June 19, 2020

The Week’s Biggest Winner & Loser

Square (SQ)

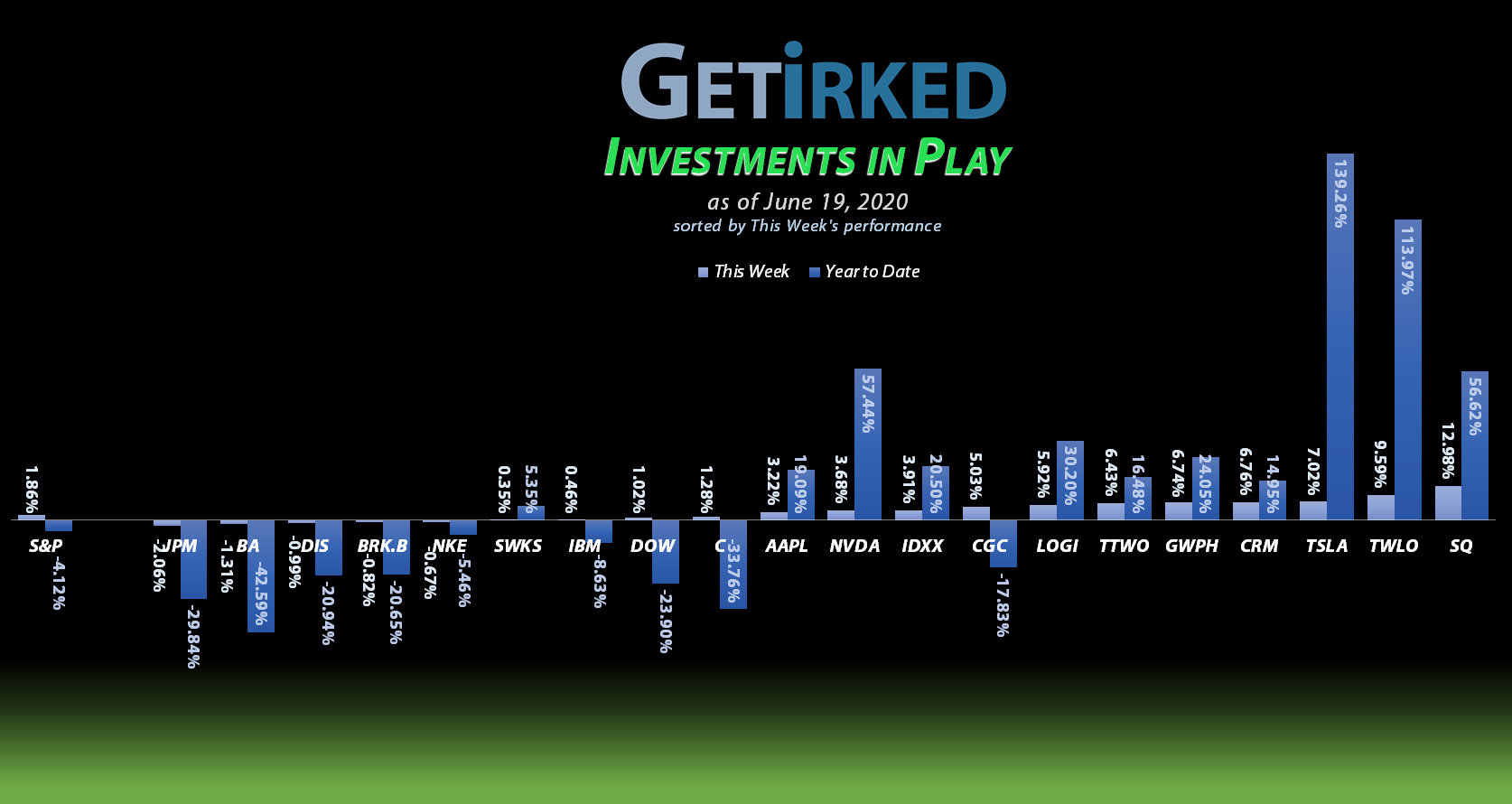

In an era of no one wanting to touch anything anyone else has touched, Square (SQ) and its no-touch payments rules the roost, dominating the week with +12.98% in gains earning itself the spot of the Week’s Biggest Winner.

JP Morgan (JPM)

With over 100 million debts not being paid by consumers in May, is it any wonder that credit card banks like JP Morgan (JPM) took it on the chin this week. JPM got slammed harder than most, though, dropping -2.06% and earning the Biggest Loser spot.

