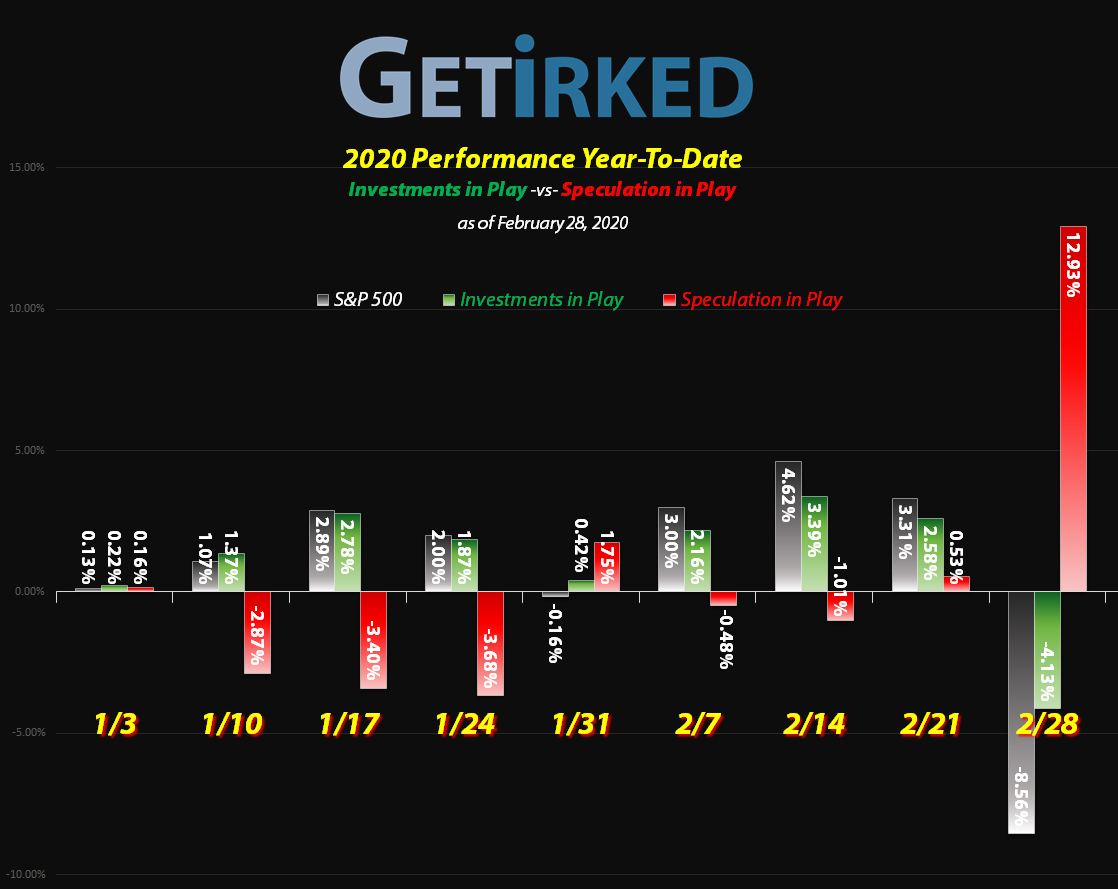

February 28, 2020

The Week’s Biggest Winner & Loser

Square (SQ)

