January 10, 2020

The Week’s Biggest Winner & Loser

Twilio (TWLO)

This week, analysts came out in droves to upgrade the cloud kings and growth stocks which caused Twilio to pop nearly +12% and earn itself the spot of the weekly’s Biggest Winner!

Dow Chemical (DOW)

With jobs reports pointing to an ever-decreasing contraction in the manufacturing sector, it’s no surprise that Dow Chemical (DOW) earned the spot of the week’s Biggest Loser, dropping -1.76% for the week to create a fairly epic -5.90% drop for 2020 in the first full week of trading,

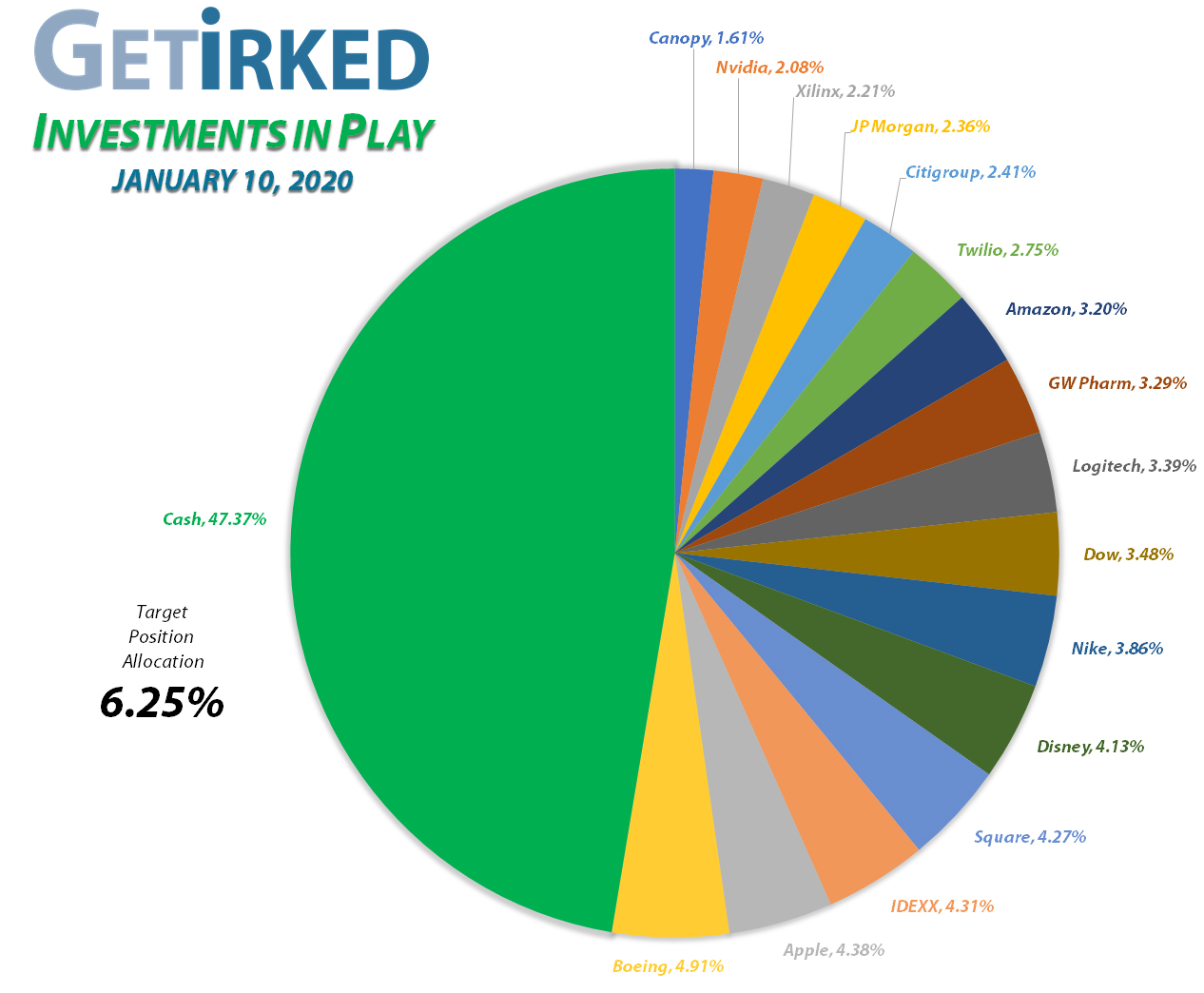

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+775.52%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$731.41)*

Apple (AAPL)

+490.63%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$158.51)*

Square (SQ)

+411.56%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Nike (NKE)

+379.11%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$61.66)*

Disney (DIS)

+279.26%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$15.25)*

Nvidia (NVDA)

+230.98%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-46.12)*

IDEXX Lab (IDXX)

+141.01%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $116.86

JP Morgan (JPM)

+56.61%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.89

Logitech (LOGI)

+49.80%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.72

Citigroup (C)

+44.88%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $54.70

Amazon (AMZN)

+16.54%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Dow (DOW)

+10.03%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $46.80

Canopy (CGC)

+9.76%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.71

Twilio (TWLO)

+7.55%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $107.61

Xilinx (XLNX)

-0.93%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $100.41

GW Pharm (GWPH)

-9.56%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.90

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

No Moves This Week

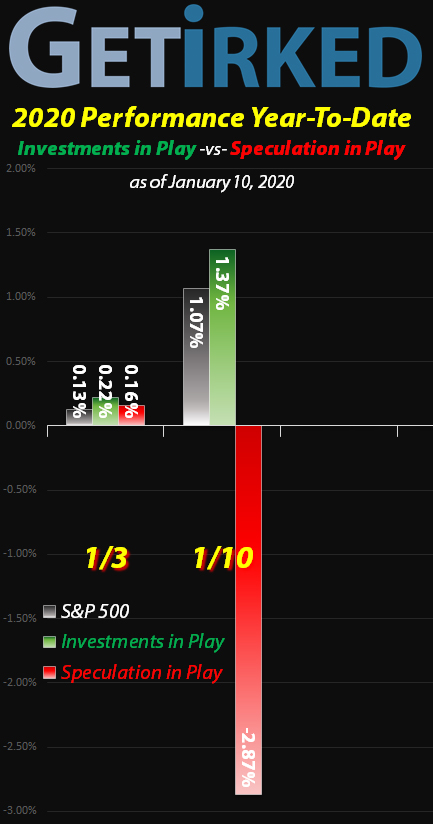

When the market’s skyrocketing with no end in sight and you’ve already taken profits in every position you hold, it’s best to sit on your hands and just watch the sparks fly.

As always, I’ll use this weekend to update my Stock Shopping List to ensure I have price targets where I’ll want to start adding to my positions. However, there’s no rush to buy anything (resist the FOMO) because the stock market is, without question, overbought at this point.

Does that mean we’re due for a huge selloff?

Not necessarily. In fact, it’s possible that the market may just calm down at some point, and move relatively sideways while it rests before the next steam higher.

The trick is this – we don’t know what the market’s going to do next.

Until it takes a break or sells off, it’s a better idea to just grab the popcorn and watch where the market takes us from here.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.