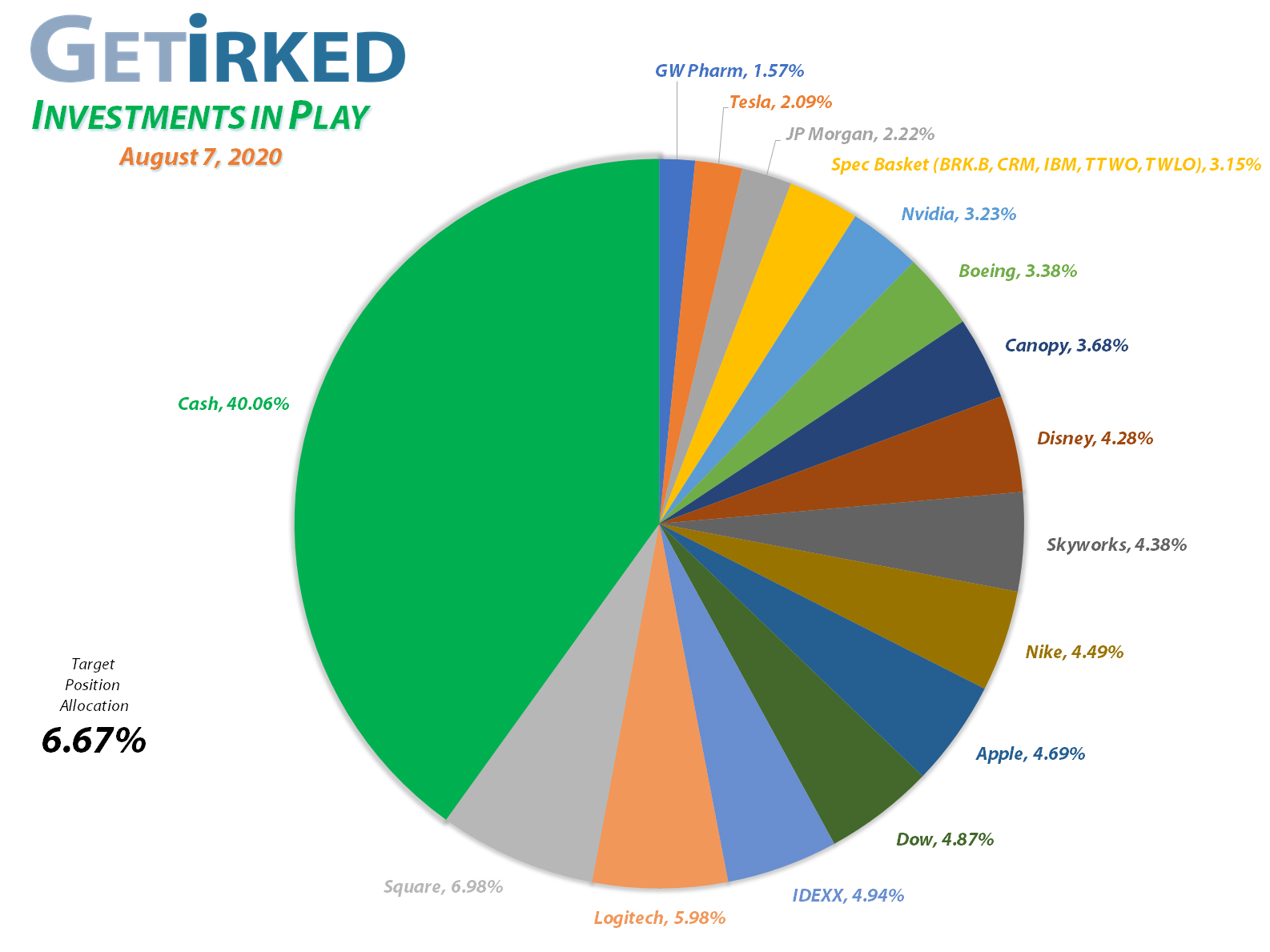

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

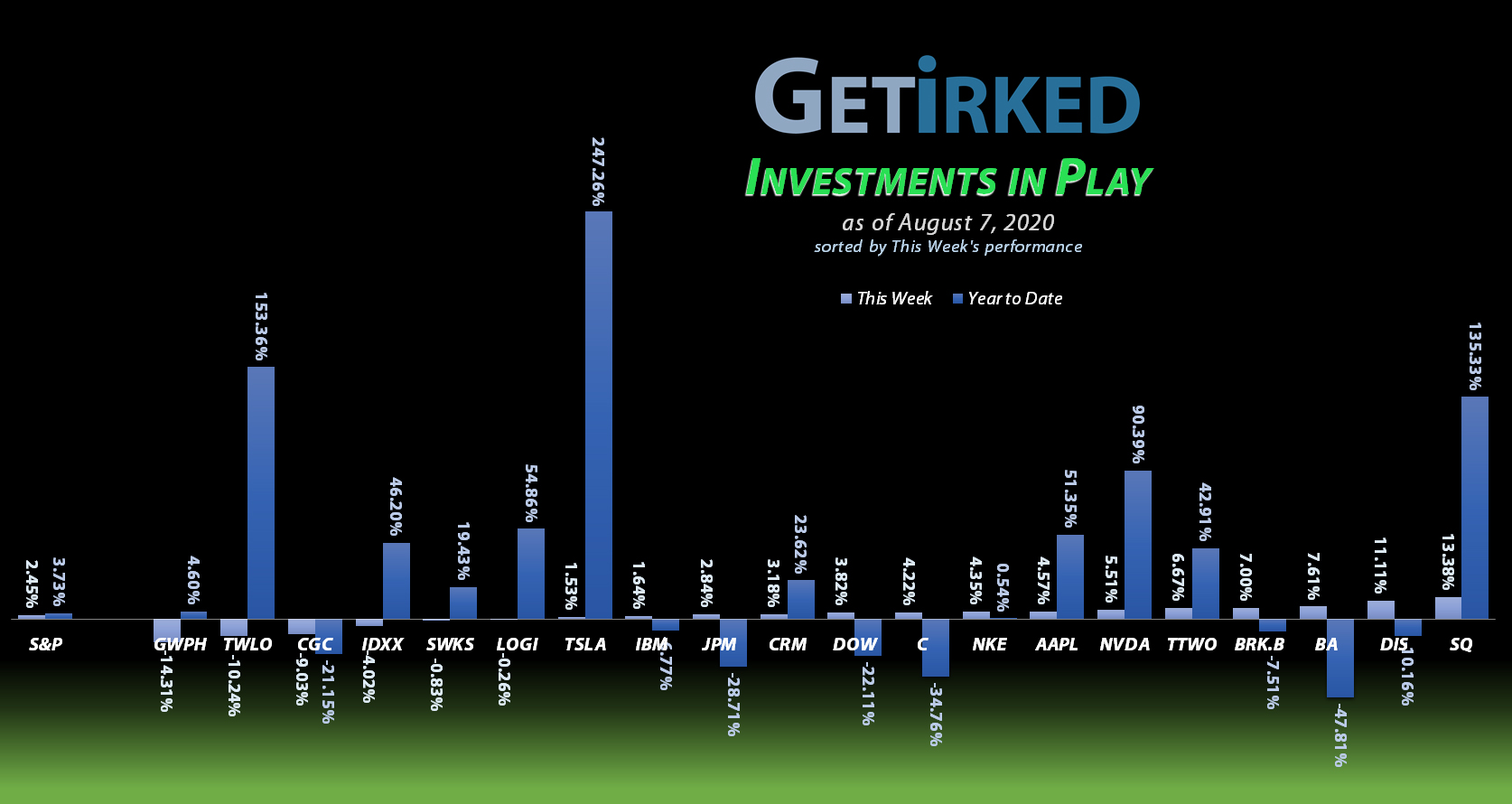

Square (SQ)

+749.25%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$80.52)*

Disney (DIS)

+723.86%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+643.17%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$198.60)*

Boeing (BA)

+626.59%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Take Two (TTWO)

