March 20, 2020

The Week’s Biggest Winner & Loser

Logitech (LOGI)

Logitech (LOGI) had a positively INSANE week with a 42.5%+ spread from its weekly low to its weekly high earning +13.6% week-over-week after all was said and done and easily landing the week’s Biggest Winner spot.

Boeing (BA)

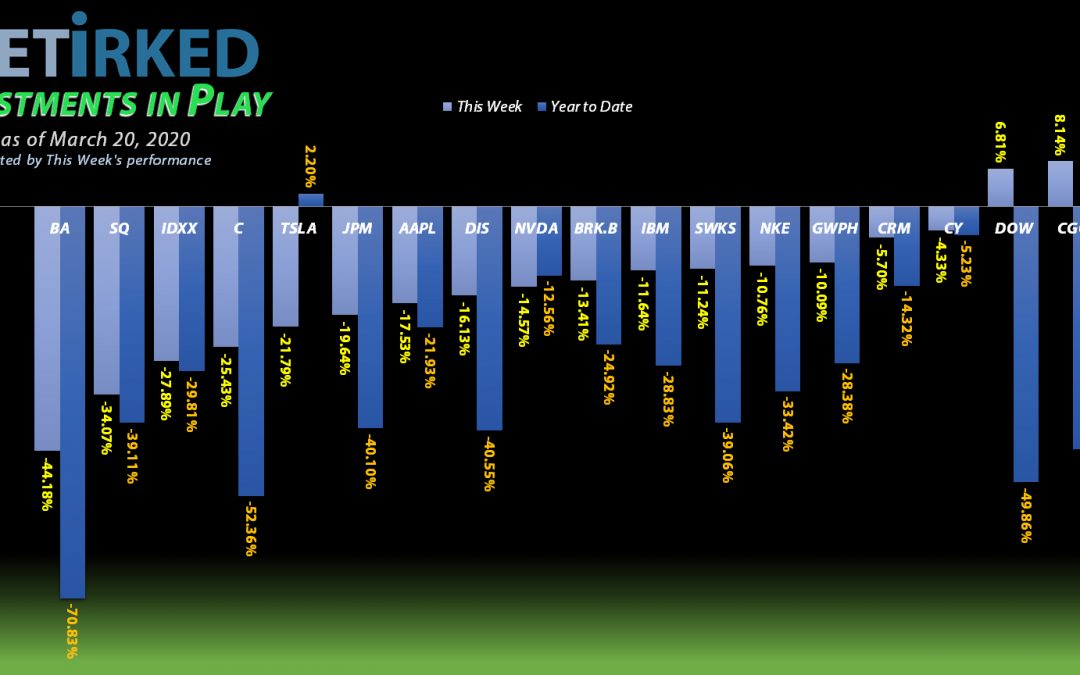

After Boeing (BA) had to seek government assistance to help cover its pension payments and nearly nonexistent cashflow, Boeing collapsed an insane -44.18% for a mind-blowing -70.83% YTD loss. Not only is BA our Biggest Loser, it’s a No-Touch until we hear what the government does or does not do for the company.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+542.59%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$411.21)*

Apple (AAPL)

+402.00%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$79.73)*

Square (SQ)

+292.82%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$21.85)*

Nike (NKE)

+289.72%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$27.13)*

Disney (DIS)

+213.60%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $22.28**

Nvidia (NVDA)

+199.07%**

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $26.77**

Cypress Semi (CY)

+168.39%*

1st Buy 4/6/2016 @ $8.20

Current Per-Share: (-$324.43)*

Twilio (TWLO)

+98.62%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $42.36

Salesforce (CRM)

+74.38%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $79.91

IDEXX Lab (IDXX)

+36.68%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $134.10

Logitech (LOGI)

+29.80%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.25

IBM (IBM)

+29.72%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $73.54

Berkshire (BRK.B)

+19.58%

1st Buy 8/2/2019 @ $199.96

Current Per-Share: $142.22

Tesla (TSLA)

-7.81%

1st Buy 3/12/2020 @ $556.49

Current Per-Share: $463.75

JP Morgan (JPM)

-9.08%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $91.83

Skyworks (SWKS)

-16.50%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $88.23

Canopy (CGC)

-19.51%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $14.70

Citigroup (C)

-28.65%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $53.34

Dow (DOW)

-32.31%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $40.54

GW Pharm (GWPH)

-32.45%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $110.87

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** For more accurate profit %, positions with extremely reduced per-share costs are calculated in the same manner as positions with sold capital investment.

