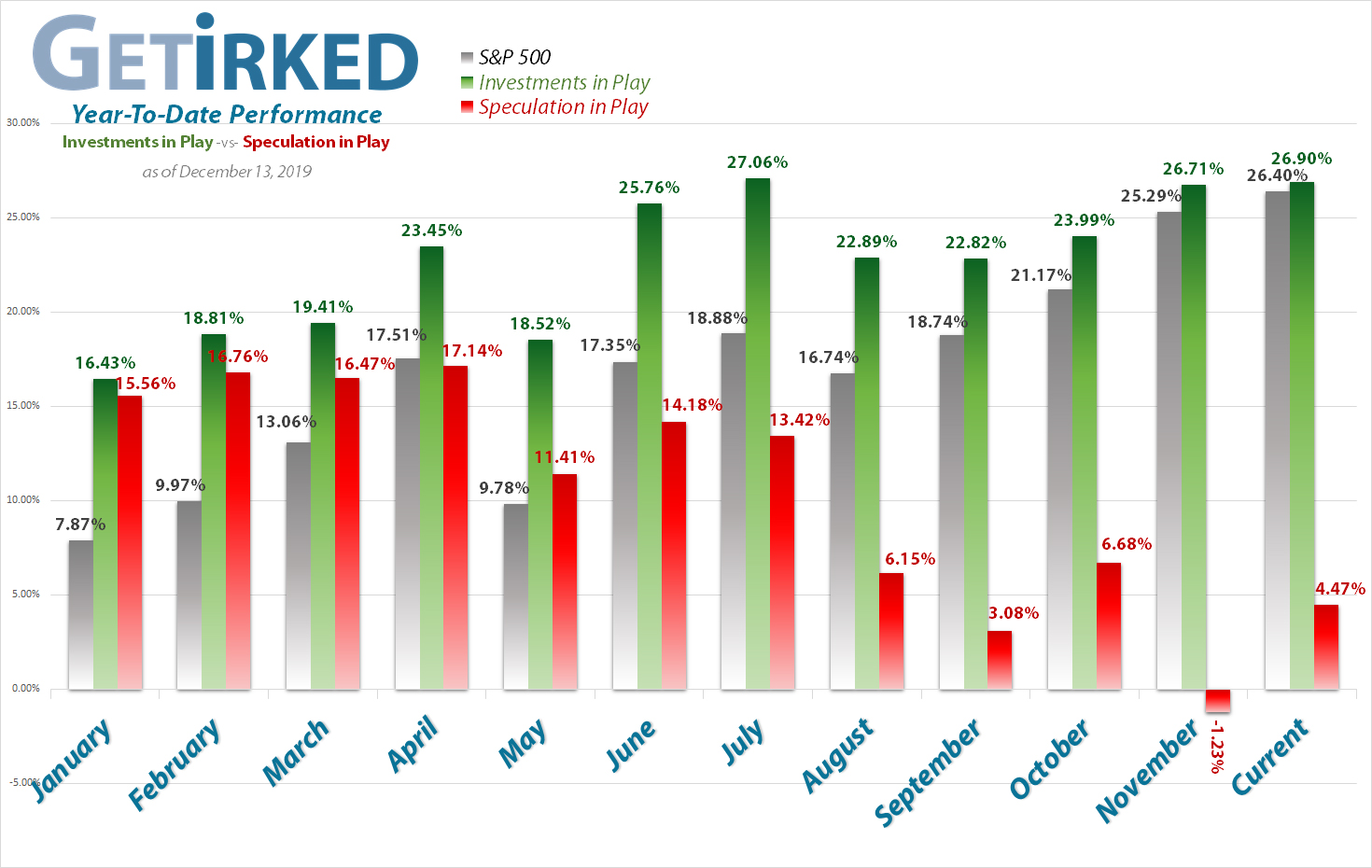

December 13, 2019

The Week’s Biggest Winner & Loser

Canopy Growth (CGC)

