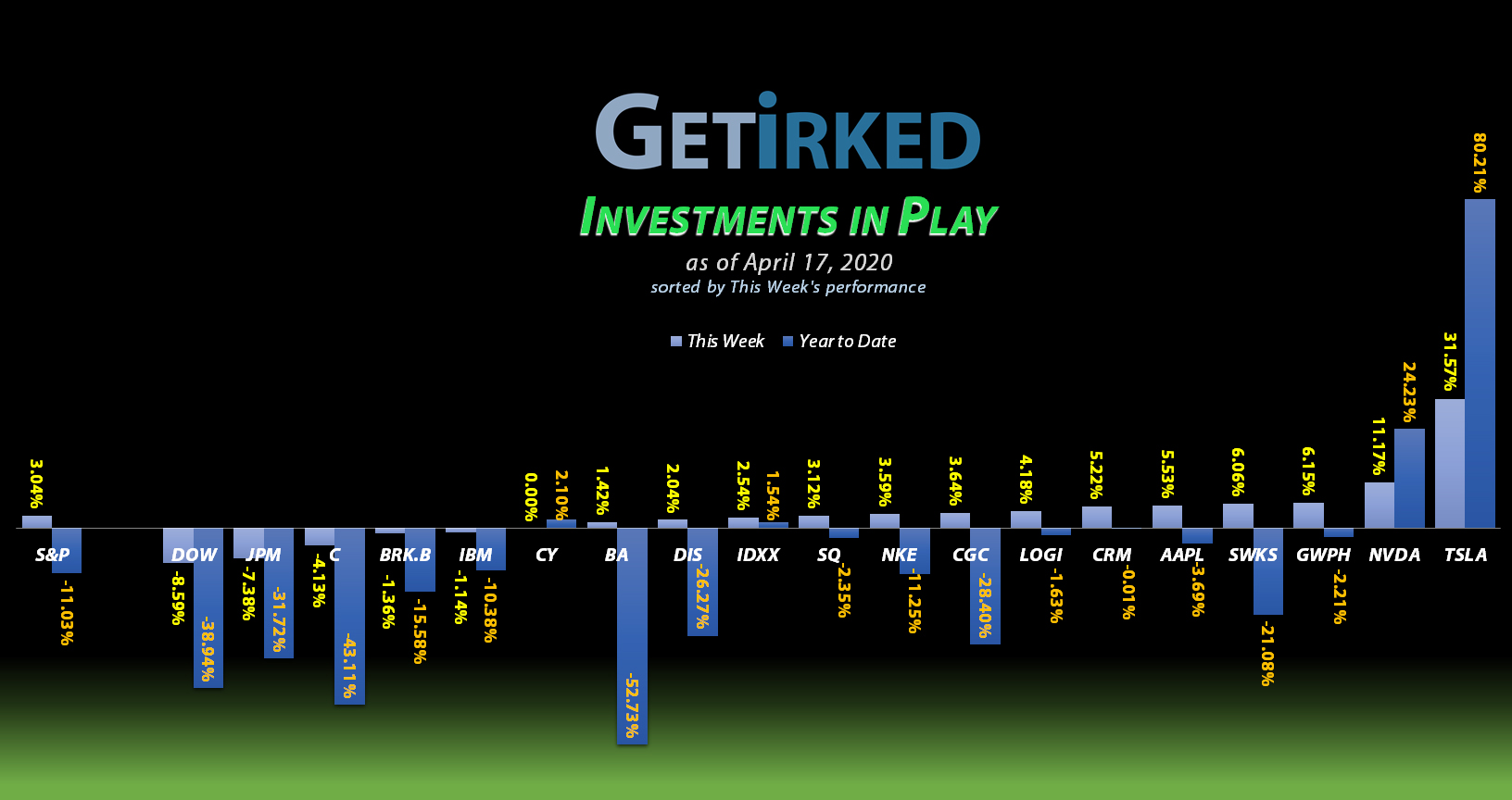

April 17, 2020

The Week’s Biggest Winner & Loser

Tesla (TSLA)

Tesla (TSLA) is perhaps the most appropriately-named stock in the market since, man, it is a lightning rod earning +31.57% in a week and currently one of only four stocks in the portfolio up for the year with a +80.21% gain.

Way to go, Elon, your company definitely earned this week’s Biggest Winner!

Dow Chemical (DOW)

Dow Chemical (DOW) has so many things working against it from China exposure to being the opposite of a recession-proof stock, it’s no wonder that it’s the week’s Biggest Loser down -8.59% for the week.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+605.82%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$411.21)*

Apple (AAPL)

+471.68%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$79.73)*

Square (SQ)

+405.36%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (–$25.42)*

Nike (NKE)

+363.70%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.26)*

Nvidia (NVDA)

+293.30%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$15.00)*

Cypress Semi (CY)

+269.26%*

1st Buy 4/6/2016 @ $8.20

*Closed on April 17, 2020*

Disney (DIS)

+264.90%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Twilio (TWLO)

+154.65%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $42.36

Salesforce (CRM)

+103.05%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

IDEXX Lab (IDXX)

+93.40%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $137.11

IBM (IBM)

+63.35%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Tesla (TSLA)

+62.56%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

Logitech (LOGI)

+43.84%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.25

Berkshire (BRK.B)

+34.44%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Skyworks (SWKS)

+8.13%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

JP Morgan (JPM)

+3.64%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $91.83

Canopy (CGC)

+2.74%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.70

GW Pharm (GWPH)

-7.77%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

Dow (DOW)

-17.56%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

Citigroup (C)

-14.79%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $53.34

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

Cypress Semiconductor (CY): *Position Closed: +269.26%*

German semiconductor giant, Infineon Technologies, announced the closing of its acquisition of Get Irked long-time favorite Cypress Semiconductor (CY) on Friday, permanently closing the position in my portfolio as the NASDAQ pulled Cypress Semi from its listings.

I re-entered Cypress back at the beginning of March when news that Trump might try to block the deal caused the stock to lose more than 40% of its value in a few days. I re-opened my position with a buy at $15.50 on March 9. Mere hours after my buy order, news broke that the deal would go through and Cypress jumped back over $22.50 a share in after-hours.

Following the NASDAQ closing my position on Friday, my average sell price was $23.07, locking in a +48.83% gain in a little over a month. Not too shabby.

The closure of Cypress also reduces my Speculative Basket to four positions: Berkshire Hathaway (BRK.B), Salesforce (CRM), IBM (IBM), and Twilio (TWLO).

I first bought Cypress Semiconductor nearly exactly four years ago to the day on April 6, 2016 at $8.20 a share. Over the life of the position, I made a final gain of 269.26% on my initial investment, an average gain of 67.31% per year.

Farewell, Cypress Semi, you were one of the greats!

Nvidia (NVDA): Profit-Taking

A combination of an incredibly exuberant and frothy market and excellent sales in the data server sector, Nvidia (NVDA) continued to rocket higher this week, leading me to take +43.19% in profits on Tuesday at $278.17 on shares I bought less than a month ago at $194.26.

I don’t have additional sell targets from here as the sale of those shares once again pulled my investment capital out of the position. I do intend to add back to my position if Nvidia pulls back to $202.35, a 78.6% retracement of its current move from March’s low.

NVDA closed the week at $292.32, up +5.09% from where I sold on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.