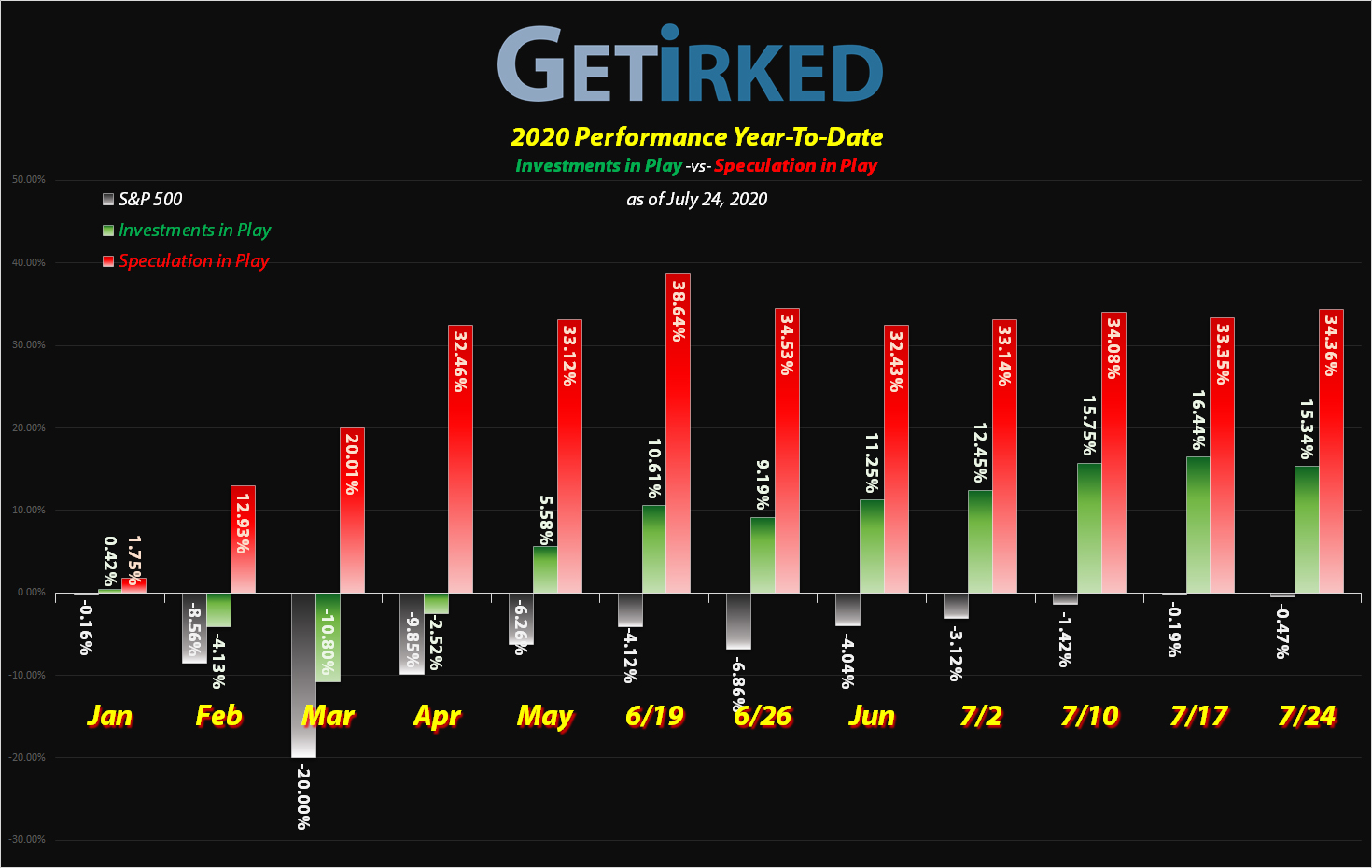

July 24, 2020

The Week’s Biggest Winner & Loser

Twilio (TWLO)