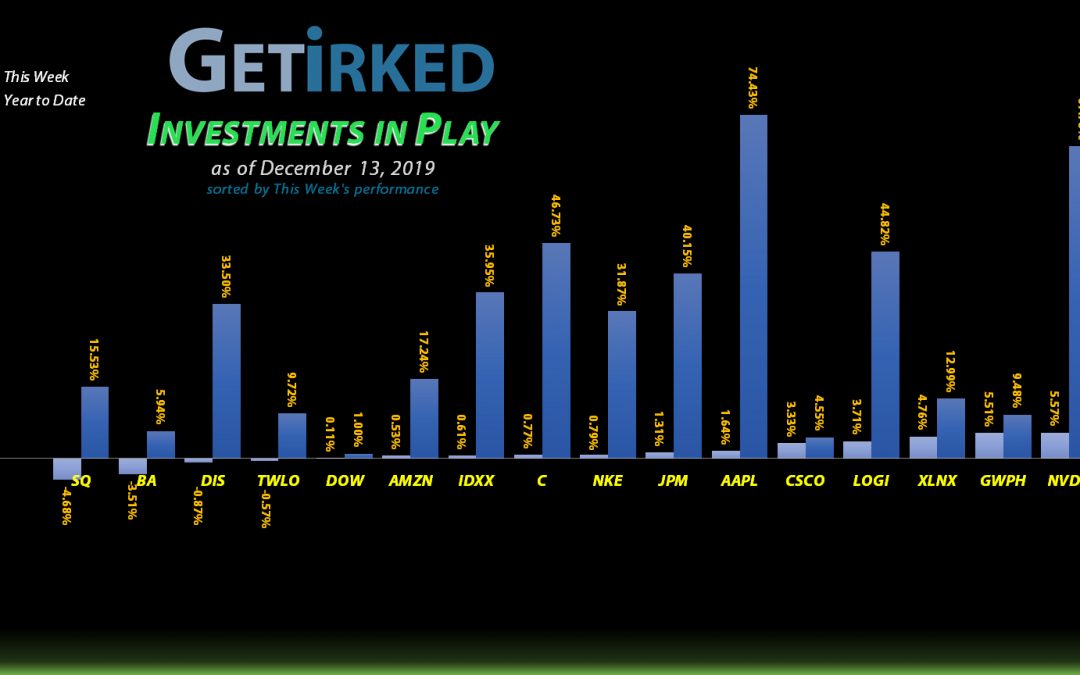

It’s amazing what having an adult in the room can do as Canopy Growth landed a permanent CEO and subsequently popped +10.88% to earn its spot as the week’s Biggest Winner.

Square (SQ)

Square (SQ) hit a bit of a rough patch this week after Paypal (PYPL) announced plans for a new competing service, causing SQ to drop -4.68% and earn itself the week’s Biggest Loser.

