November 22, 2019

The Week’s Biggest Winner & Loser

Canopy Growth (CGC)

After a destructive seven-month sell-off the cannabis sector finally got a reprieve when the U.S. House passed a marijuana legalization bill which gave Canopy Growth a 20.09% pop to earn it Biggest Winner for the week.

Kohl’s (KSS)

It’s official – Kohl’s (KSS) isn’t a broken stock, it’s a broken company with management reporting another disastrous quarter causing the stock to drop -20%… in a day… which definitely earned it Biggest Loser for the week.

Portfolio Allocation

Positions

%

Target Position Size

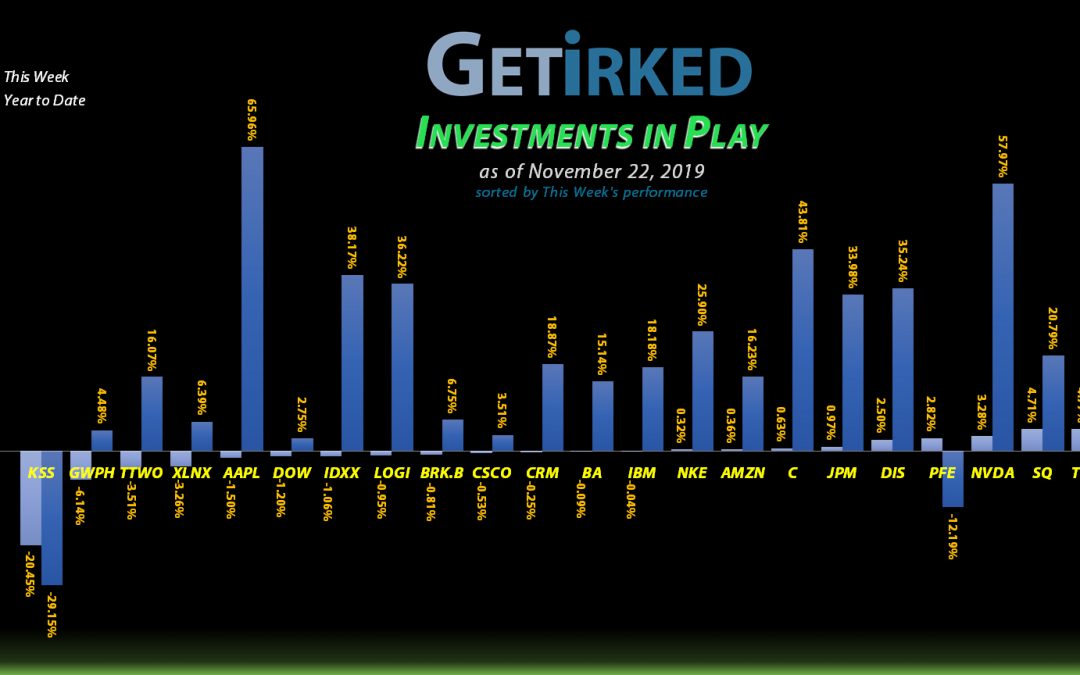

Current Position Performance

Boeing (BA)

+798.55%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Apple (AAPL)

+438.41%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$112.12)*

Square (SQ)

+410.50%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$40.61)*

Nike (NKE)

+360.51%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$55.03)*

Disney (DIS)

+285.67%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$15.25)*

Nvidia (NVDA)

+201.93%*

1st Buy 9/6/2016 @ $63.10

Current Per-Share: (-0.96)*

IDEXX Lab (IDXX)

+158.31%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Salesforce (CRM)

+48.71%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $109.48

JP Morgan (JPM)

+42.99%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $94.55

Logitech (LOGI)

+33.02%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.03

Take Two (TTWO)

+33.01%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $89.83

Citigroup (C)

+30.22%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $57.50

IBM (IBM)

+22.97%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Dow (DOW)

+14.33%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.41

Amazon (AMZN)

+8.04%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Berkshire (BRK.B)

+7.93%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Kohl’s (KSS)

+2.94%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $0.00

Pfizer (PFE)

-0.54%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Canopy (CGC)

-1.95%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.78

Twilio (TWLO)

-3.09%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $107.61

Cisco (CSCO)

-4.01%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $46.72

Xilinx (XLNX)

-10.07%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $100.75

GW Pharm (GWPH)

-17.38%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $123.16

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

Canopy Growth Corp (CGC): Profit-Taking

I know what you must be thinking: “How can you be profit-taking in a position that collapsed -28.56% just last week?”

Well, I was thinking the same thing when Canopy Growth Corporation (CGC) rallied 50% off its $13.81 low this week.

On Thursday, the U.S. House of Representatives passed a bill that signaled the potential of Federal legalization of cannabis in the U.S. reported MarketWatch.

