October 25, 2019

The Week’s Biggest Winner & Loser

GW Pharmaceuticals (GWPH)

What goes down must come up? Well, that was certainly the case this week when the bounce in the cannabis sector added +14.73% to GW Pharmaceuticals (GWPH), making it our weekly winner by a significant margin over runner-up Canopy Growth (CGC).

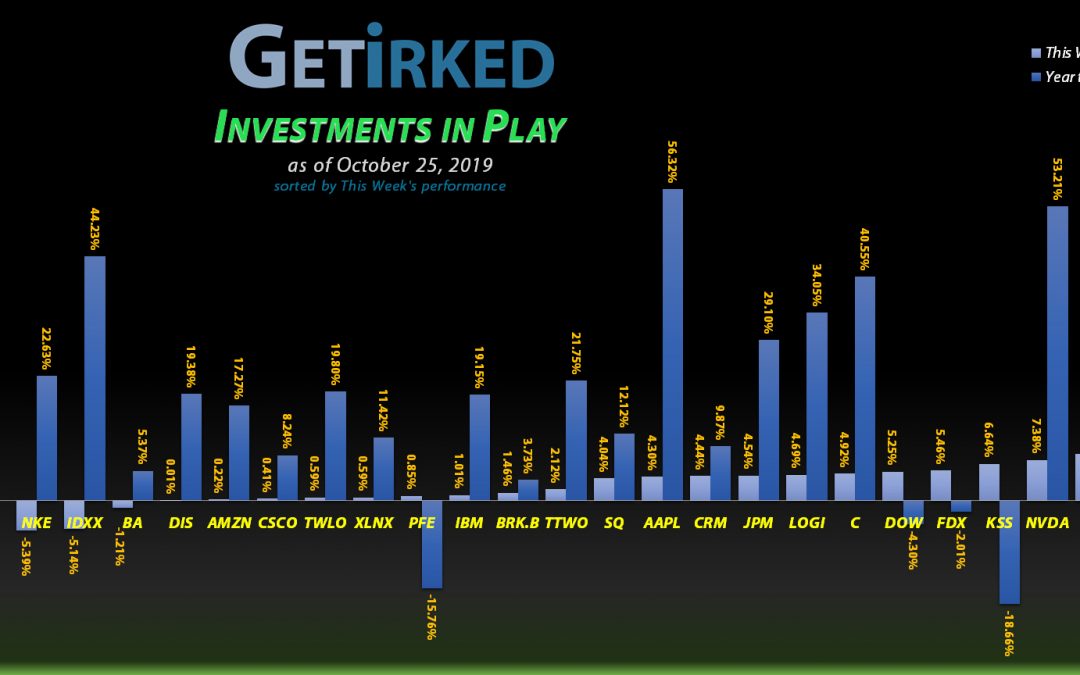

Nike (NKE)

The ongoing fight for freedom of speech between the NBA and China led to Nike (NKE) getting positively slammed for -5.39% in a generally positive week for stocks.

Analysts are concerned ongoing wars of words may lead to decreased sales for the big swoosh.

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+780.89%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Nvidia (NVDA)

+595.16%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.42

Apple (AAPL)

+419.54%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$77.33)*

Square (SQ)

+391.75%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$37.86)*

Nike (NKE)

+353.79%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.25)*

Disney (DIS)

+253.49%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$6.07)*

IDEXX Lab (IDXX)

+169.64%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Logitech (LOGI)

+28.92%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.52

JP Morgan (JPM)

+28.63%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $97.98

Take Two (TTWO)

+28.42%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $97.60

Citigroup (C)

+25.40%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.35

Salesforce (CRM)

+25.31%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

IBM (IBM)

+23.98%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Kohl’s (KSS)

+12.63%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $47.91

Canopy (CGC)

+11.33%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $19.69

Amazon (AMZN)

+9.00%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

GW Pharm (GWPH)

+6.98%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $126.67

Dow (DOW)

+5.71%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.75

Berkshire (BRK.B)

+4.87%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

FedEx (FDX)

+3.61%

1st Buy 9/18/2019 @ $152.59

Current Per-Share: $152.59

Cisco (CSCO)

-0.72%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $47.24

Pfizer (PFE)

-4.59%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Twilio (TWLO)

-5.87%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $113.66

Xilinx (XLNX)

-7.48%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $102.57

* Indicates a position where the capital investment was sold.

Profit % for * positions = Total Profit / Original Capital Investment

This Week’s Moves

Kohl’s (KSS): Profit-Taking

Kohl’s (KSS) continued to climb this week, leading me to trim another 5.8% of my position at $53.42 on Friday which lowered my per-share cost -0.66% from $48.23 to $47.91, but, as usual, freed up some capital for additional investment should Kohl’s pull back.

Just like last week, given the amount of economic slowdown combined with retail concerns, taking profits when I have them is key to properly managing this position and taking advantage of its volatility.

KSS closed the week at $53.96, up +1.01% from where I sold on Friday.

Square (SQ): Profit-Taking

I’ve been watching Square’s (SQ) volatile price action over the past few weeks and decided to start taking profits on shares I picked up at $57.03 back on September 16.

On Thursday, I sold 1/5 of those new shares at $60.94, locking in gains of 6.85% when my trailing stop target was just 5%. My next sell targets for SQ are $63.75, $69.55, $75.30, $81.15, $92.70, and $100.95 (near its all-time high).

SQ closed the week at $62.89, up +3.20% from where I sold on Thursday.

Twilio (TWLO): Added to Position

The cloud stocks continued to sell off this week with Twilio (TWLO) testing the $100.00 mark on Wednesday, triggering a trailing stop order I had placed at $100.44 which filled at $100.50.

The order added about 8% of my desired allocation for the position and lowered my per-share cost -2.8% from $116.95 to $113.66.

My next buy target for TWLO is around $93.00.

Remember: Twilio reports earnings next Tuesday, October 30, 2019. I make it a practice to not have open orders for a position around its earnings report as determining price action from a binary outcome can be downright impossible.

TWLO closed the week at $106.98, up +6.45% from where I added Wednesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.