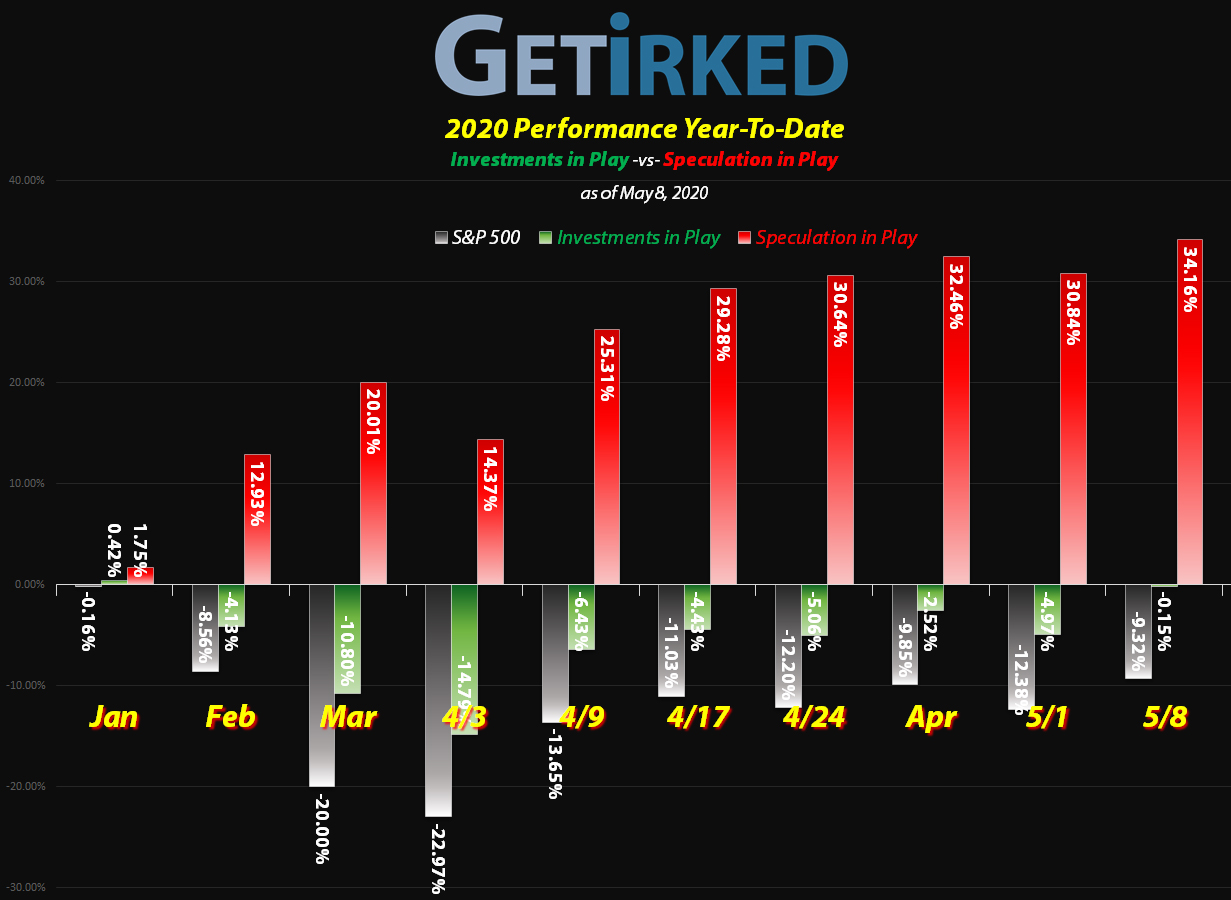

May 8, 2020

The Week’s Biggest Winner & Loser

Twilio (TWLO)