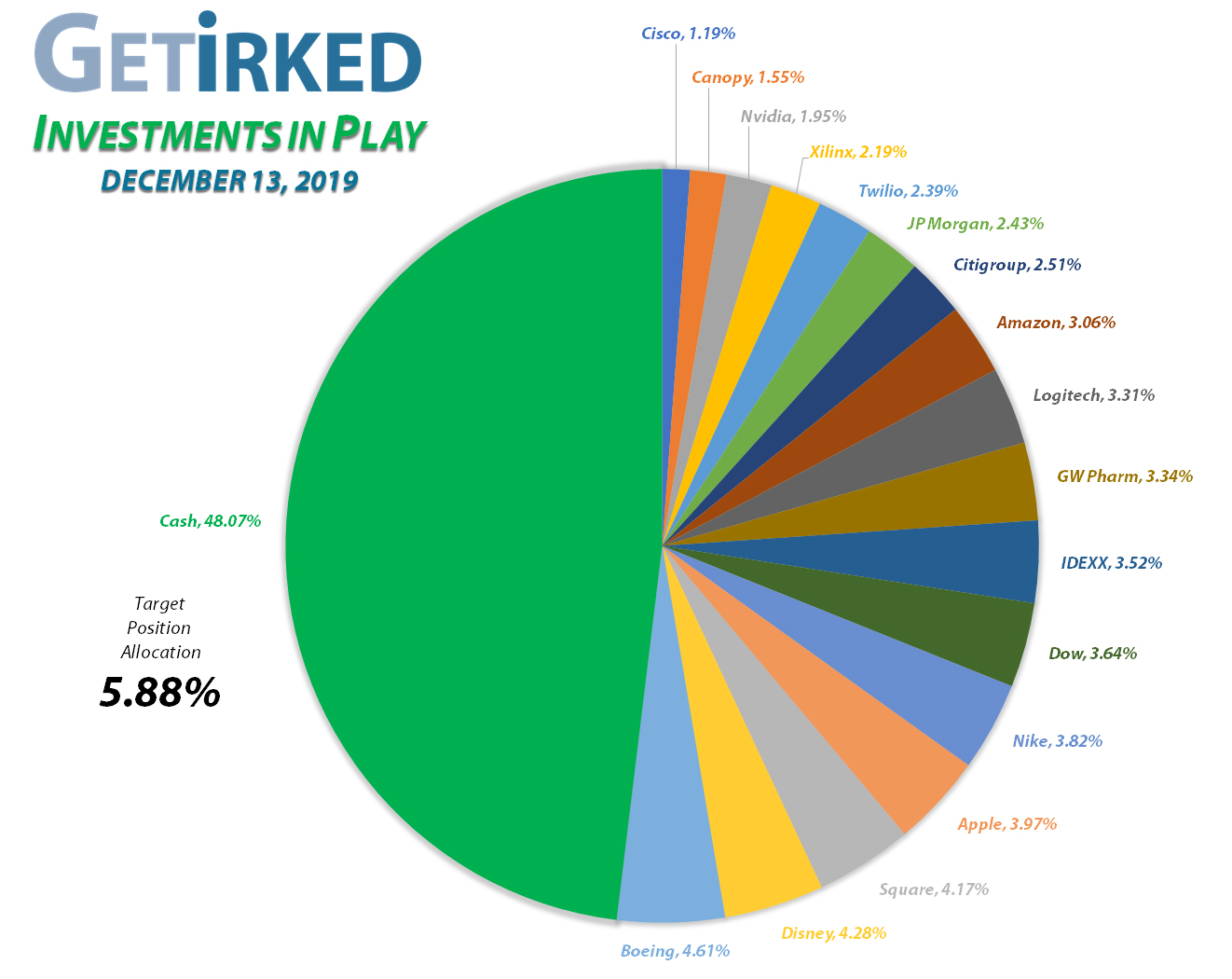

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+783.12%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$868.32)*

Apple (AAPL)

+453.82%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$158.51)*

Square (SQ)

+399.79%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$43.58)*

Nike (NKE)

+371.23%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$61.82)*

Disney (DIS)

+282.33%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$15.25)*

Nvidia (NVDA)

+214.67%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-46.15)*

IDEXX Lab (IDXX)

+154.17%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

JP Morgan (JPM)

+57.46%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $86.89

Logitech (LOGI)

+42.83%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $31.72

Citigroup (C)

+36.32%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $56.04

Dow (DOW)

+12.39%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.41

Canopy (CGC)

+10.89%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.65

Amazon (AMZN)

+8.98%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Cisco (CSCO)

-3.05%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $46.72

Xilinx (XLNX)

-4.16%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $100.41

Twilio (TWLO)

-8.95%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $107.61

GW Pharm (GWPH)

