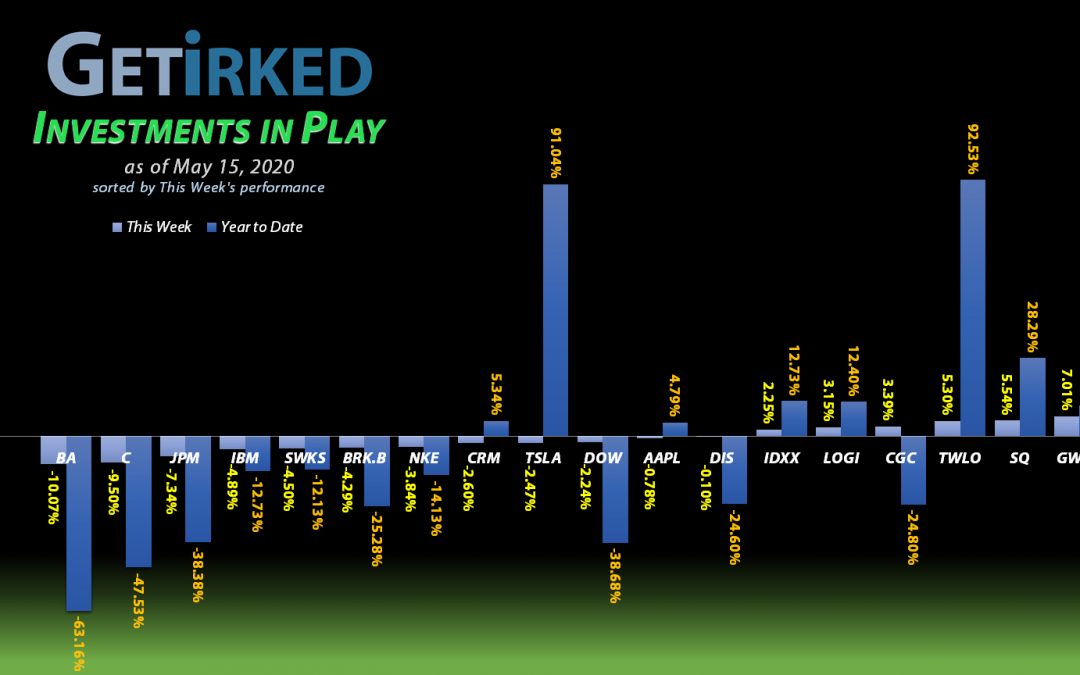

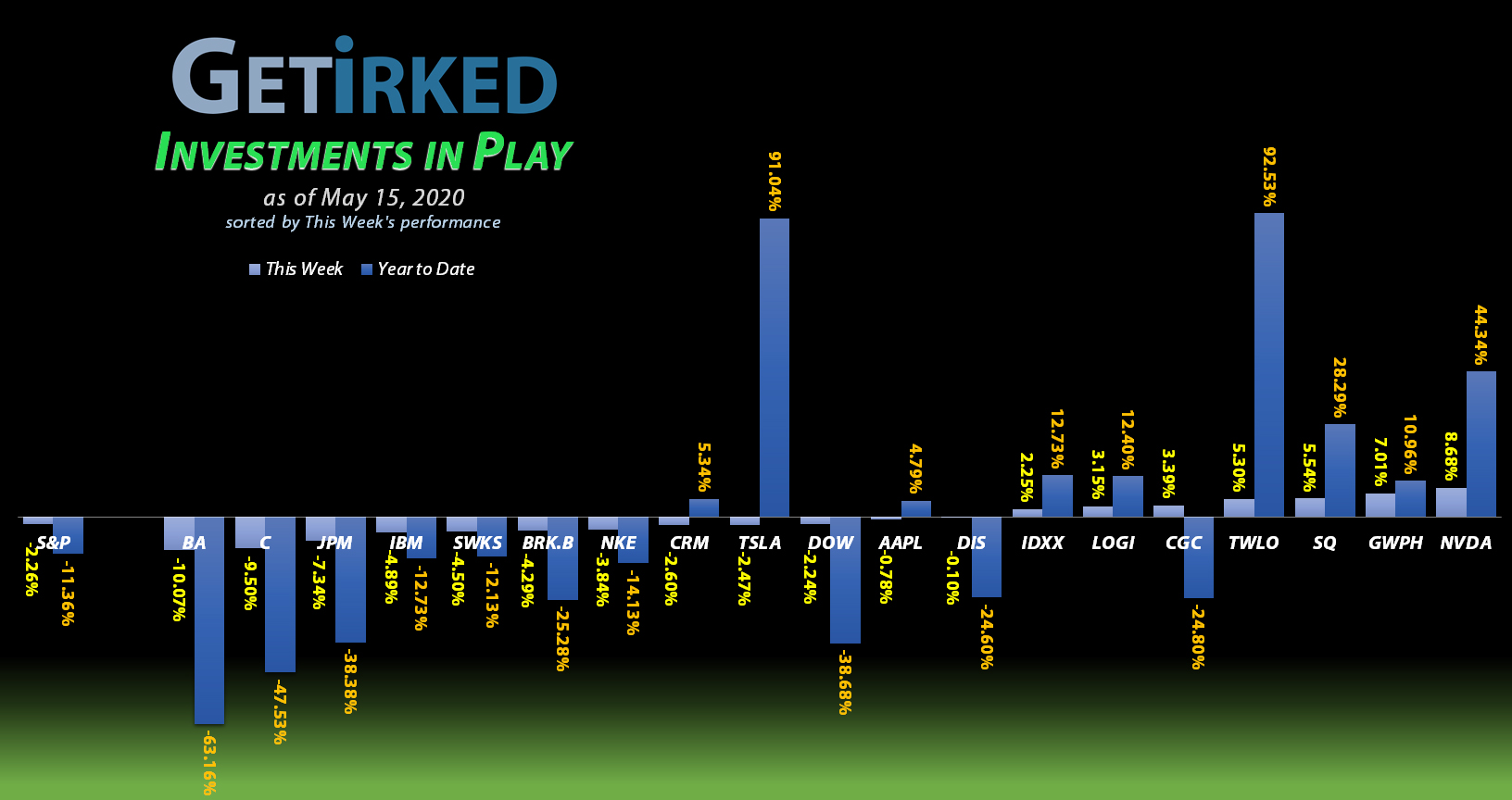

May 15, 2020

The Week’s Biggest Winner & Loser

Nvidia (NVDA)

Nvidia (NVDA) exploded +8.68% to the upside this week as demand for its chips from gaming, data centers and AI sent the stock price headed higher. Of course, it doesn’t hurt to have analysts put out price targets 33% higher from here at $400+, either

Boeing (BA)

Boeing (BA) dropped -10.07% this week after CEO David Calhoun suggested that one of his major clients would have to declare bankruptcy during a network television interview. Maybe keep that information to yourself, Dave?