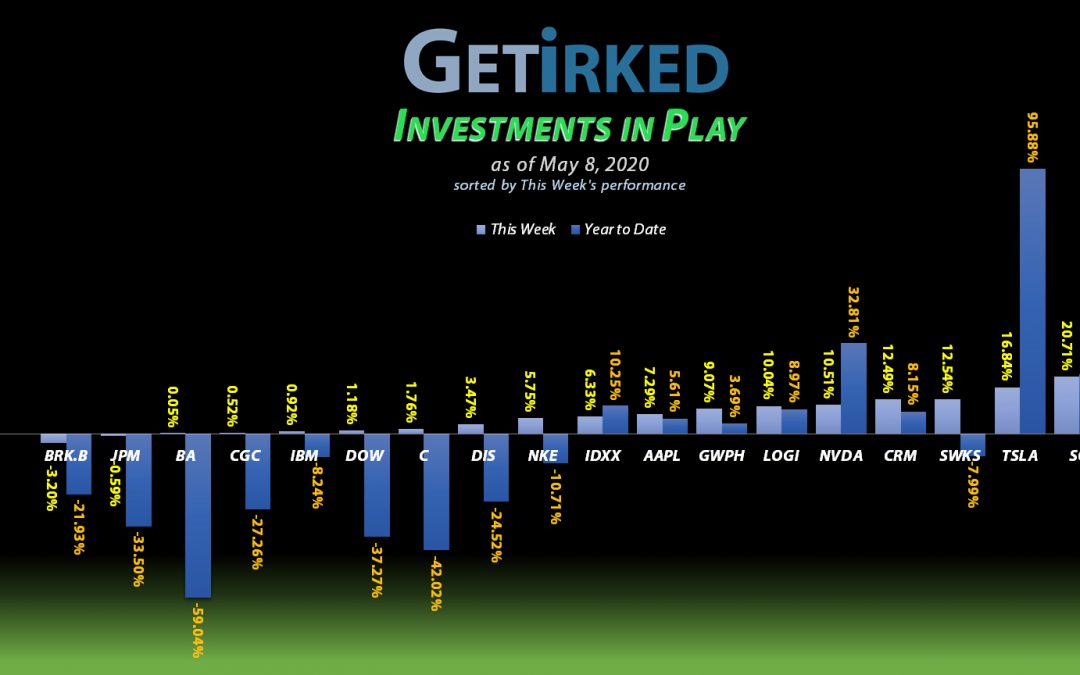

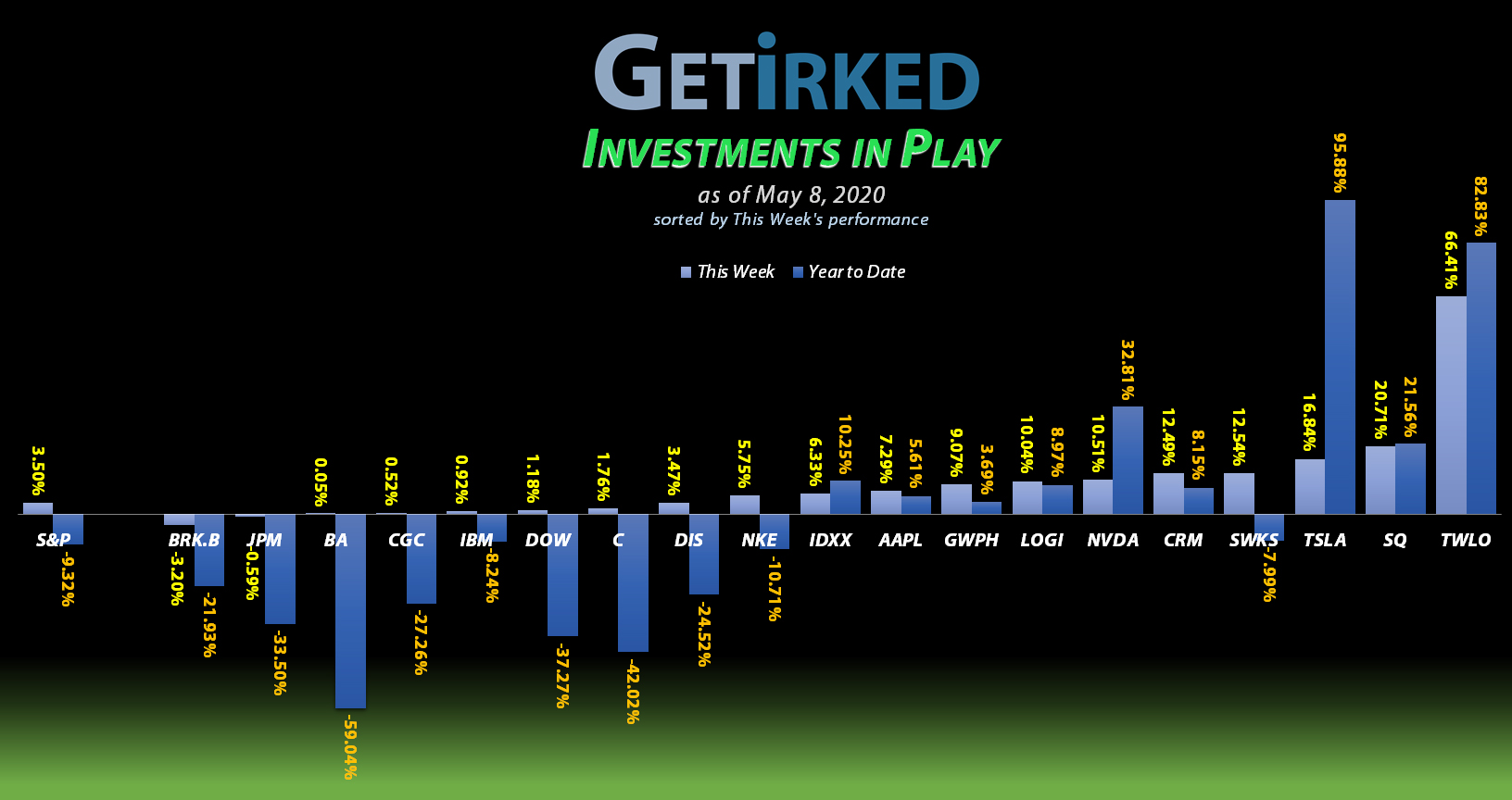

A combination of a short squeeze and an epic blowout earnings report caused Twilio (TWLO) to rocket +66.41% this week and earn gains of +82.83% Year-to-Date, almost edging out crazy Tesla (TSLA). That’s the way to earn the week’s Biggest Winner title!

Berkshire-Hathaway (BRK.B)

Maybe it was the poor earnings report? Maybe it was selling all the airline stocks at the bottom? Maybe Warren Buffett’s lost his edge?

