April 24, 2020

The Week’s Biggest Winner & Loser

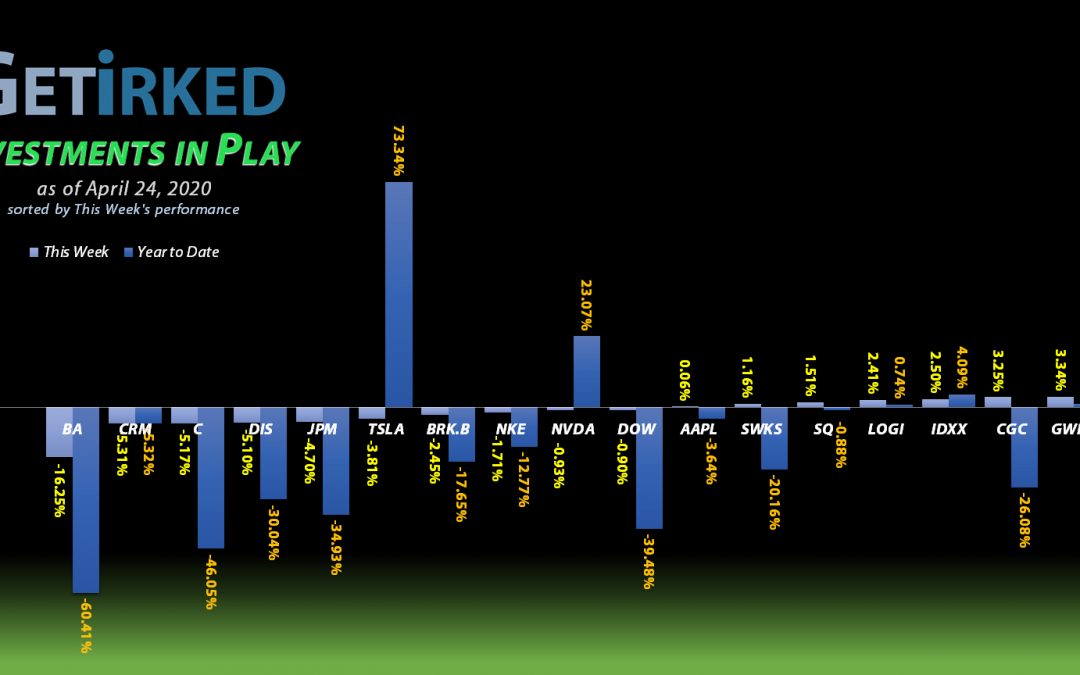

IBM (IBM)

At first, analysts thought IBM’s (IBM) earnings report wasn’t so hot and the stock sold off. However, later in the week, investors realized that IBM’s recurring revenue stream combined with its 5.196% dividend yield at these levels makes it a heck of an investment, causing IBM to earn itself the Biggest Winner position with a +3.83% weekly gain.

Boeing (BA)

Boeing (BA) couldn’t have more working against it if it tried – the FAA still hasn’t approved the 737-Max and COVID-19 has caused Boeing to push back its fix-date, the collapse of airlines has caused many of them to cancel orders, and Boeing’s cash-strapped to pay its pensioners. All this resulted in a whopping -16.25% loss for the week, an epic -60.41% Year-To-Date loss, and its position as the week’s Biggest Loser.

