August 23, 2019

Portfolio Allocation

Positions

%

Target Position Size

Current Position Performance

Boeing (BA)

+532.75%*

1st Buy 2/14/2012 @ $79.58

Current Per-Share: (-$1,059.57)*

Square (SQ)

+485.55%*

1st Buy 8/5/2016 @ $11.10

Current Per-Share: (-$48.71)*

Apple (AAPL)

+456.38%*

1st Buy 4/18/2013 @ $56.38

Current Per-Share: (-$27.68)*

Nvidia (NVDA)

+451.57%

1st Buy 9/6/2016 @ $63.10

Current Per-Share: $29.45

Nike (NKE)

+422.23%*

1st Buy 2/14/2012 @ $26.71

Current Per-Share: (-$21.94)*

Disney (DIS)

+354.60%*

1st Buy 2/14/2012 @ $41.70

Current Per-Share: (-$23.30)*

IDEXX Lab (IDXX)

+171.80%

1st Buy 7/26/2017 @ $167.29

Current Per-Share: $99.50

Canopy (CGC)

+42.23%

1st Buy 5/24/2018 @ $29.53

Current Per-Share: $17.50

Take Two (TTWO)

+31.98%

1st Buy 7/30/2018 @ $120.99

Current Per-Share: $97.60

Salesforce (CRM)

+26.11%

1st Buy 6/11/2018 @ $134.05

Current Per-Share: $120.10

Logitech (LOGI)

+20.46%

1st Buy 11/11/2016 @ $24.20

Current Per-Share: $33.01

IBM (IBM)

+17.29%

1st Buy 11/6/2018 @ $120.87

Current Per-Share: $110.47

GW Pharm (GWPH)

+12.13%

1st Buy 7/25/2018 @ $142.28

Current Per-Share: $129.73

Amazon (AMZN)

+8.28%

1st Buy 2/6/2018 @ $1,378.96

Current Per-Share: $1,615.85

JP Morgan (JPM)

+5.21%

1st Buy 10/26/2017 @ $102.30

Current Per-Share: $100.77

Twilio (TWLO)

+1.79%

1st Buy 8/8/2019 @ $125.71

Current Per-Share: $125.71

Citigroup (C)

+1.52%

1st Buy 10/26/2017 @ $74.06

Current Per-Share: $61.02

Cisco (CSCO)

-2.07%

1st Buy 8/23/2019 @ $47.60

Current Per-Share: $47.60

Berkshire (BRK.B)

-2.37%

1st Buy 8/2/2019 @ $201.96

Current Per-Share: $201.96

Xilinx (XLNX)

-5.77%

1st Buy 5/13/2019 @ $111.57

Current Per-Share: $107.15

Kohl’s (KSS)

-7.95%

1st Buy 6/3/2019 @ $50.45

Current Per-Share: $49.08

Pfizer (PFE)

-11.56%

1st Buy 1/28/2019 @ $40.50

Current Per-Share: $38.83

Dow (DOW)

-16.22%

1st Buy 5/13/2019 @ $53.18

Current Per-Share: $48.59

* Indicates a position where the capital investment was sold.

