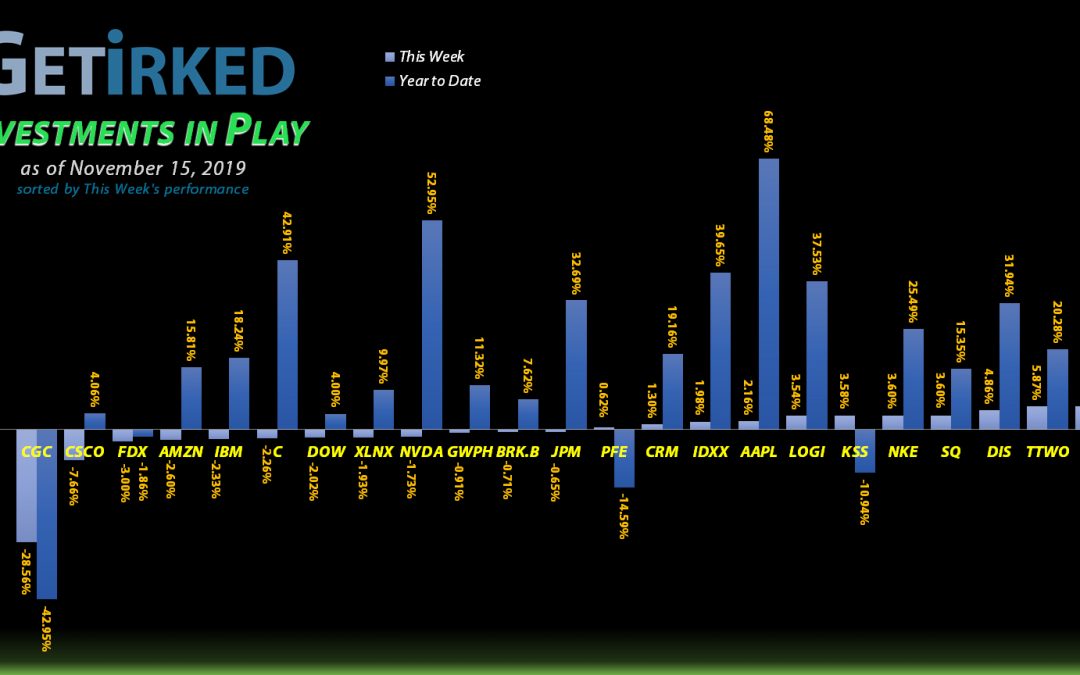

November 15, 2019

The Week’s Biggest Winner & Loser

Twilio (TWLO)

Despite reporting bad news (What’s App is reducing its usage of Twilio), Twilio (TWLO) bounced +6.77% to earn this week’s Biggest Winner. Typically, when a stock jumps on bad news, it usually indicates the bottom has formed so here’s hoping!

Canopy Growth (CGC)

The entire cannabis sector reported terrible earnings … again … this week with Canopy Growth Corp (CGC) getting hit the hardest with an epic -28.56% loss following a terrible year. Awful stuff earning it this week’s Biggest Loser spot.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+798.74%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Nvidia (NVDA)

+593.97%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.42

Apple (AAPL)

+443.08%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$112.12)*

Square (SQ)

+398.95%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$40.61)*

Nike (NKE)

+359.38%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.25)*

Disney (DIS)

+279.35%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$15.25)*

IDEXX Lab (IDXX)

+161.09%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Salesforce (CRM)

+49.07%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $109.48

JP Morgan (JPM)

+41.61%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $94.55

Take Two (TTWO)

+37.84%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $89.83

Logitech (LOGI)

+34.30%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.03

Citigroup (C)

+29.40%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $57.50

Kohl’s (KSS)

+24.40%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $47.49

IBM (IBM)

+23.03%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Dow (DOW)

+14.89%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.75

Berkshire (BRK.B)

+8.81%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Amazon (AMZN)

+7.65%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

FedEx (FDX)

+6.75%

1st Buy 9/18/2019 @ $152.59

Current Per-Share: $0.00

Pfizer (PFE)

-3.26%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Cisco (CSCO)

-3.49%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $46.72

Twilio (TWLO)

-7.50%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $107.61

Xilinx (XLNX)

-8.69%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $102.57

GW Pharm (GWPH)

-11.98%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $123.16

Canopy (CGC)

-18.82%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $18.88

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) significantly disappointed analysts by using so much stock compensation that it affected its quarterly report, causing the stock to sell off significantly on Thursday.