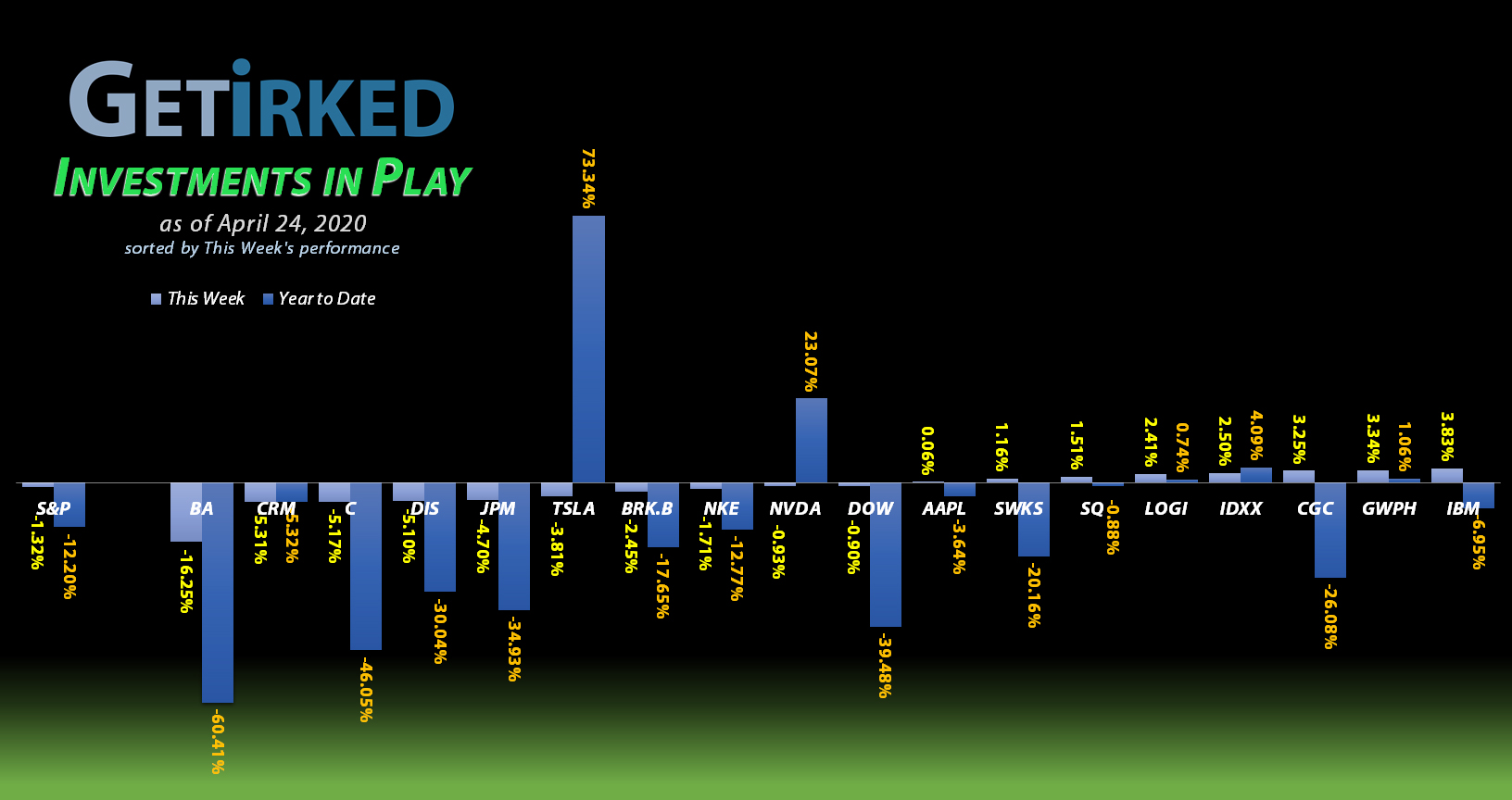

Portfolio Allocation

Positions

%

Target Position Size

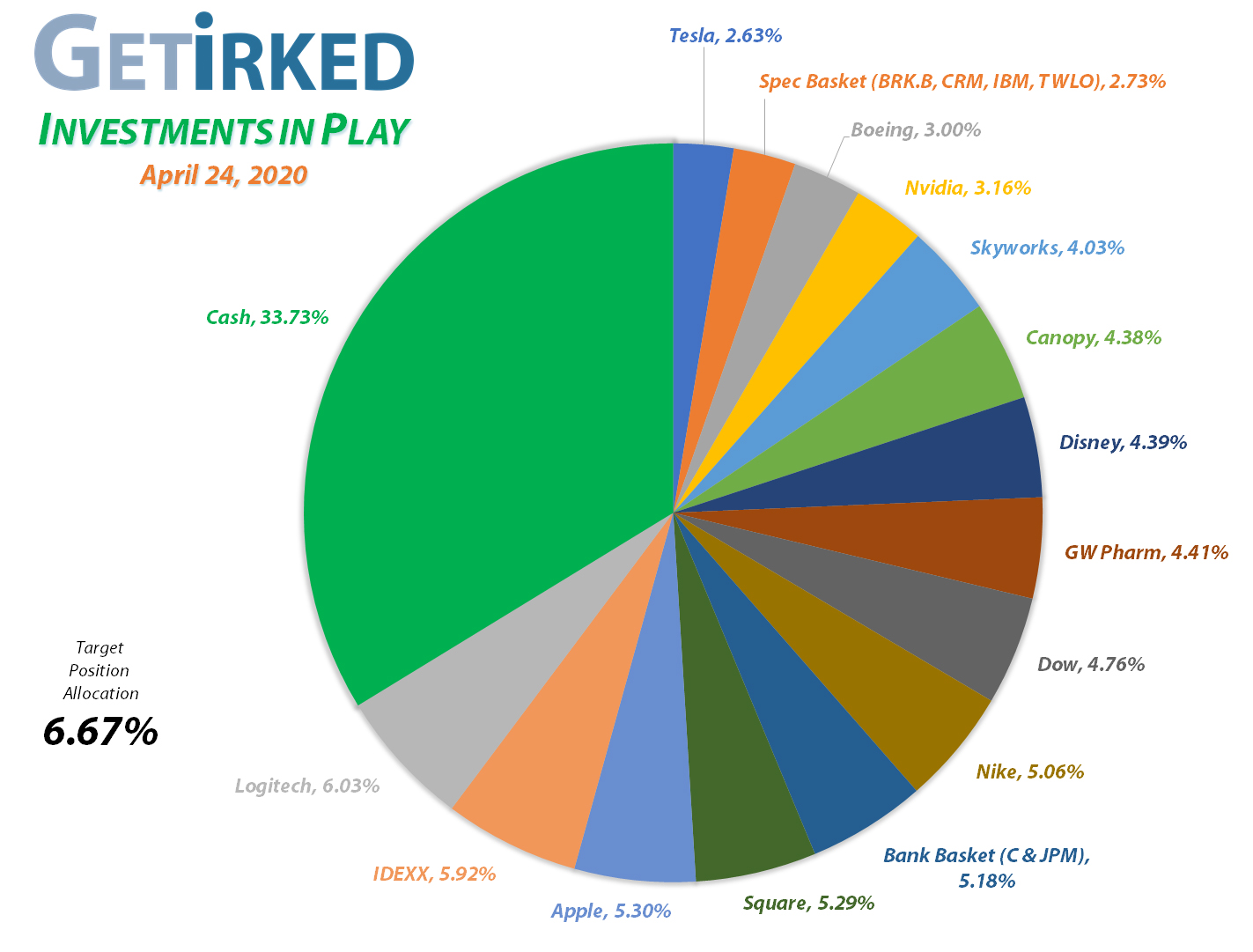

Current Position Performance

Boeing (BA)

+579.00%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$411.21)*

Apple (AAPL)

+471.91%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$79.73)*

Square (SQ)

+409.67%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (–$25.42)*

Nike (NKE)

+358.66%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.26)*

Nvidia (NVDA)

+290.69%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Disney (DIS)

+251.39%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Twilio (TWLO)

+159.54%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $42.36

IDEXX Lab (IDXX)

+98.24%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $137.11

Salesforce (CRM)

+92.68%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

IBM (IBM)

+69.60%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Tesla (TSLA)

+56.37%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

Logitech (LOGI)

