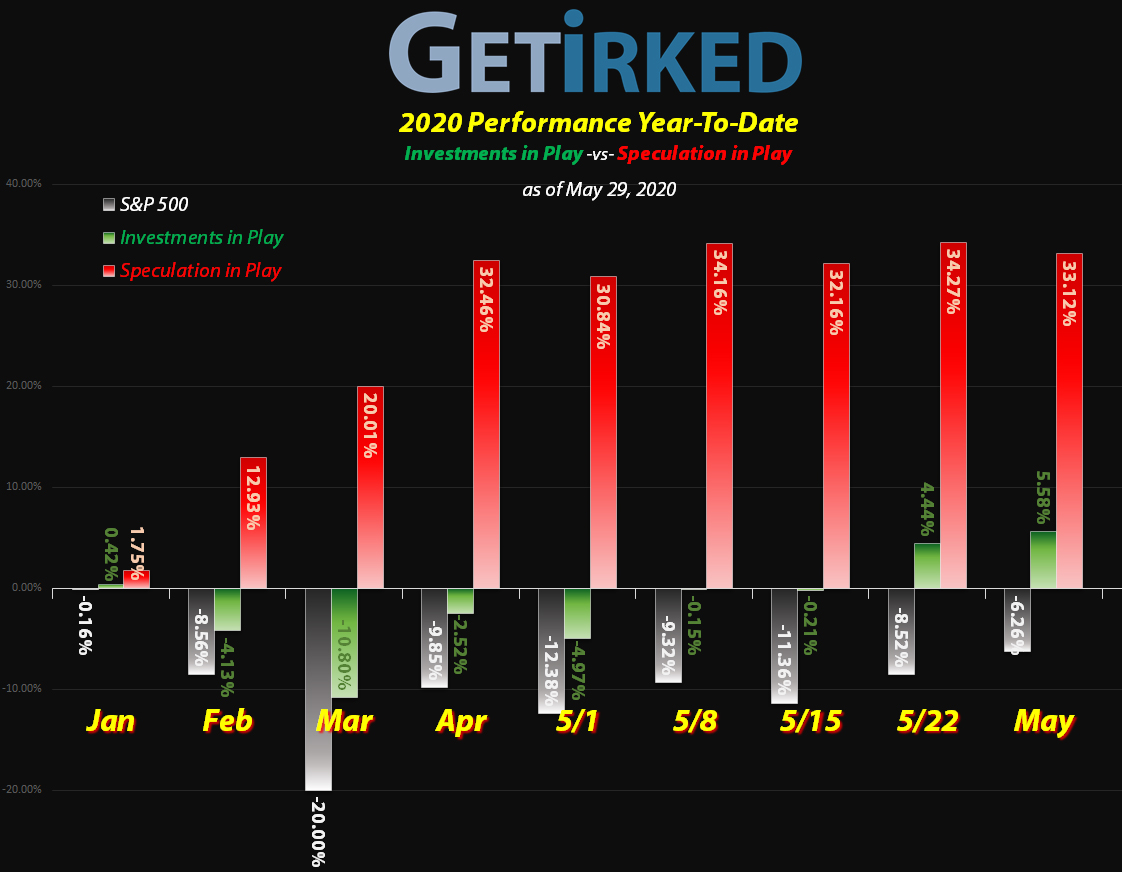

May 29, 2020

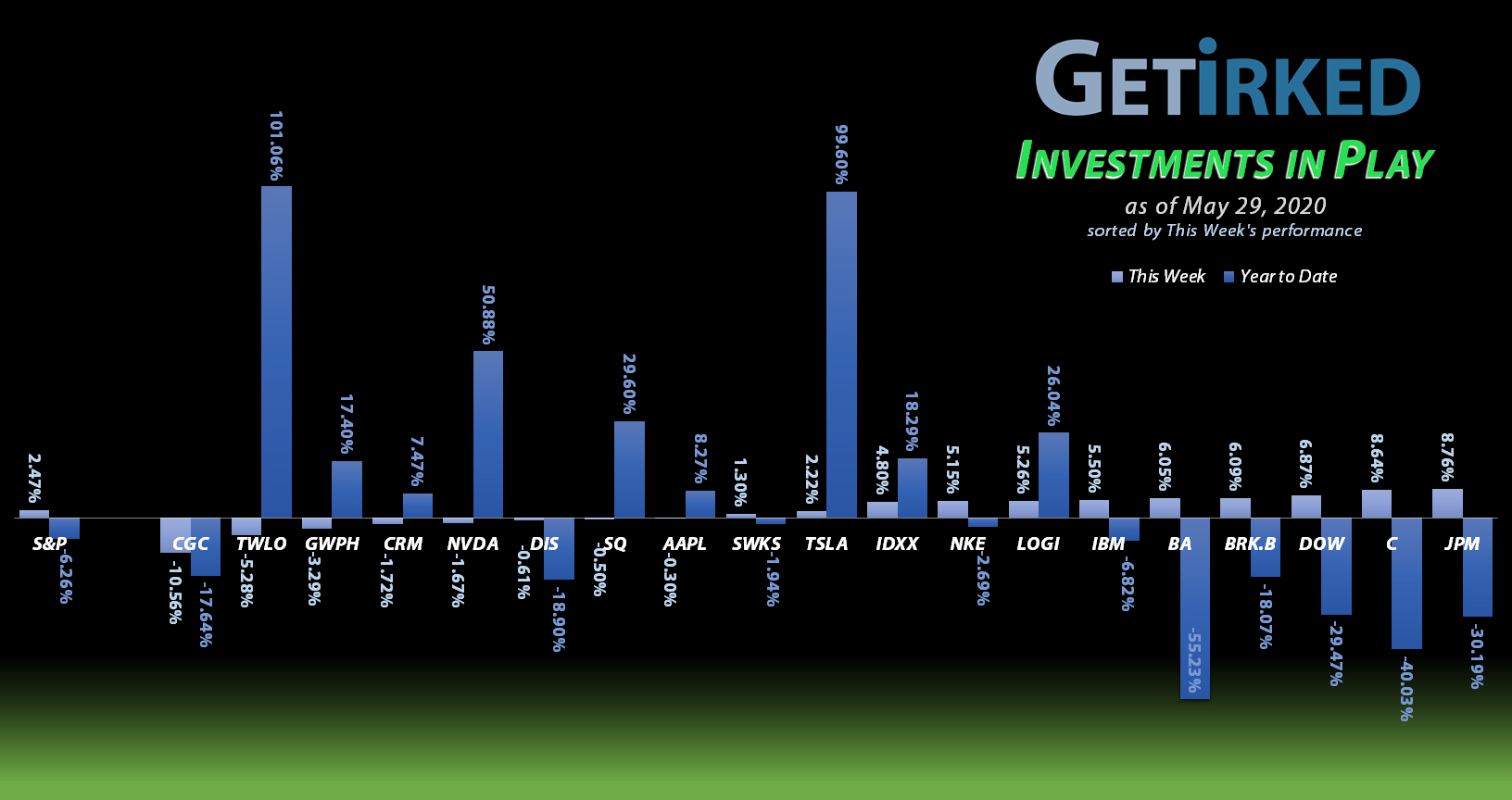

The Week’s Biggest Winner & Loser

JP Morgan (JPM)

The financials saw a decent return-to-form this week with best-in-breed JP Morgan (JPM) seeing the biggest pop at +8.76% which earned it the spot as the week’s Biggest Winner.

Canopy Growth Corp (CGC)

Investors got more than a little ahead of themselves this week, thinking Canopy Growth Corp (CGC), the Canadian cannabis play and best-in-breed in the space, would report great earnings. It didn’t.

In fact, its earnings were so bad that CGC lost -10.56% for the week and earned itself the spot of the Biggest Loser.