This Week’s Moves

Apple (AAPL): Added to Position

Apple (AAPL) had put on a good show holding the $240 mark repeatedly this week, but it finally lost all support on Friday, dropping through a buy order I had which filled at $232.97.

The order replaces shares I sold in October 2019 at $248.27, a discount of -6.16% on their replacement. My next buy target for AAPL is under $200 at $192.70.

AAPL closed the week at $229.24, down -1.60% from where I added Friday.

Berkshire-Hathaway (BRK.B): *Back in Play*

While reviewing possibilities for my Long-Term Speculative Basket over the weekend, I noticed that Berkshire-Hathaway (BRK.B) had dropped nearly -25% from its $231.61 all-time high earlier this year and nearly -20% from where I closed the position in December.

As a reminder, the positions in my Long-Term Speculative Basket share a single allocation between all of the positions in the basket (currently 5 companies: Berkshire (BRK.B), Salesforce (CRM), Cypress Semiconductor (CY), IBM (IBM), and Twilio (TWLO)).

Using the profits I collected from my first round, I reopened my Berkshire position when the stock broke through $175.00 on Monday using a limit order which filled at $175.00, giving me a $142.22 per-share price.

While I don’t expect it to get this low, my next buy price target is $136.75.

BRK.B closed the week at $170.06, down -2.82% from where I opened Monday.

Canopy Growth Corporation (CGC): Added to Position

Canopy Growth Corporation (CGC) crashed through the $10.00 mark, all the way down to trigger a buy order I had in place to add some shares at $9.34 during Wednesday’s all-out free-fall.

The order lowered my per-share cost by -8.01% from $15.98 to $14.70. My next price target is much lower at $6.68, a past point of support.

CGC closed the week at $11.83, up +26.66% from where I added Wednesday.

Citigroup (C): Added to Position

Thanks to the Federal Reserve cutting the interest rate to zero on Sunday, the financials got hit particularly hard on Monday with Citigroup (C) getting hit the most what with both its significant international exposure as well as its larger (but not by much) oil exposure.

That being said, the banks are not in danger of going out of business during this crisis like they were in 2008. And when Citigroup dropped below $40.00, its dividend yield has risen to nearly 5%. Insane.

Throughout the week, I used a series of limit orders at key levels to add to my position with an average $37.20 buying price. The orders lowered my per-share cost -6.08% from $56.79 to $53.34. My next buy price target is still lower from these levels at $30.58.

C closed the week at $38.06, up +2.31% from my average buy price.

Disney (DIS): Added to Position

With no live sports for ESPN, theme parks all shut down, and no movie release schedule to speak of, Disney (DIS) got hit hard on Wednesday following the announcement that the company would postpone the launch its hotly-anticipated Black Widow movie from May 1.

To make matters worse, the delay of the launch will delay the entire slate of Marvel movies Disney has in the works, a huge money-earner for the business.

Disney dropped through a price target of mine Wednesday with a buy order filling at $86.39. The order replaces some of the shares I sold in February 2019 at $110.38, a discount of -21.73% on their replacement. My next buy price target for Disney is $78.60.

DIS closed the week at $85.98, down -0.47% from where I bought Wednesday.

IDEXX Laboratories (IDXX): Added to Position

After missing IDEXX Labs’ (IDXX) drop below $230.00 last week, I decided to up my price target and got filled on Monday at $233.09, a bit higher than where I would have liked.

Later in the week, however, all hell broke loose and IDEXX lost all support, collapsing through the $200.00 mark where another order of mine filled at $190.27, giving me an average buying price of $211.68 for the week.

The orders replaced shares I sold back in May 2019 at $248.06, giving me a -14.67% reduction in their replacement. My next buy target for the stock is its December 2018 low around $176.25.

IDXX closed the week at $183.29, down -13.41% from my average buy price.

JP Morgan (JPM): Added to Position

JP Morgan (JPM) has shown pretty incredible resiliency during this pandemic sell-off, however all of that went out the window on Wednesday when it crashed to new lows, triggering a buy order I had in place at $82.27.