-10.32%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $118.90

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

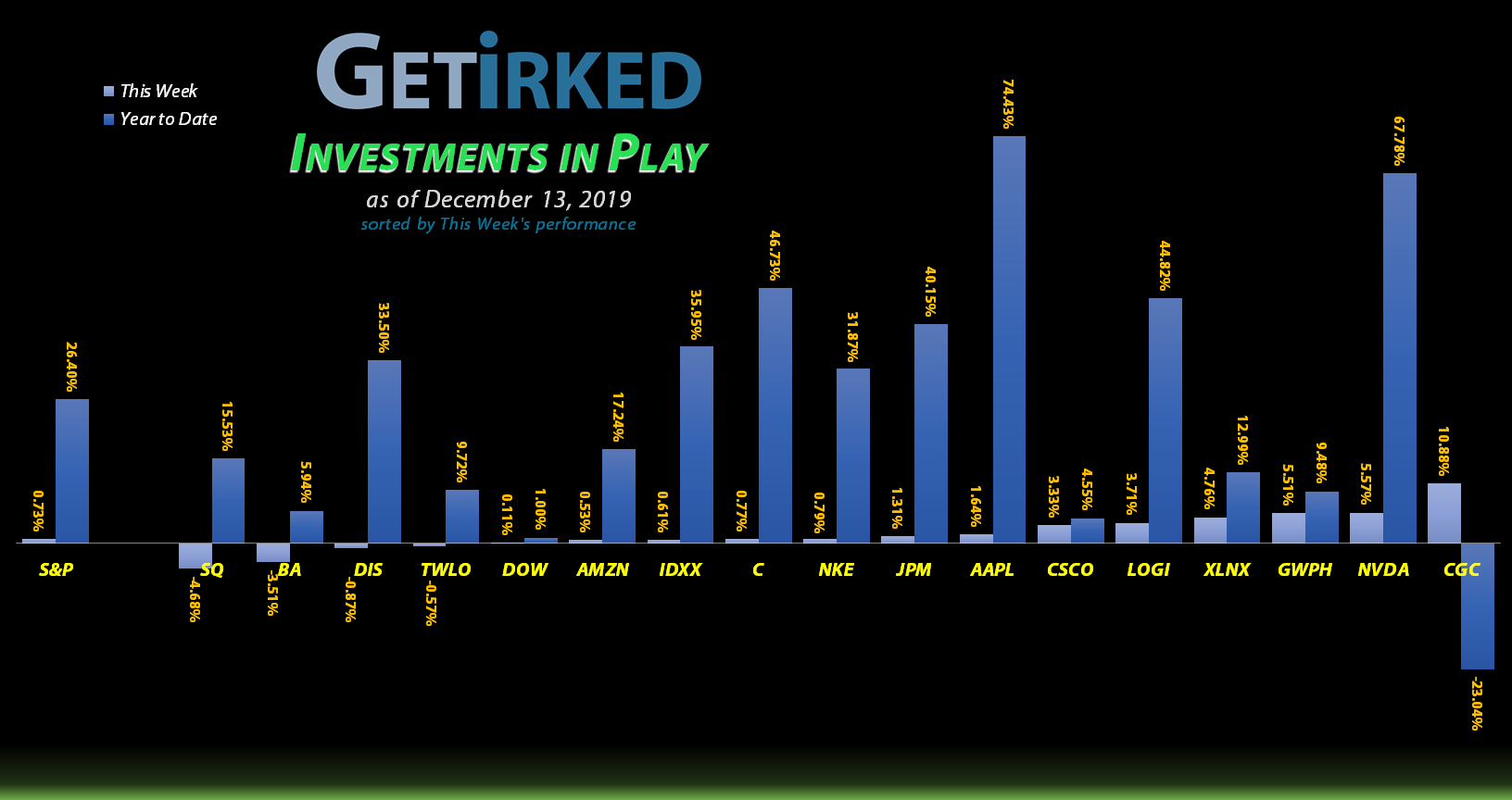

Apple (AAPL): Profit-Taking

Following Trump’s announcement on a Phase One Trade Deal and prior to China’s press conference on Friday, I took profits on some shares of my Apple (AAPL) position which was approaching overbought conditions with my average selling price at $272.98.

Apple is a long-term holding and one of my most trusted investments, so taking profits in the name is never fun for me, however I believe we’ll see a significant pullback in the coming days, weeks, or months and I hadn’t taken profits since AAPL was at $248 in October.

My next buy target for the stock is $256.35.

AAPL closed the week at $275.15, up +0.79% from where I took profits Friday.

