October 4, 2019

Portfolio Allocation

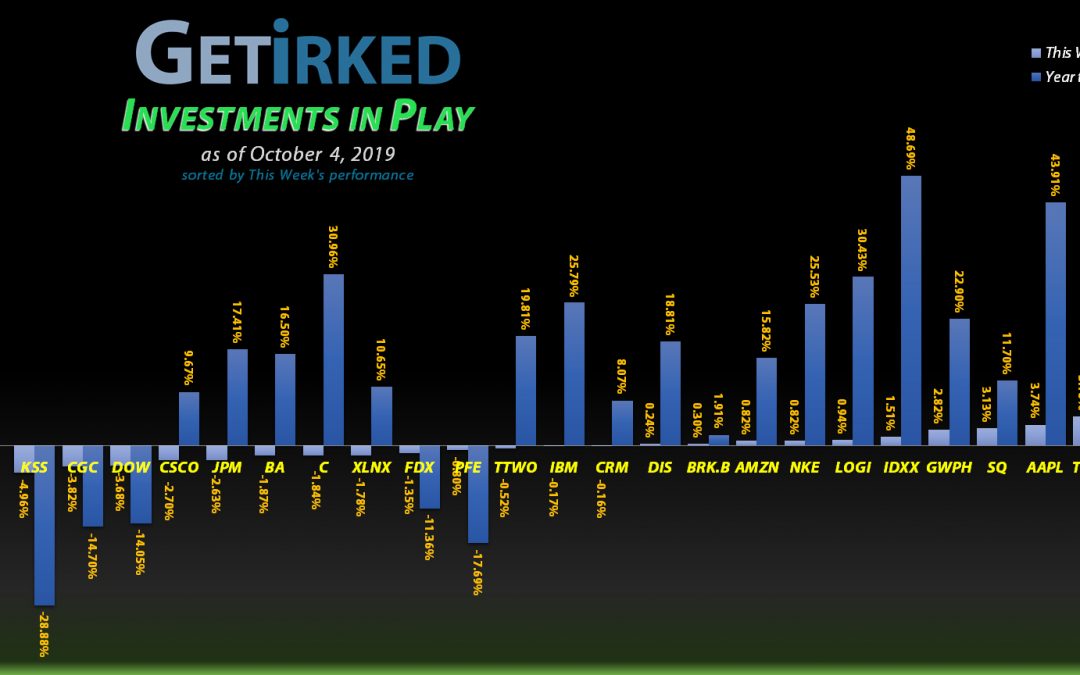

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+539.43%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Nvidia (NVDA)

+518.45%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.42

Apple (AAPL)

+493.18%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$49.63)*

Square (SQ)

+490.98%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$35.39)*

Nike (NKE)

+459.46%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.25)*

Disney (DIS)

+352.32%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$6.07)*

IDEXX Lab (IDXX)

+177.99%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

IBM (IBM)

+30.89%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Take Two (TTWO)

+26.37%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $97.60

Logitech (LOGI)

+25.45%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.52

Salesforce (CRM)

+23.26%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

Citigroup (C)

+16.85%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.35

Canopy (CGC)

+16.41%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $19.69

JP Morgan (JPM)

+13.74%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $100.77

Amazon (AMZN)

+7.66%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Berkshire (BRK.B)

+3.03%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Cisco (CSCO)

-0.16%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $47.60

Kohl’s (KSS)

-2.57%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $48.43

Dow (DOW)

-5.05%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.75

GW Pharm (GWPH)

-5.51%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $126.67

FedEx (FDX)

-6.28%

1st Buy 9/18/2019 @ $152.59

Current Per-Share: $152.59

Pfizer (PFE)

-6.77%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Twilio (TWLO)

-7.21%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $120.78

Xilinx (XLNX)

-8.12%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $102.57

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

Highlights from the Week

Biggest Winner: Nvidia (NVDA)

Despite the semiconductors getting smacked around lately, Nvidia (NVDA) once again proved it deserves to be Best-of-Breed by snagging this week’s Biggest Winner recognition with a +5.94% gain. It certainly didn’t hurt that PayPal (PYPL) was approved for a company acquisition by the Chinese government, potentially open NVDA’s way for a particular company they’ve got their eye on for merging.