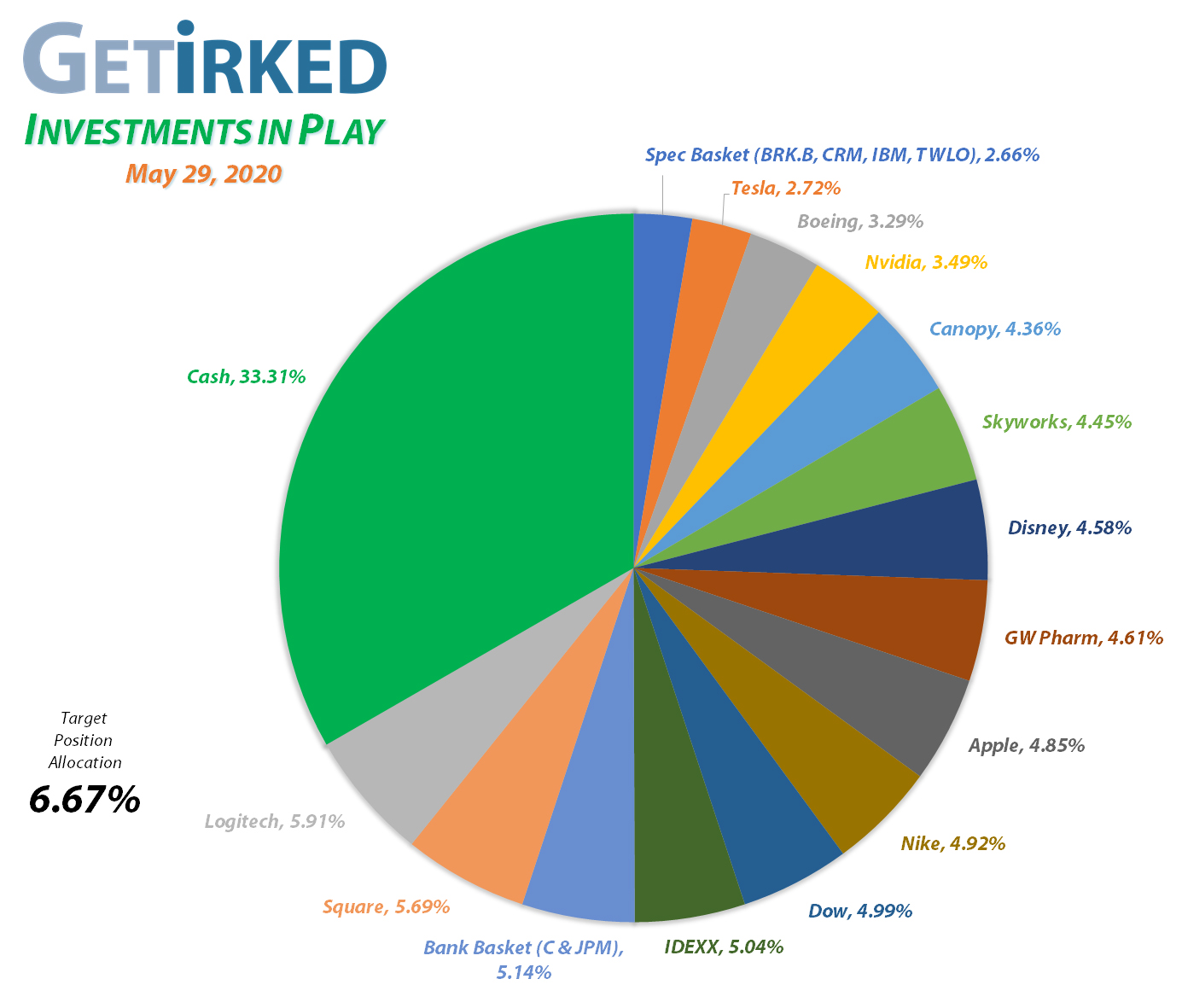

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+598.66%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+515.15%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$119.29)*

