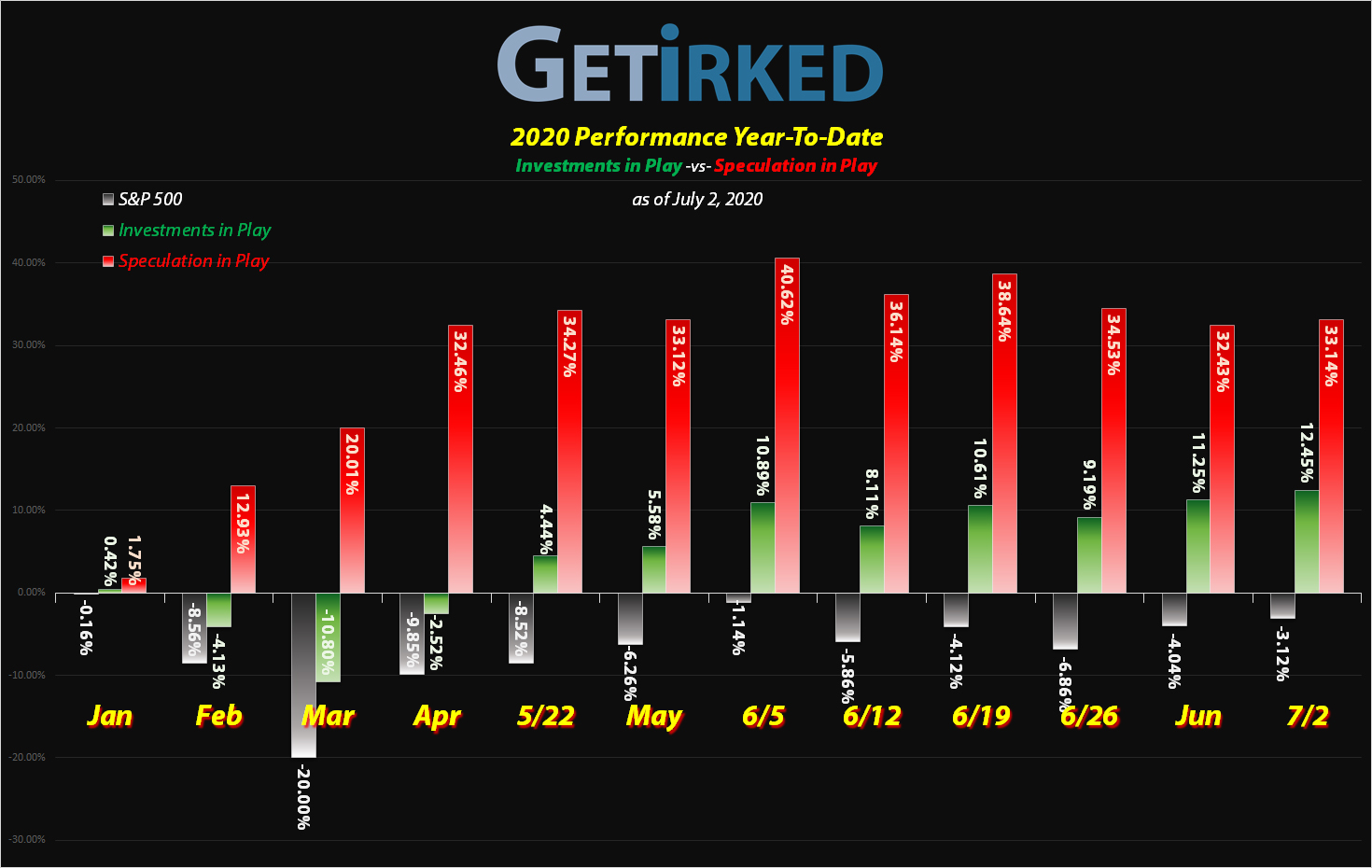

July 2, 2020

The Week’s Biggest Winner & Loser

Tesla (TSLA)