Whatever it was, Berkshire-Hathaway (BRK.B) was a spot of red in an otherwise sea of green this week. While it was only down -3.20%, the once legendary Oracle of Omaha really found a way to snatch defeat from the jaws of victory and wins this week’s Biggest Loser title.

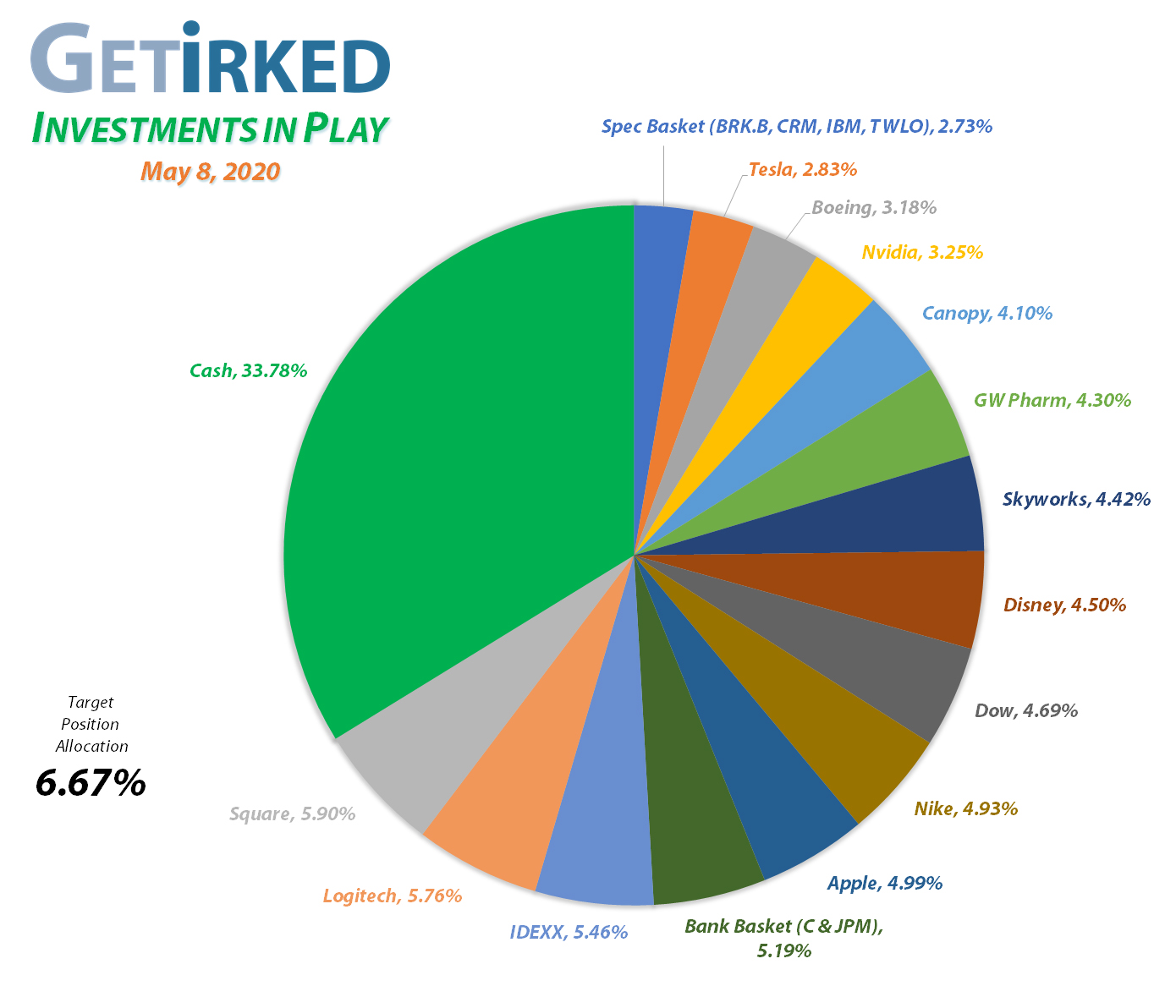

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+584.32%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$372.32)*