Profit % for * positions = Current Gross Profit / Original Capital Investment

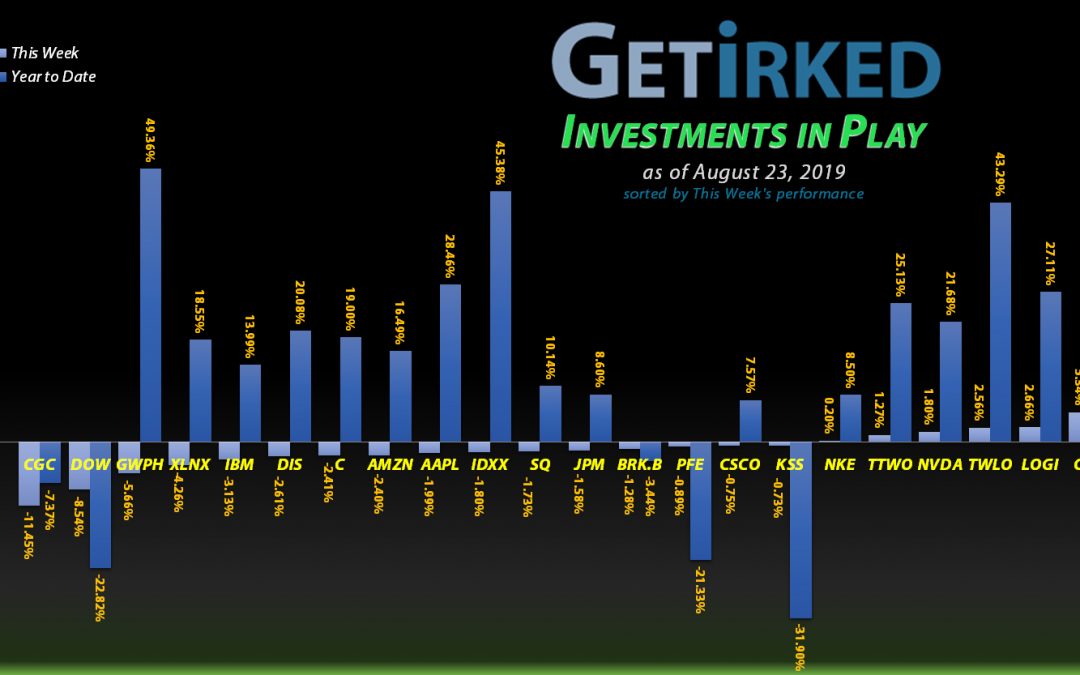

Highlights from the Week

Biggest Winner: Boeing (BA)

Boeing (BA) continues to confound analysts as expected news of increased 737-Max production in 2020 (assuming the FAA approves it for flight) caused the stock to pop +7.73%, earning it this week’s Biggest Winner spot.

Let me reiterate that – Boeing gained because of a news event we already knew was in the books: they plan to increase production so suppliers got new orders. That was it. That made the stock pop. Go figure.

Keep in mind that if the FAA doesn’t approve the 737-Max or any of the many governments affected by Boeing’s two plane crashes sues the company that the stock will be in for a whole world of hurt.

Biggest Loser: Canopy Growth Corporation (CGC)

For the second week in a row, Canopy Growth Corporation (CGC) earns itself the title of Biggest Loser, this time losing -11.45%.

Given the company’s problematic balance sheet and variety of big-time issues affecting its profit growth potential, I’ve put CGC on a “no-buy” list, going so far as to give it a big fat zero in my Stock Shopping List.

For the moment, my per-share cost basis is $17.50 in my Investments in Play, but I’m still waffling as to whether I should use a stop-loss limit order to protect a minimum amount of profits, or if I should add to my position currently dwindling in value if CGC crashes through my per-share cost…

This Week’s Moves

Cisco (CSCO): *New Position*

Cisco (CSCO), the major telecom component manufacturer, dropped more than -20% after reporting a good quarter but poor guidance a few weeks ago, dropping from a 2019 high of $58.26 to $46.00 before settling in around $48.

Between its good long-term prospects and its near 3% dividend, I had been eyeing a level around $47.50 to open a position, which happened on Friday following China’s tariffs and Trump’s retaliation pushing Cisco down where my trailing stop filled for a starting 1/5 position at $47.60 a share.

Historically, Cisco has been capable of jaw-dropping sell-offs: a 25.8% drop in 2015, a 29.29% drop in 2012 and a death-defying 52.33% drop in 2011. Seein gas how it’s already fallen 20%, from this year’s highs, I felt that this was a good starting point, however my future price targets are substantially lower to accomodate its historical price action possibilities: $41.15, $37.63, $34.42, $30.60 and $27.58.

CSCO closed the week at $46.61, down -2.07% from where I opened the position.

Take-Two Interactive (TTWO): Profit-Taking

Take-Two Interactive (TTWO) has thrown down a remarkable turnaround this year, rising nearly 60% from its 52-week low of $84.41 in late February. After Monday’s bounce, TTWO continued rising into Tuesday where I placed a stop-limit order to grab some profits when it pulled back to $131.88.

The sell-order lowers my per-share cost from 6.2% from $104.05 to $97.60. Should we see a 40% selloff in the stock (not unheard of, though frightening), I do plan to add more. My price target to add more is the low $90s.

TTWO closed the week at $128.81, down -2.33% from where I took profits Tuesday.

Want Further Clarification?

As always, if you have questions about any of my positions or have positions of your own that you’re curious about – feel free to leave a comment below!

See you next week!

Get Irked is a small community made up of helpful, friendly and motivated investors and traders of all levels looking to reach the same goal – the ability to invest profitably in order to achieve financial independence.

Investors of ALL experience levels are welcome.

Join Get Irked by clicking here!

Disclaimer: Eric “Irk” Jacobson and all other Get Irked contributors are not investment or financial advisers. All strategies, trading ideas, and other information presented comes from non-professional, amateur investors and traders sharing techniques and ideas for general information purposes.

As always, all individuals should consult their financial advisers to determine if an investing idea is right for them. All investing comes with levels of risk with some ideas and strategies carrying more risk than others.

As an individual investor, you are accountable for assessing all risk to determine if the strategy or idea fits with your investment style. All information on Get Irked is presented for educational and informational purposes only.

You must be logged in to post a comment.