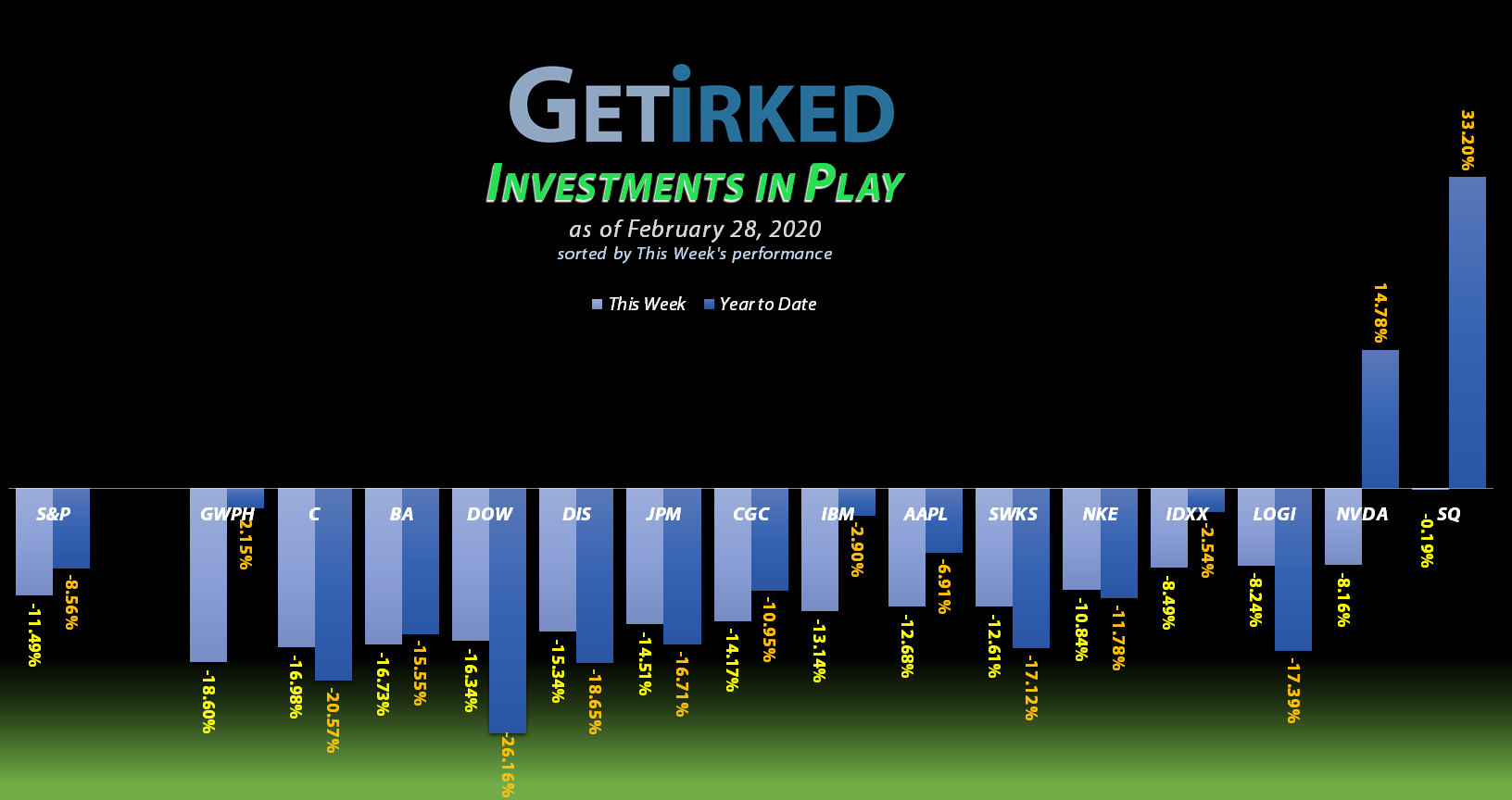

While it’s certainly a testament to Square’s (SQ) strength as a company that it only lost -0.19% in the most epic selloff week in history and still has a +33.20% YTD gain, it will always be difficult for me to call a stock that lost value the week’s “Biggest Winner.”

GW Pharma (GWPH)

In a week filled with stinkers, GW Pharma (GWPH) once again proved it can outshine all the rest, dropping an absolutely epic -18.60% in one week to earn the title of “Biggest Loser.”