While the House warned that the Senate may take its time passing its own bill, the combination of the news with the supreme oversold nature of the sector caused an epic “short squeeze” and news pop.

Short sellers bet a stock is going lower by borrowing shares and selling them in hopes of buying the shares back at a lower price. As long as a stock heads lower, the short sellers are profitable. However, when too many shorts pile into a stock, some of them will buy back shares to close their positions, causing the stock price to rise. Other shorts may panic and cover their positions at a loss while buyers rush into the stock seeing that the price is reversing.

The result is what’s called a short squeeze. In the case of Canopy, the short squeeze was epic as sellers had been pressuring the stock lower for weeks and months, resulting in the 50%+ pop in the stock price.

I used the stock’s sudden rise to place trailing sell orders on Thursday to take profits with an average selling price of $20.57. The sales captured +31.35% in profits on some of the shares I bought just last week for $15.66.

The sales also lowered my per-share cost -0.53% from $18.88 to $18.78 (the sales served as an allocation reduction since CGC will likely retreat with more profit-taking).

My next selling price to take small profits is $22.25 and my buy target to add back to my position is $14.15.

CGC closed the week at $18.41, down -10.50% from my average selling price.

Dow Chemical (DOW): Profit-Taking

The market started showing signs of rolling over early in the week, so I took some profits when Dow Chemical (DOW) lost support on Monday, using a trailing stop which filled at $54.69.

The small sale lowered my per-share cost from $47.75 to $47.41, a negligible reduction of -0.71%. My next sell target is $58.25 and my next buy target is $41.25.

DOW closed the week at $54.20, down -0.90% from where I sold on Monday.

Kohl’s (KSS): *Position Closed, +2.94% Profit*

Kohl’s (KSS) lost support on Monday as investors started taking profits before its Tuesday earnings report, and I was one of them, using a variety of trailing stop orders to lock in profits at $59.07 before Kohl’s headed lower.

The sale lowered my per-share cost -3.64% from $47.49 to $45.76.

Once again, the discipline of taking profits when I can paid off as Kohl’s completely bombed its quarterly earnings report, dropping nearly -16% in pre-market trading on Tuesday morning.

Many analysts believed this quarterly report would signify a turnaround for the company, but it definitely did not. I closed my position in Kohl’s during Tuesday trading when it lost support.

The remainder of my position sold at $47.72, capturing +2.94% of gains since I opened the position a little more than five months ago on June 3, 2019.

In the meantime, Target (TGT) reported a great quarter on Wednesday and its stock price skyrocketed to make even higher all-time highs. Even Lowe’s (LOW), which didn’t report that great a quarter, rocketed higher while Home Depot (HD) sold off – same sector but Home Depot is an A student who received a C grade (the “Home Despot” completely flubbed up this quarter’s earnings) and Lowes is a D student earning a B. The market loves an underdog.

Once again, I’m reminded of why I have no interest in the retail sector. Between different products, consumer preferences, product fads, and fashion, investing in one retail company over another feels like a crap shoot to me. Better to stick with what I know than what I don’t.

KSS closed the week at $47.00, down -0.47% from where I sold on Monday.

Nike (NKE): Profit-Taking

Nike (NKE) popped inexplicably during Tuesday trading, triggering a trailing stop I had in place to sell some shares at $94.80 which filled at $94.94 before Nike retreated below $94.00 Tuesday morning.

The sell order captured additional profits, freeing up capital to reinvest should Nike pull back to my buying price target of $80.25. I have no additional sell targets for Nike at this time as it’s a long-term core holding of my investment portfolio.

NKE closed the week at $93.34, down -1.69% from where I sold on Tuesday.

Nvidia (NVDA): *Cost Basis Removed*

Nvidia (NVDA) rebounded from last week’s pullback following its quarterly earnings report on Monday, triggering a trailing stop order I had in place at $211.84 to remove my cost basis.

The order filled at $212.17 and locked in +43.66% in profits on some of the shares I bought just six months ago on May 23, 2019 for $147.69. That’s an epic run for just six months and led me to remove my cost basis from my NVDA position once again.

That being said, I will add to Nvidia again if it drops to my buying price target back down at $142.15. Currently, I have no additional sell targets for NVDA until it breaks through its $292.76 all-time high, an additional +38% higher from Monday’s sale.

NVDA closed the week at $210.89, down -0.60% from where I sold on Monday.

Xilinx (XLNX): Added to Position

Xilinx (XLNX) shares were under pressure on Wednesday when news that the Phase One trade deal with China might not happen this year, sending the price down under $91.00 where I used a trailing stop to add 6.97% to my position at $90.73.

The buy lowered my per-share cost by -1.77% from $102.57 to $100.75 with a total allocation of about 50% of my desired amount for the portfolio. My next buy target is at the next point of support around $81.00.

XLNX closed the week at $90.61, down $0.08 from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.