The order lowered my per-share cost just -0.72% from $92.50 to $91.83 as I’m adding slowly to the banks on the way down. I believe there’s significantly further to fall, but their dividend yield grows on the way down, so it softens the blow of losses… if only slightly. My next price target to buy is $71.60.

JPM closed the week at $83.50, up +1.50% from where I added Wednesday.

Logitech (LOGI): Flip-Flopped???

After getting slapped with trailing-stop orders last week in Logitech (LOGI) which I was able to fix thanks to Friday’s insane relief-rally bounce, I took another stab at LOGI on Monday with a limit-order of $31.50.

This time, the safe and reliable approach worked better, filling at $31.37 a price of improvement of -0.41%, which is not bad in a volatile market. The buy lowered my per-share cost -0.67% overall from $33.00 to $32.78.

On Wednesday, Jim Cramer had Logitech’s CEO on Mad Money to talk about the stay-at-home economy (LOGI sells PC peripherals including webcams, keyboards, gaming, etc.). Thursday morning, LOGI popped more than 10% triggering one of my selling rules and requiring me to take profits in the middle of a Pandemic selloff.

I sold half of the shares I purchased just three days earlier with my order filling at $40.24, locking in a 28.28% gain and lowering my per-share cost slightly by -1.62% from $32.78 to $32.25.

The price movement has caused me to raise my next buy price target to where I purchased earlier in the week, around $31.50.

LOGI closed the week at $41.86, up +4.03% from where I sold Thursday.

Nike (NKE): Added to Position

Nike (NKE) has gone from holding up pretty well during the selloff to getting hit harder than most, thanks to its exposure to China and the consumer worldwide. On Monday, I used limit orders to pick up some shares at $64.69 – lower than Nike’s December 2018’s lows.

The shares replace ones I sold in September 2019 at $87.67, a discount of -26.21% on their replacement. My next buy price target is $62.25.

NKE closed the week at $67.45, up +4.27% from where I added Monday.

Nvidia (NVDA): Added to Position

Along with the rest of the market, Nvidia (NVDA) collapsed on Monday, falling through a buy order I had in place at $194.26. The order replaces some shares I sold in November 2019 at $212.17, a discount of -8.44% from those prices.

My next buy price target for Nvidia is $162.50, near its 50-Month Exponential Moving Average (EMA).

NVDA closed the week at $205.75, up +5.91% from where I added Monday.

Salesforce (CRM): Added to Position

Salesforce (CRM) completely broke down on Monday, careening through the $130 mark and triggering a buy order I had in place at $128.83.

The order replaces some of the shares I sold when I closed the position in December at an average price of $160.19, locking in a -19.58% discount on those shares. My next buy target is near CRM’s December 2018 low at $113.70.

CRM closed the week at $139.35, up +8.17% from where I added Monday.

Skyworks Technologies (SWKS): Added to Position

When the market futures went limit-down on Sunday, I put in a limit order to buy Skyworks Technology on Monday which filled at $72.69. The buy lowered my per-share cost -5.84% from $93.70 to $88.23.

At these prices, Skyworks’ dividend yield has risen above 2.25% which makes it an even more tempting long-term play on the eventual rollout of 5G wireless technology. My next buy price target is $63.45.

SWKS closed the week at $73.67, up +1.35% from where I added Monday.

Square (SQ): Added to Position

Square (SQ) has been positively destroyed during this selloff, dropping nearly -50% from its recent highs in the $80s to break through the $50 mark on Monday.. way past the $50 mark.

Throughout the week, I added small amounts to my position on the way down, landing an overall average price of $40.68. The orders replace shares I sold back in June of last year at $68.55, locking in an insane -40.66% on their replacement.

My next buy price target for SQ is $27.20.

SQ closed the week at $38.09, down -6.37% from my average buy price.

Tesla (TSLA): Added to Position

Tesla (TSLA) has always been a live wire of a stock, and the pandemic has supercharged the insanity to “Ludicrous Mode.” I knew that going into building a position, so I have painfully wide price points to add to my position.

On Wednesday, my next price point was hit as TSLA careened through $400.00, filling my buy order for just a few shares at $371.01 before crashing even further to around $350.00. The order lowered my per-share cost by -16.67% from $556.49 to $463.75.

Given the potential damage to the U.S. economy, Tesla’s still got plenty more to fall with my next price target down at $295.00.

TSLA closed the week at $427.53, up +15.23% from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.