+47.32%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.25

Berkshire (BRK.B)

+31.15%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Skyworks (SWKS)

+9.39%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

Canopy (CGC)

+6.07%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.70

JP Morgan (JPM)

-1.22%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $91.83

GW Pharm (GWPH)

-4.69%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Dow (DOW)

-18.30%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

Citigroup (C)

-19.20%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $53.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

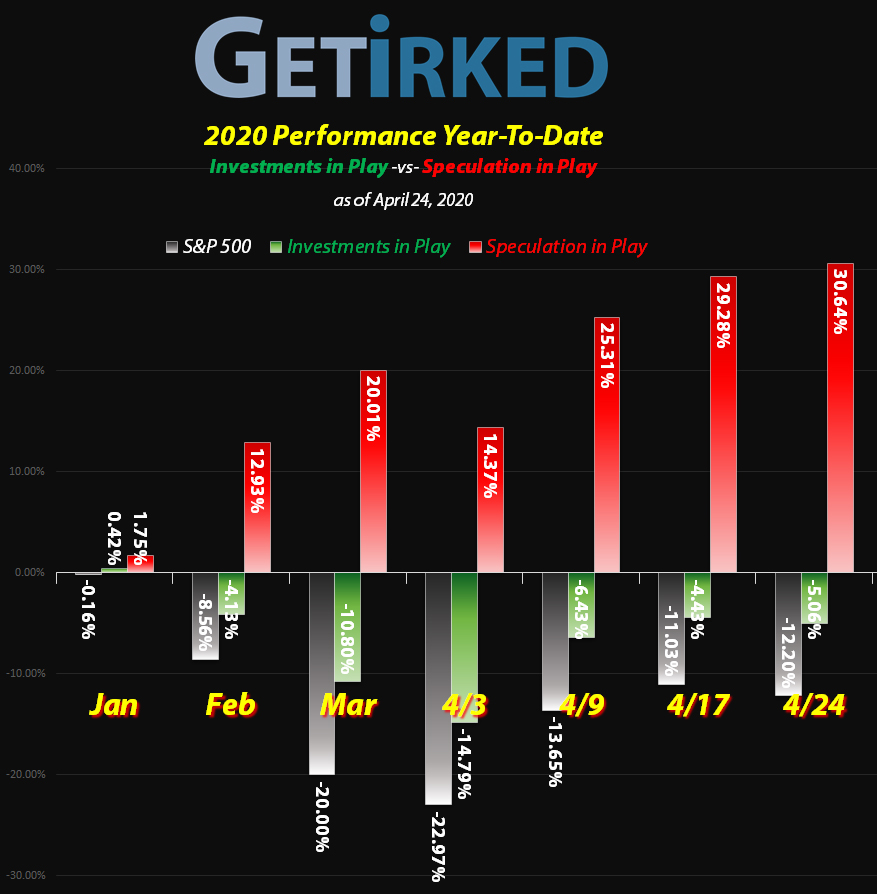

This Week’s Moves

No Moves This Week!

There’s a trading adage for everything and this week’s no exception – when you don’t know what to do, the best thing to do is nothing at all.

Medical professionals want to keep the world locked down. Governors want to open the world back up. President Trump wants us all to drink bleach and lie in tanning beds.

What’s going on here?!

The complete confusion of how to continue the fight against the COVID-19 novel coronavirus showed itself fully in the stock market this week which sold off at first due to the confusion over the oil futures contract expiration on Tuesday, and then rallied to pretty much finish the week flat.

With Georgia just opening its businesses (only the most dangerous ones) on Friday, the potential for a relapse of the virus could cause a huge selloff. With a number of companies testing drug treatments, the market could skyrocket on good treatment news.

We’re in No Man’s Land.

If the market heads higher, it will be time to take profits on key positions at key levels. If the market heads lower, I’ll start eyeing favorites to add to.

In the meantime, let’s just Netflix (NFLX) and chill.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.