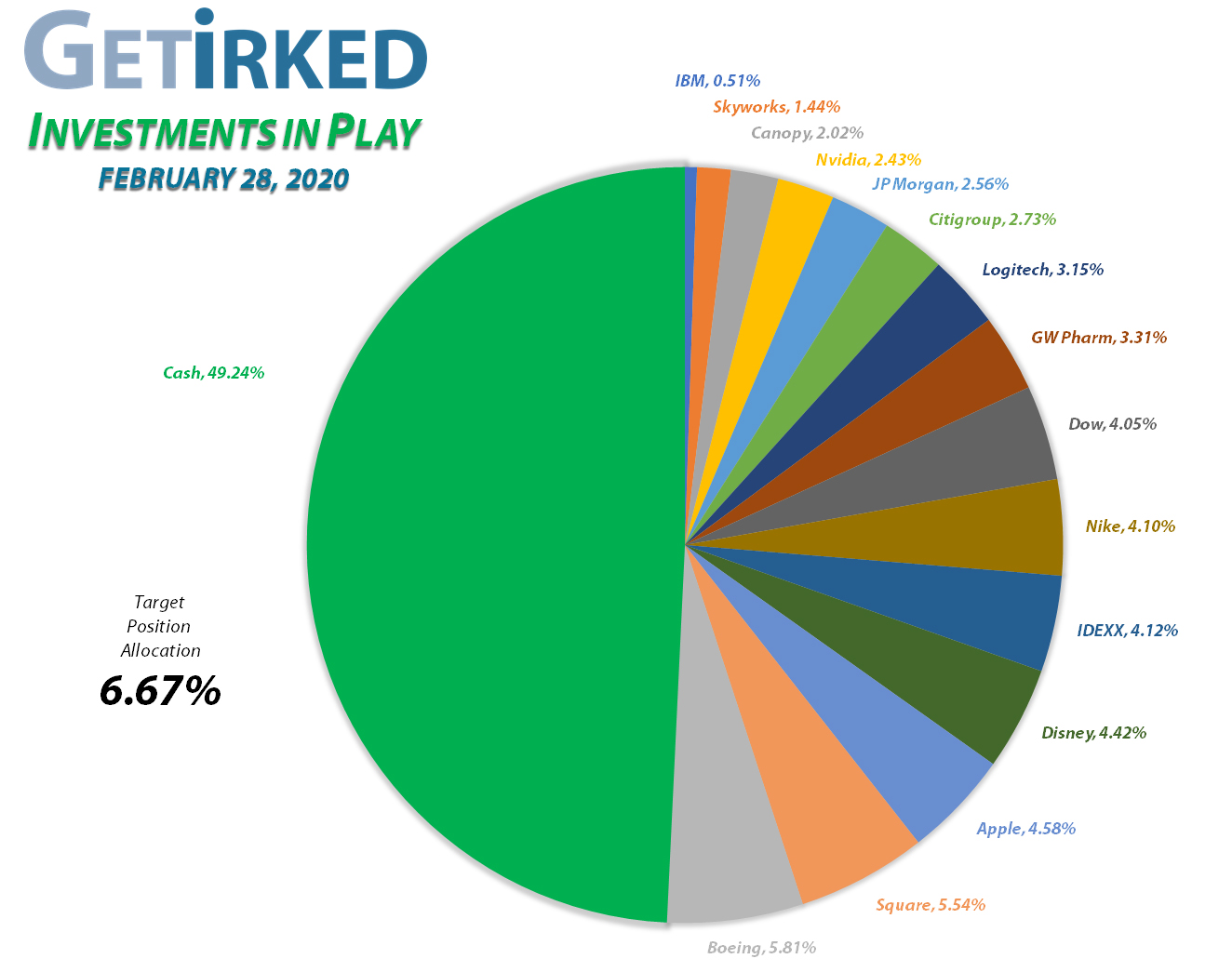

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+729.82%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$468.70)*

Square (SQ)

+468.15%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Apple (AAPL)

+454.31%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$113.27)*

Nike (NKE)

+352.14%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.87)*

Disney (DIS)

+255.63%**

1st Buy 2/14/2012 @ $41.70

Current Per-Share: $11.55**

Nvidia (NVDA)

+251.46%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-$46.12)*

IBM (IBM)

+132.85%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $38.78

IDEXX Lab (IDXX)

+117.79%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

JP Morgan (JPM)

+25.55%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $92.48

Logitech (LOGI)

+19.91%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.49

Citigroup (C)

+8.43%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.52

Canopy (CGC)

-0.86%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.94

Skyworks (SWKS)

-5.22%

1st Buy 1/31/2020 @ $113.60

Current Per-Share: $105.70

GW Pharm (GWPH)

-13.97%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.92

Dow (DOW)

-12.78%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $46.33

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

** To prevent outrageous profit %, positions with extremely low per-share costs are calculated in the same manner as positions where capital investment was sold.