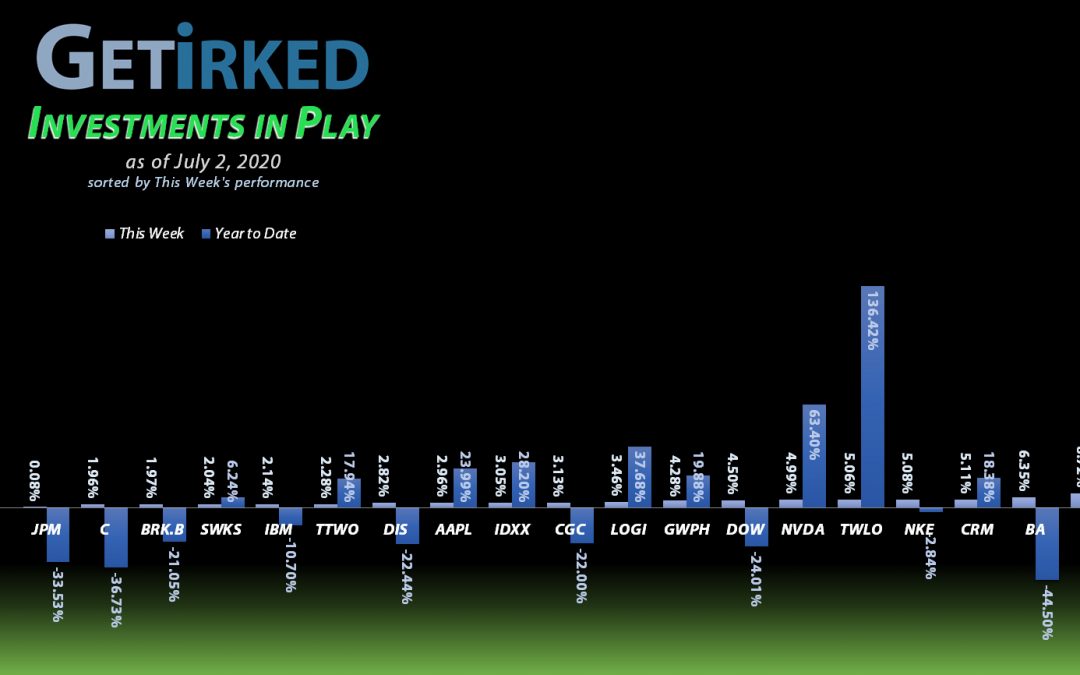

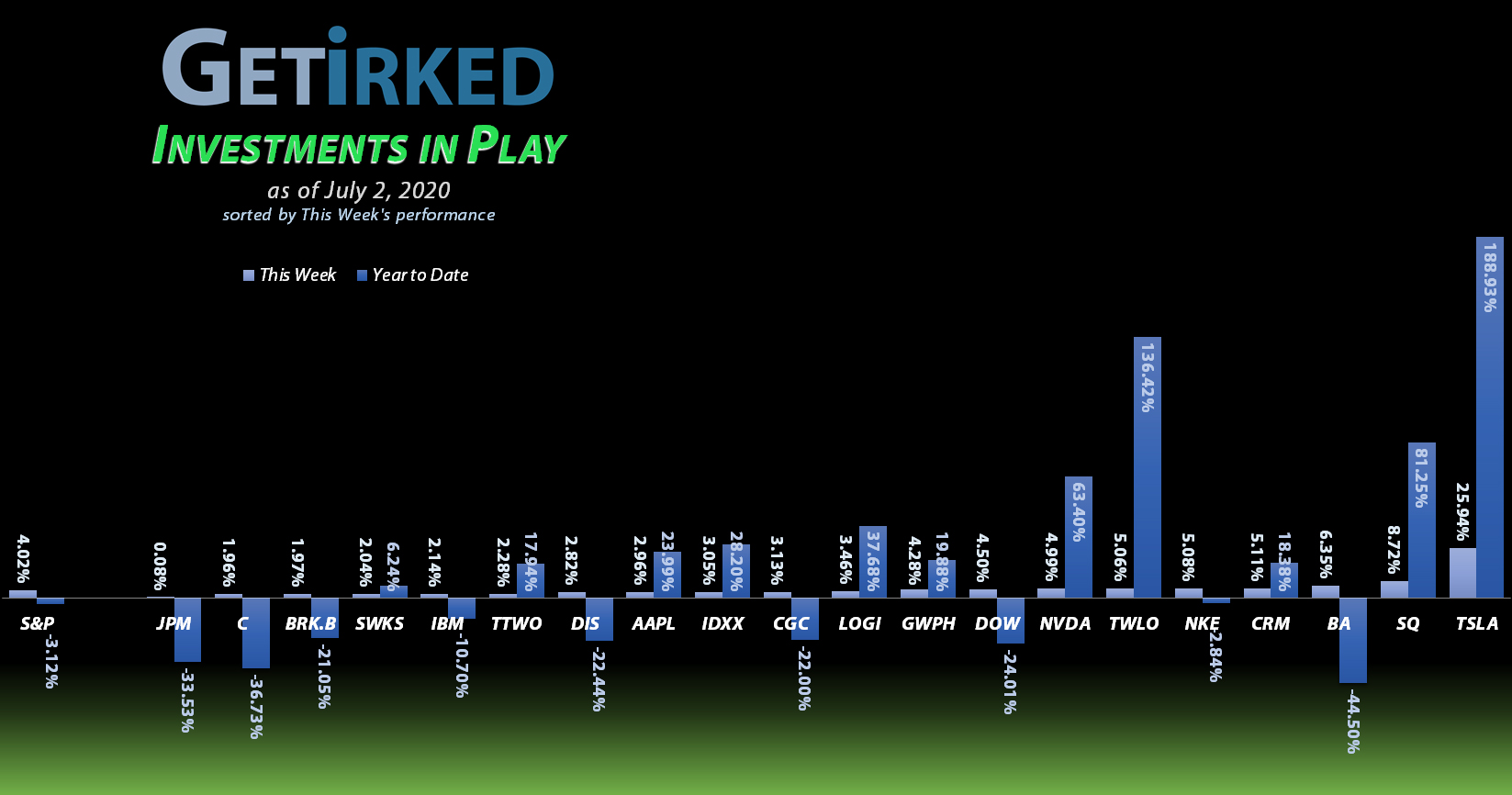

Who needs fireworks when you’ve got Tesla’s (TSLA) stock?! After leaking a memo that the company might surprise to the upside by breaking even for Q2, CEO Elon Musk reported they would be meeting their deliveries for the quarter, causing the stock to skyrocket +25.94% for the week, making an all-time high over $1,200, exceeding the market cap of Toyota Motors (TM), previously the world’s biggest car company, and basically just stunning the globe to become the Biggest Winner for the week!

JP Morgan (JPM)

Many market analysts will say it’s a bad sign if the financials don’t lead the market higher, and if that’s the case, we’re in trouble as both JP Morgan (JPM) and Citigroup (C) have substantially underperformed the markets for weeks now. The current week was no exception, with JP Morgan earning a paltry 0.08%, landing it the spot of the week’s Biggest Loser.