+560.41%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nvidia (NVDA)

+438.61%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+403.34%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$25.14)*

IDEXX Labs (IDXX)

+389.50%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Twilio (TWLO)

+240.67%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Logitech (LOGI)

+174.07%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $26.65

Tesla (TSLA)

+163.02%*

1st Buy 3/12/2020 @ $556.49

Current Per-Share: (-$59.31)*

Salesforce (CRM)

+151.59%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

IBM (IBM)

+72.19%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $72.57

Skyworks (SWKS)

+71.87%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Berkshire (BRK.B)

+47.29%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+13.52%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

JP Morgan (JPM)

+11.59%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.06

GW Pharm (GWPH)

+9.37%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $100.00

Dow (DOW)

+7.12%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $39.80

Citigroup (C)

0.00%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $0.00

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Citigroup (C): *Position Closed – Break-Even*

There’s a huge tsunami of consumer debt coming due and while no one seems to reference it much, it’s starting to freak me out. What happens when the stimulus runs out? What happens when the eviction moratorium ends and people get kicked out of their homes? What happens when the small businesses don’t pay their loans back?

And, most importantly, which sector’s going to get hit the hardest? The banks.

I definitely do want bank exposure, but over the past few weeks, I’ve realized I don’t care if I have a banking basket… why not just go with the Best-of-Breed, JP Morgan (JPM), and bail on Citigroup (C)?

So, when Citi hit my per-share cost on Friday, I decided it was time to let the entire position go, selling it for a teeny-tiny profit so small that it was basically break-even, and I’m happy to see it go at $51.96. From here on out, JP Morgan will represent the banking sector in my portfolio.

C closed the week at $52.12, up +0.3% from where I closed the position.

JP Morgan (JPM): Dividend-Reinvestment

Sure, dividends aren’t the most exciting thing in the world, however, over time, Dividend Reinvestment Programs (“DRiPs”) can substantially increase your returns and also lower your per-share cost.

For example, JP Morgan (JPM) paid out its dividend last week, lowering my per-share cost -0.91% from $89.88 to $89.06. At its current price point, JPM’s dividend yield is more than 3.75% a year which can be nice in a sector where stock prices may remain flat or down for significant periods of time.

GW Pharmaceuticals (GWPH): Profit-Taking

When GW Pharmaceuticals (GWPH) didn’t blow out their earnings report on Thursday night, I knew it was time to limit my exposure to this extremely volatile equity by using stop-loss limit orders to sell off the majority of my position.

GWPH lost support and dropped below $120 which triggered the sell order I had in place, filling at $119.23. The order reduced my per-share cost by -9.8% from $110.87 to $100.00.

While I do still believe in the long-term prospects of GW Pharma’s cannabis-based prescription pharmaceuticals, the stock’s volatility has made me adjust my strategy as the stock dropped to ~$68 during the March selloff, blowing right past the $90.14 mark that had served as support during 2018’s selloff.

Accordingly, I’m now eyeing the $82.60 mark as my next buy target.

GWPH closed the week at $109.37, down -8.27% from where I sold Friday.

Square (SQ): Profit-Taking

Square (SQ) made new all-time highs on Tuesday morning following analyst price target upgrades as high as $160 a share. Square’s explosive growth in 2020 has caused it to become the biggest position in my portfolio, outgrowing my allocation target of 6.67%.

This meant more profit-taking when Square crossed $136.30, locking in +111.55% in profits on shares I bought for $64.43 back on May 29, 2019.

And, then, Square reported earnings after the market closed Tuesday evening…

Square’s report was so outstanding that the stock rocketed beyond $150, triggering another sell order I had in place on Wednesday to sell the remainder of the shares I bought on May 29, 2019 for $64.43 at $153.00, a profit of +137.47% and an average selling price for the week of $144.65.

Even with this week’s sale, Square still remains an overweight position in the portfolio. My next sell target is $157.30, near Square’s new-all-time high, and my buy target to add back to the position is $63.70.

SQ closed the week at $147.22, up +1.78% from my average selling price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.