September 27, 2019

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+541.63%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,053.52)*

Nvidia (NVDA)

+483.75%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.42

Square (SQ)

+483.41%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$35.39)*

Apple (AAPL)

+481.41%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$27.68)*

Nike (NKE)

+456.77%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$43.37)*

Disney (DIS)

+351.79%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$23.30)*

IDEXX Lab (IDXX)

+173.85%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

IBM (IBM)

+31.12%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $109.24

Take Two (TTWO)

+27.02%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $97.60

Logitech (LOGI)

+24.28%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $32.52

Canopy (CGC)

+24.12%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $19.20

Salesforce (CRM)

+23.45%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

Citigroup (C)

+19.04%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $58.35

JP Morgan (JPM)

+16.82%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $100.77

Amazon (AMZN)

+6.78%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

Berkshire (BRK.B)

+2.72%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Cisco (CSCO)

+2.61%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $47.60

Kohl’s (KSS)

+2.51%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $48.43

Dow (DOW)

-1.43%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $47.75

FedEx (FDX)

-5.00%

1st Buy 9/18/2019 @ $152.59

Current Per-Share: $152.59

Pfizer (PFE)

-6.01%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.54

Xilinx (XLNX)

-10.12%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $106.76

GW Pharm (GWPH)

-10.31%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $129.80

Twilio (TWLO)

-11.78%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $120.78

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

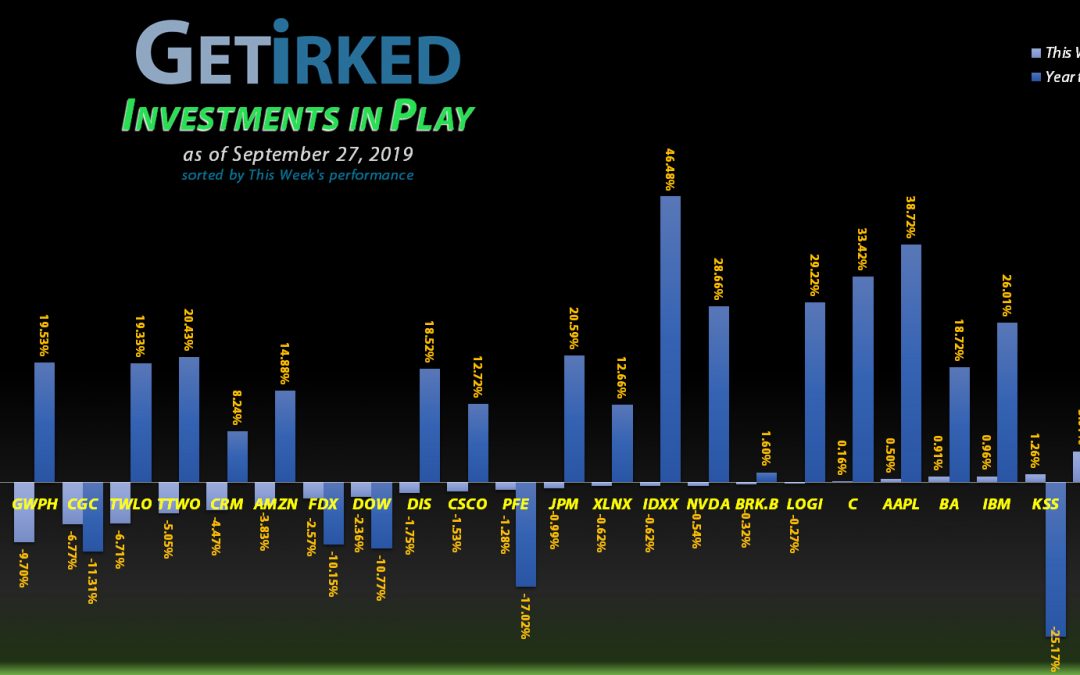

Highlights from the Week

Biggest Winner: Nike (NKE)

“Trade War?” What “Trade War?!” Nike (NKE) is the honey badger of companies with China exposure, earning +6.50% this week and reporting a quarter of epic increasing sales in… wait for it… CHINA! Where other companies are struggling with tarriffs and decreased spending, Nike simply isn’t seeing any of it.

Biggest Loser: GW Pharmaceuticals (GWPH)

GW Pharmaceuticals (GWPH) continues to get hit during the Cannabis Carnage, losing another -9.70% this week and earning the dubious distinction of being named Biggest Loser for two weeks in a row.

The CEO appeared on Jim Cramer’s Mad Money on CNBC this week and once again gave a fascinating rundown of the offerings in the works for GWPH. Unfortunately, due to its inclusion in many cannabis ETFs, GWPH will continue to get dragged down with the sector until analysts finally start to realize it’s not the same as a consumer marijuana play.

This Week’s Moves

Nike (NKE): Profit-Taking

With Nike (NKE) reporting earnings on Tuesday and its stock near all-time highs on Monday (up more than 1% just that day), I decided to take profits, selling about 15% of my position at $87.67.

Don’t get me wrong – I’m still a long-term holder of Nike, however, between its record highs, global macroeconomic concerns, and its overweight allocation in my portfolio at 4.73% when the target is 4.17%, and my trading discipline was screaming at me that it was time to lighten up.

Bulls make money, Bear make money, but Hogs get slaughtered.

Monday’s sale dropped my Nike allocation to 4.019% going into earnings and freed up capital for me to add back in if Nike disappointed (which they didn’t) and drop into my target buying range of $70-80.

Nike blew the doors off the joint with their earnings report on Tuesday! Increasing sales in China and a number of key positives caused the stock to skyrocket over 5% in after-hours trading between Tuesday and Wednesday. No doubt, this is why Nike (NKE) remains one of my best long-term holdings, and while it would’ve been nice to make an extra 5% on the shares I sold, I have no qualms taking profits when I did.

Despite reducing my allocation, Nike’s new post-earnings price jump has raised my position back to an overweight allocation for the portfolio – a job very well done, thank you, Nike.

NKE closed the week at $92.31, up +5.29% from where I took profits Monday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

You must be logged in to post a comment.