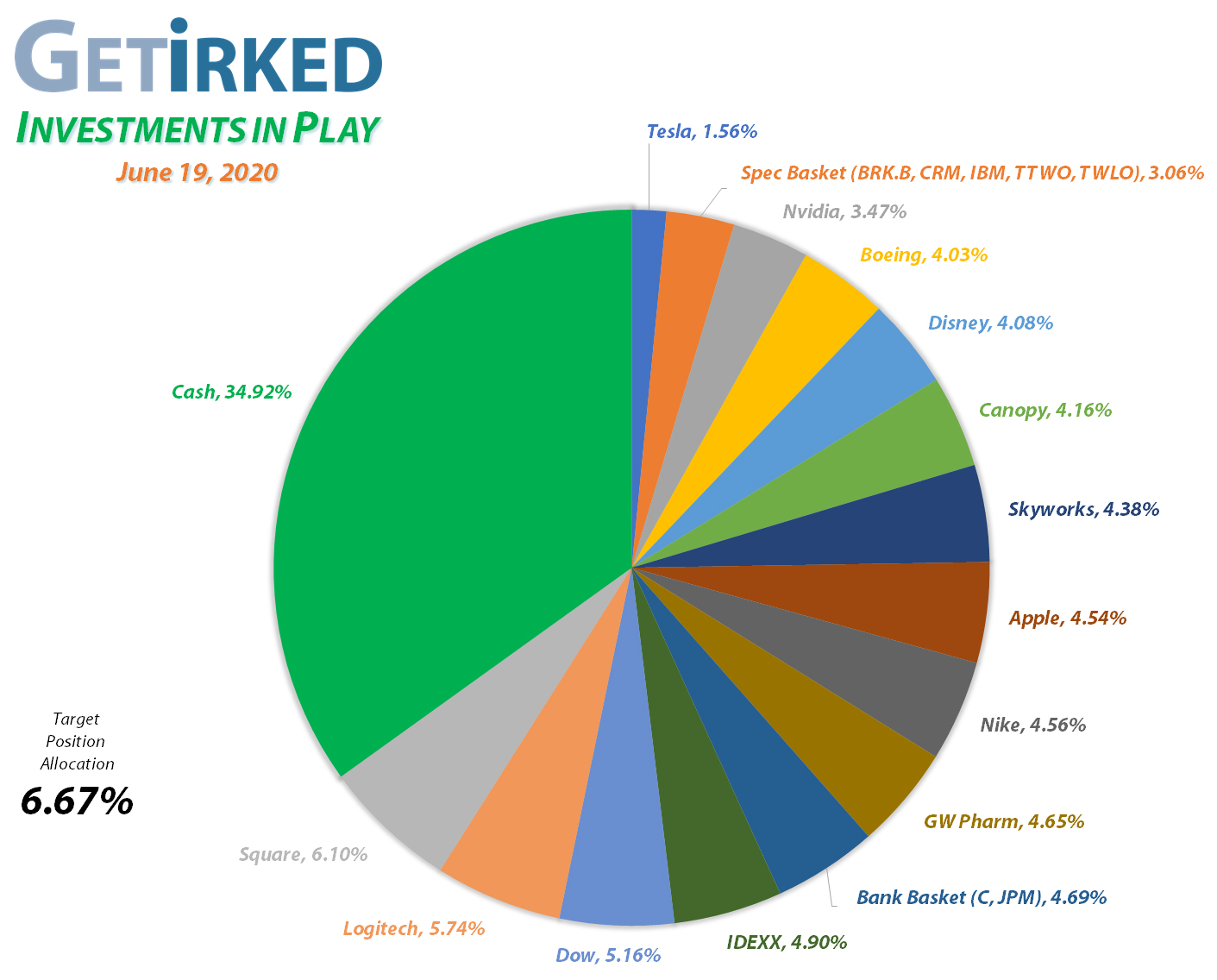

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+646.23%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Disney (DIS)

+637.06%

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $17.95

Square (SQ)

+566.80%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$44.15)*

Apple (AAPL)

+549.14%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$172.20)*

Take Two (TTWO)

+456.79%

1st Buy 10/9/2018 @ $128.40

Current Per-Share: $31.22

Nike (NKE)

+383.27%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$25.20)*

Nvidia (NVDA)

+367.86%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Twilio (TWLO)

+220.14%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IDEXX Lab (IDXX)

+194.14%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $106.98

Salesforce (CRM)

+133.94%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Tesla (TSLA)

+114.28%*

1st Buy 3/12/2020 @ $556.49

Current Per-Share: (-$59.31)*

Logitech (LOGI)

+113.59%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $28.75

IBM (IBM)

+68.76%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $72.57

Skyworks (SWKS)

+47.34%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $86.44

Berkshire (BRK.B)

+26.37%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+18.29%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

GW Pharm (GWPH)

+17.00%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

JP Morgan (JPM)

+8.82%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.88

Dow (DOW)

+4.66%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $39.80

Citigroup (C)

+1.85%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $51.96

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

This Week’s Moves

Dow Chemical (DOW): Dividend Reinvestment

Dow Chemical (DOW) paid out its quarterly dividend on Friday which didn’t clear until this week. I always opt to have dividends reinvested so their returns compound whenever my brokers offer a Dividend Reinvestment Program (DRiP) in any of my positions.

In Dow’s case, its annual dividend yield is substantial, a whopping 6.670% at these levels, with the company paying out $0.70 per share on each quarter. For my position, the Q2 dividend payment dropped my per-share cost -1.68% from $40.48 to $39.80.

Given that all I had to do was hold on to the stock, that’s not too shabby at all.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) took off with the rest of the markets Monday and Tuesday, trying for its all-time high on Tuesday and triggering a sell order I had in place which filled at $60.63 on Tuesday morning. The sale took +75.89% in profits on some of the shares I bought on March 12 for $34.47.

My next sell target for LOGI is $66.15 based on reverse Fibonacci Retracement analysis and my next buy price is around $43.50.

LOGI closed the week at $61.40, up +1.27% from where I sold on Tuesday.

Square (SQ): Profit-Taking

While the market rally seemed to slow Wednesday morning, Square’s (SQ) run did not with the stock triggering a sell order I had in place at $97.34. The sale reduces my per-share cost -8.48% from -$40.70 to -$44.15 (meaning each share I hold cost nothing and added $44.15 in profit to the portfolio).

The sale locked in +111.47% in profits on shares I bought just three short months ago on March 16, 2020 for $46.03. My next sell target is well beyond Square’s all-time high at $111.80 and my next buy target is $61.90.

SQ closed the week at $97.98, up +0.66% from where I sold Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Ways to give back to GetIrked:

Send me a tip via Stripe! Thank you!

Get free money by signing up for an account with my referral link for Schwab

Sign up for Gemini and we each get $10

Click this referral link to get the Brave Browser

If you use Brave, you can also use the Tip function to tip me in Basic Attention Token (BAT).

You must be logged in to post a comment.