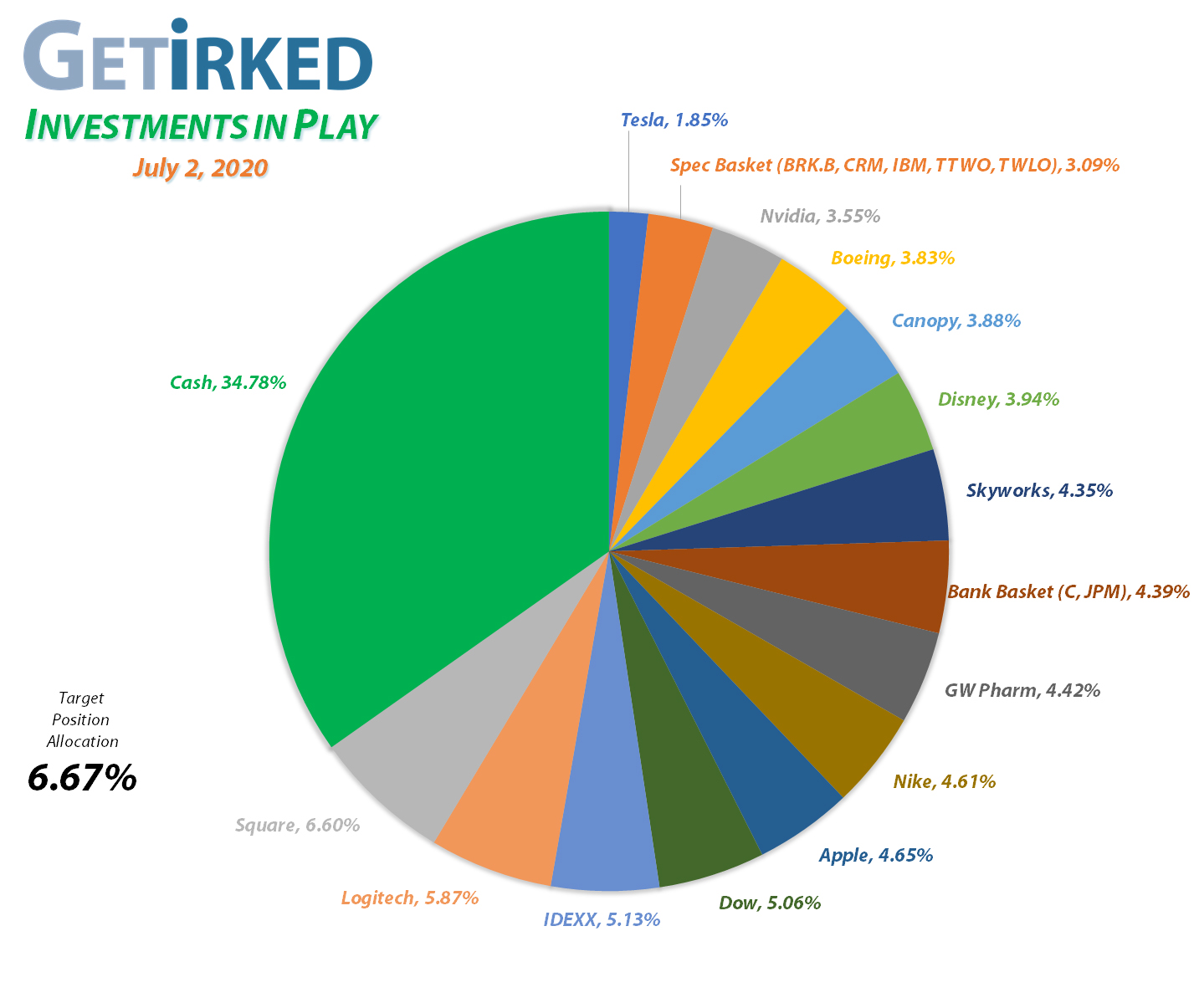

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+639.10%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Square (SQ)

+627.48%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$52.30)*

Disney (DIS)

+624.97%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Apple (AAPL)

+564.28%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$172.20)*

Take Two (TTWO)

+462.52%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nike (NKE)

+391.70%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$25.20)*

Nvidia (NVDA)

+381.43%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$14.99)*

Twilio (TWLO)

+231.84%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IDEXX Lab (IDXX)

+212.92%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $106.98

Salesforce (CRM)

+140.84%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Tesla (TSLA)

+136.71%*

1st Buy 3/12/2020 @ $556.49

Current Per-Share: (-$59.31)*

Logitech (LOGI)

+130.80%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $28.13

IBM (IBM)

+64.90%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $72.57

Skyworks (SWKS)

+48.57%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $86.44

Berkshire (BRK.B)

+25.73%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

GW Pharm (GWPH)

+13.06%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Canopy (CGC)

+12.15%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

Dow (DOW)

+4.51%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $39.80

JP Morgan (JPM)

+3.11%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.88

Citigroup (C)

-2.71%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $51.96

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Logitech (LOGI): Profit-Taking

Logitech (LOGI) once again made new all-time highs this week, breaking through the $65.00 mark and triggering a trailing-stop-loss order I had in place which filled at $64.98 on Tuesday.

The sale took +126.02% in gains from my then-$28.75 per-share cost and lowered my per-share cost -2.16% from $28.75 to $28.13. My next sell target is at $73.50 and my next buy target is $47.30.

LOGI closed the week at $64.93, down -$0.05 from where I sold Tuesday.

Square (SQ): Profit-Taking

Square (SQ) continued to skyrocket this week, hitting yet another milestone on Wednesday which required me to take profits at $115.44. The sale took +106.62% in gains on shares I bought back on March 12 at $55.87.

Even Wednesday’s sale only barely reduced my allocation below the portfolio’s target of 6.67%, leaving Square as my biggest holding at 6.60% of the portfolio. From here, my next sell target is $121.60 and my next buy target is $71.30.

SQ closed the week at $113.33, down -1.83% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.