This Week’s Moves

Apple (AAPL): Added to Position

Now, here’s a stock that I didn’t think I’d be able to get to drop to where I’d want to add more again – Apple (AAPL) positively collapsed in Friday’s epic panic sell-off, dropping below $260 at its lows where I was able to pick some up off the ground for $259.97.

The buy replaces shares I sold in December at $272.98, locking in a -4.77% discount, but, more importantly, buying Apple at -20.7% off its $327.85 all-time high set a few weeks ago. Now, that’s a sale.

I’m still very much playing with the house’s money in Apple with Friday’s orders “raising” my per-share cost to -$113.27 a share.

My next price target for Apple is much lower for the moment at $206.90, but I’m going to wait to see how the market shakes out before I raise it from there.

AAPL closed the week at $273.36, up +5.15% from where I added Friday.

Boeing (BA): Added to Position

I once again bought some Boeing (BA) on Tuesday when it re-tested its new level of support at $304-306. However, Boeing (BA) was absolutely blasted in Friday’s panic-induced selloff, dropping below $280 where I added some more at $277.07 for an average buying price of $291.74.

The orders once again replace shares I sold at an average price of $436.65, locking in a whopping -33.19% discount. Friday’s $277.07 represents a -20.83% reduction from February’s high of $349.95 set just two weeks ago.

This week’s orders still only put a small amount of the profits I have in this stock to work since I first bought it in 2012 at an average price of $75.28 a share. My per-share price is now -$468.70 ($468.70 worth of gains were taken out of each share I own – including the ones I replaced this week). From this point, my next price target is $256.30, near another past support area.

BA closed the week at $275.11, down -5.70% from my average buy price.

Citigroup (CITI): Added to Position

The financial sector was among the hardest hit during the selloff as dropping interest rates will eat into banks’ profits. Citigroup (C) was no exception, particularly with its substantial international exposure, and I nibbled up a small quantity on Tuesday when the selloff restarted.

The real buying started later in the week. On Thursday, Citigroup was absolutely crushed, filling additional orders to give me an average price of $67.11 over the course of the week.

The combination of buy orders throughout the week raised my per-share cost by +3.03% from $56.80 to $58.52, but replaced shares I sold at an average price of $72.52 back in 2019, effectively locking in a -7.46% discount.

Citigroup pays a dividend of $2.04 annually, giving it a decent 2.85% annual yield where I bought. My next price target for Citigroup is $60.35.

C closed the week at $63.46, down -5.44% from my average buy price.

Disney (DIS): Added to Position

The market selloff on Tuesday really began in earnest later in the day, causing Disney to drop -3% on Tuesday alone and this was following a bad Monday.

However, on Tuesday after the close, CNBC reported that Disney suddenly announced that Bob Iger, its long-running CEO would be stepping down effective immediately and that the current Head of the Parks Division, Bob Chapek, would be taking his place so Iger could manage creative.

Although I still have faith in the long-term prospects of Disney, I agree with analysts who feel Chapek is an odd choice. Although the parks are the company’s greatest source of revenue, it might have made more sense to promote the head of the streaming division, a 22-year Disney veteran, to the CEO role since Iger has repeatedly said the future of Disney is digital.

Unfortunately, my first (fortunately, small) buy order triggered on Tuesday before news of Iger’s departure after the close, filling at $128.28. After the news of Iger’s departure, I lowered my next price target and made a slightly more substantial buy during Friday’s epic sell-off, with an order that filled at $114.31, giving me an average $118.96 buying price.

While this week’s orders do put investing capital back into my position, between Disney’s long-term prospects and the elimination of so many other positions in this portfolio, I’m confident having real capital in play.

That, and my per-share cost is currently $11.55 a share thanks to profits taken after holding the stock for 7 years from $41.70 in 2012.

At any rate, I’m sticking with Disney, and my next price target to buy is $113.80.

DIS closed the week at $117.65, down -1.10% from my average buy price.

Dow Chemical (DOW): Added to Position

Following Monday’s big sell-off, I took the opportunity to add a small bit to my Dow Chemical (DOW) position when it pulled back again on Tuesday.