Square (SQ)

+496.57%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$34.75)*

Nike (NKE)

+392.14%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$25.20)*

Nvidia (NVDA)

+353.14%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Disney (DIS)

+291.41%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Twilio (TWLO)*

+213.41%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IDEXX Lab (IDXX)

+188.73%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $106.98

Salesforce (CRM)

+118.72%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Logitech (LOGI)

+103.08%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $29.27

Tesla (TSLA)

+80.05%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

IBM (IBM)

+69.85%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Skyworks (SWKS)

+34.36%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

Berkshire (BRK.B)

+30.49%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+18.57%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.65

GW Pharm (GWPH)

+10.72%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

JP Morgan (JPM)

+8.26%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $89.88

Dow (DOW)

-4.78%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

Citigroup (C)

-9.21%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $52.77

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

Canopy Growth Corp (CGC): Profit-Taking

Like many of the other stocks in the market, Canopy Growth Corp (CGC) roared on Thursday, breaking through the $22.00 mark and triggering a sell order I had in place which filled at $22.01.

The sale took profits on some of the shares I bought for $9.34 back on

March 18, locking in more than a double (+135.65%) in just over two months. The sale lowered my per-share cost marginally by -0.34% from $14.70 to $14.65.

My next sell target is $29.95 and my next buy target is $13.15.

CGC closed the week at $17.37, down -21.08% from where I sold on Thursday.

IDEXX Laboratories (IDXX): Profit-Taking

As the markets bounced around on Wednesday, IDEXX Laboratories (IDXX) tried to make a stab at its $302.99 all-time high which led me to take profits when the stock pulled back to $300.19.

The sale locked in +57.78% in gains on shares I bought for $190.27 back on March 19 and lowered my per-share cost -14.10% from $124.54 to $106.98.

I don’t currently have another sell target as I wait to see where IDXX will head next, but my buy target is in the $229.00-$230.00 range, a point of past support.

IDXX closed the week at $308.88, up +2.89% from where I sold on Wednesday.

JP Morgan (JPM): Profit-Taking

When Trump announced he would be holding a press conference on China toward the end of the trading day Thursday, I realized it was time to take a little off the table with JP Morgan (JPM), the Best-in-Breed bank that has pulled off a remarkable bull run in the past few weeks.

My sell order filled when JPM failed to hold $100, filling at $99.99 and locking in +21.54% in gains on shares I bought for $82.27 back on March 18. The sale lowered my per-share cost marginally by -0.69% from $90.50 to $89.88.

From here, my next sell target is $120 and my next buy target is around $83.00.

JPM closed the week at $97.31, down -2.68% from where I sold on Thursday.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) continues to be one of the darlings of the pandemic, as all the Work-From-Homers buy up new keyboards, mice, webcams, and gaming peripherals from the Best-of-Breed manufacturer of everything a home-worker or e-gamer needs.

On Friday, LOGI made new highs once again, and as much as I love this stock, it was time to take profits at $59.45, locking in +72.47% in gains on shares I bought at $34.47 back on March 12.

Friday’s sale lowered my per-share cost by -3.18% from $30.23 to $29.27. My next sell target is around $65 and my next buy is $42.85.

LOGI closed the week at $59.44, basically flat from where I sold on Friday.

Nike (NKE): Profit-Taking

As the market’s seemingly nonstop exuberance continued later in the week, I decided to take profits when Nike (NKE) broke through $100 with a sell order closing at $99.36 on Thursday.

I feel the same way about Nike (NKE) that I do about Apple (AAPL): these are long-term holdings that have performed so well that it’s almost painful taking profits in them.

The sale sold half the shares I bought for $64.69 back on March 16, locking in +53.59% in gains. My next sell target is around $106.50 if Nike breaks its all-time high and my next buy target is just under $80.00.

NKE closed the week at $98.58, down -0.79% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.