Biggest Loser: Kohls (KSS)

All the bad news that rocked the markets this week target retail, specifically, between decreasing jobs in retail and a potentially-hurt American consumer. Kohl’s (KSS) still has to prove itself from earlier this year, so it earned the Biggest Loser spot this week by dropping nearly 5% (down -4.96%). Ouch.

This Week’s Moves

Apple (AAPL): Profit-Taking

Following positive news regarding sales of its new iPhone 11, Apple (AAPL) once again took off into the mid $220s on a 2% bounce on Monday after receiving new guidance from a JP Morgan (JPM) analyst who raised the bank’s price target on AAPL to a whopping $265.

Given that AAPL was already rapidly approaching a 5% allocation in my portfolio, I used a trailing stop-loss order to sell some of the shares I picked up in May at a fill price of $223.73. The sale pocketed a little over +18% in gains (I bought the shares at $189.46) and lowered my AAPL allocation slightly to about 4.5%.

If the JPM analyst is correct, I’ll wait to take more profits until AAPL starts to approach this new $265 price target. However, if Apple drops below $180 (a 20% drop from here), I’ll be adding back to the position.

AAPL closed the week at $227.01, up +1.47% from where I took profits on Monday.

Canopy Growth Corp (CGC): Added to Position

Canopy Growth Corporation (CGC) continued making new lower-lows for 2019 on Wednesday, breaking through $22.00 where a trailing stop order of mine filled at $21.15, the last purchase I will be making until CGC is lower than my new per-share cost of $19.69.

CGC has been a long-time holder in my portfolio with my first purchase made the first day CGC traded in the American markets on May 24, 2018 at $29.76. My current per-share price of $19.69 represents a -33.83% reduction in my per-share cost with nearly double the allocation. My next buy target for CGC is $17.05.

CGC closed the week at $22.92, up +8.37% from where I added on Wednesday.

Disney (DIS): Added to Position

On Wednesday, Disney (DIS) dropped below $129 for the first time since April 2019 when it announced its new Disney Plus service. Disney has been a very long-term holding in my portfolio and its long-term growth prospects and past track record are second-to-none.

Combine Disney’s forward-looking prospects with a dividend in excess of 1.30% at these levels, and Disney is a stock I want to add more of at any opportunity. So, when Disney dipped below $128.00 on Wednesday, I used a trailing-stop order to add more when Disney bounced back up to $128.19, filling my order and taking me to a full allocation in the portfolio.

However, I’m not done, yet. Disney is a company I’m absolutely willing to hold an overweight position in much like my portfolio’s other largest holdings: Boeing (BA), Apple (AAPL), Nike (NKE) and Square (SQ), so I have another buy order if Disney drops substantially from these levels to $116.25 (a drop of nearly 10% from where I added).

DIS closed the week at $130.27, up +1.62% from where I added on Wednesday.

GW Pharmaceuticals (GWPH): Added to Position

GW Pharmaceuticals (GWPH), the prescription cannabinoid play, dropped below $116 again on Monday, triggering a trailing-stop buy order I had in place which filled at $115.92, lowering my per-share cost by -2.41% from $129.80 to $126.67.

My next buy target for GWPH is around the $100.00 mark, a key psychological level for most stocks in the triple digit prices. This price target may change depending on GWPH’s price action in the coming weeks and months.

GWPH closed the week at $119.69, up +3.25% from where I added on Monday.

Xilinx (XLNX): Added to Position

As if the semiconductors weren’t getting slammed enough already thanks to the Trade War, Tuesday’s awful manufacturing number sent them down even further. Xilinx dropped nearly 5%, triggering a buy order I had in place at $91.37.

The order reduced my per-share cost 3.92% from $106.76 to $102.57. My next buy target is at the next level of support lower from here around $80-81.

XLNX closed the week at $94.24, up +3.14% from where I added on Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.