The cannabis sector has completely collapsed as many analysts now believe the recreational marijuana market is nowhere near as big as pundits predicted. At least, not until other countries start legalizing marijuana use federally.

Because of the newfound weakness in the space, I’m building my position in Canopy very slowly.

I waited for the stock to find some stability before adding a small amount to my long-term position at $15.66. The buy lowered my per-share cost -4.11% from $19.69 to $18.88.

I currently hold 38.2% of my entire target allocation with my next buy target at $12.65 for an additional 5.25% buy.

CGC closed the week at $15.33, down -2.11% from where I added Thursday.

Cisco (CSCO): Added to Position

Cisco’s (CSCO) quarterly earnings report disappointed the street once again, causing the stock to sell off on Thursday. The stock price fell through a key area of support, triggering a trailing stop order that added more to my position at $45.68.

The buy order lowered my per-share cost -1.10% from $47.24 to $46.72. My next buy target for the stock is $43.10.

CSCO closed the week at $45.09, down -1.29% from where I added Thursday.

Disney (DIS): Profit-Taking

Disney (DIS) launched its new Disney+ streaming service this week and its stock price roared higher on support. After pulling back slightly on Thursday morning, I used a trailing stop to sell some of the shares I picked up on 10/2 for $148.29, capturing +15.68% in profits in just a little over a month.

I have no plans to take any additional profits in Disney at this time (waiting for it to continue higher) with my next buy target back at $129.25.

DIS closed the week at $144.67, down -2.44% from where I sold on Thursday.

FedEx (FDX): *Closed Position, +6.75% Gain*

With 2019 coming to a close, I’ve been reviewing my portfolios and deciding to cut back on the number of different positions, particularly overlapping ones, that I have across the board. For example, I closed FedEx (FDX) when it started to exhibit weakness on Tuesday since I already hold Berkshire-Hathaway (BRK.B), a conglomerate with a particularly strong transport play.

I opened my FedEx position on 9/18/2019 at a stock price of $152.59 and closed it on 11/12/2019 with an average sale of $162.8833, capturing +6.75% in profit in about two months (an annualized gain of 40.5%).

While I do believe FedEx will eventually make a return to its former glory, the coming years will be an uphill slog and there are more tempting targets out there.

FDX closed the week at $158.33, down -2.80% from where I closed on Tuesday.

JP Morgan Chase (JPM): Profit-Taking

After the banks’ impressive run in the past few months, I decided to take profits when JP Morgan Chase (JPM) started to show wobbly price action in the $129-$130 range, using a trailing stop to sell some shares at $129.22 on Tuesday.

The sale reduced my per-share cost by -5.88% from $97.18 to $91.47. I plan to take more profits if JPM makes new highs above $136 and my next buy target for the position is $105.35.

JPM closed the week at $129.53, up +0.24% from where I sold on Tuesday.

Logitech (LOGI): Profit-Taking

Logitech (LOGI) gapped up on the open of Friday trading crossing through $43.00. I used a trailing stop order to take profits on some shares which filled at $43.07.

The sale lowered my per-share cost -1.51% from $32.52 to $32.03. My next profit-taking target for Logitech is $46.45 and my buy target is $30.85. LOGI’s all-time high is $49.96 so I intend to take profits on the way up, however I will hold the majority of my position as this is a long-term investment play on e-sports and video games (as well as PC accessory technology).

LOGI closed the week at $43.02, down -0.12% from where I sold on Friday.

Salesforce (CRM): Profit-Taking

Salesforce’s (CRM) stock price historically rises into Dreamforce, its annual conference, which takes place next week, so I took profits as CRM rose Monday and Tuesday using a trailing stop which filled at $162.56 on Tuesday.

The sale lowered my per-share cost -8.84% from $120.10 to $109.48. I don’t currently have any additional sell targets as we wait Dreamforce news and earnings with my first buy target to add back to the position at $143.85, a price point that has shown support over the past few years.

CRM closed the week at $163.21, up +0.40% from where I sold on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.