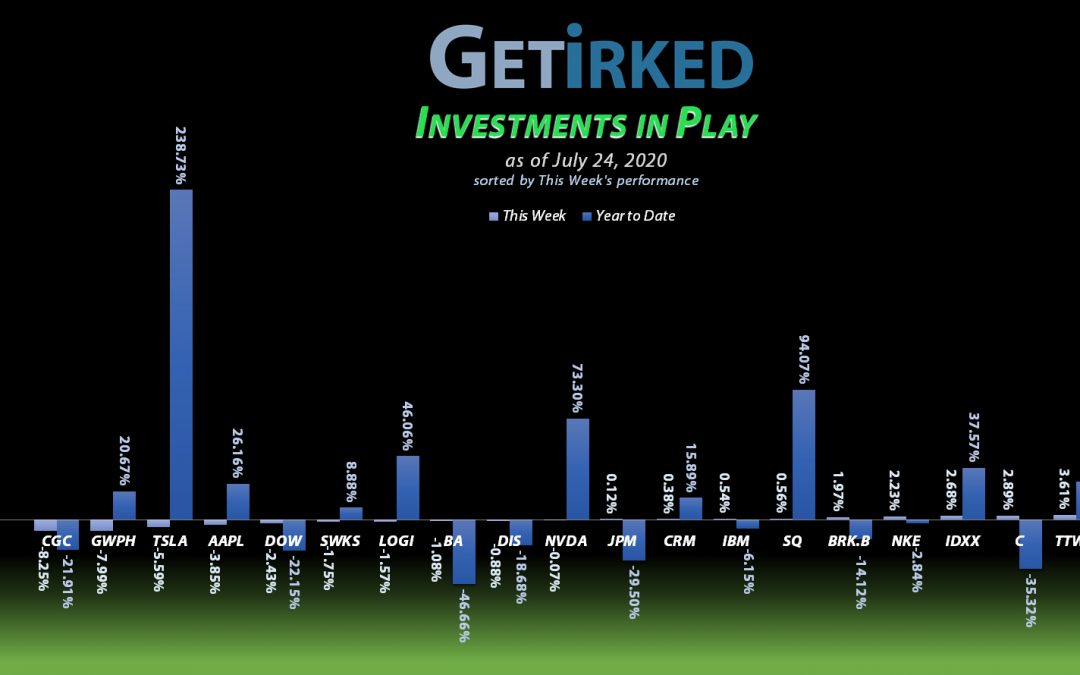

Twilio (TWLO) popped +4.07% on a down week to earn itself the spot of the biggest winner. The move came on basically no news outside of the fact that Twilio is one of the Work-From-Home-We-Can-Never-Leave-Ever-Again plays.

Canopy Growth Corp (CGC)

Canopy Growth Corp (CGC) took the week hard, dropping -8.25% and earning itself the spot of the biggest loser. Like Twilio, there was really no news driving CGC lower, but, realistically, CGC will struggle until the U.S. Federal Gov’t legalizes pot.