Boeing (BA): Added to Position

Boeing (BA) fell after the FAA chief stated that the recertification process for the 737 Max would extend into 2020, reported CNBC on Wednesday.

The 737 Max is Boeing’s best-selling plane, and the company had repeatedly claimed the plane would be recertified to fly by the end of 2019 following two tragic airplane crashes which killed hundreds.

The news that the FAA has no plans to approve the plane anywhere near Boeing’s timeline sent the stock tumbling during trading.

The drop in the stock triggered a trailing-stop buy order I had in place which filled at $340.72, replacing shares I sold at $427.72, more than 20% higher. My next buy target is $324.85, slightly above a previous significant low.

BA closed the week at $341.67, up +0.28% from where I added Wednesday.

Canopy Growth Corp (CGC): Profit-Taking

Canopy Growth Corp (CGC) gapped up at the open of Monday trading after an announcement that the company finally has a permanent CEO, David Klein. Klein also serves as the CFO of Constellation Brands (STZ), the controlling-shareholder in CGC who placed Klein following poor performance and substantial losses suffered due to CGC’s original CEO and Founder who was fired in the summer of 2019.

Long story short, I used trailing stop sell orders to capitalize on the pop in the stock which filled at an average price of $21.24 throughout the week. I’m only profit-taking on a very small portion of this long-term position, so the sale only reduced my per-share cost by 0.59% from $18.76 to $18.65.

Following the positive news over the week, Canopy continues to be the #1 way to play consumer cannabis, so I’m interested in replacing the shares I’ve taken profit on. My next buy target is $19.05, slightly above my per-share cost, where I could capture 6-8% in profits while regaining some of the long-term allocation.

CGC closed the week at $20.68, down -2.64% from my average selling price.

Citigroup (C): Profit-Taking

Following Trump’s announcement on a Phase One Trade Deal and prior to China’s press conference on Friday, I took profits in Citigroup (C) which was overbought on its Relative Strength Indicator (RSI) at $77.06.

The sale lowered my per-share cost by -1.84% from $57.09 to $56.04. My next sell target is around $80.50 with my next buy target at $62.45.

C closed the week at $76.39, down -0.87% from where I took profits Friday.

JP Morgan (JPM): Profit-Taking

Like Citigroup (C), JP Morgan (JPM) has performed very well recently and become overbought in current market conditions, leading me to take profits before China’s press conference on Friday at $138.26.

The sale lowered my per-share cost by -8.82% from $94.55 to $86.89. I don’t have plans to take additional profits in JPM at this time, however my new buy target for the stock is aggressive at $128.85 as I believe JPM will continue to retain its newfound strength into the future.

JPM closed the week at $136.81, down -1.05% from where I took profits Friday.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) is my long-term play on the video game and e-sports sector, but I took profits on a few shares when it became overbought on Friday, with my average selling price filling at $45.31.

The sale lowered my per-share cost -0.97% from $32.03 to $31.72. Despite the fact it would break my per-share cost, I have significantly raised my price target to add back to Logitech to $41.95 to begin replacing shares sold in the past few months.

LOGI closed the week at $45.30, down -$0.01 from where I took profits.

Nike (NKE): Profit-Taking

Just like the other positions above, Nike’s (NKE) performance in recent weeks has been stellar, leading me to take profits on Friday prior to China’s press conference at $97.39.

My next buy target to replace the shares I’ve sold recently is at $90.45 with additional buy targets in the low $80s.

NKE closed the week at $97.77, up +0.39% from where I took profits Friday.

Nvidia (NVDA): Profit-Taking

I’m willing to bet you see a pattern forming this week. Like all the rest of the positions where I took profits, I sold some Nvidia (NVDA) when it entered overbought conditions before the China press conference on Friday, with orders filling with an average selling price of $225.61.

The sale locked in 50.72% gains on some of the shares I added to the position back in May 2019 at $149.69.

I have no plans to take further profits in NVDA at this time with my current price target to add back to the position at $200.75, a price point that I both believe that NVDA will pull back to, but also one that should provide significant support.

NVDA closed the week at $223.99, down -0.72% from where I took profits.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.