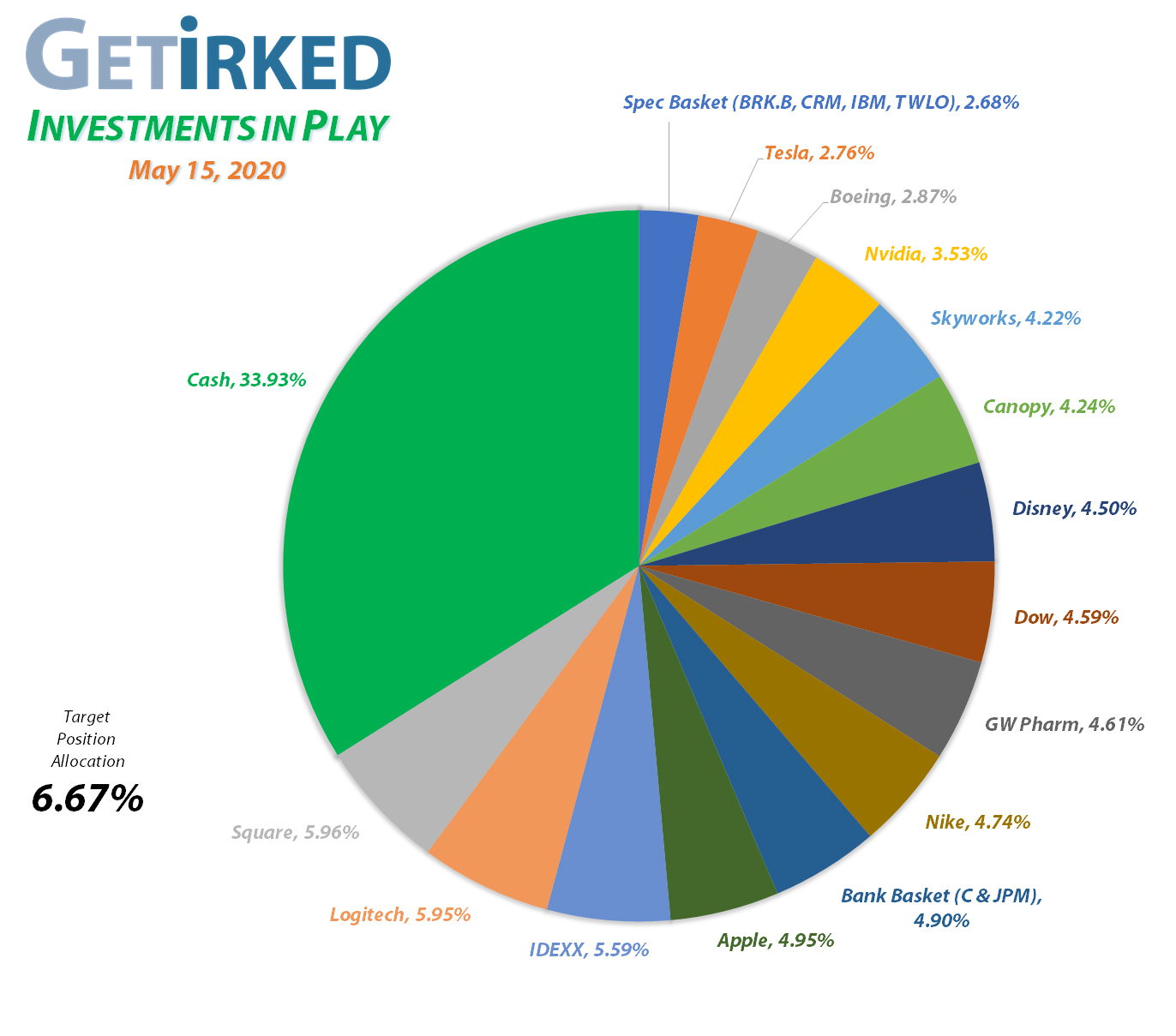

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+568.80%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+502.12%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$119.29)*

Square (SQ)

+493.06%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (–$34.75)*

Nike (NKE)

+354.15%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.26)*

Nvidia (NVDA)

+338.45%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Disney (DIS)

+270.91%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Twilio (TWLO)*

+208.97%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IDEXX Lab (IDXX)

+136.37%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $124.54

Salesforce (CRM)

+114.39%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Tesla (TSLA)

+72.33%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

Logitech (LOGI)

+71.00%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.00

IBM (IBM)

+59.08%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Skyworks (SWKS)

+20.39%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

Berkshire (BRK.B)

+19.01%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+7.91%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.70

GW Pharm (GWPH)

+4.65%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

JP Morgan (JPM)

-5.08%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $90.50

Dow (DOW)

-17.21%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

Citigroup (C)

-21.41%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $53.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

JP Morgan Chase (JPM): Added to Position

The financials have been getting slammed pretty hard during selloffs, and with good reason seeing as how they have exposure to some of the worst sectors including real estate, consumer credit, oil loans, and more. JP Morgan (JPM), the Best-in-Breed bank, was no exception and fell through my price target on Wednesday, triggering a buy order which filled at $83.49.

The order replaces some shares I sold for $115.15 back in May 2019, locking in gains of +27.49% while lowering my per-share cost -0.49% from $90.95 to $90.50. My next buy target is near March’s lows at $78.80 with my next sell target near $120, a past point of resistance.

JPM closed the week at $85.90, up +2.89% from where I added Wednesday.

Square (SQ): Profit-Taking

Square (SQ) took off when the markets rallied off their lows on Thursday, triggering sell orders I had in place which filled at an average price $78.98 on Thursday and Friday. The sales took profits on some of the shares I bought for $45.31 on March 16, locking in gains of +74.30% in less than two months.

The sales also “lowered” my per-share cost from -$29.70 to -$34.75 (meaning I have collected the capital investment from the position plus $34.75 in profits for each share I currently hold). My next sell target is slightly over $85.00 and my next buy target is $45.50.

SQ closed the week at $80.26, up +1.62% from my average selling price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.