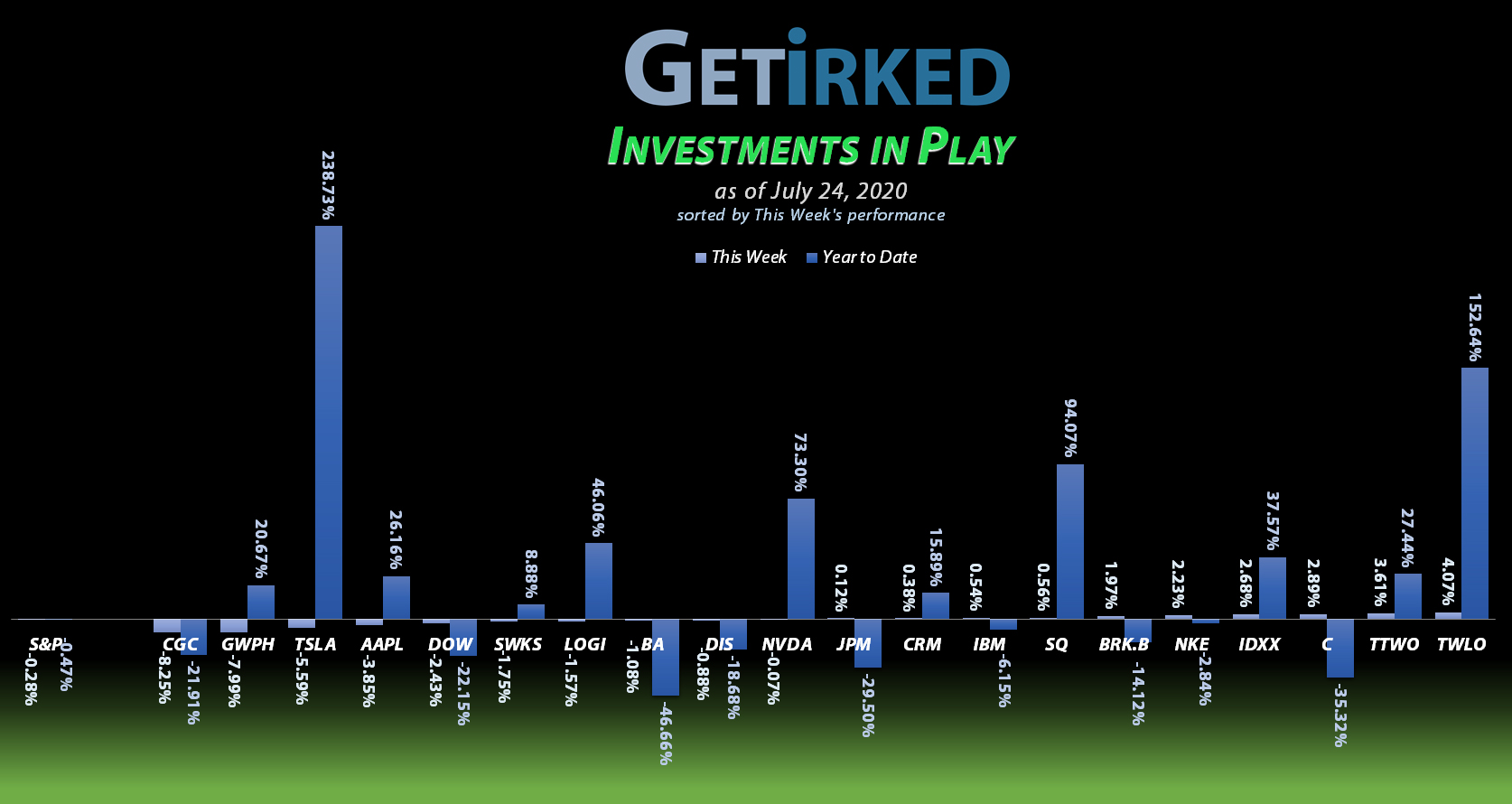

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

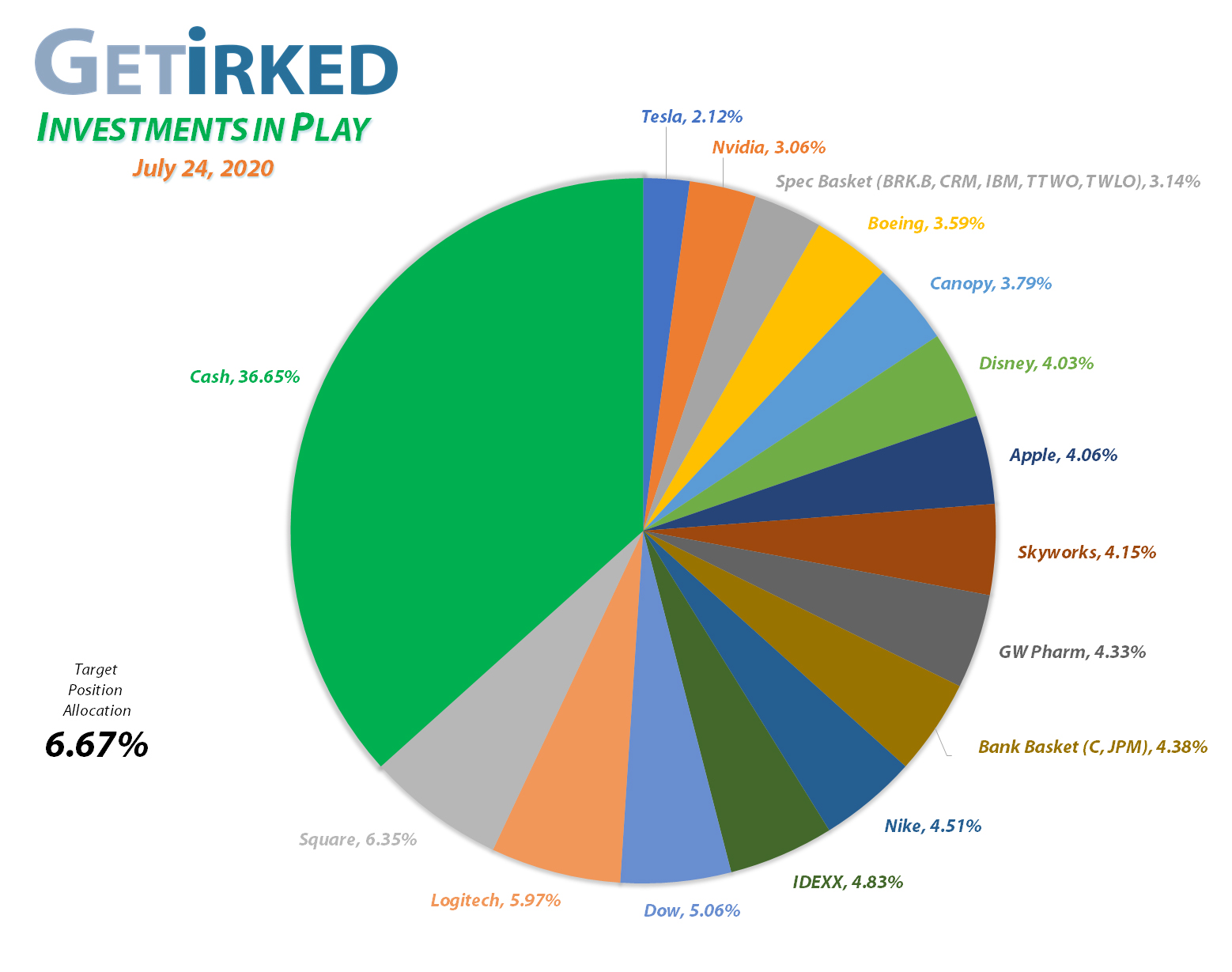

Square (SQ)

+659.70%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$67.65)*

Disney (DIS)

+655.22%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Boeing (BA)

+630.91%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+574.65%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$198.60)*

Take Two (TTWO)

+499.74%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nvidia (NVDA)

+406.60%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$102.82)*

Nike (NKE)

+392.44%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$25.14)*

IDEXX Labs (IDXX)

+360.61%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $77.99

Twilio (TWLO)

+240.29%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

Tesla (TSLA)

+159.17%*

1st Buy 3/12/2020 @ $556.49

Current Per-Share: (-$59.31)*

Logitech (LOGI)

+150.93%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $27.45

Salesforce (CRM)

+135.87%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

IBM (IBM)

+73.33%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $72.57

Skyworks (SWKS)

+56.68%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $84.00

Berkshire (BRK.B)

+36.77%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

GW Pharm (GWPH)

+23.69%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Canopy (CGC)

+12.42%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

JP Morgan (JPM)

+9.34%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.88

Dow (DOW)

+7.07%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $39.80

Citigroup (C)

-0.54%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $51.95

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Citigroup (C): Profit-Taking

While I don’t think Citigroup (C) is a poor investment as far as banks go, it’s definitely not Best-in-Breed JP Morgan (JPM), the other bank in the basket.

Given how badly the financial sector is performing combined with the potential for epic losses due to companies and consumers not paying credit card bills and other debt, I decided it was time to actively reduce my position in Citigroup.

On Wednesday, I started to trim with a sell order at $52.24 taking +15.35% in gains on shares I bought on March 12 for $45.29. The sale reduced my per-share cost relatively insignificantly from $51.96 to $51.95 (yes, I like numbers that end in zeroes or fives).