Apple (AAPL)

+504.96%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$119.61)*

Square (SQ)

+474.43%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (–$29.70)*

Nike (NKE)

+365.50%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.26)*

Nvidia (NVDA)

+312.56%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Disney (DIS)

+271.19%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Twilio (TWLO)*

+203.91%*

1st Buy 8/8/2019 @ $125.71

Current Per-Share: (-$16.25)*

IDEXX Lab (IDXX)

+131.17%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $124.54

Salesforce (CRM)

+120.11%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

Tesla (TSLA)

+76.69%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

IBM (IBM)

+67.25%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Logitech (LOGI)

+65.77%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.00

Skyworks (SWKS)

+26.06%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

Berkshire (BRK.B)

+24.34%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Canopy (CGC)

+4.37%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.70

JP Morgan (JPM)

+1.92%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $90.95

GW Pharm (GWPH)

-2.21%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Citigroup (C)

-13.16%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $53.34

Dow (DOW)

-15.31%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

A negative share price indicates the dollar amount of profit for each share currently held.

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

Boeing (BA): Added to Position

Boeing (BA) got smacked harder than the rest of the market during Monday’s selloff following legendary investor Warren Buffett’s comments over the weekend that he had sold all of his investments in airline stocks due to the effects of COVID-19.

Boeing triggered a buy order I had in place around $127 which filled at $126.99. The order replaces shares I sold from July 25, 2018 to April 9, 2019 for an average price of $369.67, nearly three times higher from here (an increase of 291.10%). Monday’s order “raises” my per-share cost from -$411.27 per share to -$372.32 per share.

The negative share price means each share of the stock I hold cost me nothing and represents $372.32 of overall gains added to my portfolio’s lifetime profits.

My next buy target is $103.25. Given the amount of profit I’ve taken in Boeing, I have no plans to sell shares at this time as it’s a long-term investment, and it will likely take quite some time for the airline industry to recover from here. I intend to take profits in the future likely around $370-375 followed by additional profit-taking at previous all-time highs near $440.

BA closed the week at $133.44, up +5.08% from where I added on Monday.

Logitech (LOGI): Profit-Taking

The markets continued to rally throughout the beginning of the week in hopes of the successful reopening of the U.S. economy which caused Logitech (LOGI) to fly through one of my sell targets at $48.50 on Tuesday.

The sale locked in +54.61% in profits on shares I bought less than two months ago on March 16 for $31.37. Tuesday’s sale also lowered my per-share cost by -3.88% from $32.25 to $31.00.

I don’t currently have additional sell targets for this long-term holding as $48.50 is precariously close to Logitech’s $49.96 all-time high and I believe we might be in for a breakout to higher-highs from here. My next buy target is near the 2018’s selloff lows at $29.13.

LOGI closed the week at $51.39, up +5.96% from where I sold on Tuesday.

Square (SQ): Profit-Taking

Despite reporting a lackluster quarterly report, Square (SQ) took off with the rest of the market on Thursday when Paypal (PYPL), a payment competitor to Square, reported a blowout quarter after-the-bell on Wednesday.

I took profits in Square on Thursday with an average price of $70.89, selling some shares I bought on March 18 for $34.52 and locking in +105.36% in profits in less than two months. The sale reduced my profit-per-share (“cost”) from -$25.42 to -$29.70 (each share I hold netted me $29.70 in profits in addition to the cost of the share itself). My next sell target is $78.45 and my next buy target is way down at $42.60.

SQ closed the week at $76.05, up +7.28% from where I sold on Thursday.

Twilio (TWLO): Profit-Taking

Twilio (TWLO) reported a positively insane quarter Wednesday after-the-bell and exploded more than +30% during trading on Thursday, leading me to take profits (and my entire capital investment) out of the stock with a sale price of $159.59 during Thursday trading.

Thursday’s sale sells some shares I bought back on March 12 for $77.00, locking in +107.26% in gains in less than two months, removes all of the capital investment I had in the position, and reduces my per-share cost from $42.36 to -$16.25 (meaning I have now received $16.25 in profit for every share I still hold in the portfolio).

I have no additional sell targets for Twilio (TWLO) at this time. My next buy target is $105.60, a past point of resistance after a move like this.

TWLO closed the week at $179.69, up +12.59% from where I sold on Thursday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.