Just like Citigroup (C) above, the real buying started on Thursday when Dow revisited its all-time low in the $40-41 range. My orders filled at an average price of $43.61 and lowered my per-share cost -1.49% from $47.03 to $46.33.

Given the inevitable weakness in DOW’s industrial sector should we see a substantial global slowdown, I’m adding to this one very slowly, despite its $2.80 per share annual dividend which gives it nearly a 7% yield in the $40-41 range.

For the long term, I believe DOW will be integral to the Environmental-Social-Governance (ESG) play that many millennials are subscribing to – the concept that investors should only invest in companies that are good for the environment, society, and stakeholders.

While it may seem counter-intuitive, I believe DOW’s technology and scientists are going to figure out products and methods to make the company fit right in with ESG, so, although many investors think DOW’s on the outs right now, I believe its long-term prospects and potential could be huge.

My next price target for DOW is an all-new low of $36.01, calculated using technical analysis (Fibonacci Retracement) since we have no fundamental news to go on before we know more about the coronavirus.

DOW closed the week at $40.41, down -7.34% from my average buy price.

IBM (IBM): *Reopened Long-Term Speculative Play*

Following the announcement that long-time CEO Ginny Rometty would finally being stepping down along with IBM’s (IBM) new-found focus on the cloud, I’ve been wanting to re-open the position using the profits I earned from my first round with the stock from 2018-2019.

My buying opportunity came on Friday.

When IBM crash-landed through $130, I reopened the position with a small buy at $126.90 giving me a per-share cost of $38.78 when rolling in the profits from round one with the stock. The potential of a turnaround combined with a 5.1% yield where I bought on Friday makes IBM hard not to speculate on.

I plan on having a second long-term speculation play in this portfolio – Salesforce (CRM) if it drops some more – and will dedicate one allocation between the two of them, giving the portfolio 15 holdings instead of 14.

My next buy target for IBM is where it started to find support during the selloff back in December 2018 at $115.50.

IBM closed the week at $130.15, up +2.56% from my Friday re-opening.

JP Morgan (JPM): Added to Position

The banks have been particularly hard-hit during this sell-off given that the global economic slowdown is combined with low interest rates, making it hard for the financials like JP Morgan (JPM) to earn a decent return.

Given this knowledge, I’m scaling up my JP Morgan position very slowly, adding on Friday when JPM fell through $116 with an order that filled at $115.79.

The buy replaces some of the shares I sold in December at $129.31, locking in a discount of -10.47% and also capturing a -17.94% drop from JPM’s all-time high of $141.10 set just last month.

My next price target is $105.25 for yet another small buy.

JPM closed the week at $116.11, up +0.28% from where I bought Friday.

Nike (NKE): Added to Position

With its significant Chinese exposure and global growth prospects becoming severely endangered by the coronavirus, Nike (NKE) got thrown down on Friday, triggering some orders I had in place at $85.96.

The orders replace shares I sold in November at $94.95, locking in a -9.47% discount while also picking up Nike at an outlet store -18.61% discount from its $105.62 all-time high hit in January.

I’m still very much playing with the house’s money in the name, having initially built my position back in 2012 with an average buying price of $26.32 a share.

My next buy target is near a past area of support at $81.09.

NKE closed the week at $89.38, up +3.98% from where I bought Friday.

Skyworks Solutions (SWKS): Added to Position

Skyworks Solutions (SWKS) sold off with the rest of the markets this week, triggering orders I had in place to add more to the position.

My first buy orders filled on Tuesday at $110.01 nibbling very small quantities given the magnitude of the selloff. My conservative approach paid off when Skyworks was DESTROYED during Friday’s sell-off, collapsing to the low $90s where I added more substantially (but still relatively small given the total allocation) at $92.71 giving me an average buy price of $97.04.

The orders lowered my per-share cost -7.58% from $114.37 to $105.70.

Since there’s still a significant amount of uncertainty in the markets, I continue to take a conservative approach with Skyworks with my next buy target at a previous area of support slightly above the stock’s 50-month Exponential Moving Average: $85.44.

SWKS closed the week at $100.18, up +3.24% from my average buy price.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.