My next sell target for the stock is around $54.60 with my next buy target near the March lows at $34.70. While it’s true I’m trying to reduce the position, if I still hold the stock and it sells off that dramatically again, I will certainly add back into it.

C closed the week at $51.67, down -1.09% from where I sold Wednesday.

IDEXX Laboratories (IDXX): Profit-Taking

IDEXX Laboratories (IDXX) may be one of the most under-the-radar home-run plays for the pandemic – veterinary supplies and pet treatment development. If you’re not a user of social media, I don’t blame you, but if you do have Facebook, I’d bet folding money that you’ve seen a never-ending onslaught of friends, family members, and random people adopting dogs, cats, turtles, spiders, and whatever other pet you can imagine during this pandemic.

And what will they all need? Veterinary treatment. No company offers better veterinary solutions and products than IDEXX Labs and it shows as the company’s stock continues to make new all-time high after new all-time high.

Despite my faith in the ongoing success of this outstanding company, it was time to make more profits on Wednesday when a sell order of mine filled at $367.87, locking in +57.82% in gains on shares I bought March 16 for $233.09. The sale also lowered my per-share cost -27.10% from $106.98 to $77.99.

My next sell target for the stock is near $430.00 and my buy target is $283.60.

IDXX closed the week at $359.23, down -2.35% from where I sold Wednesday.

Skyworks Solutions (SWKS): Profit-Taking

Skyworks Solutions (SWKS) made an attempt at breaking its all-time high of $138.22 before it reported earnings this week, prompting me to take profits once again in the name. Despite my faith in the long-term 5G prospects of SWKS, when I have gains of this magnitude, it’s time to take them.

On Monday, my sell order filled at $137.85, taking +89.64% in gains on some of the shares I bought back on March 16 for $72.69. Monday’s sale lowered my per-share cost -2.82% from $86.44 to $84.00. My next sell target for the stock is around $147.25, and my buy target is $83.80.

SWKS closed the week at $131.61, down -4.78% from where I sold Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.